|

市场调查报告书

商品编码

1687975

伺服马达和驱动器:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Servo Motors and Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

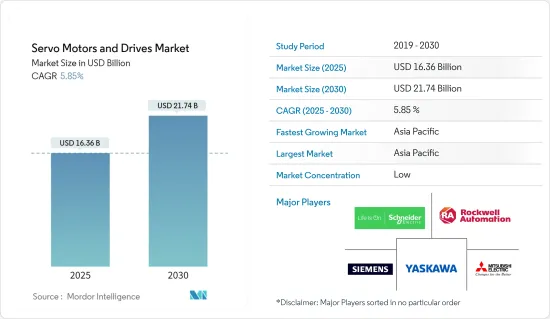

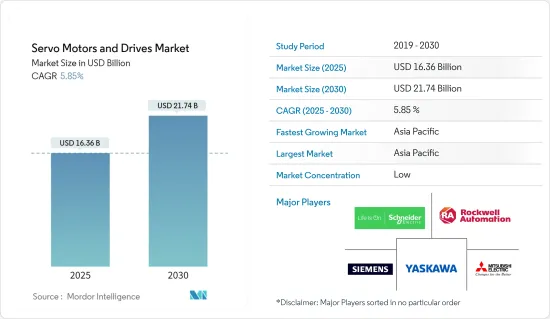

伺服马达和驱动器市场规模预计在 2025 年达到 163.6 亿美元,预计到 2030 年将达到 217.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.85%。

伺服马达是具有内建位置回馈的交流、直流或线性马达。这些马达用于封闭回路型运动控制系统,可以精确控制角位置、速度和扭矩。使用永久磁铁可以改变绕组之间的电压和电流。伺服驱动器是一种与伺服马达配合使用的自动装置,用于向马达提供所需的电压,以纠正与指令状态的任何偏差,并帮助马达准确定位。

关键亮点

- 工具机的灵活性是其最大的优势之一。此外,伺服取代了传统的齿轮、皮带和滑轮,消除了旧技术常见的磨损和故障问题。伺服可提高生产率、可靠性和机器吞吐量。

- 工业领域是伺服马达驱动器的主要消费者之一。伺服马达驱动器由于其提供精确运动控制的能力而非常适合用于许多不同类型的行业。因此,由于工业化率的提高,特别是在新兴地区,这些地区可能会更高地采用机器人和自动化设备等先进解决方案。

- 近年来,全球对节能解决方案的需求大幅成长。日益增长的环境问题和消费者意识的提高是影响节能解决方案需求的关键因素。预计这些因素在预测期内将变得更加普遍,对伺服马达驱动器市场的动态产生重大影响。

- 伺服马达的主要替代品之一是步进马达。步进马达是一种将电能转换为机械能的电子机械设备。它也是一种无刷同步电机,这意味着一圈旋转可以分成多个步骤。如果马达尺寸适合应用,则可以在没有任何回馈机制的情况下精确控制马达的位置。步进马达类似于开关式磁阻电动机。

- 新冠疫情是一场工业噩梦:製造业衰退。中国伺服马达和驱动器销售大幅放缓,扰乱了包括设备、包装材料、原材料和其他工厂供应在内的各个应用领域的供应链。钢材是伺服马达的主要原料之一。由于钢铁业遭受干扰,特别是在新冠疫情初期,伺服马达的生产受到阻碍。例如,中国是钢铁生产大国。由于中华民国政府在疫情期间实施的限制措施,疫情爆发导致贸易限制、大面积停工和工厂关闭,阻碍了该国的钢铁生产。

- 新冠疫情增加了家用电子电器和汽车产业对半导体的需求,这主要是由于疫情后电动车的普及率不断提高。根据半导体产业协会预测,2022年全球半导体销售额将达5,740亿美元,其中美国半导体公司总合销售额将达2,750亿美元,占全球市场的48%。此外,2023年第三季全球半导体销售额将达1,347亿美元,较2023年第二季成长6.3%。

伺服马达和驱动器的市场趋势

汽车领域预计将占据主要市场占有率

- 伺服马达在各种汽车应用中发挥着至关重要的作用,有助于各种车辆系统的功能和性能。以下是伺服马达在汽车行业的一些常见应用:包括动力方向盘、油门控制、煞车系统、变速箱和换檔、空调系统和前灯控制。

- 伺服马达驱动器在汽车产业的使用日益增多,推动了自动化和机器人技术的普及。事实上,伺服马达驱动器在各种汽车系统中发挥着至关重要的作用,包括防锁死煞车、燃油喷射和巡航控制。这使得这些系统能够精确控制和高效运行,从而提高车辆的整体性能和安全性。

- 机器人已经成为汽车组装的重要组成部分,执行物料输送、底盘组装和喷漆等任务。这项自动化技术提高了生产力,减少了错误并降低了汽车製造商的营运成本。福特、梅赛德斯-奔驰、通用和宝马等主要汽车製造商正在使用协作机器人(「cobots」),进一步推动了对伺服马达驱动器的需求。

- 汽车产业越来越多地采用自动化、数位化和人工智慧 (AI),从而推动了对工业机器人的需求。自动化改善了製造流程,提高了效率并增强了生产线的灵活性。正如你提到的报告所说,专家预测到2025年将有高达75%的汽车由机器人生产,这意味着机器人将在汽车产业中发挥重要作用。

- 随着自动化和机器人技术的发展,汽车产业的伺服马达驱动器市场预计将扩大。根据IFR统计,2020年全球工业机器人出货量约384万台。预计2024年全球工业机器人出货量约51.8万台。各组织正在意识到设备自动化可以提高生产力和效率的好处。这一趋势,加上数位化和人工智慧的融合,正在推动汽车领域对伺服马达驱动器的需求不断增加。

- 总体而言,汽车产业对自动化和机器人技术的推动正在推动对伺服马达驱动器的需求。这些组件可实现精确控制,提高生产力并支援汽车行业采用先进的製造流程。

亚太地区:预计大幅成长

- 由于亚太地区行业数量的不断增加及其与自动化的融合以提高投资回报率,该地区伺服马达驱动器市场正在大幅扩张。由于中国机器人解决方案的生产、销售和交易不断增加,预计亚太伺服马达和驱动器市场将由中国主导。

- 随着中国不断重视工业自动化,中国伺服马达及驱动器市场在欧洲、中东和非洲以及美洲迅速成长。例如,2021年12月21日,北京工业和资讯化部发布了机器人产业发展「十四五」规划,重点推动技术创新,在未来五年内将机器人技术纳入八大重点产业,使中国在机器人技术和产业发展方面达到全球领先水平。在日前开幕的2023世界机器人大会上,中国机器人产业取得了令人瞩目的发展,预计2022年机器人销售收入将突破1700亿元人民币(约233亿美元),2022年中国工业机器人销售占全球整体将超过50%,连续10年位居全球第一。

- 日本正快速迈向「社会5.0」的概念,引入人类发展四大阶段中的第五章。在这个新的超智能社会中,一切都将透过物联网技术连接起来,所有技术都将融合,生活品质将大幅提高。为了实现这一新时代,日本政府采取了各种适当措施,鼓励各类参与企业,包括Start-Ups企业和中小企业的“隐藏人才”,为市场带来新的创新理念,以解决人口造成的劳动力短缺等问题。在日本这样一个以将大型工业机器人引入工厂而闻名的国家,这样的製造问题意味着这些相对较小的机器被视为小众且利润低的。伺服控制器将机器人自动化提升到一个新的水平,使机器能够做出平稳、可重复和精确的运动。这些综合特性使电子设计工程师能够创造出令人兴奋的创新。

- 製造业和服务业行动计画包括先进空中运输、自动驾驶或开发以下一代人工智慧和机器人为核心的整合技术计划。此外,在2020年至2025年的五年「登月研究与发展计画」下,已为机器人相关计划拨款4.4亿美元预算。

- 印度的汽车工业历来是经济实力的重要指标,因为它在宏观经济扩张和技术进步中发挥关键作用。根据国际汽车製造商组织的数据,2022年印度的乘用车和商用车销售量为470万辆,创历史新高。此外,预计到 2025 年,印度的电动车 (EV) 市场规模将达到 70.9 亿美元。 CEEW 能源金融中心的一项研究表明,到 2030 年,印度的电动车商业机会可能达到 2,060 亿美元。预计这需要在汽车製造和充电基础设施方面投资 1800 亿美元。

伺服马达和驱动器市场概况

伺服马达和驱动器市场较为分散,主要参与者包括安川电机公司、三菱电机公司、西门子股份公司、施耐德电气和罗克韦尔自动化。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2023年10月,安川电机株式会社宣布扩大其下一代交流变频器产品线-GA700系列。 400V级容量阵容从0.4~355kW扩大至0.4~630kW。高容量频宽的加入使得GA700能够适用于更大型的通用工业机械设备,支援广泛的应用领域。

- 2023年9月,三菱电机自动化公司宣布将扩展其MELESRVO-J5产品系列,为OEM和最终用户提供更多选择。新一代MR-J5伺服产品线包括两种新型伺服类型:HK-RT/ST,以及额定转速3000rpm的HK-KT/ST高速伺服马达。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 的副作用和其他宏观经济因素将如何影响市场

第五章市场动态

- 市场驱动因素

- 新兴经济体快速工业化

- 加强能源效率法规

- 市场问题

- 存在替代产品

第六章市场区隔

- 按类型

- 马达

- 交流伺服马达

- 直流无刷伺服马达

- 有刷直流伺服马达

- 直线伺服马达

- 驾驶

- 交流伺服驱动器

- 直流伺服驱动器

- 可调伺服驱动器

- 其他驱动器

- 马达

- 电压范围

- 低电压

- 中压

- 高压

- 按最终用户产业

- 车

- 石油和天然气

- 医疗保健

- 包装

- 半导体电子

- 化工和石化

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章竞争格局

- 公司简介

- Yaskawa Electric Corp.

- Mitsubishi Electric Corp.

- Siemens AG

- Schneider Electric

- Rockwell Automation Inc.

- ABB Ltd

- Delta Electronics Inc.

- FANUC Corporation

- Kollmorgen(regal Rexnord Corporation)

- Bosch Rexroth AG(Robert Bosch GmbH)

第八章投资分析

第九章:未来展望

The Servo Motors and Drives Market size is estimated at USD 16.36 billion in 2025, and is expected to reach USD 21.74 billion by 2030, at a CAGR of 5.85% during the forecast period (2025-2030).

Servo motors are AC, DC, or linear motors with in-built positional feedback. These motors are used in closed-loop motion control systems where angular position, speed, and torque can be accurately controlled. Using permanent magnets enables the variation of the voltage and current between windings. A servo drive is an automatic device used with servo motors that provide the required voltage to the motor to correct any deviation from the commanded status, helping the motor achieve precise positioning.

Key Highlights

- Flexibility in machine tool operations is one of the most significant benefits. In addition, servos replace traditional gears, belts, and pulleys to eliminate wear and failure problems typical with older technologies. Servos increase productivity, reliability, and machine throughput.

- The industrial sector is among the major consumers of servo motors and drives as they are highly suitable for use in different types of industries owing to their ability to provide precise motion control. As a result, due to a growing rate of industrialization, especially across emerging regions, the adoption rate of advanced solutions such as robotics and automated equipment is likely to be higher across these regions.

- There has been significant growth in the demand for energy-efficient solutions on a global scale in recent years. The growing environmental concern and rising consumer awareness are among the major factors influencing the demand for energy-efficient solutions. With these factors becoming more prevalent during the forecast period, it is expected to have a notable impact on the dynamics of the servo motors and drives market.

- One of the major substitutes for servo motors is the stepper motor. A stepper motor is an electromechanical device that converts electrical energy into mechanical energy. It is also a brushless synchronous motor that can divide one rotation into many steps. Motor position can be precisely controlled without a feedback mechanism if the motor is carefully sized for the application. A stepper motor is like a switched reluctance motor.

- The outbreak of COVID-19 had been a nightmare for industrialists, i.e., a manufacturing recession. A significant slowdown in the sales of servo motors and drives from China disrupted the supply chain across applications, such as equipment, packaging materials, ingredients, and other plant supplies. Steel is among the major raw materials used in servo motors. As a result of disruptions that occurred in the steel industry, especially during the initial phase of COVID-19, the production of servo motors was hampered. For instance, China is a major steel producer. Owing to the outbreak of the pandemic, steel production in the country was hampered by trade restrictions, widespread lockdowns, and factory closures owing to restrictions imposed by the Republic of China's government during the pandemic.

- The COVID-19 pandemic increased the demand for semiconductors across the consumer electronics and automotive sectors, mainly due to the growing adoption of EVs post-pandemic. According to the Semiconductor Industry Association, in FY 2022, global semiconductor sales reached USD 574 billion, with total sales of US semiconductor companies at USD 275 billion, accounting for 48% of the global market. Moreover, worldwide sales of semiconductors totaled USD 134.7 billion during the third quarter of 2023, an increase of 6.3% compared to the second quarter of 2023.

Servo Motors and Drives Market Trends

Automotive Sector Is Expected to Hold Significant Market Share

- Servo motors play a crucial role in various automotive applications, contributing to the functionality and performance of different vehicle systems. Here are some common uses of servo motors in the automotive industry: Power Steering, Throttle Control, Brake Systems, Transmission and Gear Shift, HVAC Systems, and Headlight Control.

- There is an increasing use of servo motors and drives in the automotive industry and an increasing adoption of automation and robotics. Indeed, servo motors and drives play a crucial role in various automotive systems, including anti-lock brakes, fuel injection, cruise control, and more. They enable precise control and efficient operation of these systems, enhancing overall vehicle performance and safety.

- Robots have become integral in automotive assembly lines, performing tasks such as material handling, chassis assembly, painting, and more. This automation technology improves productivity, reduces errors, and lowers operating expenses for automakers. Collaborative robots, or "co-bots," are being utilized by major automotive manufacturers like Ford, Mercedes-Benz, GM, and BMW, further driving the demand for servo motors and drives.

- The automotive industry's increasing adoption of automation, digitalization, and artificial intelligence (AI) is propelling the demand for industrial robots. Automation improves manufacturing processes, enhances efficiency, and enables flexibility in production lines. As per the report you mentioned, experts predict that up to 75% of vehicles will be produced by robots by 2025, indicating the significant role of robotics in the automotive industry.

- With the growth in automation and robotics, the automotive industry's market for servo motors and drives is expected to expand. According to IFR, global industrial robot shipments amounted to approximately 3,84,000 in 2020. It is forecasted that 2024, the global industrial robot shipments will be about 518,000. Organizations recognize the benefits of automating their facilities to improve productivity and efficiency. This trend, coupled with the integration of digitalization and AI, contributes to the increasing demand for servo motors and drives in the automotive sector.

- Overall, the automotive industry's push toward automation and robotics is driving the demand for servo motors and drives. These components enable precise control, enhance productivity, and support adopting advanced manufacturing processes in the automotive sector.

Asia Pacific Expected to Witness Significant Growth

- The market for servo motors and drives in Asia-Pacific is expanding significantly due to the rising number of industries in the region and their integration with automation to increase ROI. The Asia-Pacific servo motors and drives market is predicted to be dominated by China with the growing production, sales, and trade of robotic solutions in China.

- The Chinese market for servo motors and drives is growing rapidly in the EMEA and Americas regions as the country continues to focus on industrial automation. For instance, the Ministry of Industry and Information Technology (MIIT) in Beijing released the "14th Five-Year Plan" for Robot Industry Development on 21st December 2021, focusing on promoting innovation to make China a global leader in robot technology and industrial advancement by including it in 8 critical industries for the next five years. As per the recent 2023 World Robot Conference, China's robotics industry has achieved significant progress, with revenue exceeding CNY 170 billion (USD 23.3 billion) in 2022, with China's sales of industrial robots accounting for more than 50% of the world's total in 2022, ranking first globally for ten consecutive years.

- Japan is rapidly moving toward the concept of "Society 5.0," introducing the fifth chapter to the four major stages of human development. In this new ultra-smart society, all things are connected through IoT technology, and all technologies are integrated, dramatically improving the quality of life. To realize this new era, the Government of Japan is taking various suitable steps to encourage various players, including start-ups and "hidden gems" among small- and medium-sized enterprises, to come up with brand-new and innovative ideas for facilitating the world with solutions to problems such as labor shortages owing to population. In a country such as Japan, known for bringing large-scale industrial robots to the factory floor, these problems in the manufacturing sector have led such relatively dainty machines to be dismissed as niche and low-margin. These factors are likely to drive the growth of the servo motors and drive market in the country as servo controllers are taking robotic automation to the next level by making it possible for machines to make smooth, repeatable, and exact movements. Together, those characteristics allow electronic design engineers to create fascinating innovations.

- The action plan for manufacturing and service included projects such as advanced air mobility, autonomous driving, or the development of integrated technologies as the core of next-generation artificial intelligence and robots. Additionally, a budget of 440 million USD was allotted to robotics-related projects in the "Moonshot Research and Development Program" for five years from 2020 to 2025.

- The Indian automobile industry has historically been a significant indicator of how well the economy is doing, as the automobile sector plays a crucial role in both macroeconomic expansion and technological advancement. According to the Organisation Internationale des Constructeurs d'Automobiles, a record 4.7 million passenger cars and commercial vehicles were sold in India in 2022. In addition, the electric vehicle (EV) market is estimated to reach USD 7.09 billion in India by 2025. A study by the CEEW Centre for Energy Finance recognized a USD 206 billion opportunity for electric vehicles in India by 2030. This is expected to necessitate a USD 180 billion investment in vehicle manufacturing and charging infrastructure.

Servo Motors and Drives Market Overview

The servo motors and drives market is fragmented with the presence of major players like Yaskawa Electric Corp., Mitsubishi Electric Corp., Siemens AG, Schneider Electric, and Rockwell Automation, Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023: Yaskawa Electric Corporation announced the expansion of the GA700 series of next-generation AC drives. The 400V-class capacity lineup has been expanded from 0.4 to 355 kW to 0.4 to 630 kW. With the addition of the high-capacity band, the GA700 can now be applied to larger general industrial machinery and equipment for a broader range of applications.

- September 2023: Mitsubishi Electric Automation Inc. announced the expansion of its MELESRVO-J5 product family to include more options for OEMs and end-users. The new generation of MR-J5 servo products includes two new servo types, HK-RT/ST, and the addition of high-speed HK-KT/ST servo motors with 3,000 rpm-rated speed.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Industrialization Across the Emerging Economies

- 5.1.2 Growing Regulations Regarding Energy Efficiency

- 5.2 Market Challenges

- 5.2.1 Presence of Substitute Products

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Motor

- 6.1.1.1 AC Servo Motor

- 6.1.1.2 DC Brushless Servo Motor

- 6.1.1.3 Brushed DC Servo Motor

- 6.1.1.4 Linear Servo Motor

- 6.1.2 Drive

- 6.1.2.1 AC Servo Drive

- 6.1.2.2 DC Servo Drive

- 6.1.2.3 Adjustable Servo Drive

- 6.1.2.4 Other Types of Drives

- 6.1.1 Motor

- 6.2 By Voltage Range

- 6.2.1 Low Voltage

- 6.2.2 Medium Voltage

- 6.2.3 High Voltage

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Oil and Gas

- 6.3.3 Healthcare

- 6.3.4 Packaging

- 6.3.5 Semiconductor and Electronics

- 6.3.6 Chemicals and Petrochemicals

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 South Korea

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Yaskawa Electric Corp.

- 7.1.2 Mitsubishi Electric Corp.

- 7.1.3 Siemens AG

- 7.1.4 Schneider Electric

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 ABB Ltd

- 7.1.7 Delta Electronics Inc.

- 7.1.8 FANUC Corporation

- 7.1.9 Kollmorgen (regal Rexnord Corporation)

- 7.1.10 Bosch Rexroth AG (Robert Bosch GmbH)