|

市场调查报告书

商品编码

1689759

抗辐射电子产品:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Radiation Hardened Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

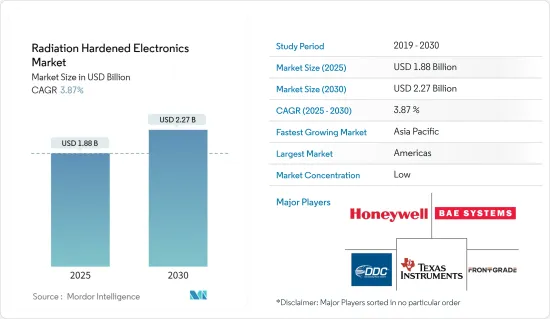

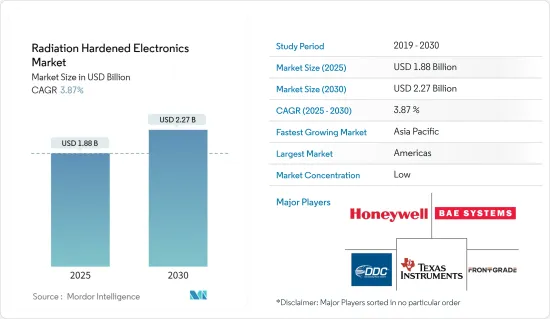

预计 2025 年抗辐射电子产品市场规模将达到 18.8 亿美元,到 2030 年预计将达到 22.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.87%。

关键亮点

- 抗辐射电子设备旨在承受极端辐射暴露,对于情报、监视和侦察 (ISR) 系统至关重要。监控、情报收集和边境管制等安全措施的需求不断增长,推动了对这些专用电子设备的需求。在高辐射环境中,电子设备的损坏会对安全性构成威胁,因此适当的电源管理对于辐射固化材料至关重要。因此,在这样的设施中,可靠的、抗辐射的电源管理系统至关重要。

- 抗辐射电子产品在太空产业的广泛使用对市场成长做出了重大贡献。例如,根据卫星工业协会的数据,预计2022年全球太空经济将创造3,840亿美元的收益。而且,截至2022年,大约有7,316颗活跃卫星绕地球运行,与前一年同期比较增加了51%,在过去五年增加了321%。

- 轨道卫星暴露在太空环境中典型的高能量带电粒子和电磁辐射下。卫星受到的辐射水平取决于它们与地球的距离,位于热层内的低轨道卫星更容易受到紫外线的照射,这会影响电子材料的分子组成。

- 在核能发电,电气和电子系统暴露在高能量辐射下,这会严重影响其功能和整体安全。核能发电中的电离辐射会产生电子空穴对,进而改变电晶体参数并造成破坏。

- 此外,这种辐射也会在电路之间造成漏电流。因此,安装适当屏蔽的防辐射电气/电子系统对于系统设计人员至关重要,这是推动市场成长的关键因素。

- 儘管各行各业对抗辐射电子元件的需求不断增长,但市场仍面临设计和开发成本上升的挑战。製造能够承受恶劣操作条件的电子元件需要特殊的设计考虑,这会增加开发成本。此外,严格的测试对于确保产品可靠性至关重要,这进一步增加了抗辐射电子产品的成本。

抗辐射电子产品市场趋势

核能发电厂大幅成长

- 随着核能发电厂管理人员越来越多地部署抗辐射电子设备来改善讯号完整性、提高核子反应炉安全性和效率并减少因辐射引起的工厂设备性能下降,核电厂对抗辐射劣化设备的需求也日益增加。

- 事实证明,抗辐射(rad-hard)电子设备的整合对于核能感测和测量至关重要。将先进的感测器和相关电子设备更靠近核子反应炉核心有望提高讯号的精度、准确性和保真度,优化核子反应炉的控制和运作。这项进步使得能源生产过程更加安全、有效率。

- 由于核能设施严重依赖电子系统,因此非常需要能够承受大量辐射的设备。在核能发电厂中,使用抗辐射电子设备进行无线监控至关重要。这些电子设备在核能发电厂调查中也扮演关键角色。这在事故发生后的危急情况下或辐射水平极高的地区通讯基础设施故障的情况下尤其重要。

- 由于开发中地区投资的增加,预计在可预见的未来,全球运作中的核子反应炉数量仍将保持相当水准。例如,根据世界核能协会 (EIA) 和核能总署(IAEA) 的资料,2022 年全球共有 411 座核子反应炉在运作,到 2023 年 5 月这一数字将跃升至 436 座。因此,对核能发电厂的持续投资将推动研究市场的机会。

- 电磁辐射和热辐射是发电和配电基础设施中常见的现象,增加了常见电子元件故障的可能性。因此,由于迫切需要确保在如此恶劣的条件下具有稳健的性能,预计预测期内抗辐射电子产品的采用将会增加。

- 核能发电技术的应用不仅在核能发电厂,还在核能等各个领域推广。近年来出现的几个新型核能计划预计将维持并推动所研究市场进一步的机会。

亚太地区预计将经历强劲成长

- 民用航太计划的兴起推动了亚太地区抗辐射电子元件市场的成长。近期,我国在FPGA、CPU等航太核心积体电路研发方面取得重大进展,这些积体电路正应用于载人航太、月球探勘等重大航太计划。

- 依上述摘要,中国明确2023年将大幅加强国家航太科技活动,包括天舟六号货运太空船、神舟十六号、神舟十七号等大型任务,并进一步加强天宫太空站活动。今年,中国航太也将加速新一代商用远端监测卫星建设,并抓紧进行发射任务。同时,北斗三号导航卫星系统也将发射三颗备援卫星。

- 2023年,中国将继续开发和研究抗辐射技术。中国致力于增加抗辐射晶片的本土产量。透过将 AI/ML 功能与机载抗辐射晶片结合起来,空间仪器可以执行全方位的高级分析,包括影像识别、影像分类、自动决策和及时行动。

- 此外,该地区半导体产业的兴起也促进了市场的成长。中国正在寻求军事和国防领域的本土化,以促进竞争和创新,进一步加强军事准备,并降低与对外依赖相关的风险。半导体对国内安全的重要性不言而喻。

- 中国强调安全与微电子之间的关係基于四个理由:强大的晶片产业将有助于解放军实现现代化,并提高其发动常规战争的能力。解放军可以利用本土先进的半导体技术发动资讯战,增强其发动非常规战争的能力;就防御性资讯战而言,强大的国内产业可以减轻依赖不可靠的外国关键半导体供应的风险。中国认识到半导体的双重用途特性以及在军事系统中使用商用现货(COTS)产品的附带趋势,正在将其新兴的商用晶片工业基础整合到军事应对措施中。

- 此外,还可以製造能够承受核子反应炉中的高温和辐射水平的抗辐射电子产品,从而对整体销售产生积极影响。根据世界核能协会的数据,2022年全球在建核子反应炉数量中,亚洲占39座。 2021-2023年期间,印度的核能发电总装置容量约为6.8吉瓦。

抗辐射电子产品市场概述

抗辐射电子产品市场主要由霍尼韦尔国际公司、BAE 系统公司、德州仪器、数据设备公司和 Frontgrade Technologies 等主要参与者瓜分。这些公司正在采取联盟和收购等策略来加强产品系列建立持久的竞争优势。

- 2023 年 8 月,Frontgrade Technologies 完成对 Aethercom 的收购,后者是一家专门从事高功率射频 (RF) 固态功率放大器、发射和接收模组以及高功率RF 开关的公司。此次收购将使 Frontgrade Technologies 能够为航太和国防领域的客户提供量身定制的全面、整合、承包解决方案。

- 2023年2月,德州仪器与Teledyne e2v合作开发抗辐射DDR4模组化平台。该倡议旨在帮助卫星OEM透过减少时间和工程工作量来优化其係统开发流程。硬体包括经过现场验证的 Teledyne e2v DDR4T0xG72 DDR4 记忆体模组(容量为 4GB/8GB),并辅以 TI 的 TPS7H3301-SP DDR 终端低压差 (LDO) 稳压器,以确保 DDR4 模组的稳定供应。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 抗辐射加固部件的原料分析

第五章市场动态

- 市场驱动因素

- 卫星发射和太空探勘活动增加

- 抗辐射电子设备在电源管理和核能环境中的应用日益广泛

- 市场挑战/限制

- 设计和开发成本高

第六章市场区隔

- 按最终用户

- 宇宙

- 航太与国防

- 核能发电厂

- 按组件

- 离散的

- 感应器

- 积体电路

- 微控制器和微处理器

- 记忆

- 按地区

- 美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 供应商排名分析

- 公司简介

- Honeywell International Inc.

- BAE Systems PLC

- Texas Instruments

- Data Device Corporation

- Frontgrade Technologies

- STMicroelectronics International NV

- Infineon Technologies AG

- Microchip Technology Inc.

- Micropac Industries Inc.

- Renesas Electronic Corporation

- Solid State Devices Inc.

- Advanced Micro Devices, Inc.

- Everspin Technologies Inc.

- Vorago Technologies

第八章 市场机会与未来趋势

The Radiation Hardened Electronics Market size is estimated at USD 1.88 billion in 2025, and is expected to reach USD 2.27 billion by 2030, at a CAGR of 3.87% during the forecast period (2025-2030).

Key Highlights

- Radiation-hardened electronics, designed to withstand extreme radiation exposures, are integral to Intelligence, Surveillance, and Reconnaissance (ISR) systems. The increased demand for security measures like monitoring, information collection, and border control is driving the need for these specialized electronics. In high radiation environments, proper power management is crucial for radiation-hardened materials, as any electronic damage can pose safety hazards. Thus, reliable radiation-hardened power management systems are essential in such facilities.

- The space industry extensively employs radiation-hardened electronics, contributing significantly to the market's growth. For example, in 2022, the global space economy generated USD 384 billion in revenue, according to the Satellite Industry Association. Additionally, as of 2022, approximately 7,316 active satellites were orbiting the Earth, marking a 51% increase from the previous year and a 321% increase over the past five years.

- Satellites in orbit face substantial exposure to highly energetic charged particles and electromagnetic radiation unique to the space environment. The radiation levels they encounter depend on their distance from Earth; satellites in low earth orbit, situated within the thermosphere, are more exposed to UV radiation, potentially impacting the molecular composition of electronic materials.

- Inside nuclear power plants, electrical and electronic systems are subjected to high-energy radiation that can severely affect their functionality and overall safety. Ionizing radiation within these plants creates electron-hole pairs, altering transistor parameters and potentially causing their destruction.

- Additionally, this radiation can induce leakage currents between circuits. Therefore, installing radiation-hardened electrical/electronic systems with proper shielding is critical for system designers, a key factor driving market growth.

- Despite increasing demand for radiation-hardened electronic components across various industries, the market faces challenges due to higher design and development costs. Specific design considerations are necessary to create electronics that can withstand harsh operating conditions, contributing to increased development costs. Furthermore, stringent testing is essential to ensure product reliability, further elevating the cost of radiation-hardened electronics.

Radiation Hardened Electronics Market Trends

Nuclear Power Plants to Witness Significant Growth

- The demand for radiation-hardened electronics within nuclear power plants is on the rise as facility managers increasingly deploy these specialized components to enhance signal integrity, bolster the safety and efficiency of nuclear reactors, and mitigate radiation-induced degradation of plant equipment.

- The integration of radiation-hardened (rad-hard) electronics has proven instrumental in nuclear sensing and instrumentation. Placing advanced sensors and associated electronics closer to reactor cores holds promise for optimizing reactor control and operation by ensuring heightened signal accuracy, precision, and fidelity. This advancement translates into safer and more efficient energy production processes.

- Given the extensive reliance on electronic systems within nuclear facilities, there's a crucial need for devices capable of withstanding substantial radiation exposure. Wireless monitoring in nuclear power plants, facilitated by radiation-hardened electronics, is paramount. These electronics also serve a critical role in surveying nuclear power plants, especially in scenarios where communication infrastructure fails during critical post-accident situations or in areas with exceedingly high radiation fields.

- The number of operational nuclear reactors worldwide is expected to maintain a significant presence in the foreseeable future, driven by increasing investments in developing regions. For instance, data from the World Nuclear Association, EIA, and the International Atomic Energy Agency (IAEA) indicated 411 operational nuclear reactors globally in 2022, a figure that surged to 436 by May 2023. Consequently, the continued investments in nuclear power plants are poised to fuel opportunities within the studied market.

- Electromagnetic and thermal radiation represent common occurrences in electricity generation and distribution infrastructures, heightening the susceptibility of general electronic components to malfunction. Consequently, the anticipated growth in the adoption of radiation-hardened electronics during the forecast period is driven by the imperative to ensure robust performance under such demanding conditions.

- Beyond nuclear power plants, the adoption of nuclear energy generation technology is expanding into various sectors, including nuclear submarines. The emergence of several new nuclear-powered submarine projects in recent years is expected to sustain and drive further opportunities within the studied market.

Asia Pacific is Expected to Witness Significant Growth

- Due to a growing number of commercial space projects, the market for radiation-hardened electronic components is driving market growth in the Asia Pacific region. In recent years, China has made significant progress in developing several aerospace core integrated circuits, including FPGA and CPU, which major aerospace projects like human spaceflight and moon exploration have utilized.

- Adhering to the above synopsis, China revealed that the country's space science and technology activities will significantly boost in 2023, including big-ticket missions like the Tianzhou-6 cargo craft, the Shenzhou-16 and the Shenzhou-17 flight missions to solidify its Tiangong space station activities further. The corporation will also take steps to speed up the construction of a new generation of commercial remote monitoring satellites this year and launch these missions. Meanwhile, the BeiDou-3 Navigation Satellite System will witness the launch of three backup satellites.

- China will continue developing and researching radiation-hardened technologies in 2023. It has undertaken to increase the local production of radiation-hardened chips. Space equipment could enable itself to perform all advanced analytics, such as image recognition, picture classification, automated decisions, and timely actions, by incorporating AI/ML functionality in conjunction with radiation-hardened chips on board.

- Moreover, the flourishing semiconductor industry in the region is another factor contributing to market growth. China is trying to indigenize the military and defense sector to promote its competitiveness and technology innovation, further strengthening the military and mitigating risks related to foreign dependence. There is an obvious importance of semiconductors for domestic security.

- China's emphasis on the relationship between security and microelectronics is predicated on four arguments: a strong chip industry will help modernize the PLA and enhance its ability to conduct conventional warfare; the PLA can wage information warfare (IW) by exploiting home-grown advanced semiconductor technologies that enhance its ability to wage unconventional war; as regards defensive IW, a robust indigenous industry can mitigate the risks of dependence on unreliable foreign supplies of critical semiconductors; and China recognizes semiconductors' dual-use nature and the trend of spin-on in its policy of using commercial off-the-shelf (COTS) items in military systems to integrate its rising commercial chip industrial base into its military counterpart.

- Furthermore, it is possible to manufacture radiation-hardened electronics that can endure high temperatures and radiation levels found in nuclear reactors, which have a favorable impact on their total sales. According to the World Nuclear Association, in 2022, Asia accounted for 39 units in the number of reactors under construction worldwide. India's total nuclear power capacity reached about 6.8 gigawatts of electricity from 2021 to 2023.

Radiation Hardened Electronics Market Overview

The radiation-hardened electronics market showcases fragmentation with major players like Honeywell International Inc., BAE Systems PLC, Texas Instruments, Data Device Corporation, and Frontgrade Technologies. These entities employ strategies such as partnerships and acquisitions to fortify their product portfolios and establish enduring competitive edges.

- In August 2023, Frontgrade Technologies finalized its acquisition of Aethercomm, a company specializing in high-power radio frequency (RF) solid-state power amplifiers, transmit/receive modules, and high-power RF switches. This acquisition positions Frontgrade Technologies to offer a comprehensive, integrated, and turnkey solution tailored for aerospace and defense clientele.

- Another notable collaboration occurred in February 2023 between Texas Instruments and Teledyne e2v, focusing on a novel radiation-tolerant DDR4 modular platform. This initiative aims to assist satellite OEMs in optimizing their system development process by reducing time and engineering efforts. The hardware comprises a field-proven 4GB/8GB capacity DDR4T0xG72 DDR4 memory module from Teledyne e2v, complemented by a TI TPS7H3301-SP DDR termination low drop-out (LDO) voltage regulator, ensuring a stable supply for the DDR4 module.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Raw Material Analysis for Radiation-Hardened Components

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Instances of Satellite Launches and Space Exploration Activities

- 5.1.2 Growing Adoption of Radiation Hardened Electronics in Power Management and Nuclear Environment

- 5.2 Market Challenges/Restraints

- 5.2.1 High Designing and Development Cost

6 MARKET SEGMENTATION

- 6.1 By End-user

- 6.1.1 Space

- 6.1.2 Aerospace and Defense

- 6.1.3 Nuclear Power Plants

- 6.2 By Component

- 6.2.1 Discrete

- 6.2.2 Sensors

- 6.2.3 Integrated Circuit

- 6.2.4 Microcontrollers and Microprocessors

- 6.2.5 Memory

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Ranking Analysis

- 7.2 Company Profiles

- 7.2.1 Honeywell International Inc.

- 7.2.2 BAE Systems PLC

- 7.2.3 Texas Instruments

- 7.2.4 Data Device Corporation

- 7.2.5 Frontgrade Technologies

- 7.2.6 STMicroelectronics International NV

- 7.2.7 Infineon Technologies AG

- 7.2.8 Microchip Technology Inc.

- 7.2.9 Micropac Industries Inc.

- 7.2.10 Renesas Electronic Corporation

- 7.2.11 Solid State Devices Inc.

- 7.2.12 Advanced Micro Devices, Inc.

- 7.2.13 Everspin Technologies Inc.

- 7.2.14 Vorago Technologies