|

市场调查报告书

商品编码

1628787

中东和非洲塑胶盖子与封口装置-市场占有率分析、产业趋势、统计、成长趋势预测(2025-2030)Middle East and Africa Plastic Caps and Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

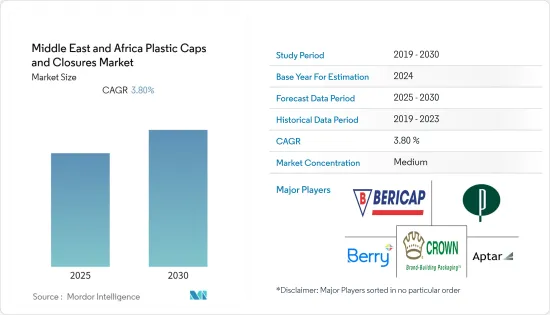

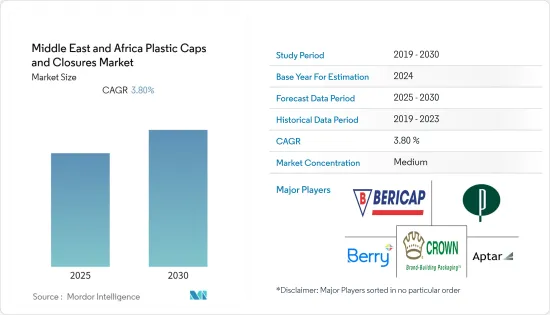

中东和非洲塑胶盖子与封口装置市场在预测期内复合年增长率预计为 3.8%

主要亮点

- 食品消费高速成长。这导致对具有长保质期的无菌包装食品的需求不断增长。该地区的公司生产包装,以帮助食品製造商实现这些目标,以便他们可以将产品运输和销售给最终客户。该行业的人口变化需要产品创新。随着市场的快速变化,企业的需求也不断变化。

- 此外,奈米技术在简便食品製造中在改善储存程序、包装方法和成品加工等关键特性方面发挥重要作用。因此,这一趋势预计将在增加包装食品容器的使用方面发挥重要作用,并有望增加对各种瓶盖的需求。

- 此外,心血管疾病等慢性疾病的盛行率不断上升,增加了对多种药物的需求。因此,製药领域对有效包装解决方案的需求不断增加,从而扩大了潜在的市场机会。

- 环境问题导致人们对替代包装的兴趣日益浓厚,包括袋子和纸板箱。这些无封闭业态的成长可能会限制未来所研究市场的成长。

中东及非洲塑胶瓶盖及瓶盖市场趋势

药品和医学发挥重要作用

- 根据波湾合作理事会(GCC)的报告,沙乌地阿拉伯将在卫生基础设施方面投资超过660亿美元,并寻求在2030年将私营部门的参与度从40%提高到65%,因此该行业将持续成长。

- 随着私营部门的贡献不断增加,沙乌地阿拉伯正在寻求与全球领先公司的合作伙伴关係,以扩大其影响力。例如,2021年2月,该国内政部与瑞士製药公司罗氏公司签署了一份发展该国医疗生命科学领域的谅解备忘录。新兴市场的发展预计将带动市场。

- 药品包装涉及组装精心挑选的材料,以保存和保护药品,并使其可供客户和患者安全使用。用于製造药品容器的主要塑胶材料是聚乙烯(HDPE 或 LDPE)、聚烯,例如聚丙烯(PP)、聚对苯二甲酸乙二醇酯(PET)和其他共聚物,该领域对瓶盖和封闭件的需求不断增加。

- 由于一些客户面临幼儿和老年人打开瓶盖和瓶盖的问题,智慧和防伪包装解决方案正在迅速开发,这项技术正在推动製药业的瓶盖广泛应用,这使其成为进一步扩展的理想选择。 。

- 在医药产品和溶液中使用塑胶盖和封闭件而不是玻璃或金属的缺点是塑胶材料会透过转移浸出物与产品相互作用。在这种情况下,玻璃包装或金属盖子与封口装置可能会抑制生长。

聚对苯二甲酸乙二酯(PET)大幅成长

- 大多数软性饮料都包装在聚对苯二甲酸乙二醇酯 (PET) 製成的瓶子中,因为它能更好地保留二氧化碳。 PET也用于果汁包装和运动饮料等市场,也用于食用油、沙拉油和酱料瓶。

- 此外,各国肥胖和糖尿病人口数量的增加预计将提高健康意识并增加对健康饮料的需求,从而导致对果汁饮料、机能饮料和其他饮料的需求增加并影响塑胶盖子与封口装置。

- 本行业高度依赖製造业投入。作为原料的PET受到市场成本波动的影响较大。製造商发现很难维持恆定的产量,因为生产成本取决于这些原料成本。

- 由于 PET 具有对二氧化碳 (CO2) 和氧气 (O2)的阻隔性,因此也可用于食品包装。 PET 耐微波,主要用于多个食品链。

- 轻量化解决方案的技术突破以及对永续性和回收的日益重视是 PET 包装的一些趋势。另一个成长趋势是在 PET 製造中使用压缩技术。许多食品和饮料公司正在努力在 2020 年至 2025 年间增加其所有产品的回收 PET 含量,以提高可回收性。

中东和非洲塑胶盖子与封口装置产业概况

中东和非洲塑胶盖子与封口装置市场部分整合,市场上有许多製造各种产品的参与企业。

- 2020 年 2 月 - Silgan Holdings Inc.(消费品硬包装领先供应商之一)宣布收购 Cobra Plastics, Inc.。该公司为各种消费品生产注塑塑胶瓶盖,并专注于气雾剂顶盖产业。 Silgun 将 Cobra 的顶盖产品线与气雾剂致动器和分配系统结合,扩大了包括功能顶盖在内的整合解决方案的选择范围。

- 2021 年 3 月 - Berry Global 成立全球硬质医疗包装设备专业业务部门。该公司的倡议之一是其全球刚性医疗包装和设备业务,该业务的销售额已从 2015 年的 5 亿美元增长到超过 10 亿美元。巩固我们在这个行业的地位。

- 2021 年 6 月 - Closure Systems International (CSI) 的 38mm D-KF铝箔内衬 HDPE 瓶盖是其液体乳製品产品线的新成员。 CSI 38D-KF 封口采用可触及的半月形箔衬里,并配有双防拆封和层架加强密封件。在 HDPE 和宝特瓶,3 引线设计经过精密设计,可确保可靠的效能。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 最终用户对创新解决方案的需求增加

- 市场限制因素

- 轻巧且经济高效的立式袋包装

第六章 市场细分

- 按材质

- PET

- PP

- 低密度聚乙烯和高密度聚乙烯

- 其他的

- 按最终用户产业

- 饮料

- 食物

- 製药/医疗

- 化妆品/洗护用品

- 家用化学品

- 其他的

- 按国家/地区

- 沙乌地阿拉伯

- 埃及

- 伊朗

- 奈及利亚

- 南非

- 其他中东/非洲

第七章 竞争格局

- 公司简介

- Berry Plastics Corporation

- Aptar Group, Inc.

- Crown Holdings, Inc.

- Portola Packaging

- Bericap

- Mocap

- Mold Rite Plastics

- Silgan Plastics

- Alpha Packaging

- All American Containers

- MJS Packaging

- Closure Systems International

第八章投资分析

第9章市场的未来

简介目录

Product Code: 54232

The Middle East and Africa Plastic Caps and Closures Market is expected to register a CAGR of 3.8% during the forecast period.

Key Highlights

- Food consumption has been witnessing high growth. This has led to a demand for packaged food products with longer shelf life and sterility. Companies around the region are manufacturing packages, which help achieve these objectives so that manufacturers of food products can transport and sell their products to the end customers. Changing demographics in this industry are demanding innovations in products. With the market changing rapidly, company needs are also changing.

- Furthermore, nanotechnology in convenience food manufacturing has played a crucial role in improving critical functions, including preservation procedures, packaging methods, and finished goods processing. Thus, this trend is anticipated to play a significant role in increasing the usage of containers for packaged food products, which is expected to increase the demand for various closures.

- In addition, the increasing prevalence of chronic conditions such as cardiovascular disease and other illnesses has raised the demand for numerous pharmaceuticals. As a result, the need for effective packaging solutions in the pharmaceutical sector increases, expanding the market's potential opportunities.

- Environmental concerns have increased interest in alternative packaging that includes pouches and paperboard cartons. The growth in these closure-less formats may restrain the growth of the market studied in the future.

MEA Plastic Caps and Closures Market Trends

Pharmaceutical and Healthcare Plays a Significant Role

- The private sector in the industry is expected to play a major role over the coming years, as Saudi Arabia is looking to invest over USD 66 billion in healthcare infrastructure and boost private sector participation from 40% to 65% by 2030, according to Gulf Cooperation Council (GCC) report.

- In line with the growing contribution from the private sector, Saudi Arabia is looking to partner with major global enterprises to expand its presence. For instance, in February 2021, the country's Ministry of Interior and Switzerland-based pharmaceuticals company Roche Products signed an MOU to develop the Kingdom's healthcare and life sciences sector. Such developments will drive the market.

- Pharmaceutical packaging involves collecting materials selected carefully to preserve and protect the drug and allow the customer or the patient to use it safely. The main plastic materials cast-off for the manufacture of pharmaceutical containers are polyolefins, type Polyethylene (HDPE or LDPE) and polypropylene (PP); Polyethylene terephthalate (PET); and other copolymers, owing to which the demand of caps and closures increases in this segment.

- As some customers face issues with opening caps and closures by a child or an old-aged person, smart and anti-counterfeiting packaging solutions became the fastest developing requirements, making the technology a perfect fit to further extend the extensive range of closures the pharma sector.

- The downside of using plastic caps and closures with a medicine, or a solution rather than glass or metal, is the possibility of plastic materials interacting with the product using transferring leachables. If that is the case, glass packaging or metal caps and closures may restrain the growth.

Polyethylene Terephthalate (PET) is Observing Significant Increase

- The majority of soft drinks are packaged in bottles made from polyethylene terephthalate (PET), as PET is good at retaining CO2. PET also found its applications in markets, such as fruit juice packaging and sports drinks, and it is also used in bottles for cooking and salad oils and sauces.

- Furthermore, the rising health and wellness trend, owing to the rising obesity and diabetic populations in various countries, is expected to drive demand for healthy drinks, resulting in increased demand for fruit drinks, energy drinks, and other beverages, influencing the plastic caps and closures market.

- This industry is heavily dependent on inputs for manufacturing. PET, which is used as raw material, has highly fluctuating costs in the market. As the cost of production is dependent on these raw material costs, manufacturers are finding it difficult to maintain constant output.

- Owing to its barrier properties against carbon dioxide (CO2) and oxygen (O2), PET can also be used for food packaging. It is microwave-resistant and is largely used in several food chains.

- Technological breakthroughs in lightweight solutions and an increasing emphasis on sustainability and recycling are some of the trends in PET packaging. Another rising trend is the use of compression technologies in PET manufacture. Many foods and beverage firms are working on boosting recycled PET content for all of their goods between 2020 and 2025 in response to the growing trend of recyclability.

MEA Plastic Caps and Closures Industry Overview

The Middle East and Africa Plastic Caps and Closures market is partially consolidated with the presence of numerous players manufacturing various products in the market.

- Feb 2020 - Silgan Holdings Inc., one of the prominent providers of rigid packaging for consumer goods, has announced the acquisition of Cobra Plastics, Inc. This company manufactures injection-molded plastic closures for a wide range of consumer items, emphasizing the aerosol overcap industry. Silgan will offer a greater choice of integrated solutions, including functioning overcaps, as a result of the combination of Cobra's overcap product line with its aerosol actuators and dispensing systems.

- March 2021 - A specialized worldwide rigid healthcare packaging and device business unit has been established by Berry Global. The global rigid healthcare packaging and device business, which has expanded sales from USD 500 million in 2015 to more than USD 1 billion, is one of the company's initiatives. To strengthen its position within this industry.

- June 2021 - The 38mm D-KF foil-lined HDPE closure from Closure Systems International (CSI) is the company's newest addition to its liquid dairy offering. The CSI 38D-KF closure features an accessibility-friendly half-moon type foil liner that provides dual tamper evidence and a shelf-reinforced seal. On HDPE and PET bottles, the 3-lead design is precision-engineered to guarantee reliable performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Innovative Solutions from End-Users

- 5.2 Market Restraints

- 5.2.1 Lightweight And Cost-effective Stand-up Pouch Packaging

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 PET

- 6.1.2 PP

- 6.1.3 LDPE and HDPE

- 6.1.4 Other Materials

- 6.2 By End-user Industry

- 6.2.1 Beverage

- 6.2.2 Food

- 6.2.3 Pharmaceutical and Healthcare

- 6.2.4 Cosmetics and Toiletries

- 6.2.5 Household Chemicals

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 Saudi Arabia

- 6.3.2 Egypt

- 6.3.3 Iran

- 6.3.4 Nigeria

- 6.3.5 South Africa

- 6.3.6 Rest of Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Berry Plastics Corporation

- 7.1.2 Aptar Group, Inc.

- 7.1.3 Crown Holdings, Inc.

- 7.1.4 Portola Packaging

- 7.1.5 Bericap

- 7.1.6 Mocap

- 7.1.7 Mold Rite Plastics

- 7.1.8 Silgan Plastics

- 7.1.9 Alpha Packaging

- 7.1.10 All American Containers

- 7.1.11 MJS Packaging

- 7.1.12 Closure Systems International

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219