|

市场调查报告书

商品编码

1687931

机器人末端执行器:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Robot End Effector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

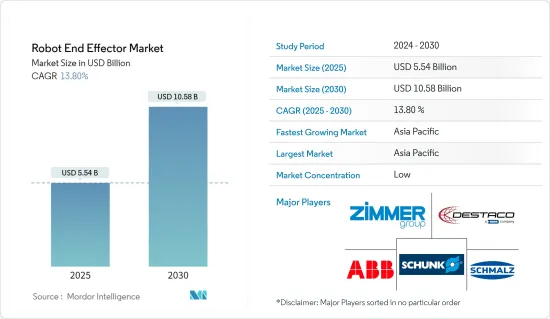

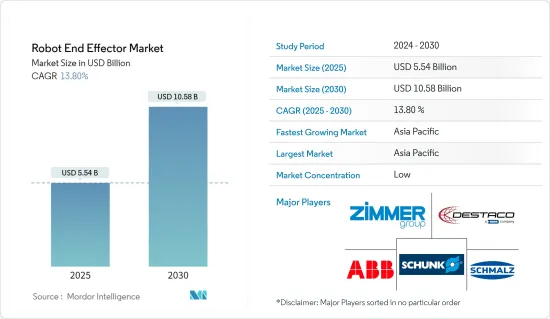

机器人末端执行器市场规模预计在 2025 年为 55.4 亿美元,预计到 2030 年将达到 105.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.8%。

关键亮点

- 人工智慧、自动化、物联网、运算能力、机器人等多种技术的整合,将推动新一代智慧工厂的建设。过去几年,机器人技术和自动化发生了巨大变化。电子、汽车、食品、金属加工和物料输送等行业范围的不断扩大以及对先进自动化的不断增加的投资为机器人技术创造了充足的机会并推动了对末端执行器的需求。

- 随着机器人与人类的合作越来越紧密,它们必须对使用者做出反应并调整自己的行为。未来几年,研究人员有望调整这些机器人的行为,使其能够识别和回应人类的基本行为。未来几年,这将发展成为一个适应复杂任务需求的更先进的程序。从用于安全举起重物而无需自行移动的智慧升降辅助装置,到第一款配备视觉整合系统用于避障的协作机器人,市场预计将进一步成长。

- 协作机器人正变得越来越便宜、越来越简单、越来越容易使用。这有望为组织提供多种选择,并增加市场对协作机器人的需求。协作机器人利用即插即用技术、先进的感测器和基于 CAD资料的自动化机器人编程,使各种规模的企业都能保持竞争力。此外,该市场的参与企业正在透过策略併购扩大业务。因此,协作机器人的快速普及正在带动末端执行器的快速成长。

- 机器人末端执行器的主要限制在于其速度与人类拾取器相比较慢、视觉系统和夹持器无法容纳不寻常的物品,以及完全自主的可靠性。受调查的市场中的公司已经显示出从手提袋中挑选单一物品的成功经验。然而,另一半公司在大规模部署这些系统时面临挑战。

- COVID-19 疫情对机器人末端执行器市场产生了重大影响,因为劳动力短缺、为限制病毒传播而关闭製造工厂以及全国范围内的封锁导致机器人製造业放缓。根据 IFR 统计,2018 年全球工业机器人出货量约 283,000 台,到 2021 年将下降至 25 万台。 9 亚洲/澳洲的安装数量最多,光是 2020 年就预计安装量将达到 266,000 台。到2024年,亚洲/澳洲的工业机器人安装量预计将达到37万台。

机器人末端执行器的市场趋势

汽车终端用户领域预计将占据主要市场占有率

- 汽车产业是机器人和自动化技术的领先应用产业之一。着名的汽车製造商使用机器人来协助焊接、喷漆、铣削钻头和刀具、Machine Tending和零件处理等关键活动。机器人技术的使用有助于降低工业操作的复杂性,同时提高产品品质。

- 在汽车製造中,机器人末端执行器在焊接、喷漆、组装和物料输送等任务中发挥关键作用。这些末端执行器设计用途广泛且精度高,可提高生产流程的效率和品质。配备焊枪的末端执行器用于焊接车身面板、车架和排气系统等零件。这些末端执行器可确保焊接精确、一致,进而提高汽车零件的结构完整性。

- 汽车产业是全球工厂中使用机器人最多的产业。根据国际机器人联合会统计,运作的机器人数量已达约100万台,创历史新高,约占所有产业所用机器人总数的三分之一。根据IFR预测,2023年全球工业机器人出货量约59万台,较2022年仅略为成长。预计未来几年工业机器人出货量将大幅成长,2026年将达到约71万台。

- 与许多其他行业一样,汽车行业希望充分利用工业 4.0。在那里,「联网」的机器可以相互通讯并与人类操作员通信,使职场更安全、更有效率。因此,汽车行业对自动化日益增长的需求正在影响汽车製造商对工人安全的看法,从而导致研究市场的激增。

- 汽车产业也采用协作机器人来简化製造流程。北美和欧洲等地区的协作机器人的兴起预计将对末端执行器产生强劲的需求。工业 4.0 趋势正在推动汽车产业传统组装的自动化,这也有望增加对协作机器人和末端执行器的需求。

亚太地区预计将占据主要市场占有率

- 亚太地区正在经历快速的现代化和工业化,导致製造业向自动化流程转变,减少对体力劳动的需求,影响了市场成长。协作机器人越来越多地被应用于电子和汽车领域以提高效率和生产力。

- 最新的工业革命,即工业 4.0,带来了协作机器人等新的技术进步。这些人工智慧机器人使各行各业能够提高效率、减少错误并简化各种流程。职场安全性的提高和生产能力的提高正在鼓励该地区的行业投资机器人系统。

- 在技术自动化方面投入大量资金并取得进步的国家正在促进该地区机器人技术的普及。由于日本拥有先进的机器人产业和技术,因此被视为製造业应用机器人和自动化的中心。

- 中国政府推出了「中国製造2025」计画。此举是该国製造业保持其最大製造业部门地位的关键优先事项。中国製造商正在实施工业4.0和工业IoT等智慧製造策略,以更好地参与国际竞争并确保其未来的生存。因此,预计中国末端执行器市场将出现成长。

- 根据IFR预测,2022年中国工业机器人安装数量将达到创纪录的290,258台,与前一年同期比较增加5%。根据华盛顿资讯科技与创新基金会(ITIF)统计,中国劳动力中机器人的比例已远远超过最初的预测,达到目前的12.5倍。

- 该地区在机器人领域占有重要地位,这将有利于整体市场的扩张。该领域的公司包括欧姆龙、川崎重工业有限公司、发那科和新松机器人自动化。

机器人末端执行器市场概览

由于全球范围内既有参与企业,也有中小型企业,因此机器人末端执行器市场高度细分。市场上的主要企业包括 ABB 集团、DESTACO Europe GmbH、Zimmer 集团、Schunk GmbH 和 J. Schmalz GmbH。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2024 年 3 月 - SCHUNK 在汉诺威工业博览会上展示其自动化解决方案,并推出两个新的电动夹持器系列:EGU 和 EGK。这些夹持器具有可自订的参数,并提供各种夹持模式,以确保在各种生产环境中可靠地执行处理任务。雄克正在积极为电动车和电子等新兴产业开发客製化自动化解决方案,以跟上不断发展的製造业格局。

- 2023 年 10 月 - 施迈茨推出真空表面夹持系统 FXP-60 和 FMP-60。 FXP-60 和 FMP-60 宽度仅为 60 毫米,而先前的版本宽度为 130 毫米,这使得它们非常适合在狭窄空间、粗糙轮廓和处理单一光束时使用。新型表面夹持器采用铝型材模组化结构,夹持表面带有密封泡沫,因此重量特别轻。这使得处理过程具有高水准的动态。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 宏观经济趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 工业营运自动化

- 市场限制

- 难以与现有流程和业务整合

第六章市场区隔

- 按类型

- 夹持器

- 加工工具

- 吸盘

- 其他的

- 按最终用户产业

- 车

- 饮食

- 电子商务

- 製药

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- ABB Group

- DESTACO Europe GmbH

- Zimmer Group

- Schunk GmbH

- J. Schmalz GmbH

- Robotiq Inc

- KUKA Robotics Corporation

- Weiss Robotics GmbH & Co. KG

- Piab AB

- Bastian Solutions, Inc.

第八章投资分析

第九章:未来市场展望

The Robot End Effector Market size is estimated at USD 5.54 billion in 2025, and is expected to reach USD 10.58 billion by 2030, at a CAGR of 13.8% during the forecast period (2025-2030).

Key Highlights

- The integration of various technologies, including artificial intelligence, automation, the Internet of Things, computing power, and robotics, facilitates the building of a new generation of smart factories. Robotics and automation have changed significantly over the past few years. In the continuously growing range of industries such as electronics, automotive, food and metalworking, and material handling, increasing investment in advanced automation creates ample opportunities for robots, thus driving end-effector demand.

- Robots work even more closely with humans, so they must respond to the users and adapt their behaviors. Over the next few years, researchers are expected to recognize basic human behaviors and adapt these robots' actions to respond to them. Over the next few years, this will develop into much more advanced programs adapting to complex tasks' needs. From the intelligent lift assist devices built to lift weight safely without motion power of their own to the emergence of the first cobots that came with vision-integrated systems for obstacle avoidance, the market is expected to grow even further.

- Collaborative robots are becoming increasingly affordable, less complex, and more accessible to use. This will provide multiple options to the organizations, augmenting the demand for collaborative robots in the market. Collaborative robots enable enterprises of all scales and sizes to stay competitive as these robots utilize plug-and-play technologies, advanced sensors, and automatic robot programming from CAD data. Players in the market are also expanding their operations through strategic mergers & acquisitions. Thus, the rapid adoption of collaborative robots results in the rapid growth of end-effectors.

- The main limitations of robot end-effectors have been observed in terms of their slow speed relative to human pickers, the inability of the vision system and gripper to deal with unusual items, and the reliability of being fully autonomous. The companies in the market studied have demonstrated some degree of success in picking individual items out of totes. However, the remaining half of the companies face various challenges when it comes to implementing these systems on a larger scale.

- The COVID-19 pandemic significantly impacted the robot end-effector market due to the workforce shortage, the shutdown of manufacturing facilities to restrict the spread of the virus, and nationwide lockdowns, leading to a downturn in robot manufacturing. According to IFR, Around 283,000 industrial robots were shipped worldwide in 2018 and it decreased to 250,000 in 20219 . Asia/Australia had the highest number of units installed, with an estimated 266,000 units fitted in 2020 alone. By 2024, industrial robot installations in Asia/Australia are projected to reach 370,000 units.

Robot End Effector Market Trends

Automotive End-User Segment is Expected to Hold Significant Market Share

- The automotive industry is one of the major adopters of robotics and automation. Prominent automotive manufacturers use robotics to assist in critical activities such as welding, painting, milling bits, cutters, machine tending, and parts transfer. Using robotics helps improve the product's quality while reducing the complexity of industrial operations.

- In automotive manufacturing, robot end-effectors play an important role in welding, painting, assembly, and material handling tasks. These end-effectors are designed to be versatile and precise, aiding production processes' efficiency and quality. End-effectors equipped with welding torches are used for welding components such as body panels, frames, and exhaust systems. These end-effectors ensure precise and consistent welds, improving the structure integrity of automotive parts.

- The automotive industry has the largest number of robots in factories worldwide. The International Federation of Robotics stated that the operational stock hit a record of about one million units, representing about one-third of the total number installed across all industries. According to IFR, global industrial robot shipments amounted to about 0.59 million in 2023, just a slight increase compared to 2022. Industrial robot shipments are projected to increase significantly in the coming years, and in 2026, they are expected to amount to about 0.71 million.

- Like many other industries, the auto industry wants to make the most of Industry 4.0, where "connected" machines communicate with one another and human operators to deliver workplace safety and productivity benefits. As a result, the rising need for automation in the vehicle industry affects automakers' attitudes about worker safety, resulting in a spike in the studied market.

- The automotive industry is also adopting Cobots or Collaborative robots to smoothen the manufacturing process. The increase of Cobots in regions like North America and Europe is expected to create a robust demand for end effectors. The trend of Industry 4.0 pushing the automation of traditional assembly lines in the automotive industry is also expected to increase the demand for collaborative robots and end-effectors.

Asia Pacific is Expected to Hold Significant Market Share

- The Asia-Pacific region is experiencing swift modernization and industrialization, leading to a shift toward automated processes in production industries and a decrease in the need for manual labor, which is impacting the growth of the market. Collaborative robots are increasingly utilized in the electronics and automotive sectors to improve efficiency and productivity.

- The latest industrial revolution, called Industry 4.0, has led to the advancement of new technologies, such as collaborative robots. These AI-powered robots have allowed industries to enhance efficiency, minimize mistakes, and streamline various processes. The improved safety in the workplace and increased production capabilities have encouraged industries in the area to invest in robotic systems.

- Countries with significant investments and advancements in technological automation have contributed to the widespread adoption of robots in the region. Japan is considered a hub for utilizing robotics and automation in manufacturing due to its advanced robotic industry and technology.

- The Chinese government initiated the 'Made in China 2025' policy. This policy has become a significant priority for the manufacturing industry in the country to maintain its position as the largest manufacturing sector. Chinese manufacturers are implementing smart manufacturing strategies such as Industry 4.0 and Industrial IoT to enhance global competitiveness and ensure future survival. As a result, it is anticipated that the end-effector market in China will experience growth.

- According to IFR, in 2022, the number of industrial robots installed in China reached a record high of 290,258, marking a 5% increase from the previous year. According to the Washington Information Technology and Innovation Foundation (ITIF), China's workforce has significantly more robots than predicted, with a ratio of 12.5 times higher than initially anticipated.

- The area has a solid presence in the field of robotics, which is beneficial for the overall expansion of the market. A few of the companies in this sector include OMRON Corporation, Kawasaki Heavy Industries Ltd, Fanuc Corporation, and Siasun Robot & Automation Co. Ltd.

Robot End Effector Market Overview

The robot end-effector market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are ABB Group, DESTACO Europe GmbH, Zimmer Group, Schunk GmbH, and J. Schmalz GmbH. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- March 2024 - SCHUNK presented automated solutions at the Hannover Messe, unveiling two novel electric gripper series, namely EGU and EGK. These grippers can customize parameters and provide various gripping modes, ensuring secure handling operations in diverse production settings. SCHUNK is actively involved in developing tailored automation solutions for emerging industries like e-mobility and electronics, thereby adapting to the evolving manufacturing landscape.

- October 2023 - Schmalz launched a vacuum surface gripping system, the FXP-60 and FMP-60. In contrast to the established 130-millimeter-wide version, the FXP-60 and FMP-60 measure just 60 millimeters and are ideal for use in tight spaces, with disruptive contours, or for handling individual beams. The new surface gripper is particularly light with its modular structure made of an aluminum profile with sealing foam as a gripping surface. This enables a high level of dynamics in the handling process.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro-economic Trends in the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Automation of Industrial Operations

- 5.2 Market Restraints

- 5.2.1 Difficulty in Integration with Existing Processes and Operations

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Grippers

- 6.1.2 Processing Tools

- 6.1.3 Suction Cups

- 6.1.4 Other Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Food and Beverage

- 6.2.3 E-commerce

- 6.2.4 Pharmaceutical

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Group

- 7.1.2 DESTACO Europe GmbH

- 7.1.3 Zimmer Group

- 7.1.4 Schunk GmbH

- 7.1.5 J. Schmalz GmbH

- 7.1.6 Robotiq Inc

- 7.1.7 KUKA Robotics Corporation

- 7.1.8 Weiss Robotics GmbH & Co. KG

- 7.1.9 Piab AB

- 7.1.10 Bastian Solutions, Inc.