|

市场调查报告书

商品编码

1689873

热塑性淀粉(TPS) -市场占有率分析、产业趋势和成长预测(2025-2030)Thermoplastic Starch (TPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

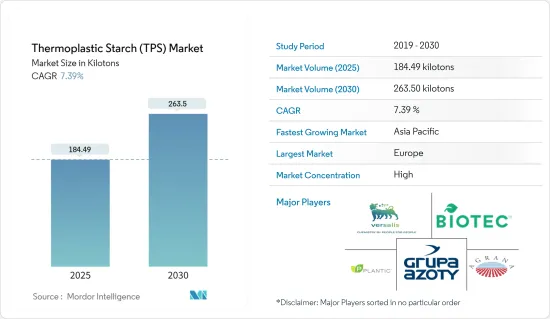

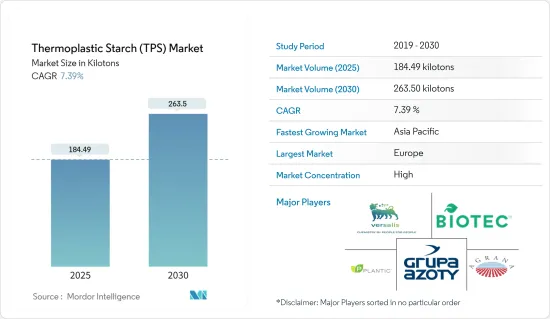

热塑性淀粉市场规模预计在 2025 年为 184.49 千吨,预计在 2030 年达到 263.50 千吨,预测期内(2025-2030 年)的复合年增长率为 7.39%。

主要亮点

- 短期内,包装产业不断增长的需求和政府推广生质塑胶的有利政策预计将推动所研究市场的成长。

- 然而,与热塑性淀粉(TPS)相关的一些技术限制可能会阻碍市场成长。

- 在预测期内,热塑性淀粉性能改善方面的技术进步和创新可能为所研究的市场带来有利的机会。

- 预计欧洲将成为热塑性淀粉的最大市场,而亚太地区预计将在 2024 年至 2029 年间实现最高的复合年增长率。

热塑性淀粉(TPS)市场趋势

电影领域占据市场主导地位

- 热塑性淀粉薄膜显然利用了自然资源,因此有助于减少环境污染。热塑性淀粉薄膜具有许多优点,包括生物分解性、成本低、易于加工和可再生潜力。淀粉膜是一种很有前景的商业保鲜膜,可以延长食品的保存期限。

- TPS 薄膜的水蒸气阻隔性较差,气体渗透性低,无法承受包装过程中产生的应变。热塑性淀粉越来越多地被用作塑胶薄膜的填料,以提高生物分解性,扩大其在包装领域的应用。

- 热塑性淀粉(TPS)是一种淀粉衍生物,被广泛认为是包装行业最适合的合成聚合物替代品。

- 作为一种永续包装材料,水解玉米粉薄膜与其他传统石油基塑胶相比具有多种优势,包括生物分解性、再生性和减少对环境的影响。

- 许多公司正在选择永续的包装材料。例如,总部位于美国的全球配料解决方案公司 Ingredion 提供脆皮薄膜,一种高直链淀粉、白色至灰白色的玉米粉。本产品具有优异的成膜性能,用于包裹油炸食品时可作为优异的保护屏障。

- 据美国农业部称,农业研究服务局(ARS)的科学家研发出一种被覆剂基薄膜,可以使纸张等材料更耐水性和生物分解性。该薄膜产品广泛应用于塑胶袋、食品包装等,有助于减少堵塞垃圾掩埋场的合成产品的数量。

- 根据 Moldo Intelligence 的数据,热塑性淀粉市场的薄膜部分预计在 2024 年至 2029 年期间实现 6.77% 的复合年增长率。

- 包装产业的大量投资可能会刺激所调查市场的需求。例如,2023年3月,华天科技取得重大突破,投资28.58亿元人民币,完全子公司江苏华天科技,建置「高密度、高可靠先进封装研究及产业化」计划。建设工期为5年,自2023年6月至2028年6月。

- 因此,预计所有这些因素都会影响预测期内的市场需求。

预计欧洲将主导市场

- 在德国,我们的包装解决方案广泛应用于客製化产品和创新开发。此外,在包装食品领域,对较小包装尺寸的需求很高。根据德国联邦统计局的资料,到 2023 年,德国包装产业的收益将达到 325 亿欧元(约 358.7 亿美元)。

- 德国是欧洲领先的3D列印市场之一。该国拥有着名的工程传统,在各行业建立了一系列製造设施,可协助国际投资者拓展欧洲业务。

- 据英国包装联合会称,英国包装製造业的年营业额约为 140 亿英镑(约 178.2 亿美元)。该公司拥有超过 85,000 名员工,占英国製造业的 3%。

- 义大利是欧盟最大的农业生产国和食品加工国之一。此外,义大利的农业部门和农业食品体系对该国经济贡献巨大,到 2023 年分别占 GDP 的 2% 和 15% 左右。

- 根据法国国家统计与经济研究所 (INSEE) 的数据,预计 2023 年农业生产年收益将达到 566 亿欧元(约 609.6 亿美元),而 2022 年为 587 亿欧元(约 632.2 亿美元)。不利的宏观经济因素和能源成本上升对受调查的市场产生了负面影响。

- 因此,受上述因素影响,欧洲市场对热塑性淀粉市场的需求可能会受到影响。

热塑性淀粉(TPS)产业概况

热塑性淀粉(TPS)市场正在不断整合。市场的主要企业(不分先后顺序)包括 Versalis SpA、BIOTEC、Kuraray (Plantic)、AGRANA Beteiligungs AG 和 Grupa Azoty。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 包装产业需求不断成长

- 政府推出优惠政策促进生质塑胶发展

- 限制因素

- 与TPS相关的几个技术限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按生产类型

- 挤压

- 射出成型

- 按应用

- 包包

- 电影

- 3D列印

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 北欧国家

- 其他欧洲国家

- 世界其他地区

- 南美洲

- 中东和非洲

- 亚太地区

第六章竞争格局

- 合併、收购、合资、合作和协议

- 市场排名分析

- 主要企业策略

- 公司简介

- AGRANA Beteiligungs-AG

- Biome Bioplastics Limited

- Biotec Biologische Naturverpackungen GmbH & Co. KG

- Biologiq Inc.

- Cardia Bioplastics

- Great Wrap

- Grupa Azoty SA

- Kuraray Co. Ltd

- Rodenburg Biopolymers

- Versalis SpA

第七章 市场机会与未来趋势

- 技术进步和创新增强了热塑性淀粉的性能

简介目录

Product Code: 69028

The Thermoplastic Starch Market size is estimated at 184.49 kilotons in 2025, and is expected to reach 263.50 kilotons by 2030, at a CAGR of 7.39% during the forecast period (2025-2030).

Key Highlights

- Over the short term, increasing demand from the packaging industry and favorable government policies promoting bio-plastics are expected to drive the growth of the market studied.

- However, multiple technical constraints associated with thermoplastic starch (TPS) are likely to hinder the market's growth.

- Technological advancements and innovations to enhance the properties of thermoplastic starch are likely to act as an opportunity for the market studied during the forecast period.

- Europe emerged as the largest market for thermoplastic starch, while Asia-Pacific is expected to witness the highest CAGR between 2024 and 2029.

Thermoplastic Starch (TPS) Market Trends

Films Segment to Dominate the Market

- Thermoplastic starch films lucidly use natural resources, which help reduce environmental pollution. Thermoplastic starch films present many advantages, such as biodegradability, low cost, ease of processing, and renewability. Starch films are being used as promising commercial preservation films to extend the shelf life of food.

- TPS films have poor water vapor barrier properties, low permeability to gases, and resist the tensions arising from their usage in packaging. The increasing use of thermoplastic starch as a filler in plastic films to improve their biodegradability has enhanced their application in the packaging sector.

- Thermoplastic starch (TPS) is a starch derivative and is widely accepted as the most suitable material to replace synthetic polymers in the packaging industry.

- Hydrolyzed cornstarch films, as a sustainable packaging material, offer several advantages, such as biodegradability, reusability, and reduced environmental impact compared to other traditional petroleum-based plastics.

- Many companies are opting for sustainable packaging materials. For instance, Ingredion, a US-based global ingredients solutions company, offers CRISP FILM, a high amylose, white to off-white colored corn starch. The products offer good film-forming characteristics and act as an excellent protective barrier when it is used as a coating for fried foods.

- According to the United States Department of Agriculture, scientists from the Agricultural Research Service (ARS) developed starch-based films, or coatings, that can make paper and other materials more water-resistant and biodegradable. The film product is widely used in plastic bags, food packaging, and other products, thus reducing the amount of synthetic products that are clogging landfills.

- As per the analysis of Mordor Intelligence, the films segment in the thermoplastic starch market is expected to register a CAGR of 6.77% between 2024 and 2029.

- Significant investment in the packaging sector is likely to boost demand in the market studied. For instance, in March 2023, Huatian Technology made significant strides by investing CNY 2.858 billion (~USD 0.42 billion) in its wholly-owned subsidiary, Huatian Technology (Jiangsu) Co. Ltd, for the construction of the "High-Density, High-Reliability Advanced Packaging Research and Industrialization" project. The construction period spans five years, from June 2023 to June 2028.

- Therefore, all these factors are expected to impact the market's demand during the forecast period.

Europe is Expected to Dominate the Market

- In Germany, packaging solutions are used for various customized products and innovation development. Further, smaller pack sizes are in high demand across the county in the packaged food sectors. According to the Statistisches Bundesamt's data, the revenue of the packaging sector in Germany in 2023 accounted for EUR 32.5 billion (~USD 35.87 billion).

- Germany is one of the leading 3D printing markets in Europe. The country has a renowned engineering heritage, which led to the establishment of various manufacturing facilities in industries that can assist international investors with their expansion into Europe.

- According to the Packaging Federation of the United Kingdom, the UK packaging manufacturing industry registers annual sales of around GBP 14 billion (~USD 17.82 billion). It employs over 85,000 people, representing 3% of the UK manufacturing workforce.

- Italy is one of the largest agricultural producers and food processors in the European Union. Moreover, Italy's agricultural sector and agri-food system strongly contribute to the country's economy, accounting for around 2% and 15% of the GDP, respectively, in 2023.

- According to the National Institute of Statistics and Economic Studies (INSEE), in 2023, agricultural production generated an annual revenue of EUR 56.6 billion (~USD 60.96 billion) compared to EUR 58.7 billion (~USD 63.22 billion) in 2022 due to unfavorable macroeconomic factors, high energy costs, and others, thus negatively impacting the market studied.

- Hence, with the abovementioned factors, demand in the thermoplastic starch market is likely to be affected in the European market.

Thermoplastic Starch (TPS) Industry Overview

The thermoplastic starch (TPS) market is consolidated in nature. Some of the major players (not in any particular order) in the market include Versalis SpA, BIOTEC, Kuraray Co. Ltd (Plantic ), AGRANA Beteiligungs AG, and Grupa Azoty.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Packaging Industry

- 4.1.2 Favorable Government Policies Promoting Bio-plastics

- 4.2 Restraints

- 4.2.1 Multiple Technical Constrains Associated with TPS

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Manufacturing Type

- 5.1.1 Extrusion Molding

- 5.1.2 Injection Molding

- 5.2 By Application

- 5.2.1 Bags

- 5.2.2 Films

- 5.2.3 3D Print

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 NORDIC Countries

- 5.3.3.6 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGRANA Beteiligungs-AG

- 6.4.2 Biome Bioplastics Limited

- 6.4.3 Biotec Biologische Naturverpackungen GmbH & Co. KG

- 6.4.4 Biologiq Inc.

- 6.4.5 Cardia Bioplastics

- 6.4.6 Great Wrap

- 6.4.7 Grupa Azoty SA

- 6.4.8 Kuraray Co. Ltd

- 6.4.9 Rodenburg Biopolymers

- 6.4.10 Versalis SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements and Innovation to Enhance the Properties of Thermoplastic Starch

02-2729-4219

+886-2-2729-4219