|

市场调查报告书

商品编码

1689700

永续食品服务包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Sustainable Foodservice Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

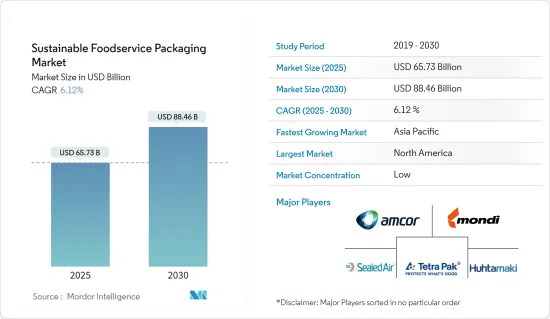

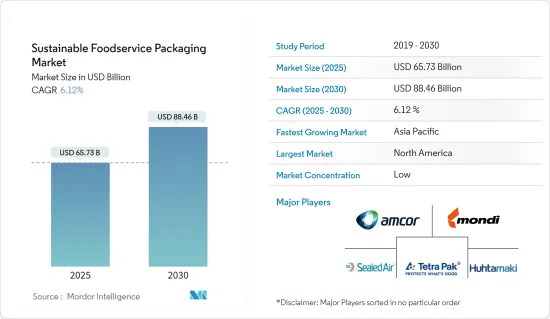

永续食品服务包装市场规模预计在 2025 年为 657.3 亿美元,预计到 2030 年将达到 884.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.12%。

主要亮点

- 随着客户对环境问题和包装洩漏影响的关注度不断提高,包装的永续性正成为影响产业的关键趋势。因此,各个领域都出现了严格的永续性要求。餐饮业担心塑胶包装对环境的影响,正转向再生材料,推动市场研究。越来越多的公司采用可回收和生物分解性的材料,这不仅有助于减少碳排放,而且还能满足有环保意识的消费者群体的需求。

- 城市人口的快速成长推动了对已调理食品和已调理食品食品的需求,从而增加了餐饮业对永续包装解决方案的需求。因此,餐饮业对永续包装解决方案的需求日益增加。都市化推动人口向都市区集中,增加了对方便食品的需求。这一趋势在大都会圈尤其明显,因为繁忙的生活方式需要快速简便的膳食解决方案,从而增加了对食品包装的依赖。

- 在全部区域,都市化、不断变化的生活方式、现代忙碌的工作生活以及对线上食品平台日益增长的依赖正在重塑餐饮服务和格局。这项变化推动了该行业对永续包装解决方案的需求。网路食品宅配服务的便利性导致一次性包装的激增,推动了对更多永续替代品的需求。为了应对这一问题,各公司正在开发创新包装,这种包装不仅环保,而且还能在运输过程中保持食品的品质和安全。

- 随着产业向废弃物未来转变,包装创新问题(包括新材料、补充系统和回收解决方案)正成为焦点。雀巢透过雀巢包装科学研究所内部进行了广泛的研究,并设立了 2.5 亿瑞士法郎的永续包装风险基金,以支持专注于这些关键领域的新兴企业。该基金旨在加速尖端永续包装技术的开发和应用,并确保新的解决方案有效且可扩展。

- 虽然永续包装的好处显而易见,但必须注意的是,其成本明显高于传统的外食方式。这种成本差异是由于材料采购(原始材料和再生材料)、供应链和製造流程(该行业仍在发展中)目前都缺乏规模经济,阻碍了市场成长。高成本还在于开发符合行业标准和消费者期望的永续包装解决方案所需的先进技术和研究。

永续食品服务包装市场的趋势

快餐店预计在终端用户中引领市场

- 快餐店 (QSR) 注重快速服务和价格实惠,与注重最低限度餐桌服务和自助服务的传统餐饮场所有所区别。然而,该行业对永续性的立场并不一致。

- 从历史上看,QSR 一直与不太环保的做法联繫在一起,例如使用发泡聚苯乙烯杯、塑胶盖、纸板容器、基因改造蔬菜和无机肉,但这种趋势正在转变。随着顾客越来越重视环保服务,许多速食店纷纷转向更绿色、更环保的选择。

- 一些快餐店,尤其是那些以提供有机食品而闻名的快餐店,正在积极采用环保做法来减少其碳排放。这些努力包括采购有机和当地种植的农产品、使用生物分解性的包装和实施节能业务。

- 此外,该行业的伙伴关係正在不断增多,这在很大程度上是由于对永续包装解决方案的需求不断增长。这些合作通常包括与专门从事环保材料和技术的供应商合作,进一步促进产业的永续性。例如,2024 年 6 月,包装解决方案公司 Saika Group 与主要企业的快速消费品製造商亿滋国际联手推出了一款创新的纸製品。该产品专为糖果零食、饼干和巧克力市场的多件包装而设计。新的包装可以在纸质废物流中回收,并且可以热封。此外,它还具有灵活性,可以根据所需的最终外观製造涂层或无涂层的产品。

亚太地区占最大市场占有率

- 亚太地区是中国和印度等人口稠密的新兴经济体的所在地,该地区对餐饮服务的需求正在激增。同时,人们开始明显转向永续包装,该地区预计将在未来几年引领这一趋势。这种转变是由消费者对环境问题意识的不断提高和政府减少塑胶废弃物的严格监管所推动的。

- 塑胶长期以来一直是包装中为消费者提供便利的基石,但其主导地位正在丧失。儘管具有成本效益,塑胶在食品工业中的应用正在超越纸板、玻璃和金属等传统材料。然而,塑胶的耐用性使得它如此吸引人,但同时也意味着它不可降解,并造成了印度 43% 的污染。塑胶废弃物对环境的影响促使公共和私营部门探索永续的替代方案。

- 印度铁路公司和印度航空等公司认识到形势的紧迫性,已承诺用环保纸和木质刀叉餐具取代塑料,标誌着整个行业的转变。这些努力是永续性运动的一部分,包括减少碳足迹和促进循环经济。从大公司到本土品牌,人们越来越倾向于放弃使用一次性塑料,转而选择可回收、可重复使用和可堆肥的替代品。预计这项转变不仅可以减少环境破坏,还能实现全球永续性目标。

永续食品服务包装产业概况

在永续食品服务包装市场,Amcor Limited、Sealed Air Corporation 和 Mondi PLC 等知名公司正在透过策略伙伴关係、联盟和创新倡议推动成长。这些努力包括开发环保包装解决方案、投资研发和扩大产品系列。这些活动正在推动市场发展势头并满足对永续包装选择日益增长的需求。

- 2024 年 3 月,SEE 推出了创新的纸基网,帮助食品加工商和零售商减少塑胶使用量,同时满足消费者对纸包装日益增长的需求。该产品以 CRYOVAC 阻隔成型纸品牌销售,由 90% 的 FSC 认证纤维製成。据 SEE 称,用这种阻隔纸取代传统的 PET/PE 网可显着减少底网包装中 77% 的塑胶使用量。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争程度

- 替代品的威胁

- 生态系分析

- 评估微观经济因素对产业的影响

第五章 市场动态

- 市场驱动因素

- 线上食品订购服务将推动市场

- 消费者偏好转向可回收和环保材料

- 市场限制

- 永续食品服务包装所用材料的高回收成本可能会阻碍市场成长

第六章 市场细分

- 依产品类型

- 瓦楞纸箱和纸箱

- 托盘、盘子、食品容器、碗

- 泡壳

- 其他产品类型

- 按最终用户

- 速食店

- 全方位服务餐厅

- 机构

- 饭店业

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Amcor PLC

- Mondi PLC

- Sealed Air Corporation

- Tetra Pak International SA

- Huhtamaki Oyj

- Winpak Limited

- Amhil North America

- Sonoco Products Company

- WestRock Company

- Dart Container Corporation

第八章投资分析

第九章:市场的未来

The Sustainable Foodservice Packaging Market size is estimated at USD 65.73 billion in 2025, and is expected to reach USD 88.46 billion by 2030, at a CAGR of 6.12% during the forecast period (2025-2030).

Key Highlights

- With a rising customer focus on environmental concerns and the repercussions of package leaks, sustainability in packaging emerges as a pivotal trend shaping the industry. Consequently, stringent sustainability mandates are emerging across various sectors. The foodservice industry, alarmed by the environmental impact of plastic containers, is pivoting toward recycled materials, propelling the market studied. Companies are increasingly adopting recycled and biodegradable materials to meet these new standards, which not only help in reducing the carbon footprint but also cater to the eco-conscious consumer base.

- The surge in urban population growth is fueling the demand for prepared and ready-to-eat foods, consequently bolstering the need for sustainable packaging solutions in the foodservice sector. This, in turn, is set to drive the market in the coming years. Urbanization leads to a higher concentration of people in cities, which increases the demand for convenient food options. This trend is particularly evident in metropolitan areas where busy lifestyles necessitate quick and easy meal solutions, thereby increasing the reliance on foodservice packaging.

- Across major regions, urbanization, evolving lifestyles, the rush of modern work life, and a growing reliance on online food platforms are reshaping the food service and landscape. This shift is amplifying the call for sustainable packaging solutions in the sector. The convenience of online food delivery services has led to a surge in single-use packaging, prompting a need for more sustainable alternatives. Companies are responding by developing innovative packaging that is not only eco-friendly but also maintains the quality and safety of food during transit.

- As the industry steers toward a waste-free future, challenges like packaging innovation, encompassing novel materials, refill systems, and recycling solutions, come to the forefront. Nestle, bolstering commitment, conducts extensive in-house research via the Nestle Institute of Packaging Sciences, earmarking a CHF 250 million sustainable packaging venture fund to back startups focusing on these pivotal areas. This fund aims to accelerate the development and adoption of cutting-edge sustainable packaging technologies, ensuring that new solutions are both effective and scalable.

- While the benefits of sustainable packaging are evident, it is crucial to note that its costs are notably higher than traditional foodservice alternatives. This cost disparity is attributed to the sourcing of materials, both virgin and recycled, and the industry's nascent supply chains and manufacturing processes, all of which currently lack economies of scale, thus impeding market growth. The higher costs are also due to the advanced technology and research required to develop sustainable packaging solutions that meet industry standards and consumer expectations.

Sustainable Foodservice Packaging Market Trends

Quick-service Restaurants are Expected to Drive the Market Among End Users

- Quick-service restaurants (QSRs) prioritize fast service and affordability, distinguishing them from traditional dining establishments with their minimal table service and self-service focus. However, the industry's stance on sustainability has been inconsistent.

- While QSRs have historically been associated with less eco-friendly practices, such as styrofoam cups, plastic lids, cardboard holders, genetically modified vegetables, and inorganic meat, the tide is turning. With customers increasingly valuing eco-conscious services, many QSRs are pivoting toward greener, more eco-friendly options.

- Some QSRs, particularly those known for their organic offerings, are actively adopting eco-friendly practices to shrink their carbon footprint. These practices include sourcing organic and locally grown produce, using biodegradable packaging, and implementing energy-efficient operations.

- Moreover, the sector is witnessing a surge in partnerships, largely driven by the growing demand for sustainable packaging solutions. These collaborations often involve working with suppliers who specialize in eco-friendly materials and technologies, further promoting sustainability within the industry. For instance, in June 2024, Saica Group, a packaging solutions company, and Mondelez, a leading fast-moving consumer goods manufacturer, collaborated to introduce an innovative paper-based product. This product is specifically designed for multipack offerings in the confectionery, biscuits, and chocolate markets. The new packaging is recyclable within the paper waste stream and compatible with heat-seal processes. Additionally, it offers the flexibility of being produced either coated or uncoated, depending on the desired final appearance.

Asia-Pacific Accounts for the Largest Market Share

- The Asia-Pacific region, home to densely populated and emerging economies like China and India, is witnessing a surge in the demand for food services. Concurrently, there is a notable shift toward sustainable packaging, with the region poised to lead this trend in the coming years. This shift is driven by increasing consumer awareness about environmental issues and stringent government regulations to reduce plastic waste.

- While plastic has long been the cornerstone of consumer convenience in packaging, its dominance is being challenged. Despite its cost-effectiveness, plastics have edged traditional materials like corrugated paper boards, glass, and metals in the food industry. Yet, the very durability that makes plastic appealing also renders it non-degradable, leading to a concerning 43% pollution contribution in India. The environmental impact of plastic waste has prompted both public and private sectors to seek sustainable alternatives.

- Recognizing the urgency, entities like the Indian Railways and Air India have pledged to swap plastic for eco-friendly paper and wooden cutlery, signaling a broader industry shift. These initiatives are part of a larger movement toward sustainability, which includes efforts to reduce carbon footprints and promote circular economies. From major corporations to local brands, there is a palpable momentum toward ditching single-use plastics in favor of recyclable, reusable, and compostable alternatives. This transition is expected to not only mitigate environmental damage but also align with global sustainability goals.

Sustainable Foodservice Packaging Industry Overview

In the sustainable foodservice packaging market, prominent companies like Amcor Limited, Sealed Air Corporation, and Mondi PLC are driving growth through strategic partnerships, collaborations, and innovative initiatives. These efforts encompass the development of eco-friendly packaging solutions, investment in research and development, and the expansion of product portfolios. Such activities are enhancing the market's momentum and meeting the rising demand for sustainable packaging options.

- March 2024: SEE introduced an innovative paper-based bottom web designed to assist food processors and retailers in reducing plastic usage while meeting the growing consumer demand for paper packaging. Marketed under the CRYOVAC Barrier Formable Paper brand, this product is composed of 90% FSC-certified fibers. According to SEE, replacing traditional PET/PE webs with this Barrier Formable Paper can achieve a significant 77% reduction in plastic usage in bottom web packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Degree of Competition

- 4.3.5 Threat of Substitutes

- 4.4 Industry Ecosystem Analysis

- 4.5 Assessment of the Impact of Microeconomic Factors on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Online Food Ordering Services Will Drive the Market

- 5.1.2 Shift in Consumer Preferences Toward Recyclable and Eco-friendly Materials

- 5.2 Market Restraints

- 5.2.1 The High Recycling Cost for the Materials Used for the Sustainable Foodservice Packaging Might Hinder the Growth of the Market

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Corrugated Boxes and Cartons

- 6.1.2 Trays, Plates, Food Containers, and Bowls

- 6.1.3 Clamshells

- 6.1.4 Other Product Types

- 6.2 By End Users

- 6.2.1 Quick Service Restaurants

- 6.2.2 Full Service Restaurants

- 6.2.3 Institutional

- 6.2.4 Hospitality

- 6.2.5 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Mondi PLC

- 7.1.3 Sealed Air Corporation

- 7.1.4 Tetra Pak International SA

- 7.1.5 Huhtamaki Oyj

- 7.1.6 Winpak Limited

- 7.1.7 Amhil North America

- 7.1.8 Sonoco Products Company

- 7.1.9 WestRock Company

- 7.1.10 Dart Container Corporation