|

市场调查报告书

商品编码

1687937

生产印表机:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Production Printer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

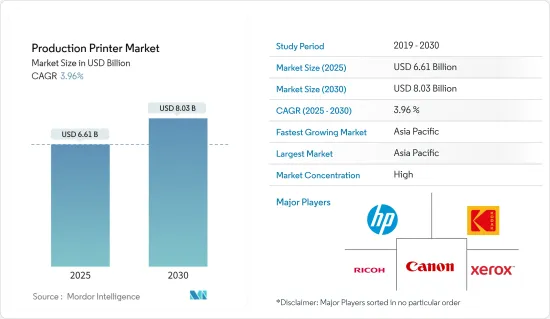

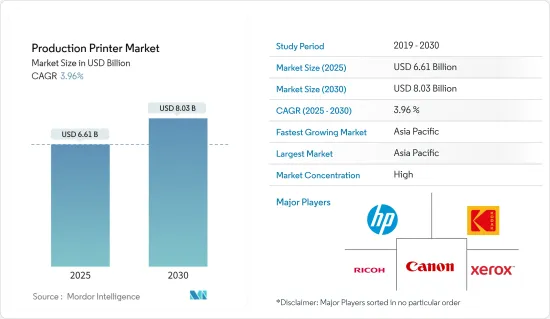

预计 2025 年生产印表机市场规模为 66.1 亿美元,到 2030 年将达到 80.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.96%。

关键亮点

- 包装应用的成长推动了市场扩张:生产印表机市场正在经历显着成长,主要由包装领域推动。 2022年,包装应用占据43.7%的市场占有率。这是因为品牌拥有者越来越重视使用创意包装来吸引消费者的注意。 2022年生产印表机市场中包装应用的市场规模预计为25.306亿美元,2023年至2028年的复合年增长率为4.35%,到2028年将达到32.972亿美元。

- 电子商务热潮:电子商务的兴起刺激了对创新包装解决方案的需求,产品製造商转向数位印刷,为目标消费群组订製包装。

- 折迭纸盒:对设计、永续性和数位印刷的投资使折迭纸盒越来越受欢迎,尤其是在食品行业。

- 烟草、药品和酒类包装:动态法规和防伪措施正在推动这些产品对高品质印刷的需求

- 高效能喷墨印表机推动市场成长:高效能喷墨印表机在市场扩张中发挥关键作用,喷墨生产领域的市场规模预计在 2022 年达到 50.813 亿美元。到 2028 年,该领域预计将成长到 64.567 亿美元,实现 3.92% 的复合年增长率。喷墨技术因其速度、客製化选项和效率而受到青睐,可以满足现代印刷生产需求。

- 主导参与企业:施乐、佳能、理光、惠普和利盟透过不断创新提升品质和可靠性,引领喷墨印表机市场。

- 最新发布的产品:Canon的 ProStream 3,000 系列(2023 年 2 月发布)提供具有胶印品质的高速工业印刷。 Markem-Imaje 的新款 9750+ 喷墨印表机(将于 2023 年 4 月推出)可使用染料和颜料墨水进行进阶编码。

- 市场细分与区域动态:生产印表机市场根据类型、生产方法、技术和地区进行细分。连续进纸印表机在 2022 年占据了 95.6% 的市场占有率,被证明是一种经济高效的大量列印解决方案。按地区来看,亚太地区占44.9%的市占率。

- 亚太优势:印度、印尼、越南等新兴市场成长强劲,为该地区整体市场领先地位做出贡献。

- 美国市场趋势:2022 年美国市场价值为 13.762 亿美元,预计到 2028 年将达到 17.139 亿美元,由于支持商业印刷的有利政策,复合年增长率为 3.57%。

- 竞争格局与技术进步:生产印表机市场高度整合,施乐、惠普、理光和佳能等主要参与者在市场上占有重要地位。

- 施乐与惠普的创新:施乐的产品组合包括 IRIDESSE PRODUCTION PRESS 等数位印刷机,而惠普的 Designjet Z6800 在照片製作领域处于领先地位。为了保持竞争力,公司也正在投资云端技术和人工智慧解决方案。

生产印表机市场趋势

单色印表机占据生产型印表机市场的主导地位

2022 年单色市场价值为 36.378 亿美元,预计到 2028 年将成长至 45.591 亿美元,复合年增长率为 3.68%。推动这一成长的是单色印表机的成本效益和速度,这在不需要彩色列印的大批量列印环境中至关重要。

- 经济高效:单色印表机具有更快的列印速度和更低的营运成本,使其成为注重大批量输出的办公室和行业的理想选择。

- 技术进步:佳能的 varioPRINT 140 QUARTZ (2024) 和Konica Minolta的 bizhub 950i 和 850i (2024) 为小型印刷厂提供了处理生产高峰和维持营运弹性的工具。

- 主要应用:单色印刷对于图书出版、使用手册和交易表格等领域至关重要,这些领域需要以最低的成本实现一致、大量的产出。

亚太地区:生产型印表机市场的成长引擎

亚太地区正成为生产型印表机的最大市场,2022 年的市场占有率为 44.9%。预计该地区将从 2022 年的 26.019 亿美元增长到 2028 年的 33.796 亿美元,复合年增长率为 4.30%。

- 中国占据领先地位 到 2022 年,中国将以 53.39% 的份额主导区域市场,而印度是成长最快的国家,预计复合年增长率为 4.38%。

- 行业多样性:从食品到家用电子电器等广泛的行业都促进了该地区对印刷解决方案的需求不断增长。

- 创新:富士软片商业创新公司等公司不断透过 Revorias Press EC1100 和 Revorias Press SC180/SC170 等型号突破技术界限,提供高品质的生产力解决方案。

生产印表机市场概览

全球参与企业主导整合市场:生产印表机市场持续整合,施乐、惠普、Canon和Ricoh等全球大型企业引领市场。这些公司利用其广泛的产品系列、创新能力和财务实力来保持其市场主导地位。

进入门槛高:由于生产印表机行业大型企业的主导地位以及高昂的开发成本,新参与企业面临巨大的挑战。

端到端解决方案:市场领导者提供整合硬体、软体和服务的综合产品,以满足各领域的广泛客户需求。

创新和全面的解决方案推动领先地位:为了保持竞争力,公司专注于技术创新,尤其是高速喷墨技术、数位印刷和自动化。Canon和惠普透过提供特定细分市场的差异化产品,始终展现出领先地位。

未来策略:主要企业正在探索符合市场永续发展需求的成长机会,例如 3D 列印、人工智慧解决方案和环保技术。向工业和包装印刷等高成长领域扩张也为我们带来了战略优势。

未来市场成功的策略:成功的公司是那些能够成功拥抱技术创新以及云端基础的列印和数位服务等新市场趋势的公司。伙伴关係、收购和研发投资将继续在扩大市场占有率和技术专长方面发挥核心作用。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业相关人员分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场动态

- 市场驱动因素

- 包装印刷应用的扩大有望推动成长

- 推出高性能喷墨印表机,喷墨印表机销售增加

- 市场限制

- 数位行销与线上阅读的成长

- COVID-19 对生产印表机供应链分销的全球影响

第六章 重大技术投入

- 云端技术

- 人工智慧

- 网路安全

- 数位服务

第七章市场区隔

- 按类型

- 单色

- 颜色

- 按生产方式

- 切进

- 收藏的动态

- 依技术

- 喷墨

- 碳粉

- 按应用

- 商业的

- 出版

- 包装

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 其他的

- 北美洲

第八章竞争格局

- 公司简介

- Xerox Corporation

- Hewlett-Packard Development Company LP

- Ricoh Company Ltd

- Canon Inc.

- Eastman Kodak Company

- Konica Minolta Inc.

- Miyakoshi Printing Machinery Co. Ltd

- Inca Digital Printers Ltd(Dainippon Screen Mfg. Co. Ltd)

第九章投资分析

第十章 市场机会与未来趋势

The Production Printer Market size is estimated at USD 6.61 billion in 2025, and is expected to reach USD 8.03 billion by 2030, at a CAGR of 3.96% during the forecast period (2025-2030).

Key Highlights

- Growth in Packaging Applications Drives Market Expansion: The Production Printer Market is undergoing significant growth, with the packaging sector being a primary driver. In 2022, packaging applications accounted for 43.7% of the market share. The rising demand for customization in product packaging is pushing this growth, as brand owners increasingly focus on using creative packaging to capture consumer attention. In 2022, the market size for packaging applications in the production printer market was valued at USD 2,530.6 million, and it is projected to reach USD 3,297.2 million by 2028, growing at a CAGR of 4.35% from 2023 to 2028.

- E-commerce boom: The rise in e-commerce is fueling demand for innovative packaging solutions, with product manufacturers using digital printing to customize packaging for targeted consumer groups.

- Folding cartons: Investments in design, sustainability, and digital printing have popularized folding cartons, especially within the food industry.

- Tobacco, pharmaceutical, and alcohol packaging: Dynamic regulations and anti-counterfeiting measures are boosting the demand for high-quality printing on these products.

- High-Performance Inkjet Printers Fuel Market Growth: High-performance inkjet printers play a pivotal role in market expansion, with the inkjet production segment valued at USD 5,081.3 million in 2022. By 2028, this segment is expected to grow to USD 6,456.7 million, achieving a CAGR of 3.92%. Inkjet technology is favored due to its speed, customization options, and efficiency in handling modern print production demands.

- Dominant players: Xerox, Canon, Ricoh, HP, and Lexmark lead the inkjet printer market with continuous innovations that enhance quality and reliability.

- Recent launches: Canon's ProStream 3000 series (launched in February 2023) offers high-speed industrial printing with offset quality. Markem-Imaje's new 9750+ inkjet printer (April 2023) allows for advanced coding using both dye and pigment inks.

- Market Segmentation and Regional Dynamics: The Production Printer Market is divided by type, production method, technology, and geography. Continuous feed printers held 95.6% of the market share in 2022, proving to be a cost-effective solution for high-volume printing. Regionally, the Asia-Pacific area dominated the market with a 44.9% share.

- Asia-Pacific dominance: Emerging markets in India, Indonesia, and Vietnam are showing strong growth, contributing to the region's overall market leadership.

- U.S. market trends: The U.S. market was valued at USD 1,376.2 million in 2022, and is expected to grow at a CAGR of 3.57% to reach USD 1,713.9 million by 2028, driven by favorable policies supporting commercial printing.

- Competitive Landscape and Technological Advancements: The production printer market is highly consolidated, with major players like Xerox, HP, Ricoh, and Canon holding a strong market presence.

- Xerox and HP innovations: Xerox's portfolio includes digital presses like the IRIDESSE PRODUCTION PRESS, while HP's Designjet Z6800 leads in photo production. Companies are also investing in cloud technologies and AI-driven solutions to stay competitive.

Production Printer Market Trends

Monochrome Segment Dominates Production Printer Landscape

The monochrome segment, valued at USD 3,637.8 million in 2022, is expected to grow to USD 4,559.1 million by 2028, representing a CAGR of 3.68%. This growth is driven by the cost-efficiency and speed of monochrome printers, which are crucial for high-volume print environments that do not require color printing.

- Cost-efficiency: Monochrome printers offer faster print speeds and lower operational costs, making them the preferred choice for offices and industries focused on high-volume output.

- Technological advancements: Canon's varioPRINT 140 QUARTZ (2024) and Konica Minolta's bizhub 950i and 850i (2024) provide small-scale print shops with the tools to handle production peaks and maintain operational flexibility.

- Critical applications: Monochrome printing is essential for sectors like book publishing, user manuals, and transactional forms, which require consistent high-volume output at minimal cost.

Asia-Pacific: The Growth Engine of Production Printer Market:

The Asia-Pacific region has emerged as the largest market for production printers, with a 44.9% market share in 2022. The region is expected to grow from USD 2,601.9 million in 2022 to USD 3,379.6 million by 2028, with a CAGR of 4.30%.

- China leads the way: China dominates the regional market with a 53.39% share in 2022, while India is showing rapid growth with a projected CAGR of 4.38%.

- Industrial diversity: The wide range of industries, from food to consumer electronics, contributes to the region's growing demand for printing solutions.

- Innovation: Companies like FUJIFILM Business Innovation Corp. continue to push technological boundaries with models like the Revoria Press EC1100 and Revoria Press SC180/SC170, offering high-quality productivity solutions.

Production Printer Market Overview

Global Players Dominate Consolidated Market: The Production Printer Market remains consolidated, with major global players such as Xerox, HP, Canon, and Ricoh leading the space. These companies leverage their extensive product portfolios, innovation capabilities, and financial resources to maintain market dominance.

High entry barriers: New entrants face significant challenges due to the dominance of large players and high development costs in the production printer industry.

End-to-end solutions: Leaders in the market provide comprehensive offerings that integrate hardware, software, and services, addressing a wide range of customer needs across different sectors.

Innovation and Comprehensive Solutions Drive Leadership: Companies are focusing on innovation, particularly in high-speed inkjet technology, digital printing, and automation, to maintain their competitive edge. Canon and HP have consistently demonstrated leadership by offering differentiated products tailored to specific market segments.

Future strategies: Key players are exploring growth opportunities in 3D printing, AI-powered solutions, and eco-friendly technologies, aligning with market demands for sustainability. Expanding into high-growth areas like industrial and packaging printing also offers strategic advantages.

Strategies for Future Success in the Market: In addition to technological innovation, companies that can successfully tap into emerging market trends, such as cloud-based printing and digital services, are expected to thrive. Partnerships, acquisitions, and R&D investments will remain central to expanding market share and technological expertise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Printing Applications in Packaging is Expected to Drive Growth

- 5.1.2 Increasing Inkjet Sales Due to Introduction of High-performance Inkjet Printers

- 5.2 Market Restraints

- 5.2.1 Growth of Digital Marketing and the Practice of Online Reading

- 5.3 Impact of COVID-19 in Supply Chain Distribution of Production Printer Globally

6 KEY TECHNOLOGY INVESTMENTS

- 6.1 Cloud Technology

- 6.2 Artificial Intelligence

- 6.3 Cyber Security

- 6.4 Digital Services

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Monochrome

- 7.1.2 Color

- 7.2 By Production Method

- 7.2.1 Cut Fed

- 7.2.2 Continuous Feed

- 7.3 By Technology

- 7.3.1 Inkjet

- 7.3.2 Toner

- 7.4 By Application

- 7.4.1 Commercial

- 7.4.2 Publishing

- 7.4.3 Packaging

- 7.5 By Geography

- 7.5.1 North America

- 7.5.1.1 United States

- 7.5.1.2 Canada

- 7.5.2 Europe

- 7.5.2.1 Germany

- 7.5.2.2 United Kingdom

- 7.5.2.3 France

- 7.5.2.4 Italy

- 7.5.2.5 Rest of Europe

- 7.5.3 Asia-Pacific

- 7.5.3.1 India

- 7.5.3.2 China

- 7.5.3.3 Japan

- 7.5.3.4 Rest of Asia-Pacific

- 7.5.4 Rest of the World

- 7.5.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Xerox Corporation

- 8.1.2 Hewlett-Packard Development Company LP

- 8.1.3 Ricoh Company Ltd

- 8.1.4 Canon Inc.

- 8.1.5 Eastman Kodak Company

- 8.1.6 Konica Minolta Inc.

- 8.1.7 Miyakoshi Printing Machinery Co. Ltd

- 8.1.8 Inca Digital Printers Ltd (Dainippon Screen Mfg. Co. Ltd)