|

市场调查报告书

商品编码

1689919

菲律宾瓷砖:市场占有率分析、行业趋势和成长预测(2025-2030 年)Philippines Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

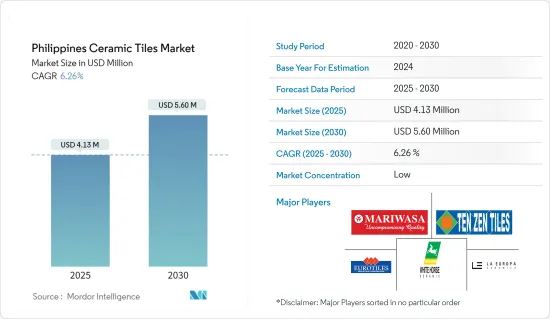

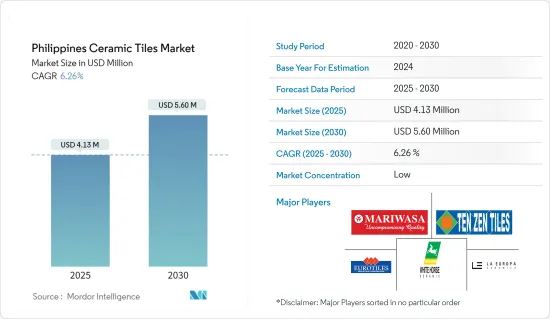

菲律宾瓷砖市场规模预计在 2025 年为 413 万美元,预计在 2030 年达到 560 万美元,预测期内(2025-2030 年)的复合年增长率为 6.26%。

推动该国瓷砖行业需求的关键因素包括建设活动的增加、可支配收入的增加以及人口的成长。

此外,中国不断加快的都市化可能会导致公共工程需求激增,进而增加住宅需求。预计这一趋势将在整个估计和预测期内保持一致,从而推动瓷砖市场的成长。

该公司正在采用最新的自动化生产技术,如Monopteros和单火技术,以提高产品品质并使瓷砖更具成本效益。菲律宾的瓷砖透过专卖店和非专卖店进行分销。然后,分销商要么将这些产品转交给经销商(经销商卖给最终用户),要么自己零售。

瓷砖使用量的增加远超出了预期,导致市场需求增加,瓷砖行业也随之增长。企业必须以专业化、现代化的瓷砖技术提高产品质量,才能以合理的价格在国内和国际市场上竞争。目前菲律宾大部分瓷砖均采用单烧技术、一次烧製技术等最新瓷砖技术,并提高了产品质量,使瓷砖行业更具成本效益。

陶瓷砖优于普通瓷砖,因为它们外观更好、更坚固、使用寿命更长。这些是导致菲律宾众多建筑工地使用瓷砖的一些决定性因素。

在菲律宾,瓷砖被认为是最重要和最常见的建材之一。瓷砖的主要进口国是中国。中国也进口瓷砖,其中义大利占菲律宾瓷砖进口量的3%,西班牙占9%。在出口方面,日本仍然是菲律宾瓷砖出口的最大海外市场,其次是美属萨摩亚和美国。

菲律宾瓷砖市场趋势

建筑业的成长推动了对瓷砖的需求

- 菲律宾瓷砖行业的成长依赖于建筑业的成长,而建筑业是房地产行业的相关行业。菲律宾的建设业目前正在蓬勃发展,全国各地的住宅和商业建筑都在增加。

- 截至 2022 年,菲律宾建设业创造的总增加价值约为 1.4 兆菲律宾披索。过去四年来,建筑业的增加价值一直在波动。 2019年3月28日,贸工部(DTI)和菲律宾承包商协会(PCA)发布了2020-2030年建筑业蓝图,主题为“Tatag at Tapat 2030”,以确保建筑业的永续性发展和竞争力。该蓝图还补充了政府的大规模基础设施计画「大建特建」。

- 住宅建筑的兴起可能会刺激对瓷砖的需求,因为它们在建筑施工过程中用作地板材料和墙壁材料。瓷砖因其耐用、维护成本低且经济实惠而被广泛应用于住宅。磁砖多用于客厅、厨房、卫浴墙面等空间。这些产品在市场上有多种颜色、尺寸和纹理可供选择,吸引了消费者对高端地板材料应用的注意。

- .

地砖是主要类别

- 说到菲律宾的住宅室内设计,陶瓷地砖是最重要的元素之一。地砖有助于改善住宅的美观。马赛克瓷砖是菲律宾最受欢迎的地砖设计之一。马赛克以多种颜色和图案的混合而闻名,有助于形成最终的设计。瓷砖的另一个主要特点是易于更换和安装,使其成为理想的地板材料。

- 在非住宅领域,设计师和建筑师对瓷砖作为地板材料的偏好日益增加,预计将推动对该产品的需求。该国正在经历公寓和住宅等住宅基础设施以及农业、机构、工业和商业等非住宅基础设施的发展,这增加了对陶瓷地砖的需求。

菲律宾瓷砖行业概况

菲律宾瓷砖行业以本土品牌和国际品牌的混合而闻名。市场竞争激烈,众多企业进入。没有一家公司能够主宰整个行业,但有些公司却占据着强大的地位并占据了相当大的市场占有率。然而,随着技术进步和产品创新,中小企业透过赢得新契约和开拓新市场来扩大其市场占有率。

市场的一些主要参与者包括 Mariwasa Siam Ceramics、Formosa Ceramic Tile Manufacturing(Tenzen Tiles)、Eurotiles Industrial Corporation、Whitehorse Ceramic、La Europa Ceramica、Floor Center、Tile Center、Machuca Tiles、Galleria Ceramica 和 Nilo Ceramic Philippines Inc.

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概览

- 市场驱动因素

- 建设产业的成长

- 房地产市场成长

- 市场限制

- 原物料价格不稳定

- 替代产品的可用性

- 市场机会

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 深入了解业界正在使用的最新技术

- 深入了解菲律宾瓷砖监管标准

- 洞察产业设计瓷砖趋势

- COVID-19 市场影响

第五章市场区隔

- 按产品

- 釉药

- 瓷

- 无刮痕

- 其他产品

- 按应用

- 地砖

- 墙砖

- 其他磁砖

- 依建筑类型

- 新建筑

- 更换和翻新

- 按最终用户

- 住宅

- 建造

第六章竞争格局

- Market Competion Overview

- 公司简介

- Mariwasa Siam Ceramics Inc.

- Formosa Ceramic Tiles Manufacturing Corp.(Ten Zen Tiles)

- Eurotiles Industrial Corp.

- White Horse Ceramic

- La Europa Ceramica

- Floor Center

- TILE Center

- Machuca Tile

- Galleria Ceramica

- Niro Ceramic Philippines Inc

- Reyaimpex Pvt. Ltd

- MOZZAICO BGC

- AllHome

- Taicera

- Dynasty Ceramic

第七章:市场的未来

第八章 免责声明和出版商

The Philippines Ceramic Tiles Market size is estimated at USD 4.13 million in 2025, and is expected to reach USD 5.60 million by 2030, at a CAGR of 6.26% during the forecast period (2025-2030).

Some of the major factors fuelling the demand for the ceramic tiles industry in the country are increasing construction activities, rising disposable income, and increased population in the country.

Furthermore, the growing urbanization in the country will further lead to surging demands for utilities and, subsequently, to increased housing demands. This trend is estimated to be consistent over the forecast period and is expected to boost the ceramic tiles market growth.

The companies are using the latest production technology automation, such as monopteros or single-fire technology, to enhance product quality and improve the cost efficiency of ceramic tiles. The ceramic tiles are distributed in the Philippines through exclusive and nonexclusive distributors. Distributors pass these products on to dealers (who sell to end-users) or retail the products themselves.

The increased use of ceramic tiles was much higher than predicted, resulting in increased market demand and growth in the ceramic tile industry. Companies must improve their quality with specific and modern ceramic tile technology in order to compete in domestic and international markets at reasonable prices. Most Philippine ceramic tiles are now using the most recent ceramic tile technology, such as monopteros or single-fire technology, to improve product quality and, as a result, the ceramic tile industry's cost efficiency.

Ceramic tiles are superior to regular tiles because they are aesthetically pleasing, solid, and long-lasting. These are some of the critical factors that have led to the use of ceramic tiles on numerous construction sites throughout the Philippines.

In the Philippines, ceramic tiles are seen as one of the most important yet common forms of materials to be used in construction. China is the leading importer of ceramic tiles in the country. The country also imports ceramic tiles, with Italian tiles accounting for 3% and Spanish tiles accounting for 9% of total ceramic tile imports to the Philippines. In terms of exports, Japan remains the key foreign market for ceramic tile exports from the Philippines, followed by American Samoa and the United States.

Philippines Ceramic Tiles Market Trends

Growth of Construction Sector to Drive Demand for Ceramic Tiles

- The growth of the Philippines' ceramic tiles industry is hinged on the growth of the construction industry, which is the related industry of the property sector. The construction business in the country is currently witnessing positive growth, with a rise in residential as well as commercial construction throughout the country.

- As of 2022, the gross value added generated by the construction sector in the Philippines was approximately 1.4 trillion Philippine pesos. The construction sector's value-added has fluctuated over the last four years. On March 28, 2019, the Department of Trade and Industry (DTI) and the Philippine Contractors Association (PCA) launched the Construction Industry Roadmap 2020-2030 with the theme "Tatag at Tapat 2030," which will ensure the sustainability of the construction industry's growth and competitiveness. The roadmap will also serve as a supplement to the government's massive infrastructure program, "Build Build Build."

- The increase in residential buildings is likely to boost the demand for ceramic tiles as ceramic tiles find application for floorings and walls during the construction of buildings. Ceramic tiles are used widely in houses as they are durable, offer lower maintenance, and are cost-effective. Ceramic tiles are mainly used in the living room, kitchen and bathroom walls, and other spaces. These products are commercially available in a wide range of colors, sizes, and textures, thus gaining consumer attraction for high-end flooring applications.

- .

Floor Tiles is the Dominant Category

- When it comes to home interior design, one of the most important elements is ceramic floor tiles in the Philippines. Floor tiles help improve the aesthetic appeal of houses. Mosaic tiles are one of the most popular floor tile designs in the Philippines. Mosaics are known for being a mix of colors and patterns that help create one final design. Ease of replacement and installation are some major characteristics of ceramic tiles which makes them ideal for flooring.

- The growing presence of designers and architects for the application of porcelain ceramic tiles for flooring in the non-residential segment is anticipated to fuel product demand. The growing development of residential infrastructures, such as apartments and housing units, and non-residential infrastructure in the country, such as agricultural, institutional, industrial, and commercial, are also witnessing an increase in demand for ceramic floor tiles in the country.

Philippines Ceramic Tiles Industry Overview

The ceramic tile business in the Philippines is distinguished by a blend of local and international brands. The market is competitive, with a large number of companies in the business. While no dominating businesses control the industry, certain corporations have built a strong presence and enjoy a significant market share. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Some of the leading players in the market are Mariwasa Siam Ceramics Inc, Formosa Ceramic Tiles Manufacturing Corp. (Ten Zen Tiles), Eurotiles Industrial Corp., White Horse Ceramic, La Europa Ceramica, Floor Center, TILE Center, Machuca Tile, Galleria Ceramica, Niro Ceramic Philippines Inc. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth In Construction Sector

- 4.2.2 Growth In Real Estate Market

- 4.3 Market Restraints

- 4.3.1 Volatile Raw Material Prices

- 4.3.2 Availability of Substitutes

- 4.4 Market Opportunities

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Latest Technologies Used in the Industry

- 4.8 Inisghts on Regulatory Standards for Ceramic Tiles in Philippines

- 4.9 Insights on Design Tile Trends in the Industry

- 4.10 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Glazed

- 5.1.2 Porcelain

- 5.1.3 Scratch Free

- 5.1.4 Other Products

- 5.2 By Application

- 5.2.1 Floor Tiles

- 5.2.2 Wall Tiles

- 5.2.3 Other Tiles

- 5.3 By Construction Type

- 5.3.1 New Construction

- 5.3.2 Replacement and Renovation

- 5.4 By End-User

- 5.4.1 Residential

- 5.4.2 Construction

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competion Overview

- 6.2 Company Profiles

- 6.2.1 Mariwasa Siam Ceramics Inc.

- 6.2.2 Formosa Ceramic Tiles Manufacturing Corp. (Ten Zen Tiles)

- 6.2.3 Eurotiles Industrial Corp.

- 6.2.4 White Horse Ceramic

- 6.2.5 La Europa Ceramica

- 6.2.6 Floor Center

- 6.2.7 TILE Center

- 6.2.8 Machuca Tile

- 6.2.9 Galleria Ceramica

- 6.2.10 Niro Ceramic Philippines Inc

- 6.2.11 Reyaimpex Pvt. Ltd

- 6.2.12 MOZZAICO BGC

- 6.2.13 AllHome

- 6.2.14 Taicera

- 6.2.15 Dynasty Ceramic