|

市场调查报告书

商品编码

1689689

生质能源-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Bioenergy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

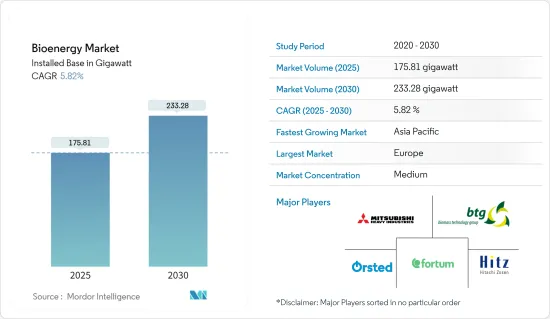

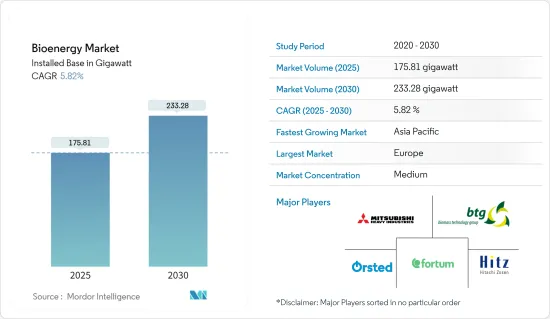

生质能源市场安装基数预计将从 2025 年的 175.81 吉瓦成长到 2030 年的 233.28 吉瓦,预测期内(2025-2030 年)的复合年增长率为 5.82%。

关键亮点

- 从中期来看,预计生质能源投资增加和生质能源设施发电成本下降等因素将在预测期内推动市场发展。

- 另一方面,建立工厂的高初始投资可能会阻碍市场成长。为了覆盖安装和营运成本,工厂的生产量必须充足且稳定。

- 德国近期在废弃物生物处理领域创新的Dendro液体能源(DLE)等新型废弃物能源技术接近「零废弃物」技术,在生质能源领域显示出巨大潜力。

- 预计欧洲将主导全球市场,大部分需求来自挪威、德国和英国等国家。

生质能源市场趋势

生物质可望主导市场

- 生质能源是生物来源的能量,其特征是储存了化学能的有机物,例如木材或肥料。

- 根据国际能源协会的数据,现代生质能源是世界上最大的再生能源来源,占可再生能源的55%,占全球能源供应的6%以上。现代生质能源的采用正在增加,2010年至2021年间平均每年增长约7%。

- 根据国际可再生协会的预测,2022年全球生质能源装置容量约为1.489亿千瓦,较2021年成长5%。

- 生物质的来源多种多样,包括木质燃料、林业残留物、木炭、颗粒、农作物和残留物、城市和工业废弃物、沼气和生质燃料。广义分为林业、农业和废弃物三个部门。

- 2023年6月,印度政府采取倡议推动永续能源实践,电力部宣布修订生物质混烧政策。该修正案将允许发电厂以标准价格购买生物质颗粒燃料,减少对进口的依赖,并促进生物质作为可再生能源的应用。

- 2023年6月,美国能源资讯署(EIA)收集的资料显示,2023年3月,美国高密度生质燃料的总设备容量达到1,336万吨,所有装置容量均列为目前运作中或暂时运作。其中东部地区196万吨,南部地区1051万吨,西部地区88.42万吨。

- 因此,由于全球对可再生能源发电的需求不断增加,预计生质能发电在预测期内将出现显着的成长率。

预计欧洲将主导市场

- 预计生质能源也将在未来十年实现 2030 年可再生能源目标方面发挥关键作用。这就是为什么欧盟成员国在其国家可再生能源行动计画(NREAP)中纳入生质能源选项。

- 生物质是一种重要的再生能源来源,也是实现欧洲 2030 年可再生能源目标(即到 2030 年欧盟能源结构中 45% 来自可再生能源)的关键要素。

- 到2022年,生质能源将占欧洲可再生能源装置容量的5.8%。在德国,预计到2023年,生质能源将占总总设备容量的6.7%。

- 2023年6月,西班牙能源部宣布计画将2030年的沼气和绿色氢气产量目标提高一倍。修订后的计画将2030年的电解槽目标设定为11GW,高于先前的4GW,沼气产量设定为20兆瓦时(TWh)。

- 德国是生质能源的主要参与者之一,并且不断扩大生质能源生产能力。 2023 年 2 月,专门从事沼气厂设计、建造和营运的德国公司 BioEnergy 获得 BlueHills Capital Projects (Pty) Limited 的合同,在马拉威中部的恩科塔科塔区建造一座 56 兆瓦的沼气厂。该沼气厂将使用来自周边农场的紫狼尾草作为燃料。

- 此外,义大利等国家可能会支持该地区生质能源领域的成长。 2023年6月,Enterra从UniCredit获得3,800万美元的计划融资,用于义大利的一座生质能发电厂。该发电厂位于普利亚大区南部的福贾,发电容量为 13 兆瓦,将利用生物质生产电能和热能。

- 因此,由于即将开展的计划以及未来几年实现碳中和环境的目标,该地区预计将在预测期内占据主导地位。

生质能源产业概况

生质能源市场是半细分的。市场的主要企业(不分先后顺序)包括三菱重工业有限公司、日立造船公司、BTG 生物质技术集团、Babcock & Wilcox Volund AS、Biomass Engineering Ltd. 和 Orsted AS。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概述

- 介绍

- 2028年生质能源装置容量的历史与预测趋势

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 转向可再生能源

- 透过生质能源降低发电成本

- 限制因素

- 初期投资高

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 类型

- 固体生物质

- 沼气

- 可再生废弃物

- 其他的

- 科技

- 气化

- 快速热解

- 发酵

- 其他的

- 市场分析:按地区(截至 2028 年按地区分類的市场规模和需求预测)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 卡达

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Mitsubishi Heavy Industries Ltd

- MVV Energie AG

- A2A SpA

- Hitachi Zosen Corp.

- BTG Biomass Technology Group

- Babcock & Wilcox Volund AS

- Biomass Engineering Ltd

- Orsted AS

- Enerkem

- Fortum Oyj

第七章 市场机会与未来趋势

- 先进技术

简介目录

Product Code: 67322

The Bioenergy Market size in terms of installed base is expected to grow from 175.81 gigawatt in 2025 to 233.28 gigawatt by 2030, at a CAGR of 5.82% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing investments in bioenergy, and declining electricity generation costs from bioenergy facilities are expected to drive the market during the forecast period.

- On the other hand, the high initial investment for establishing plants may resist market growth. The plant output must be sufficient and consistent to cover the installation and operating costs.

- Nevertheless, Emerging waste-to-energy technologies, such as Dendro Liquid Energy (DLE), a recent German innovation in the biological treatment of waste, present high potential in the bioenergy field, being close to 'zero-waste' technology.

- Europe is expected to dominate the world's market, with most of the demand coming from countries such as Norway, Germany, and the United Kingdom.

Bioenergy Market Trends

Biomass is Expected to Dominate the Market

- Bioenergy is energy derived from biological materials characterized as organic materials with stored chemical energy like wood and manure.

- According to Internation Energy Association, Modern bioenergy is the largest renewable energy source globally, accounting for 55% of renewable energy and over 6% of the global energy supply. The adoption of modern bioenergy has increased on average by about 7% per year between 2010 and 2021 and is on an upward trend.

- According to the International Renewable Association, in 2022, the global installed capacity for bioenergy accounted for about 148.9 GW, with a 5% increase from 2021.

- Biomass supply comes from various feedstock - wood fuel, forestry residues, charcoal, pellets, agriculture crops and residues, municipal and industrial waste, biogas, biofuels, etc. Broadly, the supply can be classified into three main sectors - forestry, agriculture, and waste.

- In June 2023, the Indian government took the initiative to promote sustainable energy practices, and the Ministry of Power announced the revision of the biomass co-firing policy. This revision will enable power plants to purchase biomass pellets at benchmark prices, reducing import dependencies and enhancing the adoption of biomass as a renewable energy source.

- In June 2023, data gathered by the Energy Information Administration (EIA) showed that the total United States densified biomass fuel capacity reached 13.36 million tons in March 2023, with all of that capacity listed as currently operating or temporarily not in operation. Capacity included 1.96 million tons in the East, 10.51 million in the South, and 884,200 tons in the West.

- Therefore, with the increasing demand for renewable energy sources worldwide, biomass-based electricity generation is expected to witness a significant growth rate during the forecast period.

Europe is Expected to Dominate the Market

- Bioenergy is expected to remain crucial over the next decade to reach renewable energy targets in 2030. Hence, the European Union (EU) member states incorporated the bioenergy option in their National Renewable Energy Action Plans (NREAPs).

- Biomass is an essential renewable energy source and is a key factor in reaching the European renewable energy target by 2030, where the target for the share of renewables in the EU energy mix to 45% by 2030

- Bioenergy contributed to 5.8% of the total renewable energy installed capacity in Europe in 2022. Germany is expected to have 6.7% of its total installed capacity from bioenergy in 2023.

- In June 2023, the Energy Ministry of Spain announced plans to double its 2030 biogas and green hydrogen production targets. The revised plan sets a 2030 target of 11 gigawatts (GW) of electrolyzers, up from a previous target of 4 GW and biogas production to 20 terawatt hours (TWh).

- Germany is one of the crucial players in bioenergy, and the country is constantly expanding its bioenergy capacity. In February 2023, BioEnergy Germany company, which specializes in the design, construction, and operation of biogas plants, secured a contract for the construction of a 56 MWel biogas plant in Nkhotakota District in the Central Region of Malawi by BlueHills Capital Projects (Pty) Limited. The biogas plant will be fed with Napier grass from the surrounding plantations.

- Further, countries like Italy are likely to support the region's growth in the bioenergy sector. In June 2023, Enterra secured USD 38 million in project financing from UniCredit for a biomass plant in Italy. Located in Foggia in the southern region of Apulia, the 13 MW plant produces electric and thermal energy from biomass.

- Hence, with the upcoming projects and the targets to achieve a carbon-neutral environment during the upcoming years, the region is expected to have dominancy during the forecast period.

Bioenergy Industry Overview

The bioenergy market is semi fragmented. Some of the major players in the market (in no particular order) include Mitsubishi Heavy Industries Ltd, Hitachi Zosen Corp., BTG Biomass Technology Group, Babcock & Wilcox Volund AS, Biomass Engineering Ltd., and Orsted AS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Bioenergy Installed Capacity Historic and Forecast, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Shift towards Renewable Energy

- 4.5.1.2 Less Electricity Generation Cost from Bioenergy

- 4.5.2 Restraints

- 4.5.2.1 High Initial Investments

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Solid Biomass

- 5.1.2 Biogas

- 5.1.3 Renewable Waste

- 5.1.4 Other Types

- 5.2 Technology

- 5.2.1 Gasification

- 5.2.2 Fast Pyrolysis

- 5.2.3 Fermentation

- 5.2.4 Other Technologies

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Qatar

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Heavy Industries Ltd

- 6.3.2 MVV Energie AG

- 6.3.3 A2A SpA

- 6.3.4 Hitachi Zosen Corp.

- 6.3.5 BTG Biomass Technology Group

- 6.3.6 Babcock & Wilcox Volund AS

- 6.3.7 Biomass Engineering Ltd

- 6.3.8 Orsted AS

- 6.3.9 Enerkem

- 6.3.10 Fortum Oyj

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advanced Technologies

02-2729-4219

+886-2-2729-4219