|

市场调查报告书

商品编码

1687974

数位印刷:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Digital Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

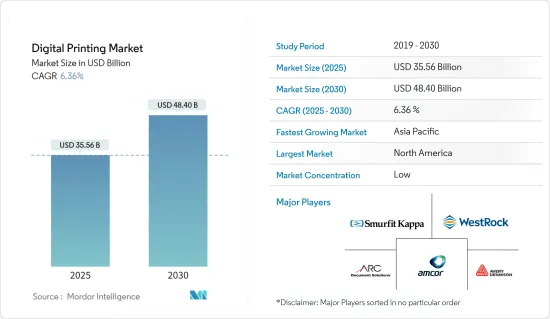

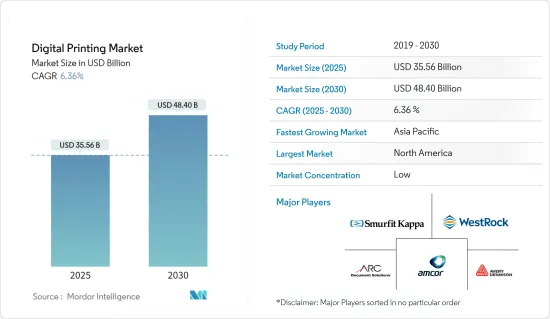

预计 2025 年数位印刷市场规模为 355.6 亿美元,到 2030 年将达到 484 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.36%。

数位印刷是利用科技将印刷品印刷到各种介质基材上的过程。数位印刷比传统印刷工艺更准确、更经济。对高品质、高性价比的图形和环境永续性的需求预计将提高人们对数位印刷的认识。

主要亮点

- 印刷製造业的显着进步,包括从准时生产中获得的效率以及对供应链管理的更多关注,正在减少印刷市场的浪费。支援数位印刷的技术发展确保在保持相同印刷品质的同时最大限度地废弃物。

- 先进的数位印刷技术不含溶剂或有害化学物质,比固体油墨印刷和胶印等传统印刷技术更温和。因此,印刷电子市场对数位印刷解决方案的需求日益增加,并且越来越注重绿色印刷和高效的生产。

- 商业印刷作为一种关键应用,正在经历转型和结构性变化,因为从传统印刷方法到数位化的即时过渡很困难。商业印刷仍然是一种小众业务,需要短版印刷和定製印刷,因此印刷成本预计会成为一个负担。

- 此外,超级市场、大卖场、电子商务等零售业的兴起正在推动个人化、客製化印刷产品的需求。数位印刷技术使公司能够以经济高效的方式生产小批量或单一产品,以满足利基市场和客製化客户的选择。

- 人工智慧、机器学习、物联网和资料分析等最新进步在很大程度上实现了产品个人化。数位印刷融合为大量订单的印刷个人化带来了优势。然而,成本因素仍然是一个主要障碍。此外,油墨、设备、维护、安装成本和其他消耗品的高额投资可能会限制市场的成长。

主要市场趋势

包装产业可望大幅成长

- 包装产业看到了采用数位印刷的巨大潜力。为了满足不同的产品类型,不同的包装方法和技术引入了不同的印刷技术。包装产业包括纸箱、标籤、金属包装、硬质塑胶包装、瓦楞包装、软包装等。

- 瓦楞纸箱和展示架处于加工行业的数位化前沿。数位印刷可以在印前或印后製作中取代平版印刷或柔版印刷,但每种印刷都需要不同的配置。在过去的十年中,高速单一途径,配备了强大的送纸器,其产量远高于每小时可处理数千张纸的平板印刷机。

- 根据 Huhtamaki Ois 的研究,无论是采用个人化包装的节日促销,还是推出基于多种产品设计的高檔干果包装,创新的数位印刷都在资料打印、短版印刷、短交货时间和重振软质包装的货架吸引力等方面为包装带来了新的机会。数位印刷在未来的产品安全和透过软包装进行促销的过程中发挥着不可或缺的作用。

- 纸箱具有许多优点,包括出色的印刷性和灵活性。作为二次包装,它被广泛应用于药品、消费品、化妆品、家用产品等各领域的产品包装。数位印刷系统和装饰印刷机可以将特殊涂层应用于折迭纸盒,为商业印刷商开闢新的收益来源。

- 根据Suzano SA预测,2021年纸板消费量将达5,300万吨,预计2024年将达5,600万吨。此外,预计未来十年纸板需求量将进一步成长,2032年将达到6,600万吨。数位印刷包装产品可以重现原始设计文件的渐变和细节,创造出令人惊嘆的视觉效果。数位印刷可产生全系列的 CMYK 颜色并适用于各种纸质材料。

亚太地区可望成为成长最快的市场

- 数位印刷产业专注于基于资料库的经营模式、数位平台解决方案和端到端的数位化价值创造链。过去十年,由于网路媒体的兴起,印度的印刷相关产业竞争愈加激烈。

- 印度等新兴国家的数位印刷产业呈现显着的成长势头,全球市场规模不断扩大。技术进步、消费行为的变化以及包装产业的发展正在推动市场的发展。

- 随着中小型企业 (SME) 的发展以及客製化行销材料需求的激增,迫切需要一种能够高效且经济地提供少量高品质印刷输出的解决方案。小型企业的崛起和客製化行销材料的日益增长的趋势成为解决在确保速度和成本效益的同时小批量生产一流印刷材料的挑战的解决方案。

- 从事该行业的公司正专注于在市场上创新新的印刷解决方案。例如,2024年1月,为印刷OEM开发智慧软体元件的Global Graphics Software与一家日本数位喷墨印表机製造商扩大了策略业务合作伙伴关係。双方合作始于 2016 年,当时该公司将 Global Graphics Software 的 Harlequin Core SDK 整合到推动其印表机的 RIP 软体中。

- 此外,根据《印度印刷和出版商》报道,商业印刷越来越多地采用数位印刷。指示牌产业也关注数位 3D 增材列印等新技术。因此,作为成长最快的经济体之一的印度等新兴经济体可能会推动该国各个终端用户产业的数位印刷市场的发展。

数位印刷业概况

数位印刷市场由几家主要企业组成。目前,Smurfit Kappa Group PLC、Westrock Company、Avery Dennison Corporation、Multi-Color Corporation、Amcor PLC 和 ARC Document Solutions LLC 等少数主要公司在市场市场占有率方面占据主导地位。每家公司都在透过提供专门的产品和利用策略合作计划来增加市场占有率和盈利。在市场上运营的公司倾向于透过併购来增强其产品能力并改善数位印刷设备提供的市场组合。

- 2024 年 3 月:惠普公司 (HP Inc.) 将利用最新的惠普数位印刷机和智慧解决方案推动数位印刷的发展,旨在解决商业印刷实验室、ELS 和包装行业的生产挑战。 HP 是数位转型的领导者,其数位印刷技术为商业印刷、标籤和包装生产树立了黄金标准。

- 2023 年 10 月 - 全球数位印刷技术领域的领导者之一 ZEICON 宣布将参加在乔治亚乔治亚世界会议中心举行的印刷业顶级盛会 PRINTING United 2023。作为印刷技术领域的主要参与者,Zeikon 展示了尖端的数位化生产解决方案。该公司推出了一系列产品,包括 Xeikon SX30000,它重新定义了数位印刷的可能性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

第五章 市场动态

- 市场驱动因素

- 包装和纺织业的成长以及对数位广告的需求不断增长

- 使用数位印表机降低列印成本

- 市场限制

- 研发活动投资与额外资本支出

第六章 市场细分

- 按印刷工艺

- 电子照相术

- 喷墨

- 按应用

- 图书

- 商业印刷

- 包装

- 标籤

- 纸板

- 纸盒

- 软包装

- 硬质塑胶包装

- 金属包装

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 波兰

- 亚洲

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 沙乌地阿拉伯

- 埃及

- 北美洲

第七章 竞争格局

- 公司简介

- Smurfit Kappa Group PLC

- Westrock Company

- Southland Printing Company Inc.

- IronMark Inc.

- Xeikon NV

- ARC Document Solutions LLC

- Avery Dennison Corporation

- Multi Color Corporation

- Amcor PLC

- Sato America

- DS Smith PLC

- Mondi PLC

- CPI Corporate

- Core Publishing Solutions

- Command Companies

- Quad/Graphics Inc.

- Walsworth Publishing Company

第八章投资分析

第九章 市场机会与未来趋势

The Digital Printing Market size is estimated at USD 35.56 billion in 2025, and is expected to reach USD 48.40 billion by 2030, at a CAGR of 6.36% during the forecast period (2025-2030).

Digital printing is a process of printing using technologies onto various media substrates. Digital printing is more accurate and cost-effective than conventional printing processes. The need for high-quality, cost-effective graphics and environmental sustainability is anticipated to drive awareness toward digital printing.

Key Highlights

- Significant improvements in print manufacturing include efficiency, with just-in-time production and a growing focus on supply chain management, which have reduced wastage in the print market. Technological developments aiding digital printing have guaranteed waste minimization, keeping the print quality at par.

- Advanced digital printing technology includes mild solvents and less harmful chemicals than conventional printing technologies, such as solid ink printing and offset printing. Hence, the demand for digital printing solutions is increasing in the printed electronics market, increasing the focus on green printing and cost-effective production.

- Commercial printing is witnessing transitional and structural changes as a significant application, as the immediate transition from conventional methods of print to digital is challenging. The printing cost is expected to take a toll since it is still a niche method requiring print of shorter/customized batches.

- Moreover, with the rise of retail businesses such as supermarkets, hypermarkets, and e-commerce, there is an increasing demand for personalized and customized printed products. Digital printing technology allows firms to produce small batches or even individualized items cost-effectively, catering to niche markets and customized customer choices.

- The latest advancements, such as AI, machine learning, IoT, and data analytics, have personalized offerings to a significant extent. The convergence in digital printing enables superiority in print personalization for large-volume orders. However, the cost factor remains a big hurdle. Additionally, high-priced investments for inks or equipment, maintenance, installation fees, and other consumables might limit the market's growth.

Key Market Trends

The Packaging Segment is Expected to Witness Significant Growth

- The packaging industry sees vast scope for implementing digital printing. Different packaging methods and technologies to cater to varying product demands for specific types of branding deploy different printing technologies. Some packaging industries include cartons, labels, metal packaging, rigid plastic packaging, corrugated packaging, and flexible packaging.

- Corrugated boxes and display making have been at the forefront of digital in the converting sectors. Digital printing can replace litho or flexo for either pre-print or post-print production, although each requires different configurations. The past decade witnessed the advancement in high-speed single-pass inkjet presses with robust sheet feeders for much higher throughputs than flatbeds could ever manage, which could handle thousands of sheets per hour.

- According to a study by Huhtamaki Oyj, from festive promotion with personalized packaging or premium dry fruit packing launched in multiple product-based designs, innovative digital printing allows a realm of new packaging opportunities in terms of data printing, short-runs, quick turn-around time, and energizing shelf-appeal of flexible packaging. Digital printing is shaping up an essential role in the future of product safety and promotions through flexible packaging.

- Cartons offer many benefits, such as superior printability and flexibility. As secondary packaging, it is widely needed for packaging products in different sectors, such as medicine, consumer goods, cosmetics, and household products. Digital printing systems and embellishment presses can apply specialty coatings to folding cartons, delivering new sources of profitability for commercial printers.

- According to Suzano SA, the consumption of cartonboard in 2021 was 53 million tons and is expected to reach 56 million tons in 2024. Moreover, the demand for cartonboards is predicted to increase further over the next decade, reaching 66 million tons by 2032. Digitally printed packaging products can be created with stunning visual effects, reproducing the gradient and details in original design files. Digital printing will generate the full CMYK spectrum of colors and works on a range of paper materials.

Asia-Pacific is Expected to be the Fastest Growing Market

- The digital printing industry is focused on data-based business models, digital platform solutions, and end-to-end digitized value-creation chains. Over the last decade, enterprises operating in printing-related industries in India have witnessed fierce competition owing to the rise of online media.

- The digital printing industry in emerging countries such as India is on a trajectory of significant growth, with an expanding global market size. Technological advancements, transforming consumer behavior, and developing the packaging industries are pushing the market.

- As small and medium enterprises (SMEs) have grown and customized marketing collateral has surged, a pressing demand arose for a solution that could efficiently and affordably deliver high-quality prints in small quantities. The rise of SMEs and the growing trend of tailored marketing materials have arisen as a solution to address the challenge of producing top-notch prints in small amounts while also ensuring speed and cost-effectiveness.

- Companies operating in the industry are focused on innovating new printing solutions in the market. For instance, in January 2024, Global Graphics Software, a developer of smart software components for print OEMs, extended its strategic business partnership with a Japanese manufacturer of digital inkjet printers. The partnership was initially started in 2016 when the company integrated Global Graphics Software's Harlequin Core SDK into its RIP software that pushes its printers.

- Further, according to Indian Printer and Publisher, commercial printing increasingly embraces digital printing. Also, the signage industry is considering new technologies such as digital 3D additive printing. Therefore, developing countries, such as India, are among the fastest-growing economies, which would leverage the market for digital printing in various end-user industries across the country.

Digital Printing Industry Overview

The digital printing market consists of several major players, and the market is fragmented. Some significant players, such as Smurfit Kappa Group PLC, Westrock Company, Avery Dennison Corporation, Multi-Color Corporation, Amcor PLC, and ARC Document Solutions LLC, currently dominate the market in terms of market share. The companies offer specialized products, increasing their market share and profitability by leveraging strategic collaborative initiatives. Companies operating in the market prefer mergers and acquisitions to strengthen their product capabilities and improve the market portfolio served by digital printing devices.

- March 2024: HP Inc. is driving digital printing with the latest HP digital printing presses and intelligent solutions designed to address production challenges in the commercial printing lab, ELS, and packaging industries. HP has been a digital transformation leader, and its digital printing technology has established the gold standard in commercial print, label, and packaging production.

- October 2023 - Xeikon, one of the global leaders in digital printing technology, announced its participation in PRINTING United 2023, the premier event for the printing industry, which took place at the Georgia World Congress Center in Atlanta, Georgia. As a critical player in the printing technology sector, Xeikon showcased its cutting-edge digital production solutions. The company launched various products, such as Xeikon SX30000, which redefines the possibilities of digital printing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Packaging and Textile Industries and Rising Demand for Digital Advertisements

- 5.1.2 Reduction in Per Unit Cost of Printing with Digital Printers

- 5.2 Market Restraints

- 5.2.1 Investment in R&D Activities and Additional Capital Expenditure

6 MARKET SEGMENTATION

- 6.1 By Printing Process

- 6.1.1 Electrophotography

- 6.1.2 Inkjet

- 6.2 By Application

- 6.2.1 Books

- 6.2.2 Commercial Printing

- 6.2.3 Packaging

- 6.2.3.1 Labels

- 6.2.3.2 Corrugated Packaging

- 6.2.3.3 Cartons

- 6.2.3.4 Flexible Packaging

- 6.2.3.5 Rigid Plastic Packaging

- 6.2.3.6 Metal Packaging

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Netherlands

- 6.3.2.7 Poland

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 South Africa

- 6.3.5.3 Saudi Arabia

- 6.3.5.4 Egypt

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Smurfit Kappa Group PLC

- 7.1.2 Westrock Company

- 7.1.3 Southland Printing Company Inc.

- 7.1.4 IronMark Inc.

- 7.1.5 Xeikon NV

- 7.1.6 ARC Document Solutions LLC

- 7.1.7 Avery Dennison Corporation

- 7.1.8 Multi Color Corporation

- 7.1.9 Amcor PLC

- 7.1.10 Sato America

- 7.1.11 DS Smith PLC

- 7.1.12 Mondi PLC

- 7.1.13 CPI Corporate

- 7.1.14 Core Publishing Solutions

- 7.1.15 Command Companies

- 7.1.16 Quad/Graphics Inc.

- 7.1.17 Walsworth Publishing Company