|

市场调查报告书

商品编码

1689772

纸杯产业-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Paper Cups Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

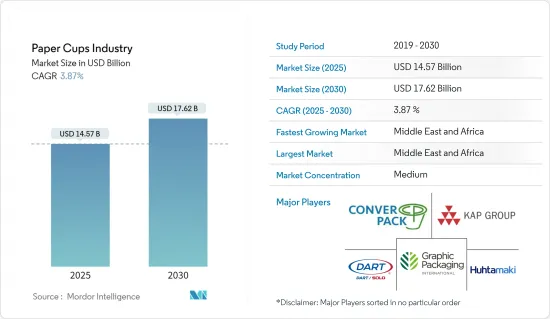

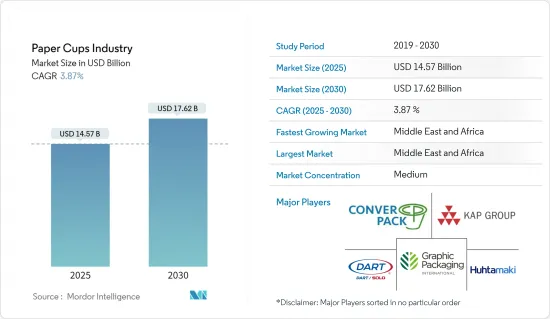

预计纸杯产业规模将从 2025 年的 145.7 亿美元成长至 2030 年的 176.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.87%。

近年来,由于国际上食品和饮料行业要求用可持续材料替代一次性塑料,并为环保产品建立高效的废弃物管理和回收系统的压力越来越大,纸杯的需求也在增加。

关键亮点

- 政府推出的各项减少碳足迹的措施和法规为包装製造商推广环保纸杯提供了强劲动力。根据包装製造商Mondi对6,000名欧洲成年人的调查,约73%的法国人和68%的德国人重视永续包装。因此,全球的纸张消费量也在增加。

- 饮料产业在全球范围内不断发展,预计也将在纸杯市场发挥关键作用。随着饮料业的发展和饮料种类的增多,对运输工具的需求也随之增加。外带和宅配的需求也在上升。这种转变还包括包装製造商拥有多种选择来满足食品和饮料行业的创新包装需求。

- 快餐店 (QSR) 提供低成本的食品选择,并专注于服务速度。快餐店与永续性有着密切的关係。在已开发国家的都市区,更悠閒的生活方式推动了食品、饮料和速食消费的增加,从而催生了新的咖啡馆和快餐店。这一趋势也正逐渐蔓延至开发中地区。此外,外食作为休閒活动日益增长的趋势也刺激了成长。

- 纸质咖啡杯要么被焚烧,要么被送往垃圾掩埋场。将塑胶内衬从纸杯中分离出来并进行化学消毒等过程需要先进的机械,以防止它们被回收。

- 预计这将增加公司的营运费用并大幅减少利润。因此,纸杯回收对环境构成间接威胁,并对市场成长构成重大挑战。

- 然而,餐饮业严重依赖一次性杯子和咖啡、茶等热饮。食品服务业的成长显示咖啡店和类似企业的市场正在扩大,从而增加了对纸杯的需求。后疫情时代,出于卫生考虑,人们仍然使用一次性纸杯。

纸杯产业趋势

速食店(QSR)市场占有率较大份额

- 快餐店提供在最短时间内准备好的快餐。 QSR 也被称为速食店,全球 QSR 数量的增加推动了对纸杯的需求。据国际专利权协会称,快餐店提供经济实惠的菜单选项,由于食品配送需求强劲,其规模可能会扩大。

- 速食和快餐店在世界各地越来越受欢迎,因为它们为个人提供了方便的用餐选择和快速的服务。此外,外出用餐时食品和饮料消费的增加,加上千禧世代忙碌的生活方式,导致快餐店产业显着成长。

- 专利权模式的日益普及也促进了快餐店数量的增长。根据国际专利权协会的数据,QSR 行业的专利权销售额预计将在 2023 年增长 2.5%,从而推动市场成长。

- 快餐店使用一次性纸杯来盛装冷热饮品。纸杯采用单层或双层聚合物涂层或蜡涂层,以确保饮料的刚性和防漏性。这些杯子的图案、颜色、大小和形状根据餐厅的供应量而有所不同。

- 快餐店 (QSR) 中可持续包装的日益普及导致外带和饮料外带和送餐选项的增加。消费者对一次性包装的认识不断提高,也鼓励企业投资于可最大限度减少环境影响的替代品。

- 例如,2024 年 4 月,加拿大快餐店 New York Fries (NYF) 与加拿大纸杯和盖子製造商 SOFi Products 合作,提供 100% 可堆肥和生物分解的纸杯。

- 根据 AFRY 和 Suzano PaperLine 的数据,全球纸张消费量预计将从 2021 年的 4.17 亿吨增加到 2032 年的 4.76 亿吨。预计纸张消费量的激增将主要受到包装行业需求的推动,其中包括一次性纸杯。预计在预测期内,对永续纸包装的需求将持续成长,从而推动纸杯产业向前发展。

中东和非洲地区实现显着成长

- 由于旅游业的繁荣、社交媒体的使用增加以及沙乌地阿拉伯社会相当一部分人接触西方文化,沙乌地阿拉伯纸杯市场预计将大幅成长。科技和日益宽鬆的社会规范正在扩大选择的自由,促进消费群、销售额和贸易量的增加,从而使酒店业受益。

- 沙乌地阿拉伯食品和饮料服务市场的成长正在创造有利于扩大纸杯市场的环境,因为需求不断增加、永续性得到促进、产品多样化增加、品牌机会受到鼓励,以及可能有利于环保包装解决方案的监管变化。根据沙乌地阿拉伯统计总局的数据,沙乌地阿拉伯食品和饮料服务市场的收益预计将在 2025 年达到 160.3 亿美元,而 2020 年为 144.6 亿美元。

- 人们对环境议题的认识不断提高可能会影响消费者对环保包装的偏好。纸杯生物分解性且可再生,符合具有环保意识的消费者对永续性的关注。随着消费者物价指数 (CPI) 上升以及消费者对价格的意识增强,公司可能会优先考虑纸杯等环保包装解决方案,以吸引这个不断增长的细分市场。

- 根据南非统计局统计,截至2024年2月,南非消费者物价指数(CPI)为113.9点。比上年增加了1.1个百分点。

- 随着越来越多的人为了寻求更好的机会而迁移到城市,埃及的城市人口正在成长。总体而言,由于快节奏的生活以及咖啡馆、餐厅和小吃摊的普及,都市区对一次性食品和饮料容器的需求不断增长。因此,这一趋势促进了纸杯市场的成长。

纸杯行业概况

纸杯市场已呈现半固体状态,有几家规模较小的参与企业正进入这个新兴市场。不过,与新兴经济体相比,已开发经济体的市场仍相对整合。纸杯市场的主要企业包括 Huhtamaki oyj、Kap Cones Private Limited、Graphic Packaging International LLC、Dart Container Corporation 和 Converpack Inc.

- 2024 年 1 月,纸杯和其他食品包装产品製造商 Go-Pak Group 宣布与 H&M Distribution 建立为期三年的策略伙伴关係。这是一个重要的里程碑,因为我们透过优先考虑交付效率、提高可靠性和积极减少碳排放来改善客户服务。

- 2023 年 9 月,Graphic Packaging International 宣布计划在德克萨斯州韦科建造一座工厂,生产再生纸板,这是负责任的包装替代品。该工厂计划于2026年投入生产。韦科工厂将利用业界最新技术生产再生纸板,用于包装从谷物到义式麵食等各种标准产品。该先进设施竣工后,预计每天可回收约 1500 万个纸杯的纤维,为美国客户提供高品质的再生纸板。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 当前地缘政治情势如何影响市场

第五章市场动态

- 市场驱动因素

- 随时随地饮料消费需求不断成长

- 最近的技术创新提高了保质期

- 市场问题

- 对可回收性的担忧以及废物形式的高度细分预计将影响利润率

第六章市场区隔

- 按罩杯类型

- 热纸杯

- 冷纸杯

- 按最终用户

- 速食店(QSR)

- 设施

- 其他的

- 依墙体类型

- 单层纸杯

- 双层纸杯

- 三层纸杯

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 西班牙

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 埃及

- 北美洲

第七章竞争格局

- 公司简介

- Huhtamaki oyj

- Kap Cones Private Limited

- Graphic Packaging International LLC

- Dart Container Corporation

- Converpack Inc.

- Go-Pak UK Ltd(SCGP Packaging)

- Benders Paper Cups

- Hotpack Global

- Tekni-Plex Inc.

- CEE Schisler Packaging Solutions

第八章投资分析

第九章:未来市场展望

The Paper Cups Industry is expected to grow from USD 14.57 billion in 2025 to USD 17.62 billion by 2030, at a CAGR of 3.87% during the forecast period (2025-2030).

The demand for paper cups has increased over the past few years due to increased international pressure to replace single-use plastic with sustainable materials in the food and beverage industry and to create efficient waste management and recycling systems for environmentally friendly products.

Key Highlights

- Various government initiatives and regulations call for reduced carbon footprints, providing a robust push for packaging manufacturers to sell eco-friendly paper cups. As per the survey presented by the packaging manufacturer Mondi on 6,000 European adults, around 73% and 68% of the population from France and Germany, respectively, gave more importance to sustainable packaging. Therefore, the consumption of paper is also increasing globally.

- The beverage industry is growing worldwide, and it is expected to play a significant role in the paper cups market. As the beverage industry develops and provides a greater variety of drinks, the need for carriers also increases. There is a growing demand for to-go and home delivery options. This transition includes packaging producers with several options for meeting innovative packaging needs in the food and beverage industry.

- Quick service restaurants (QSRs) offer low-cost food options, focusing on the speed of service. The relationship between quick service restaurants and sustainability has been steady. The growing consumption of beverages and fast food due to the fast-paced lifestyle in the cities of the most developed countries has led to new coffee shops and quick service restaurants. This trend is gradually penetrating developing regions. In addition, people's rising inclination to eat outside as part of their leisure activities adds to growth.

- Paper coffee cups are incinerated or sent to landfills since most paper recycling machines cannot recycle them properly. The hindering process involved in recycling, like separating the plastic liner from the paper cup and chemically sterilizing them, needs advanced machinery.

- This is expected to increase the company's operating expenses and reduce profit significantly. Hence, recycling these paper cups poses a significant indirect threat to the environment, thereby acting as a major challenge to the growth of the market studied.

- However, the food service industry heavily relies on disposable cups and scorching beverages like coffee and tea. The food service industry's growth suggests an expanding market for coffee shops and similar businesses, contributing to the demand for paper cups. In the post-pandemic era, people continue using single-use paper cups, keeping hygiene in mind.

Paper Cups Industry Trends

The Quick Service Restaurants (QSRs) Segment Holds a Significant Market Share

- Quick service restaurants offer fast service for food items prepared with minimal time. QSRs are also known as fast-food restaurants, and the growing number of QSRs globally has boosted the demand for paper cups. According to the International Franchise Association, QSRs offer economical menu options and are likely to expand due to strong demand for food deliveries.

- Fast food and fast-service restaurants are becoming popular across the globe as they offer convenient food options and speed of service to individuals. Furthermore, the growing consumption of beverages and food in restaurants, coupled with the busy lifestyle of millennials, has led to significant growth of quick service restaurants globally.

- The increasing popularity of the franchise model is also boosting the number of quick service restaurants. According to the International Franchise Association, franchise outputs in the QSR industry were projected to increase by 2.5% in 2023, boosting the market's growth.

- Quick service restaurants use disposable paper cups for serving hot or cold beverages. The paper cups are single or double poly-coated or wax-coated, offering rigidity and leakage protection for beverages. These cups vary in patterns, colors, sizes, and shapes, depending on the restaurant's servings.

- The rise in sustainable packaging trends in QSRs has led to the growing trend of take-out food and beverage options and delivery options. Increasing consumer awareness regarding single-use packaging has also prompted companies to invest in alternatives that minimize environmental impact.

- For instance, in April 2024, New York Fries (NYF), a Canadian quick service restaurant, partnered with SOFi Products, a Canada-based manufacturer of paper cups and lids, to provide a paper cup that is 100% compostable and biodegradable.

- According to AFRY and Suzano PaperLine, the global consumption of paper is expected to increase from 417 million metric tons in 2021 to 476 million metric tons in 2032. This spike in paper consumption is anticipated to be bolstered by the demand from the packaging industry, which primarily includes disposable paper cups. This constant demand rise for sustainable paper packaging is likely to continue during the forecast period, driving the paper cup industry forward.

Middle East and Africa to Witness Major Growth

- The Saudi Arabian paper cups market is expected to grow significantly due to increased travel and social media usage, exposing a significant segment of Saudi society to Western culture. Technology and increasingly relaxed social norms have amplified freedom of choice, benefiting the hospitality industry by facilitating a growing consumer base, sales, and transaction volumes.

- The growth of the food and beverage service market in Saudi Arabia creates an environment for expanding the paper cups market by increasing demand, promoting sustainability, fostering product diversification, facilitating branding opportunities, and potentially driving regulatory changes favoring eco-friendly packaging solutions. According to the General Authority for Statistics (Saudi Arabia), the revenue of the food and beverage service market in Saudi Arabia is estimated to amount to USD 16.03 billion in 2025 compared to 2020, which was USD 14.46 billion.

- Rising awareness of environmental issues may influence consumer preferences toward eco-friendly packaging options. Paper cups are biodegradable and renewable, aligning with the sustainability concerns of environmentally conscious consumers. As the CPI increases and consumers become more price-sensitive, businesses may prioritize environmentally friendly packaging solutions like paper cups to appeal to this growing market segment.

- According to Statistics South Africa, as of February 2024, the Consumer Price Index (CPI) in South Africa, an economic indicator providing information on the change of prices over time, was measured at 113.9 points regarding food and non-alcoholic beverages. This was an increase of 1.1 points from the previous year.

- Egypt's urban population is increasing as more people migrate to cities for better opportunities. Typically, a higher demand for disposable food and beverage containers is observed in urban areas due to the prevalence of fast-paced lifestyles and the popularity of cafes, restaurants, and street food vendors. Thus, this trend contributes to the growth of the paper cups market.

Paper Cups Industry Overview

The paper cups market is semi-consolidated, leading to several small players entering the emerging markets. However, the market remains relatively consolidated in developed economies compared to developing economies. The key players operating in the paper cups market include Huhtamaki oyj, Kap Cones Private Limited, Graphic Packaging International LLC, Dart Container Corporation, and Converpack Inc.

- In January 2024, Go-Pak Group, a manufacturer of paper cups and other food service packaging products, announced a three-year strategic partnership with H&M Distribution, marking a pivotal milestone in enhancing customer service by prioritizing delivery efficiency, bolstering reliability, and actively reducing carbon emissions.

- In September 2023, Graphic Packaging International announced its plans to build a facility in Waco, Texas, to produce recycled paperboard, a responsible packaging alternative. The plant is slated to ramp up production in 2026. The Waco facility will leverage the industry's modern technology to produce recycled paperboard to package standard products ranging from cereal to pasta. When complete, the cutting-edge facility is anticipated to recycle fiber from about 15 million paper cups daily, increasing the company's capacity to provide high-quality recycled paperboard to customers across the United States.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of the Current Geo-political Scenarios on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for On-the-go Consumption of Beverages

- 5.1.2 Recent Innovations Have Aided Shelf Life

- 5.2 Market Challenges

- 5.2.1 Recyclability-related Concerns in the Form of Disposal and High Levels of Fragmentation are Expected to Affect Profit Margins

6 MARKET SEGMENTATION

- 6.1 By Cup Type

- 6.1.1 Hot Paper Cups

- 6.1.2 Cold Paper Cups

- 6.2 By End User

- 6.2.1 Quick Service Restaurants (QSRs)

- 6.2.2 Institutional

- 6.2.3 Other End Users

- 6.3 By Wall Type

- 6.3.1 Single Wall Paper Cups

- 6.3.2 Double Wall Paper Cups

- 6.3.3 Triple Wall Paper Cups

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 France

- 6.4.2.3 Germany

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Argentina

- 6.4.5.3 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 Saudi Arabia

- 6.4.6.2 South Africa

- 6.4.6.3 Egypt

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huhtamaki oyj

- 7.1.2 Kap Cones Private Limited

- 7.1.3 Graphic Packaging International LLC

- 7.1.4 Dart Container Corporation

- 7.1.5 Converpack Inc.

- 7.1.6 Go-Pak UK Ltd (SCGP Packaging)

- 7.1.7 Benders Paper Cups

- 7.1.8 Hotpack Global

- 7.1.9 Tekni-Plex Inc.

- 7.1.10 CEE Schisler Packaging Solutions