|

市场调查报告书

商品编码

1689695

全球热泵市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Heat Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

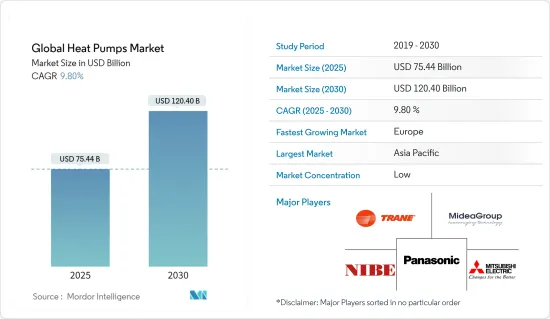

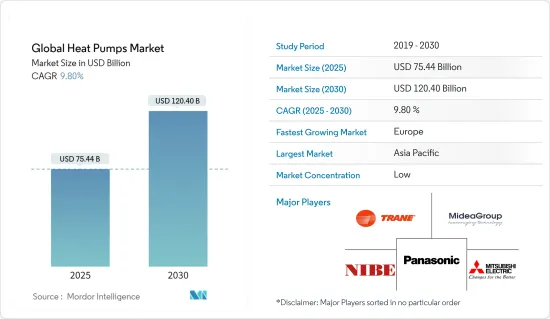

预计 2025 年全球热泵市场规模为 754.4 亿美元,到 2030 年将达到 1,204 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.8%。

热泵采用机械压缩循环冷冻原理运行,也可以逆转以加热或冷却设施中的所需空间。因此,冷却和加热应用的市场正在不断扩大。

关键亮点

- 热泵可以从促进环境永续性中获得策略性利益。此外,欧盟产业整合策略预测,到2030年,65%的商业建筑将采用电力暖气。资料显示,由于建筑物使用热泵进行供暖和製冷,热泵的销售量预计会增加。

- 此外,对节能电器日益增长的需求推动了热泵等技术的应用,为最终用户提供了为世界各地可再生能源和气候目标做出贡献的巨大潜力。

- 此外,预计在预测期内,减少对石化燃料的依赖以及寻找更节能的炉子和空调替代品的需求将推动对热泵的需求。由于热泵移动热量而不是产生热量,因此它们可以提供相同水平的空间调节,而营业成本约为传统加热和冷却设备的四分之一。

- 对设施的某些区域进行加热可以节省空气处理机组 (AHU) 的材料成本。但是,如果您安装热泵作为主要的加热和冷却系统,这些因素可能会影响整体安装成本。

- 儘管可以预见,由于 COVID-19 疫情的影响,热泵销量将停滞甚至下降,但政府倡议和消费者需求预计将推动热泵销售。

热泵市场趋势

住宅热泵预计将强劲成长

- 各地区实施的旨在推广近零能耗建筑的法规指导住宅使用热泵等高效能源来源来提高能源性能。热泵通常用作独立式住宅和联排式住宅的热源。多用户住宅中热泵的使用量也在增加。

- 此外,加州能源委员会(CEC)通过的2022年建筑能源效率标准(能源法规)将于2023年1月1日生效,对美国加州的建筑物提出了几项新要求。根据2022年能源法规,新建的独栋住宅必须安装水对空气电热泵。此外,所有新建多用户住宅都必须配备电热泵加热。

- 供应商也致力于住宅脱碳以减少二氧化碳排放。例如,大金最近宣布了一项改造住宅供暖和製冷的四阶段计划。据该公司称,欧洲的建筑存量约占欧盟二氧化碳排放总量的36%。因此,在新建住宅中都安装了热泵,从而推动了该地区对热泵的需求。

- 儘管受到新冠疫情的影响,许多市场的住宅仍大幅增加,这也支持了市场的成长。例如,根据德国两大建筑协会ZDB和HDB的数据,预计2022年德国建筑业的销售额将达到1,510亿欧元,比2021年成长5.5%。预计成长预测将受到该国住宅建筑业强劲表现的推动,该行业在整个疫情期间一直保持着韧性。

- 此外,2022年4月,大金宣布支援REPowerEU,目标是将热泵的使用数量从2027年的1000万台增加到2030年的3000万台。该运动也将推动住宅脱碳,帮助欧盟实现2050年住宅领域脱碳目标。

- 德国联邦热泵协会 (Bundesverband Warmepumpe) 表示,2023 年德国购买的大部分热泵将是空气加热型,即从室外空气中获取能量。此外,用于加热生活热水的热泵数量也在快速增长。

亚太地区可望主导市场

- 中国是热泵的主要市场之一,因为中国政府大力支持节能基础建设,这将促进市场成长。中国幅员辽阔,官方将其划分为五大气候区,每个气候区都有不同的热设计要求。可以为这些地区量身定制供暖解决方案,以满足巨大的市场机会。

- 在日本,热泵是私人和商业环境中众所周知的产品。热泵也正在被广泛应用于各种行业。这项发展始于几十年前,并透过节能措施得到了进一步推动。这是由自然资源和能源局製定的,要求在2013年至2030年期间实现节能5,030万立方公尺原油当量。这样的案例可能会刺激该国对热泵的需求。

- 在印度,饭店、商场、剧院等场所对热泵的使用逐渐增加。此外,印度拥有丰富的太阳能。根据韩国新可再生能源部统计,截至2022年11月30日,太阳能发电装置容量已达约6,197千万瓦。上年度,该国的太阳能发电能力位居世界第四。太阳能集热器和热泵组合系统可能成为增加全球可再生能源用于空间加热和生活热水使用的一个有吸引力的选择。

- 在韩国,政府在节能解决方案方面的措施正在推动市场成长。例如,韩国环境部对现代科纳电动车和起亚尼罗电动车进行的一项研究发现,热泵可显着降低寒冷条件下的电池消耗。

- 在澳大利亚,澳洲绿建筑委员会(GBCA)于2003年推出了绿星认证。澳洲政府也计划在2030年将温室气体排放在2005年的水平上减少26-28%。这些案例显示预测期内市场存在巨大的成长机会。

- 其他亚太地区包括印尼、新加坡和泰国。印尼是世界领先的地热能源国家之一,并有志于采用可再生能源进一步发展地热能源产业。例如,在2022年第八届印尼国际地热大会暨展览会(IIGCE)上,印尼政府宣布,透过其电力供应总体规划,已设定了2030年地热开发装置容量容量达到330万千瓦的目标。这些倡议预计将为所研究的市场带来积极的前景。

热泵产业概况

由于特灵公司、美的集团、松下公司、三菱电机公司和大金工业株式会社等主要参与者的存在,全球热泵市场的竞争态势处于较高水平。

- 2022 年 11 月 - TRANE 宣布将透过从领先供应商 Nucor Corporation Econiq 购买低碳钢并从美国 Steel verdeX 获得额外配给来减少其耐用 HVAC 解决方案的碳影响。该钢材将用于美国製造流程,生产特灵的家用高效热泵和空调,以及学校和资料中心等商业建筑的温度控管系统。

- 2022 年 11 月 - 三菱推出一款连锁空气源热泵,可产生 7.8kW 至 640kW 的热量。此热泵无需增压加热器即可产生高达 70°C 的热水。三菱电机推出了这款空气源热泵,供学校、医院等业务用途使用。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- COVID-19 市场影响

第五章市场动态

- 市场驱动因素

- 对节能解决方案的需求不断增加

- 政府加大力度控制碳排放

- 市场限制

- 热泵安装成本高

第六章市场区隔

- 按类型

- 空气热源

- 水热源

- 地热(表面)热源

- 按行业

- 工业的

- 商业的

- 设施

- 住宅

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 西班牙

- 法国

- 义大利

- 德国

- 荷兰

- 亚洲

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章竞争格局

- 公司简介

- Trane Inc.(Trane Technologies)

- Midea Group

- NIBE Group

- Panasonic Corporation

- Mitsubishi Electric Corporation

- Daikin Industries Ltd

- Stiebel Eltron GmbH & Co. KG(De)

- Glen Dimplex Group

- Viessmann Werke GmbH & Co. KG

- Flamingo Heat Pumps(Flamingo Chillers)

- WOLF GMBH(ARISTON GROUP)

- Efficiency Maine

第八章投资分析

第九章:市场的未来

The Global Heat Pumps Market size is estimated at USD 75.44 billion in 2025, and is expected to reach USD 120.40 billion by 2030, at a CAGR of 9.8% during the forecast period (2025-2030).

The heat pump works on the principle of mechanical-compression cycle refrigeration that can even be reversed to heat or cool the desired space of a facility. Hence, the market studied is growing for cooling applications and space heating.

Key Highlights

- Heat pumps are strategically placed to benefit from the drive to environmental sustainability. Furthermore, the European Union's strategy of sector integration suggests that 65% of all commercial buildings will be heated by electricity in 2030. The data indicate that heat pump sales are only expected to grow with buildings depending on them for heating and cooling.

- Furthermore, The growing demand for energy-efficient devices has been driving the deployment of technology, such as heat pumps, to provide end users with significant potential to contribute to renewable energy and climate targets across various regions worldwide.

- Moreover, The growing need to curb dependence on fossil fuels and look for an energy-efficient alternative to furnaces and air conditioners is expected to boost the demand for heat pumps over the forecast period. As heat pumps transfer heat rather than generate heat, they can offer equivalent space conditioning at as little as one-quarter of the operating costs of conventional heating or cooling appliances.

- Heating a few areas of the facility may save money on material costs for the air handler unit (AHU). However, these factors may affect the overall installation costs if heat pumps are installed as the main heating and cooling system.

- While it is realistic to expect slow growth or even a decline in heat pump sales owing to the COVID-19 pandemic, government policies and consumer demand are expected to drive the sales of heat pumps.

Heat Pump Market Trends

Residential Heat Pumps are Expected to Witness Significant Growth

- The regulations implemented in different regions aimed at promoting nearly zero energy buildings are directing residential buildings to improve energy performance through efficient energy sources, such as heat pumps. Heat pumps are often used as heat sources in single-family and terraced houses. Heat pumps are also increasingly used in apartment buildings.

- Further, the 2022 Building Energy Efficiency Standards (Energy Code) adopted by the California Energy Commission (CEC), which goes into effect January 1, 2023, introduced some new requirements for buildings in California, United States. According to the 2022 Energy Code, new single-family homes must have electric heat pumps for water and air. Electric heat pumps for space heating are also needed in all new multi-family residences.

- Vendors are also focusing on residential decarbonizing to decrease CO2 emissions. For instance, in recent years, Daikin announced a four-step plan to transform residential heating and cooling. According to the company, the European building stock is responsible for approximately 36 % of all CO2 emissions in the European Union. Therefore, heat pumps are being deployed in new residential constructions, thus, driving the need for heat pumps in the region.

- Residential construction has seen a considerable boost in many markets despite the impact of COVID-19, which also supports market growth. For instance, the German construction sector was expected to bring in sales of EUR 151 billion in 2022, up 5.5% from 2021, according to figures from the country's two leading construction associations, ZDB and HDB. The growth projection was anticipated to be led by the strong performance of the country's residential construction sector, which has remained resilient throughout the pandemic.

- Further, in April 2022, Daikin announced its support for the REPowerEU, which has set a goal to boost the rollout of heat pumps from 10 million units in 2027 to 30 million units in 2030. This is further associated with residential decarbonization as the movement can help the European Union achieve the residential sector's decarbonization goals by 2050.

- As stated by Bundesverband Warmepumpe, the majority of heat pumps purchased in Germany in 2023 were aerothermal, meaning they draw energy from the external air. Moreover, the quantity of heat pumps being utilized for heating household water is rapidly rising.

Asia Pacific Expected to Dominate the Market

- China is one of the significant markets for heat pumps, owing to the government's policies to support more energy-efficient infrastructure in the country, thereby augmenting the market growth. China's vast geographic area is officially divided into five primary climate zones with different thermal design requirements. Heating solutions for these regions can be tailor-made to meet the huge market opportunities.

- In Japan, heat pumps are well-known products in private and commercial settings. Various types of industries have also embraced them. This development began several decades ago and has been further pushed by energy conservation measures. These were formulated by the Agency for Natural Resources and Energy, stipulating energy conservation of 50.3 million m3 crude oil equivalent between 2013 and 2030. Such instances are likely to boost the demand for heat pumps in the country.

- Applications of heat pumps in hotels, malls, theatres, etc., are gradually gaining traction in India. Moreover, a tremendous amount of solar energy is available in the country. According to the Ministry of New and Renewable Energy, solar power installed capacity reached around 61.97 GW as of 30th November 2022. The country stood 4th in solar PV deployment across the globe in the previous year. The system combination of solar thermal collectors and heat pumps can be an attractive option for increasing renewable energy usage worldwide for heating and domestic hot water preparation.

- In South Korea, government initiatives concerning energy-efficient solutions are driving the market growth. For instance, a study carried out by Korea's Ministry of the Environment on the Hyundai Kona Electric, and Kia Niro EV found that the heat pump significantly reduced battery consumption in cold conditions.

- In Australia, the Green Building Council of Australia (GBCA) launched the Green Star certification in 2003. Additionally, the Australian Government is focused on a 26-28% reduction in greenhouse gas emissions from 2005 levels by 2030. Such instances demonstrate a significant market growth opportunity over the forecast period.

- The countries considered under the rest of Asia-Pacific include Indonesia, Singapore, and Thailand. Indonesia is one of the leading geothermal energy powers in the world and has set ambitions to grow the sector further as the country embraces renewable energy sources. For instance, During the 8th Indonesia International Geothermal Convention & Exhibition (IIGCE) 2022, the Indonesian government announced that, through the General Plan for the Provision of Electricity, it had set a geothermal development target of 3.3 GW installed capacity by 2030. Such initiatives are likely to create a positive outlook for the studied market.

Heat Pump Industry Overview

The competitive rivalry in the global heat pumps market is high owing to the presence of some major players such as Trane Inc., Midea Group, Panasonic Corporation, Mitsubishi Electric Corporation, and Daikin Industries Ltd, amongst others. Their ability to continually innovate their offerings has enabled them to gain a competitive advantage over other players in the market. These players have expanded their market footprint through R&D activities, mergers & acquisitions.

- November 2022 - TRANE announced that it would reduce the carbon impact of its endurable HVAC solutions by buying low-carbon steel from major supplier Nucor Corporation Econiq, with an additional allotment from US Steel verdeX. The steel will be utilized in US manufacturing processes to build Trane high-efficiency heat pumps and air conditioners for homes and thermal management systems for commercial buildings such as schools and data centers.

- November 2022 - Mitsubishi launched a cascaded air source heat pump that can produce between 7.8 kW and 640 kW of heat. The heat pump can generate hot water at a temperature of up to 70 C without boost heaters. Mitsubishi Electric released the air source heat pump for commercial applications, including schools and hospitals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Degree of Competition

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Energy Efficient Solutions

- 5.1.2 Increasing Government Initiatives to Curb Carbon Emission

- 5.2 Market Restraints

- 5.2.1 High Installation Cost of Heat Pumps

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Air-Source

- 6.1.2 Water-Source

- 6.1.3 Geothermal (Ground) Source

- 6.2 By End-User Vertical

- 6.2.1 Industrial

- 6.2.2 Commercial

- 6.2.3 Institutional

- 6.2.4 Residential

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Spain

- 6.3.2.2 France

- 6.3.2.3 Italy

- 6.3.2.4 Germany

- 6.3.2.5 Netherlands

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Trane Inc. (Trane Technologies)

- 7.1.2 Midea Group

- 7.1.3 NIBE Group

- 7.1.4 Panasonic Corporation

- 7.1.5 Mitsubishi Electric Corporation

- 7.1.6 Daikin Industries Ltd

- 7.1.7 Stiebel Eltron GmbH & Co. KG (De)

- 7.1.8 Glen Dimplex Group

- 7.1.9 Viessmann Werke GmbH & Co. KG

- 7.1.10 Flamingo Heat Pumps (Flamingo Chillers)

- 7.1.11 WOLF GMBH (ARISTON GROUP)

- 7.1.12 Efficiency Maine