|

市场调查报告书

商品编码

1689916

义大利瓷砖:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Italy Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

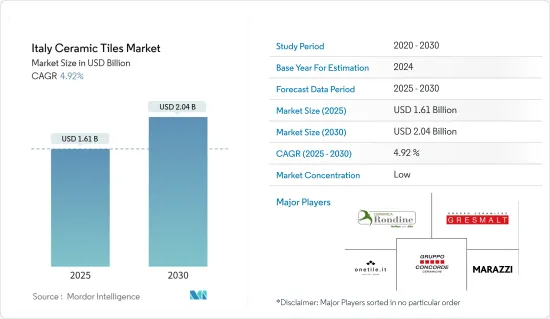

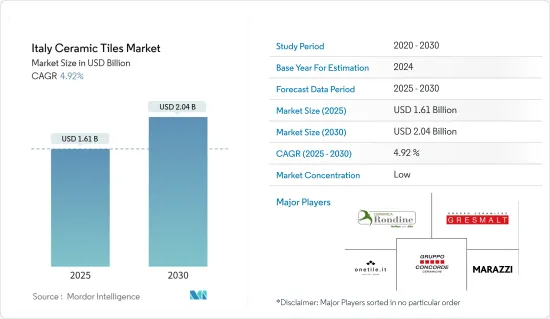

义大利瓷砖市场规模预计在 2025 年为 16.1 亿美元,预计到 2030 年将达到 20.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.92%。

预计义大利瓷砖市场在预测期内将出现强劲成长。义大利瓷砖行业的成长很大程度上受到技术创新的推动,其中包括工艺发明、行业新技术的采用和传播。技术工人和负责人的高流动性也促进了义大利瓷砖行业的发展。

过去几年,义大利瓷砖市场持续成长。该行业受到了 COVID-19 疫情的严重影响。 2020年3月,新冠疫情爆发导致义大利全国封锁,造成劳动力短缺。因此,疫情期间瓷砖製造商面临的最大问题之一是由于劳动力短缺而无法及时完成计划。然而,随着封锁开始放鬆,瓷砖行业成为首批从危机中恢復过来并比以往任何时候都更加强劲的行业之一。预计义大利瓷砖需求将在新冠疫情后迅速復苏。

义大利是领先的瓷砖生产国和出口国之一。义大利也是瓷砖潮流的发源地之一,这里的企业不断为瓷砖产品引入各种创新。义大利2021年陶瓷产品销售量量达4.59亿平方米,与前一年同期比较去年同期成长12%。出口与前一年同期比较年增13%,达3.67亿平方米,国内销售量超过9,100万平方米(成长9%)。

义大利瓷砖可用作地板、墙壁和建筑物的表面覆盖物,非常适合室内和室外应用。义大利瓷砖是地板、墙壁、架子、淋浴设备间等的时尚选择。

义大利瓷砖市场的趋势

义大利瓷砖产量增加

义大利公司采用最新技术生产技术和环境上均较优越的高品质磁砖。义大利瓷砖产业生产出设计精美的产品,为生活空间赋予独特而鲜明的品质。这些产品采用最新技术製造,以充分利用资源,尊重环境和职场安全,并遵守最高的性能标准。

对生产设施的持续投资使得许多公司,特别是义大利瓷砖製造商扩大了其厚度范围,推出了陶瓷瓷砖。瓷砖可以承受霜冻和热衝击,使其成为理想的耐磨耐用的覆材。这些因素刺激了义大利对瓷砖的需求,预计未来几年该市场将进一步成长。

义大利瓷砖出口

2021年义大利城镇居民占比与2020年相比仍维持在71.35%左右,没有明显变化。不过,调查期间占比最高的是2021年。投资涉及城市管理的各个方面,包括住宅、道路系统、城市交通、供水、发电基础设施和智慧城市。义大利的都市化推动了住宅和商业开发的需求,从而刺激了义大利瓷砖市场的扩张。中产阶级收入水准的提高和稳定的民主制度导致义大利城市人口绝对数量增加。

义大利瓷砖行业概况

义大利瓷砖市场竞争激烈且分散。市场的主要参与者包括 Marazzi、Concorde、Cooperativa Ceramica d'Imola 和 Gresmalt Group。义大利瓷砖公司不断尝试颜色、尺寸和图案,为消费者打造独一无二的瓷砖。这些发展和趋势很可能在未来几年主导瓷砖市场。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概览

- 市场驱动因素

- 市场限制/挑战

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 市场创新洞察

- COVID-19 市场影响

第五章市场区隔

- 按产品

- 上釉

- 瓷

- 耐刮擦

- 其他的

- 按应用

- 地砖

- 墙砖

- 其他的

- 依建筑类型

- 新建筑

- 更换和翻新

- 按最终用户

- 住宅装修

- 建筑学

第六章竞争格局

- Market Competion Overview

- 公司简介

- Gruppo Concorde

- Marazzi

- Iris Ceramica Group

- Panariagroup Industrie Ceramiche SpA

- Florim

- Casalgrande Padana SpA

- Ceramica Faetano SpA-Del Conca

- Gresmalt Group

- Gruppo Romani SpA Industrie Ceramiche

- Abk Group Industrie Ceramiche SPA

- Rondine SpA

- Onetile.it

- Cooperativa Ceramica dImola

- Gruppo Ceramiche Ricchetti Spa*

第七章 市场机会与未来趋势

第八章 免责声明和出版商

The Italy Ceramic Tiles Market size is estimated at USD 1.61 billion in 2025, and is expected to reach USD 2.04 billion by 2030, at a CAGR of 4.92% during the forecast period (2025-2030).

The Italy ceramic tiles market is expected to witness strong growth in the forecast period. The growth of the Italian ceramic tile industry has been largely driven by technological changes that involve process invention, adoption, and diffusion of new techniques in the industry. The fact that skilled workers and salespeople move around a lot has also contributed to the growth of the Italian ceramic tile industry.

Over the past few years, Italy's market for ceramic tiles has shown consistent growth. The industry was severely impacted by the COVID-19 epidemic. There was a labor shortage in March 2020, following Italy's imposition of a nationwide lockdown due to the COVID-19 outbreak. As a result, one of the biggest problems ceramic tile manufacturers faced in the midst of the pandemic was the timely completion of projects due to a labor shortage. The tile industry was the first to recover from the crisis and come out stronger than ever, though, once the lockdown began to end. The recovery in demand for ceramic tile in Italy was anticipated to soar dramatically after COVID-19.

Italy is one of the leading producers and exporters of ceramic tiles. Italy is also one of those countries and is also where tile trends are born, so the players keep introducing various innovations in their ceramic tile product offerings. In Italy, sales of ceramic products reached 459 million m2 in 2021, up 12% from the previous year. Exports reached 367 million m2, up 13% from the previous year, and domestic sales reached over 91 million m2 (+9%).

Italian ceramic tiles can be used as a surface covering on floors, walls, and architectural volumes and are ideal for both interiors and exteriors. Italian ceramic tiles have great design and look great on floors, walls, shelves, and in the shower enclosure.

Italy Ceramic Tiles Market Trends

Increasing Production of Ceramic Tiles in Italy

Italian companies use the latest technologies to produce high-quality ceramic tiles with outstanding technical and environmental characteristics. The Italian ceramic tile industry manufactures products with high design content that lend unique, distinctive qualities to living spaces. They are made with modern technologies that pay attention to the environment and the safety of the workplace and that make the best use of resources according to the highest performance standards.

With continued investment in production equipment, many companies, especially the Italian tile manufacturers, are expanding their range of thicknesses and coming up with tiles ranging from 3 to 30 millimeters, including a new 12-millimeter-thick porcelain tile specifically designed for kitchen countertops, bathroom vanities, tables, and outdoor kitchens. Due to their ability to withstand frost and thermal shock, ceramic tiles are ideal for use in exteriors, where they deliver wear resistance and durability. These factors are fueling the demand for ceramic tiles in Italy, and the market is expected to witness further growth in the coming years.

Exports of Ceramic Tiles from Italy

Italy's proportion of urban residents stayed at roughly 71.35 percent in 2021 compared to 2020, showing no discernible changes. However, the share's maximum value over the examined time was in 2021. Housing, the road system, urban transportation, the water supply, infrastructures for generating electricity, smart cities, and other aspects of urban administration are all subject to investment. The country's demand for residential and commercial development is increased by urbanization, which has sped up the expansion of the ceramic tile market in Italy. Due to rising middle-class income levels and a stable democracy, Italy's urban population is growing in absolute terms.

Italy Ceramic Tiles Industry Overview

The Italian ceramic tile market is highly competitive and fragmented. Some of the major players in the market are Marazzi, Concorde, Cooperativa Ceramica d'Imola, and Gresmalt Group. The ceramic tile companies in Italy are continuously experimenting with color, size, and patterns to create one-of-a-kind ceramic tiles for the consumers. These developments and trends are likely to dominate the ceramic tile market in the upcoming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions And Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints/Challenges

- 4.4 Industry Attractiveness - Porters' Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.5 Insights of Technology Innovations in the Market

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Glazed

- 5.1.2 Porcelain

- 5.1.3 Scratch Free

- 5.1.4 Other Products

- 5.2 By Application

- 5.2.1 Floor Tiles

- 5.2.2 Wall Tiles

- 5.2.3 Other Tiles

- 5.3 By Construction Type

- 5.3.1 New Construction

- 5.3.2 Replacement and Renovation

- 5.4 By End User

- 5.4.1 Residential Replacement

- 5.4.2 Construction

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competion Overview

- 6.2 Company Profiles

- 6.2.1 Gruppo Concorde

- 6.2.2 Marazzi

- 6.2.3 Iris Ceramica Group

- 6.2.4 Panariagroup Industrie Ceramiche S.p.A.

- 6.2.5 Florim

- 6.2.6 Casalgrande Padana S.p.A

- 6.2.7 Ceramica Faetano S.p.A. - Del Conca

- 6.2.8 Gresmalt Group

- 6.2.9 Gruppo Romani S.p.A. Industrie Ceramiche

- 6.2.10 Abk Group Industrie Ceramiche S.P.A.

- 6.2.11 Rondine S.p.A.

- 6.2.12 Onetile.it

- 6.2.13 Cooperativa Ceramica dImola

- 6.2.14 Gruppo Ceramiche Ricchetti Spa*