|

市场调查报告书

商品编码

1689891

美国塑胶瓶盖和封口:市场占有率分析、行业趋势和成长预测(2025-2030)United States (US) Plastic Caps and Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

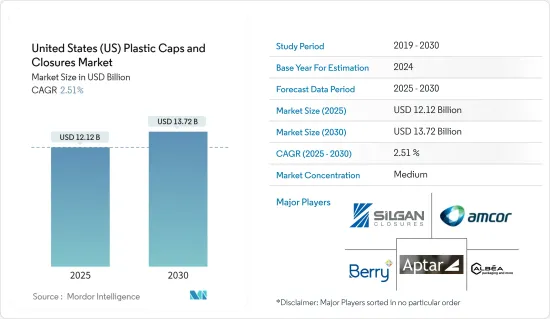

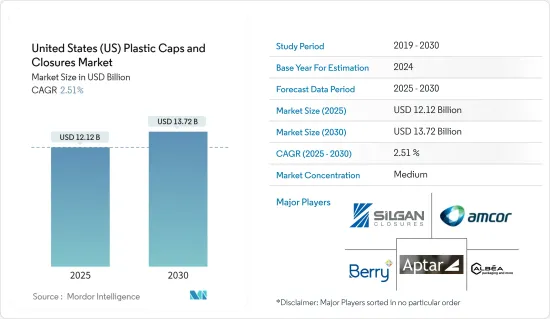

预计 2025 年美国塑胶瓶盖和封口市场规模将达到 121.2 亿美元,到 2030 年将达到 137.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 2.51%。

主要亮点

- 塑胶瓶盖和封盖以PP和PE为主要原料製造。各行各业都严重依赖这些材料来提供经济高效的密封解决方案。包装食品和药品的需求正在稳步增长,对瓶盖和封口市场产生了影响。

- 同样,消费者健康意识的增强也推动了包装饮料和药品的需求激增,从而促进了瓶盖和封口市场的发展。塑胶瓶盖和封口部分的增幅尤其显着,这得益于注重健康的消费者对瓶装水的需求增加。

- 值得注意的是,2023 年,饮料行销公司和国际瓶装水协会报告称,瓶装水是美国消费量最大的饮料。儘管该类别的成长率正在放缓,但它仍然是销量领先的饮料类别,生产商收益和总加仑数均创下历史新高。具体而言,预计 2023 年瓶装水市场将成长 0.4%,低于 2022 年的 1.1% 增幅,也远低于 2021 年和 2020 年分别为 4.6% 和 4.1% 的强劲成长率。

- 此外,美国消费者对瓶装水的需求不断增长也推动了塑胶瓶盖和封口市场的发展。这些部件对于密封水瓶以防止溢出、方便运输和延长保质期至关重要。人们对水污染和安全问题的认识不断提高,推动了对瓶装水的需求,预计这一趋势将在预测期内持续下去,并可能导致整个市场对塑胶瓶盖的需求激增。

- 原料价格直接影响塑胶瓶盖和封盖的成本。随着塑胶树脂价格上涨,製造商在采购、加工和将这些材料转化为包装产品时面临的成本增加。原材料成本上涨可能会对利润率造成压力,特别是如果製造商无法将增加的成本转嫁给客户。因此,对技术创新和业务扩张的投资可能会减少或缩减,从而抑制市场成长。

美国塑胶瓶盖和封盖市场趋势

聚乙烯(PE)预计将成为成长最快的原料领域

- 聚乙烯 (PE) 是最耐用的塑胶之一,耐化学腐蚀且成本低廉。 PE 源自石油聚合物,能够抵御各种环境危害,通常分为高密度聚苯乙烯(HDPE) 和低密度聚乙烯 (LDPE)。

- HDPE 和 LDPE 是瓶盖和封盖的主要材料。 HDPE 广泛用于水瓶、奶瓶和果汁瓶,尤其是水瓶盖,由于其优异的有机性能,多年来一直是一种流行的材料。 HDPE 塑料以其强度和耐用性而闻名,可以进行颜色匹配,通常为白色。其适应性和耐用性使 HDPE 成为化妆品瓶的首选。

- Borealis 指出,高密度聚乙烯瓶盖和封口的成长主要是由于玻璃瓶上的金属瓶盖被取代,以及消费模式的改变,人们更倾向于使用小瓶装轻食。

- 据美国工业理事会称,到2023年,美国将生产70.5亿磅聚乙烯,包括HDPE、LDPE和LLDPE。射出成型技术对医疗设备、瓶盖和封盖的生产产生了重大影响,尤其是在LDPE领域。

- 由于其强度和成本效益,美国许多行业更喜欢 HDPE 而不是 LDPE。 HDPE 具有很高的刚性,因此非常适合包装耐衝击的货物。化学工业已成为主要消费产业,推动了市场的成长。

- 由于聚乙烯产业策略重点放在出口措施上,美国塑胶瓶盖和封口市场正在经历显着成长。亚洲已成为这些出口产品的重要市场。根据美国商务部的资料,2023年第一季美国PE出口出货量与前一年同期比较增30%,达到3,196,437万吨(7,050万磅)。

饮料业预计将占据主要市场占有率

- 瓶盖和封口对于饮料业至关重要,用于密封碳酸饮料和非碳酸饮料的容器、袋子和瓶子。防止污染并保持饮料的风味和口感。饮料部门包括瓶装水、果汁、即饮饮料和能量饮料。

- 单份饮料需求的不断增长,加上延长包装饮料保质期的热填充工艺,预计将推动美国瓶盖和封口市场的成长。该公司更喜欢热填充工艺,因为宝特瓶无需使用防腐剂,从而提高了饮料的健康指数。具体来说,热填充塑胶瓶的优点包括延长产品保质期、不含防腐剂、结构轻巧、以及由于采用塑胶结构而具有成本效益。

- 随着各种热填充工艺在饮料行业变得越来越普遍,热填充塑胶瓶也越来越受欢迎。热填充应用的兴起,尤其是在即饮领域,预计将推动市场成长。

- 随着瓶装水和能量饮料需求的不断增长,运动瓶盖市场也不断扩大。儘管运动帽很重,但它具有防篡改功能。运动瓶盖具有多种美观的外形、颈部直径和防篡改解决方案,以满足冷、干、湿无菌填充需求。根据《饮料文摘》报道,到2023年,可口可乐在美国碳酸软性饮料(CSD)市场的零售量份额将超过40%。同期,北美地区占可口可乐总收益的近37%。该公司2023年全球净营业收益约460亿美元。

- 影响饮料封口的另一个有影响力的趋势是电子商务的兴起。网路购物的便利性为企业提供了接触新消费者和满足日益增长的宅配需求的机会。因此,越来越多的食品和饮料销售转向直接面向消费者的电子商务平台。

美国塑胶瓶盖和封盖市场概况

美国塑胶瓶盖和封口市场一直保持半固定结构,预计这种趋势将在预测期内持续下去。该市场的主要特征包括适度的退出障碍、对成熟品牌的偏好以及强劲的併购活动。市场值得关注的公司有 Silgan Closures (Silgan Holdings Inc.)、Amcor Ltd.、Aptargroup Inc.、Berry Global Inc. 和 Albea Services SAS。

2024 年 3 月-全球餐饮品牌赛百味宣布已与百事可乐签署一项为期 10 年的协议,自 2025 年 1 月 1 日起为其美国餐厅供应饮料。赛百味与菲多利的长期伙伴关係将延长至 2030 年,将其美国零食和饮料组合整合到一家供应商旗下,并提高全系统的效率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- COVID-19疫情对市场的影响评估

第五章市场动态

- 市场驱动因素

- 包装食品和药品的需求

- 中小型终端用户产业需求不断成长

- 市场挑战

- 原料成本波动

第六章市场区隔

- 按原料

- 聚乙烯(PE)

- 聚对苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 其他材料(聚苯乙烯、PVC)

- 按类型

- 螺桿式

- 自动贩卖机

- 无螺丝

- 儿科

- 按应用

- 食物

- 製药和医疗保健

- 饮料

- 化妆品和盥洗用品

- 日用化学品

- 其他用途

第七章竞争格局

- 公司简介

- Silgan Closures(Silgan Holdings Inc.)

- Amcor Ltd

- Aptargroup Inc.

- Berry Global Inc.

- Albea Services SAS

- Trimas Corporation

- Tetra Pak International SA

- Guala Closures Group(Guala Pack SPA)

- MJS Packaging

- O Berk Company LLC

- Closure Systems International Inc.

- Bericap Holding

第八章投资分析

第九章 市场机会与未来趋势

The United States Plastic Caps and Closures Market size is estimated at USD 12.12 billion in 2025, and is expected to reach USD 13.72 billion by 2030, at a CAGR of 2.51% during the forecast period (2025-2030).

Key Highlights

- Plastic caps and closures utilize PP and PE as primary raw materials for manufacturing. Industries heavily rely on these materials, providing a cost-effective sealing solution. The demand for packaged food and pharmaceutical drugs has been steadily increasing, consequently impacting the caps and closures market, which is expected to see a rise in demand during the forecast period.

- Similarly, amid a growing trend of health-consciousness among consumers, the demand for packaged beverages and pharmaceutical drugs is surging, propelling the caps and closures market. This rise is particularly pronounced in the plastic caps and closures segment, driven by the increasing accessibility of bottled water, which is a favored choice for health-conscious consumers.

- Notably, in 2023, the Beverage Marketing Corporation and the International Bottled Water Association reported that bottled water claimed the top spot as the most consumed beverage in the United States. While the growth rate in the sector has tapered, the leading beverage category, in terms of volume, marked record highs in both producer revenues and total gallons. Specifically, in 2023, the bottled water market saw a modest increase of 0.4%, a slowdown from the 1.1% growth in 2022 and a significant decline from the robust growth rates of 4.6% and 4.1% observed in 2021 and 2020, respectively.

- Also, the rise in bottled water demand among customers in the United States is propelling the plastic caps and closures market. These components are essential for sealing water bottles to prevent spills, facilitate transportation, and enhance shelf life. The growing awareness of water contamination and safety concerns is driving up the demand for bottled water, a trend expected to continue during the forecast period, potentially spiking the demand for plastic caps across the market.

- Raw material prices directly impact the cost of plastic caps and closures. When the price of plastic resins rises, manufacturers face increased costs in sourcing, processing, and transforming these materials into packaging products. The escalation in raw material costs can strain profit margins, particularly if manufacturers cannot pass on the increased costs to customers. Consequently, this may result in reduced investments in innovation, expansion, or even downsizing, thus restraining the market's growth.

United States (US) Plastic Caps and Closures Market Trends

Polyethylene (PE) is expected to be the Fastest Growing Raw Material Segment

- Polyethylene (PE) is one of the most durable plastics available, exhibiting resistance to chemicals and boasting a low cost. Derived from petroleum polymers, PE can withstand various environmental hazards, typically categorized as high-density polyethylene (HDPE) and low-density polyethylene (LDPE).

- HDPE and LDPE represent the primary materials used in caps and closures. HDPE variants find extensive use in water, dairy, and juice bottles, favored for their excellent organoleptic properties, particularly in water bottle closures, due to their longstanding preference. Renowned for strength and durability, HDPE plastics can be color-matched and commonly found in white. Its adaptability and durability position HDPE as a top choice for cosmetic bottles.

- Borealis notes that the growth in HDPE caps and closures is largely attributed to the replacement of metal caps on glass bottles (by PET) and shifting consumption patterns favoring smaller bottles for refreshments.

- According to the American Chemistry Council, in 2023, the United States produced 7.05 billion pounds of polyethylene, including HDPE, LDPE, and LLDPE. Injection molding technology, particularly influential in the LDPE segment, contributes to the production of medical devices, caps, and closures.

- Due to its strength and cost-effectiveness, many industries in the United States prefer HDPE over LDPE. HDPE's rigidity makes it an ideal packaging choice for impact-resistant goods. The chemical industry emerges as a major consumer, propelling the market's growth.

- The US plastic caps and closures market is experiencing a notable increase, driven by a strategic emphasis on the polyethylene industry's export initiatives. Asia has emerged as a critical market for these exports. According to data from the US Commerce Department, US PE export shipments in the first quarter of 2023 increased by 30% compared to the previous year, totaling 3,196,437 million metric tons (mt) or 7.05 billion pounds.

The Beverage Segment is expected to Hold Major Market Share

- Caps and closures are crucial in sealing containers, pouches, and bottles in the beverage industry, encompassing carbonated and non-carbonated drinks. They safeguard against foreign particles and preserve the flavor and taste of beverages. The beverage segment encompasses bottled water, fruit juices, ready-to-drink beverages, and energy drinks.

- The escalating demand for single-serve beverages, coupled with the hot fill process that extends the shelf life of packaged drinks, is set to propel growth in the US caps and closures market. Companies favor plastic bottles for hot fill processes as they eliminate the need for preservatives, enhancing the drink's health quotient. Notably, the advantages of hot-fill plastic bottles include extended product shelf life and preservative-free content, their lightweight composition, and their cost-effectiveness due to their plastic composition.

- Hot-fill plastic bottles are increasingly prevalent as various hot-fill processes become commonplace in the beverage industry. The rising prominence of hot-fill applications, particularly in the ready-to-drink segment, is anticipated to drive market growth.

- The market for sports caps is expanding alongside the increasing demand for bottled water and energy drinks. Despite their weight, sports closures offer tamper-evident features. Diverse sports closure designs vary in aesthetics, neck diameters, and tamper-evident solutions catering to cold, dry, or wet aseptic filling requirements. According to Beverage Digest, in 2023, Coca-Cola's retail volume share of the US carbonated soft drink (CSD) market exceeded 40%. North America accounted for nearly 37% of the Coca-Cola Company's total revenue during the same period. The company's global net operating revenue in 2023 was approximately USD 46 billion.

- Another influential trend impacting beverage closures is the rise of e-commerce. The convenience of online shopping presents an opportunity for companies to access new consumers and cater to the growing demand for at-home delivery. Consequently, more food and beverage sales are transitioning to direct-to-consumer e-commerce platforms.

United States (US) Plastic Caps and Closures Market Overview

The plastic caps and closures market maintains a semi-consolidated structure in the United States, a trend expected to continue during the forecast period. Key characteristics of this market include moderate exit barriers, a preference for established brands, and significant merger and acquisition activities. Noteworthy players in this market landscape are Silgan Closures (Silgan Holdings Inc.), Amcor Ltd, Aptargroup Inc., Berry Global Inc., and Albea Services SAS.

In March 2024 - Subway, a global restaurant brand, announced a 10-year agreement with PepsiCo to supply beverages in US restaurants beginning January 1, 2025. Subway's longstanding partnership with Frito-Lay will extend through 2030, bringing the brand's US snack and beverage portfolio together under one supplier and driving more efficiency across the system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Packaged Food and Pharmaceutical Drugs

- 5.1.2 Increasing Demand from Small and Medium-Scale End-user Industries

- 5.2 Market Challenges

- 5.2.1 Fluctuation in the Cost of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Raw Material

- 6.1.1 Polyethylene (PE)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Polypropylene (PP)

- 6.1.4 Other Materials (Polystyrene and PVC)

- 6.2 By Type

- 6.2.1 Threaded

- 6.2.2 Dispensing

- 6.2.3 Unthreaded

- 6.2.4 Child-resistant

- 6.3 By Application

- 6.3.1 Food

- 6.3.2 Pharmaceutical and Healthcare

- 6.3.3 Beverage

- 6.3.4 Cosmetics and Toiletries

- 6.3.5 Household Chemicals

- 6.3.6 Other Applications

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Silgan Closures (Silgan Holdings Inc.)

- 7.1.2 Amcor Ltd

- 7.1.3 Aptargroup Inc.

- 7.1.4 Berry Global Inc.

- 7.1.5 Albea Services SAS

- 7.1.6 Trimas Corporation

- 7.1.7 Tetra Pak International SA

- 7.1.8 Guala Closures Group (Guala Pack SPA)

- 7.1.9 MJS Packaging

- 7.1.10 O Berk Company LLC

- 7.1.11 Closure Systems International Inc.

- 7.1.12 Bericap Holding