|

市场调查报告书

商品编码

1689729

自动贴标机:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Automatic Labeling Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

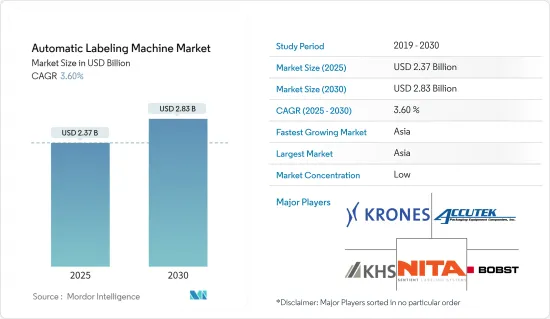

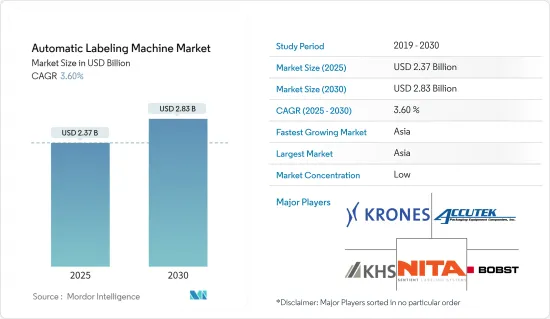

自动贴标机市场规模预计在 2025 年为 23.7 亿美元,预计到 2030 年将达到 28.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.6%。

主要亮点

- 技术进步和数位转型大大增加了标籤的重要性。供应链复杂性的提高、监管要求的提高以及消费者对产品资讯的需求正在推动这一增长。最终用户产品有多种包装和材料选择,从塑胶容器到生物分解性材料,每种都需要独特的标籤解决方案。从全球来看,随着製造商寻求提高效率、减少错误和适应日益增加的产品变化,对速度更快的自动化贴标机的需求正在增长。这一趋势在食品饮料、製药和电子商务行业中尤为明显,准确、快速的标籤对于库存控制、可追溯性和客户满意度至关重要。

- 标籤技术的进步也促进了智慧标籤的发展,智慧标籤结合了二维码和无线射频识别标籤等功能,以增强产品追踪并向消费者提供更多资讯。此外,电子商务加速了对高效标籤系统的需求,以管理大量的运输和退货。环境议题也影响标籤实践,人们更重视永续材料和环保油墨。随着全球市场联繫日益紧密,多语言和特定地区的标籤要求为产业带来了新的复杂性,推动了灵活、适应性强的标籤解决方案的创新。

- 食品和饮料行业对快速、准确的标籤解决方案的需求日益增长,推动了贴标机市场的成长。这项需求是由各行各业推动的,他们不断提高生产流程的自动化和效率。贴标机可确保产品识别、可追溯性和符合法规要求。为了满足日益增长的需求,製造商正致力于透过采用新的技术进步来增强其产品功能。这些进步包括改进的印刷技术、与生产线系统的整合、增强的资料管理和客製化的软体功能。

- 市场也呈现出一种趋势,即机器的用途更加广泛,可以适应各种类型和尺寸的标籤,以满足食品和饮料製造商的多样化需求。随着产业的不断发展,贴标机製造商有望投资研发以创造更多创新解决方案。这可能包括用于即时监控和维护的物联网连接,以及用于优化标籤流程和减少错误的人工智慧驱动系统。

- 自动贴标机在零售产品中的使用越来越广泛,推动了贴标机市场的发展。这一趋势与零售业密切相关,预计将持续下去。在新兴经济体中,包装食品和饮料的普及率很高,为各种包装材料提供了成长机会。追踪和防伪标籤可以有效地监控货物并确保产品的完整性。用于打击诈骗和盗窃的安全标籤的需求可能会增加对该设备的需求。在美国,将无线射频辨识(RFID)技术融入感压标籤在各行各业中正变得越来越重要。然而,製造商面临着跟上最新贴标机技术的挑战,而且与半自动或手动替代品相比,全自动机器的初始成本更高。

- 贴标机的高成本限制了市场的扩展。如此高成本可能会阻止潜在买家(例如中小型企业)投资先进的标籤设备。购买和安装贴标机的初始资本支出可能很大,通常需要占用公司预算的很大一部分。此外,持续的维护、维修和潜在的升级也会进一步增加整体拥有成本。这些经济负担可能会导致一些公司选择手动标记流程或不太复杂的设备,从而导致效率和准确性降低。因此,儘管自动标籤解决方案具有长期利益,但一些公司仍需要帮助证明投资的合理性,而且市场的潜在成长将受到这些经济进入障碍的限制。

自动贴标机市场趋势

饮料领域占很大市场占有率

- 饮料业对自动化的需求不断增长将推动自动贴标机市场的发展。随着消费者越来越注重产品细节,标籤对于提供产品资讯和促进销售至关重要。为了满足日益增长的饮料需求,製造商正在转向自动标籤系统。自动贴标机与手动贴标流程相比有几个优点:这些机器可以提高效率、降低人事费用并提高标籤放置的准确性。此外,我们能够适应各种容器形状和尺寸,满足饮料行业多样化的包装需求。此外,自动贴标机可以高速运行,使製造商能够满足不断增长的生产需求。

- 饮料业对一致的品牌和法规遵循的需求进一步推动了自动贴标机的采用。这些系统可以实现精确的标籤定位,确保整个产品线的外观统一。它还可以透过准确显示营养成分、成分和有效期等所需资讯来帮助製造商遵守标籤法规。随着饮料行业的扩大和多样化,对灵活高效的标籤解决方案的需求预计会增加。这一趋势可能会刺激自动贴标机技术的进一步创新,包括与生产线更好地整合以及更强的客製化能力,以满足特定行业需求。

- 饮料製造商面临多重挑战,包括劳动力短缺、需求增加以及供应链持续中断。食品包装自动化对于这些组织来说至关重要,因为它可以提高製造生产力而无需额外的劳动力。由于未来几年需求预计会增加,而且劳动力短缺的情况将持续下去,包装自动化可能会变得更加重要。因此,製造商正在转向技术解决方案。工业 4.0 技术的进步将在未来十年改变食品製造业。

- 由于食品和饮料行业的需求不断增长,製造商不断投资于贴标机的创新。不断发展的饮料产业对高速自动贴标机的需求日益增加。这项需求是由业界对高效、准确的标籤解决方案的需求所推动的,以满足消费者的期望和监管标准。此图显示了 2023 年德国蔬果饮料销售量按包装类型分布。一次性 PET 是最受欢迎的包装,占总销售量的 49%,其次是纸盒包装,占 34%。这些资料凸显了这些包装材料的庞大市场占有率,并强调了多功能标籤解决方案的重要性。

- 由于饮料包装材料种类繁多,包括PET、玻璃和纸盒,饮料包装行业需要高端的自动贴标机。这些机器必须能够适应各种容器形状、尺寸和物料输送,同时保持高速和高精度。快速适应不同包装类型的能力对于製造商在动态饮料行业中保持竞争力至关重要。此外,对永续性和环保包装选择的关注度不断提高,推动了标籤技术的创新。製造商正在开发能够有效应用可回收标籤和使用环保包装材料的机器,以符合消费者偏好和永续包装解决方案的监管要求。

亚洲:可望实现高成长

- 亚洲是世界上人口最多的地区,消费者对包装的认识正在显着提高。这一趋势推动了食品业对包装解决方案和高速、高品质标籤系统的巨大需求。中国、台湾和越南利用这个不断成长的市场,已成为该地区自动贴标机的主要出口国。受多种关键因素推动,亚太地区对印刷标籤的需求正在快速成长。新兴市场的经济成长正在增加可支配收入和消费者的消费能力。同时,消费者的健康意识也日益转向标示清晰的包装食品和饮料。这些因素共同促进了该地区食品和饮料行业的扩张。

- 随着都市化进程的加速和零售网路在亚太地区的扩张,高效、准确的标籤解决方案变得越来越重要。自动贴标机满足严格的贴标要求,确保产品可追溯性并保持高速生产。在语言要求多样化和监管标准严格的市场中,这项技术非常有价值。电子商务的成长和对产品差异化的日益重视也推动了先进标籤解决方案的采用。为了满足亚太市场的多样化需求,製造商正在投资能够适应多种包装类型和尺寸的多功能贴标机。随着该地区的不断发展,自动贴标机市场预计将成长,製造过程的自动化将进一步推动这一趋势。

- 中国对贴标机的需求主要由两个关键因素驱动:各行业对提高生产力的需求日益增长以及技术的持续进步。食品饮料、製药、化工等行业尤其重要。此外,中国的监管要求在塑造市场方面发挥重要作用。中国监管机构要求,包括糖果、葡萄酒、坚果、罐头食品和起司在内的进出口食品在过境前必须接受标籤和产品品质检查。然而,这些特定的标籤要求并不适用于国产食品。

- 此外,印度标籤机械产业近年来也经历了显着成长。这种成长归因于多种因素,包括工业化程度的提高、包装商品的需求增加以及标籤技术的进步。食品和饮料、製药和消费品产业是这项扩张的主要驱动力,因为它们需要高效、准确的标籤解决方案来满足监管要求和消费者的期望。此外,政府推动国内製造业的倡议进一步推动了印度标籤机械市场的成长。

- 推动日本包装市场的产业主要包括食品、酒精饮料、非酒精饮料、化妆品和盥洗用品。这些行业反映了消费者偏好和市场动态,极大地影响了日本的包装趋势和需求。 2022 年,亚太国家将消费约 2,880 亿公升包装饮料,预计到 2025 年将上升至 3,360 亿公升。这一成长轨迹证实了该地区包装商品市场的不断扩大。

- 2022年全球包装饮料消费量将达到约1.4兆公升,凸显国际饮料包装产业规模庞大。这些统计数据,包括区域细分和到 2025 年的预测,显示亚太地区为自动标籤市场带来了庞大的商机。饮料消费量的预期成长将推动对高效、准确标籤解决方案的需求,使该地区成为自动标籤技术提供者和包装设备製造商的有吸引力的市场。

自动贴标机市场概况

自动贴标机市场较为分散,Nita Labeling Systems、Bobst Group SA、KHS GmbH 和 Krones AG 等多家全球和区域参与者在竞争激烈的市场领域争夺关注。该市场的特征是产品差异化程度低、产品扩散度高、竞争激烈。

- 2024 年 7 月,Nita Inc. 收购了位于明尼苏达州的专门生产旋转标籤的製造商 Shorewood Engineering LLC。 Shorewood 因向美国主要消费品公司供应顶级标籤而闻名。 Shorewood 的旋转贴标机无缝增强了 Nitta 现有的线上贴标机。值得注意的是,传统的行业领导者主要位于欧洲,而 Shorewood 是唯一一家位于北美的旋转贴标机製造商。

- 2024 年 7 月 Domino Printing Sciences 推出尖端的自动印刷和标籤检验技术。这项创新旨在最大限度地减少代价高昂的标籤错误。新推出的产品拥有先进的编码自动化软体,无需手动输入。此外,它还具有整合的机器视觉系统,以确保精确的程式码准确性。

- 2023 年 11 月西班牙标籤专家 Germark 透过购买新的 DIGITAL MASTER 340 加强了与 BOBST 的合作。这是 Germark 在短短三年内购买的第四台 BOBST 机器。一体式模组化标籤印刷机将增强德国的数位印刷能力,实现完全成品标籤的线上生产,满足高端客户的需求,尤其是美容和化妆品行业的高端客户。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 进出口分析

第五章 市场动态

- 市场驱动因素

- 食品和饮料包装自动化需求不断成长

- 自动贴标机的普及

- 市场限制

- 贴标机高成本

第六章 市场细分

- 依技术分类

- 压敏/自黏贴标机

- 收缩套标机

- 不干胶贴标机

- 套标机

- 其他技术

- 按最终用户

- 食物

- 饮料

- 药品

- 个人护理

- 化学品

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 亚洲

- 印度

- 中国

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 墨西哥

- 巴西

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- SACMI IMOLA SC

- Accutek Packaging Equipment Companies Inc.

- Krones AG

- SIDEL GROUP(Tetra Laval Group)

- HERMA GmbH

- Nita Labeling Systems

- World Pack Automation Systems

- Domino Printing Sciences PLC

- Bobst Group SA

- KHS GmbH

- ProMach Inc.

第八章投资分析

第九章 市场机会与未来趋势

The Automatic Labeling Machine Market size is estimated at USD 2.37 billion in 2025, and is expected to reach USD 2.83 billion by 2030, at a CAGR of 3.6% during the forecast period (2025-2030).

Key Highlights

- The importance of labeling has grown significantly due to technological advancements and digital transformation. The increasing complexity of supply chains, regulatory requirements, and consumer demand for product information drives this growth. End-user products are available in various packaging and material options, ranging from plastic containers to biodegradable materials, each requiring specific labeling solutions. The demand for faster and automated labeling equipment has increased globally as manufacturers seek to improve efficiency, reduce errors, and meet the rising volume of product variations. This trend is particularly evident in the food and beverage, pharmaceuticals, and e-commerce industries, where accurate and rapid labeling is crucial for inventory management, traceability, and customer satisfaction.

- The evolution of labeling technology has also led to the development of smart labels, incorporating features like QR codes and RFID tags, which enhance product tracking and provide consumers with detailed information. Additionally, e-commerce has further accelerated the need for efficient labeling systems to manage the high volume of shipments and returns. Environmental concerns have also influenced labeling practices, with a growing emphasis on sustainable materials and eco-friendly inks. As global markets become more interconnected, multilingual and region-specific labeling requirements have added another layer of complexity to the industry, which is driving innovation in flexible and adaptable labeling solutions.

- The increasing need for high-speed and accurate labeling solutions in the food and beverage industry is driving the growth of the labeling machine market. This demand is fueled by the industry's push for automation and efficiency in production processes. Labeling machines ensure product identification, traceability, and compliance with regulatory requirements. Manufacturers are focusing on enhancing their product features by incorporating new technological advancements to meet this growing demand. These advancements include improved printing technologies, integration with production line systems, and enhanced data management and customization of software capabilities.

- The market is also seeing a trend toward more versatile machines that can handle various label types and sizes, catering to the diverse needs of food and beverage producers. As the industry continues to evolve, labeling machine manufacturers are expected to invest in research and development to create more innovative solutions. These may include IoT connectivity for real-time monitoring and maintenance and AI-driven systems for optimizing labeling processes and reducing errors.

- The increasing use of automatic labeling machines in retail products drives the labeling machine market. This trend is closely tied to the retail industry and is expected to continue. Developed economies show high penetration of packaged food and beverages, offering growth opportunities for various packaging materials. Labels with tracking and anti-counterfeiting features enable effective shipment monitoring and ensure product integrity. The demand for security labeling to combat fraud and theft will likely increase equipment demand. In the United States, radio-frequency identification (RFID) integration in pressure-sensitive labels has gained importance across various industries. However, manufacturers face challenges in keeping up with the latest labeling machine technologies, and fully automatic machines come with higher initial costs compared to semi-automatic or manual alternatives.

- The significant expenses associated with labeling machines pose a limitation on market expansion. These high costs can deter potential buyers, such as tiny and medium-sized enterprises, from investing in advanced labeling equipment. The initial capital outlay for purchasing and installing labeling machines can be substantial, often requiring a considerable portion of a company's budget. Additionally, ongoing maintenance, repairs, and potential upgrades further contribute to the total cost of ownership. This financial burden may lead some businesses to opt for manual labeling processes or less sophisticated equipment, potentially compromising efficiency and accuracy. Consequently, the market's growth potential is restricted by these financial barriers to entry, as some businesses need help to justify the investment despite the long-term benefits of automated labeling solutions.

Automatic Labeling Machine Market Trends

The Beverages Segment to Hold a Significant Market Share

- The increasing demand for automation in the beverages industry drives the automatic labeling machine market. Labels are crucial in providing product information and boosting sales as consumers become more conscious about product details. Manufacturers are shifting to automated labeling systems to meet the growing beverage demand. Automatic labeling machines offer several advantages over manual labeling processes. These machines increase efficiency, reduce labor costs, and improve accuracy in label placement. They can handle various container shapes and sizes, accommodating the diverse packaging needs of the beverages industry. Additionally, automatic labeling machines can operate at high speeds, enabling manufacturers to meet increased production demands.

- The beverages industry's need for consistent branding and regulatory compliance further fuels the adoption of automatic labeling machines. These systems can apply labels with precise positioning, ensuring a uniform appearance across product lines. They also help manufacturers comply with labeling regulations by accurately applying required information, such as nutritional facts, ingredients, and expiration dates. As the beverages industry expands and diversifies, the demand for flexible and efficient labeling solutions is expected to grow. This trend will likely drive further innovations in automatic labeling machine technology, including improved integration with production lines and enhanced customization capabilities to meet specific industry requirements.

- Beverage manufacturers face several challenges, including labor shortages, increased demand, and persistent supply chain disruptions. Food packaging automation is crucial for these organizations as it enhances manufacturing productivity without requiring additional labor. As demand is expected to rise over the next few years and workforce shortages continue, packaging automation will likely become increasingly important. Consequently, manufacturers are adopting technological solutions. Advancements in Industry 4.0 technologies are poised to transform food manufacturing in the coming decade.

- Due to increasing demand for the food and beverage industries, manufacturers are continuously investing in innovating with labeling machines. The growing beverages industry further drives the need for fast, automatic label machines. This demand is fueled by the industry's requirement for efficient and accurate labeling solutions to meet consumer expectations and regulatory standards. The graph illustrates the sales distribution of fruit and vegetable beverages in Germany in 2023 by packaging type. Disposable PET was the most popular packaging, accounting for 49% of total sales, followed by cartons at 34%. This data highlights the significant market share of these packaging materials and underscores the importance of versatile labeling solutions.

- The diverse range of beverage packaging materials, including PET, glass, and cartons, necessitates high-end automated labeling machines in the beverage packaging industry. These machines must be capable of handling various container shapes, sizes, and materials while maintaining high-speed operations and precision. The ability to quickly adapt to different packaging types is crucial for manufacturers to remain competitive in the dynamic beverages industry. Furthermore, the increasing focus on sustainability and eco-friendly packaging options drives innovation in labeling technology. Manufacturers are developing machines that can efficiently apply recyclable labels and work with environmentally friendly packaging materials, aligning with consumer preferences and regulatory requirements for sustainable packaging solutions.

Asia Expected to Register a High Growth Rate

- Asia, home to the world's largest population, is experiencing a significant increase in consumer awareness regarding packaging. This trend drives substantial demand for packaging solutions and high-speed, high-quality labeling systems in the food industry. China, Taiwan, and Vietnam have emerged as the region's primary exporters of automatic labeling machines, capitalizing on this growing market. The demand for printed labels in Asia-Pacific is expanding rapidly, fueled by several key factors. Economic growth in emerging markets has resulted in increases in disposable incomes and consumer spending power. Simultaneously, consumer health consciousness is increasingly shifting toward packaged food and beverages with clear labeling. These factors collectively contribute to expanding the region's packaged food and beverages industry.

- As urbanization continues and retail networks expand across Asia-Pacific, efficient and accurate labeling solutions are becoming more critical. Automatic labeling machines meet stringent labeling requirements, ensure product traceability, and maintain high production speeds. This technology is precious in markets with diverse language requirements and strict regulatory standards. The growth of e-commerce and the increasing emphasis on product differentiation also drive the adoption of advanced labeling solutions. Manufacturers are investing in versatile labeling machines that can handle various packaging types and sizes, catering to the diverse needs of the Asia-Pacific market. As the region continues to develop, the automatic labeling machine market is expected to grow, while increasing automation in manufacturing processes is further propelling this trend.

- The demand for labeling machines in China is primarily driven by two key factors: the increasing need for productivity enhancements across various industries and ongoing technological advancements. Industries such as food and beverage, pharmaceutical, and chemical are particularly significant. Additionally, Chinese regulatory requirements play a crucial role in shaping the market. Chinese regulators mandate label verification and product quality testing before goods cross borders for imported and exported food, including candy, wine, nuts, canned food, and cheese. However, these specific labeling requirements do not apply to domestically produced food items.

- Further, India's labeling machinery industry has experienced a substantial expansion in recent years. This growth can be attributed to several factors, including increased industrialization, rising demand for packaged goods, and advancements in labeling technology. The food and beverage, pharmaceutical, and consumer goods industries have been critical drivers of this expansion, as they require efficient and accurate labeling solutions to meet regulatory requirements and consumer expectations. Additionally, the government's initiatives to promote domestic manufacturing have further boosted the growth of the labeling machinery market in India.

- The key industries driving the Japanese packaging market include food, alcoholic beverages, non-alcoholic beverages, cosmetics, and toiletries. These industries significantly influence packaging trends and demand in Japan, reflecting consumer preferences and market dynamics. In 2022, Asia-Pacific countries consumed approximately 288 billion liters of packaged beverages, with projections indicating an increase to 336 billion liters by 2025. This growth trajectory underscores the region's expanding market for packaged goods.

- Global consumption of packaged beverages reached about 1.4 trillion liters in 2022, highlighting the vast scale of the international beverage packaging industry. These statistics, which provide regional breakdowns and forecasts for 2025, suggest that Asia-Pacific presents significant opportunities for the automatic labeling market. The anticipated growth in beverage consumption will likely drive demand for efficient and accurate labeling solutions, making the region an attractive market for automatic labeling technology providers and packaging equipment manufacturers.

Automatic Labeling Machine Market Overview

The automatic labeling machine market is fragmented, comprising several global and regional players like Nita Labeling Systems, Bobst Group SA, KHS GmbH, and Krones AG, vying for attention in a contested market space. This market is characterized by low product differentiation, growing product penetration, and high competition.

- July 2024: Nita Inc. acquired Shorewood Engineering LLC, a Minnesota-based manufacturer specializing in rotary labels. Shorewood is renowned for providing top-tier labels to leading US consumer packaged goods companies. The rotary labelers from Shorewood seamlessly enhance Nita's existing in-line labeler offerings. Notably, Shorewood stands out as the sole North American manufacturer of rotary labelers, with traditional industry leaders based predominantly in Europe.

- July 2024: Domino Printing Sciences unveiled a cutting-edge automated printing and label verification technology. This innovation aims to assist manufacturers in minimizing expensive labeling mistakes. The newly introduced product boasts sophisticated coding automation software, which removes the need for manual input. Additionally, it features an integrated machine vision system, guaranteeing precise code accuracy.

- November 2023: Spanish label specialist Germark bolstered its collaboration with BOBST by acquiring a new DIGITAL MASTER 340. This marked Germark's fourth BOBST machine in just three years. The All-in-One modular label press is set to enhance Germark's digital printing capabilities, enabling the production of fully finished labels in-line, catering specifically to its upscale clientele in the beauty and cosmetics industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Import and Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Automation in Food and Beverage Packaging

- 5.1.2 Growing Adoption of Automatic Labeling Machine

- 5.2 Market Restraints

- 5.2.1 High Costs Associated with Labeling Machines

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Pressure-sensitive/Self-adhesive Labelers

- 6.1.2 Shrink Sleeve Labelers

- 6.1.3 Glue-based Labelers

- 6.1.4 Sleeve Labelers

- 6.1.5 Other Technologies

- 6.2 By End User

- 6.2.1 Food

- 6.2.2 Beverages

- 6.2.3 Pharmaceutical

- 6.2.4 Personal Care

- 6.2.5 Chemicals

- 6.2.6 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SACMI IMOLA SC

- 7.1.2 Accutek Packaging Equipment Companies Inc.

- 7.1.3 Krones AG

- 7.1.4 SIDEL GROUP (Tetra Laval Group)

- 7.1.5 HERMA GmbH

- 7.1.6 Nita Labeling Systems

- 7.1.7 World Pack Automation Systems

- 7.1.8 Domino Printing Sciences PLC

- 7.1.9 Bobst Group SA

- 7.1.10 KHS GmbH

- 7.1.11 ProMach Inc.