|

市场调查报告书

商品编码

1689886

工作流程自动化:市场占有率分析、产业趋势与统计资料、成长预测(2025-2030 年)Workflow Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

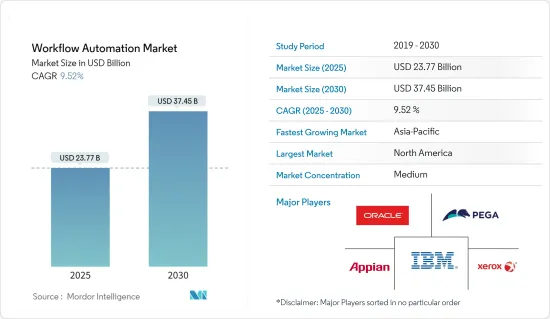

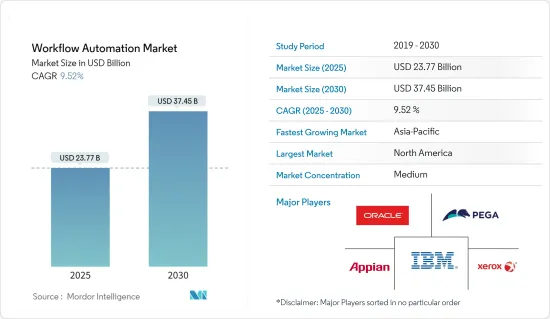

工作流程自动化市场规模预计在 2025 年为 237.7 亿美元,预计到 2030 年将达到 374.5 亿美元,预测期间(2025-2030 年)的复合年增长率为 9.52%。

工作流程的概念源自于工业时代以来製造业和办公业的流程概念,是透过专注于工作活动的常规方面来追求快速提高效率的结果。流程通常将工作活动分为明确定义的任务、规则、角色和程序,并规范大部分製造和办公室工作。最初,所有过程都是由人类操纵物理物件来完成的。

主要亮点

- 随着资讯科技的引入,职场流程已部分或全部由资讯系统自动化,其中电脑程式执行任务并执行先前由人类执行的规则。工作流程自动化旨在透过在製造和管理工作流程中实施最佳实践来提高生产力和品质。它有助于定义工作流程以及从资料来源检索的资料和执行特定阶段的各个阶段的网路位置产生作业票。该系统为使用者提供作业票状态的可视化指示,并允许作业票自动移动,无需任何外部因素的干预。该系统还能适应特定阶段的变化。

- 组织对工作流程软体的需求不断增加,导致对更复杂、更有效率的软体的开发投入迅速增加。据 Signavio 称,62% 的组织业务的 25% 进行建模,但只有 2% 的组织对其整个流程进行建模。此外,13% 的受访组织表示他们已经大规模部署了智慧自动化解决方案,23% 的组织正在部署中,37% 的组织正在试行自动化。

- 组织对工作流程软体的需求不断增长,导致对开发更复杂、更有效率的软体的投资迅速增加。从电脑视觉、认知自动化和机器学习到机器人流程自动化,人工智慧和相关新技术的应用正在兴起。这种技术融合创造了自动化能力,大大提高了客户业务价值和竞争优势。

- 与采用任何新技术不同,工作流程自动化可能会带来针对人类和非人类帐户的网路攻击风险。这就是为什么流程自动化安全如此重要。 RPA 机器人通常处理敏感资料并将资料从一个系统传输到另一个系统。如果资料没有受到保护,资料能被滥用并对公司造成数百万美元的损失。

- 新冠疫情暴露了供应链的脆弱性。对大多数 IT 组织而言,脆弱的生态系统包括关键 IT 服务提供者。此外,在家工作工作的规定使服务提供者能够确保其关键任务企业客户拥有所需的工具和技术,以实现其所提供服务的速度、安全性、品质和整体效率。

工作流程自动化市场趋势

软体领域预计将实现显着成长

- 由于新兴应用、经营模式和设备成本的降低,物联网在各行各业的采用呈指数级增长。随着物联网连接的激增,用于工作流程自动化的工具(如工作流程自动化软体、工作流程管理软体、工作流程系统和业务流程自动化(BPA))的需求庞大。工作流程自动化软体提供多种优势,包括增值功能和整合功能,可扩大自动化范围。预计这种采用将推动整个工作流程自动化市场软体领域的进一步需求。

- 它的一些功能包括能够减少实施和维护软体所需的 IT 支援量。业务用户可以透过直觉的视觉化介面方便地存取多项功能,从而加速自动化并让业务团队共同创造性工作流程优化的角色。低程式码还可以减少 IT 积压的压力。例如,Integrify 是一个低程式码工作流程自动化平台,提供易于使用的建构器、灵活的客製化、多种定价选项和专门的客户支援。

- 工作流程自动化软体透过标准化流程、避免错误以及使用可定製表单等功能消除重复资料输入,提供简化请求管理的解决方案。此入口网站可以轻鬆组织并与内部和外部合作伙伴安全地共用表单。在工作流程自动化中发挥关键作用的其他功能包括整合、范本和规则的存在以及条件逻辑。

- 例如,2023 年 10 月,商业软体低程式码开发平台 Retool Inc. 宣布 Retool Workflows 全面上市。这种高度创新的自动化工具旨在极大地增强开发人员的能力,允许他们优先考虑编码,并透过监控和维护工具无缝地自动执行任务。在 Retool 工作流程中,开发人员可以看到一个用户友好、视觉上吸引人的介面,该介面提供了大量的编码工具,可以有效地原型製作和建立重复性作业、自订警报和资讯管理任务。此外,该工具还促进基于触发器的资料提取、转换和载入。

预计亚太地区将在预测期内实现最快成长

- 随着中国市场竞争日益激烈,各行各业都在透过数位转型改善工作流程。例如,东风日产启动数位转型计划,以提高效率并加快新车的行销进程。该公司开始实施数位转型策略,以更好地利用资料,目标是改善现有工作流程、简化内部业务并提高整体效率。作为该计划的一部分,该公司部署了机器人流程自动化 (RPA) 软体 UiPath,以自动执行重复的数位任务。

- 2021年,中国联通智慧网路创新中心与华为合作,基于华为AUTIN系统开发并部署了基于AI的网路管理营运平台。该公司部署了基于人工智慧的网路管理和营运平台,利用资料简化和自动化全国网路营运、规划和管理,同时在推出 5G 网路和服务时提高成本效率、客户体验和永续性。

- 自动化是与未来工作方式相关的最重要的部分之一,日本正在透过人工智慧进行创新。根据野村综合研究所预测,到2035年,日本的人工智慧领域将实现重大飞跃。 ABEJA、NEC等自动化公司正在透过创新提高生产效率,从而推动日本的GDP成长。

- 自动化在印度经济发展中也扮演着重要角色。随着技术和创新的采用,该国大多数领域目前正处于转型期。国家人工智慧战略(NSAI)强调,预计到 2035 年,人工智慧将使印度的年增长率提高 1.3%。

- 亚太地区其他值得关注的地区包括东南亚和澳洲。东南亚企业正在为人工智慧驱动的未来培养员工并拥抱新技术。因此,公司需要透过适当的技能提升策略来弥补技能差距。数位化不仅将帮助该地区为当地企业建立具有全球竞争力的伙伴关係,还将增加全球扩张的潜力并支持成功的技术和知识转移。

工作流程自动化产业概览

工作流程自动化市场分散且竞争激烈。该市场有几家主要参与者,包括 IBM 公司、Oracle 公司、Pegasystems 公司、施乐公司和 Appian 公司。这些公司正在利用战略合作计划来增加市场占有率和盈利。

- 2023 年 11 月,Esker 是一家全球云端平台,也是财务、采购和客户服务职能领域 AI主导流程自动化解决方案的产业领导者,该公司宣布 Teknion 已采用 Esker 的应付帐款自动化解决方案来提高业务效率。透过利用 Esker 的创新技术,以色列理工学院旨在简化其全球各地的系统和 ERP 工作流程。具体来说,Teknion 寻求一种结合自动化和人工智慧的解决方案,以有效地结合来自多个 ERP 的讯息,从而实现其财务系统的持续转型。

- 2023 年 9 月, 销售团队为 Slack 平台引入了一些令人兴奋的改进。这包括整合 Slack 的原生生成 AI 功能、有助于结构化工作流程的清单功能以及对自动化平台的各种增强。同时,Slack 也迈出了一大步,宣布推出自己的 Slack AI,该 AI 由其原生的 LLM 技术提供支援。此外,Slack 还对工作流程自动化做出了有价值的补充,例如用于组织任务、核准和资讯的清单。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 市场驱动因素

- 各行各业对物联网的采用率不断提高

- RPA 在业务流程管理的应用日益增多

- 市场限制

- 资料安全问题

第五章市场区隔

- 按部署

- 本地

- 云

- 按解决方案

- 软体

- 按服务

- 按最终用户产业

- 银行

- 电信

- 零售

- 製造和物流

- 医疗保健和製药

- 能源与公共产业

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区(拉丁美洲、中东和非洲)

- 北美洲

第六章竞争格局

- 公司简介

- IBM Corporation

- Oracle Corporation

- Xerox Corporation

- Pegasystems Inc.

- Appian Corporation

- Bizagi

- Software AG

- IPsoft Inc.

- Newgen Software Technologies Limited

- Nintex Global Limited

第七章投资分析

第八章市场趋势与未来机会

The Workflow Automation Market size is estimated at USD 23.77 billion in 2025, and is expected to reach USD 37.45 billion by 2030, at a CAGR of 9.52% during the forecast period (2025-2030).

The workflow concept has evolved from the notion of process in manufacturing and the office, and such processes have existed since the time of industrialization and are the outcome of a search to surge efficiency by concentrating on the routine aspects of work activities. They typically separate work activities into well-defined tasks, rules, roles, and procedures that regulate most of the manufacturing and office work. Initially, processes were carried out entirely by humans who manipulated physical objects.

Key Highlights

- With the introduction of information technology, processes in the workplace are partially or totally automated by information systems through computer programs performing tasks and enforcing rules that humans previously implemented. Workflow automation is developed to enhance productivity and quality by incorporating best practices in workflow processes involved in manufacturing as well as management. It facilitates defining workflow processes from the data fetched from the data sources and the network location of the various stages at which the execution of that particular stage is performed, along with the generation of job ticket. The system is able to move the job ticket automatically without any intervention of any external factor along with providing the user, a visual display of status of any job ticket at any point of time. The system is also adaptable to changes at a particular stage.

- The growing demand for workflow software from organizations is leading to rapid investment in the development of more sophisticated and efficient software. According to Signavio, 62% of the organizations have modeled up to 25% of their businesses, but a meager 2% have all their processes modeled. Moreover, 13% of the surveyed organizations say that they are implementing intelligent automation solutions at scale; 23% are implementing, and 37% are piloting automation.

- The increasing demand for workflow software by organizations is leading to rapid investment in the development of more sophisticated and efficient software. There is increasing adoption of artificial intelligence and related new technologies ranging from computer vision, cognitive automation, and machine learning to robotic process automation. This convergence of technologies produces automation capabilities that dramatically elevate business value and competitive advantages for customers.

- Unlike any new technology implementation, workflow automation can create risks for cyberattacks directed at both human and non-human accounts. As a result, process automation security is of critical importance. RPA bots often work on confidential data, transferring it from one system to another. If data is not protected, it can be leveraged, costing businesses millions.

- With the onset of COVID-19, the vulnerability of supply chains has been exposed. For most IT organizations, a fragile ecosystem includes providers of critical IT services. In addition, work-from-home mandates led the service providers to ensure that mission-critical enterprise customers have the necessary tools and technologies to enable the speed, security, quality, and overall efficacy of services provided.

Workflow Automation Market Trends

Software Segment is Expected to Register Significant Growth

- The adoption of IoT is surging among industries owing to the emergence of applications and business models and reduced device costs. With surging IoT connective, the tools used to automate workflows, including workflow automation software, workflow management software, workflow systems, or business process automation (BPA) are observing significant demand. The workflow automation software has various advantages, including value-adding features, and provides integration capabilities to increase the range of automation one can implement. Such adoption will bring more demand for the software segment across the workflow automation market.

- Some features include the capability of reducing the amount of IT support required to implement and maintain the software. Business users can conveniently access some features through an intuitive visual interface, making the automation faster and putting business teams in a co-creative role for optimizing workflows. Low code also relieves pressure on the IT backlog. For instance, Integrify is a low-code workflow automation platform that offers an easy-to-use builder, flexible customization, multiple pricing options, and dedicated customer support.

- Moreover, capturing and consolidating incoming data can be challenging for any team, and workflow automation software facilitates a solution with features such as customizable forms to simplify request management by standardizing processes, avoiding errors, and eliminating duplicate data entry. Portals make organizing and securely sharing forms with internal or external partners easy. Other features that play a crucial role in the workflow automation includes integrations, presence of templates and rules as well as conditional logic.

- For instance, In October 2023, Retool Inc., a low-code development platform for business software, announced the general availability of Retool Workflows. This highly innovative automation tool has been designed with the aim of greatly assisting developers by enabling them to prioritize coding and then seamlessly automate tasks alongside monitoring and maintenance tools. With Retool Workflows, developers are offered a user-friendly and visually appealing interface that provides an extensive array of coding tools, allowing for efficient prototyping and construction of periodic jobs, customized alerts, and information management tasks. Furthermore, this tool facilitates data extraction, transformation, and loading based on triggers.

Asia-Pacific Expected to Register the Fastest Growth During the Forecast Period

- With the increasing competition in the Chinese market, various industries in the country have been improving workflow through digital transformation. For instance, Dongfeng Nissan initiated its digital transformation program to improve efficiency and speed up the process of marketing a line of new vehicles. The company launched its digital transformation strategy for promoting the better use of data aimed to improve existing workflows, streamline internal business operations, and promote overall efficiency. As part of the program, the company implemented robotic process automation (RPA) software, UiPath, to automate repetitive digital tasks.

- China Unicom's Intelligent Network Innovation Center worked with Huawei in 2021 to develop and deploy an AI-powered network management and operations platform based on Huawei's AUTIN system. The company deployed an AI-based network management and operations platform to use data to simplify and automate national network operation, planning, and management while improving cost-effectiveness, customer experience, and sustainability as it rolled out 5G networks and services.

- Automation is one of the most crucial parts related to the future of work approach, and Japan is innovating through AI. According to the Nomura Research Institute, the AI sector in the country will see a massive stride by 2035. Automation companies such as Abeja, NEC, and others innovate to bring more production efficiency to push Japan's GDP.

- Automation has been playing a major role in India's economic development. The country is currently witnessing a transition in most sectors through the implementation of technology and innovation. The National Strategy for Artificial Intelligence (NSAI) highlighted that AI is predicted to accelerate India's annual growth rate by 1.3% by 2035.

- Southeast Asia and Australia are prominent regions in the Rest of Asia-Pacific. Southeast Asian companies are preparing employees for an AI-centered future and embracing new technologies. This would require enterprises to plug the skills gap through a proper upskilling strategy. Digitization would help the region to create globally competitive partnerships for local companies as well as improve the potential for global expansion and support a successful technology and knowledge transfer.

Workflow Automation Industry Overview

The Workflow Automation Market is fragemented and highly competitive. This market consists of several major players, such as IBM Corporation, Oracle Corporation, Pegasystems Inc., Xerox Corporation, and Appian Corporation. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

- November 2023: Esker, a global cloud platform and industry leader in AI-driven process automation solutions for Finance, Procurement, and Customer Service functions, announced Teknion has selected Esker's Accounts Payable automation solution to enhance its operational efficiencies. By leveraging Esker's innovative technology, Teknion aims to streamline its systems and ERP workflow across its global sites. Teknion specifically sought a solution incorporating automation and artificial intelligence to effectively combine information from multiple ERPs for their ongoing transformation of financial systems.

- September 2023: Salesforce has introduced some impressive advancements to its Slack platform. These include integrating Slack-native generative AI capabilities, a helpful lists function for structured workflow, and various enhancements to its automation platform. On the other hand, Slack has also made significant strides by launching its own Slack AI, which is powered by its own native LLM technology. Additionally, Slack has made valuable additions to its workflow automation, such as a lists feature for organized tasks, approvals, and information.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Market Drivers

- 4.3.1 Increasing Adoption of IoT across industries

- 4.3.2 Rise in Implementation of RPA in Business Process Management

- 4.4 Market Restraints

- 4.4.1 Data Security Concerns

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Solution

- 5.2.1 Software

- 5.2.2 Service

- 5.3 By End-user Industry

- 5.3.1 Banking

- 5.3.2 Telecom

- 5.3.3 Retail

- 5.3.4 Manufacturing and Logistics

- 5.3.5 Healthcare and Pharmaceuticals

- 5.3.6 Energy and Utilities

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Rest of the World (Latin America, Middle East and Africa)

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Oracle Corporation

- 6.1.3 Xerox Corporation

- 6.1.4 Pegasystems Inc.

- 6.1.5 Appian Corporation

- 6.1.6 Bizagi

- 6.1.7 Software AG

- 6.1.8 IPsoft Inc.

- 6.1.9 Newgen Software Technologies Limited

- 6.1.10 Nintex Global Limited