|

市场调查报告书

商品编码

1689926

智慧流量计量:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Intelligent Flow Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

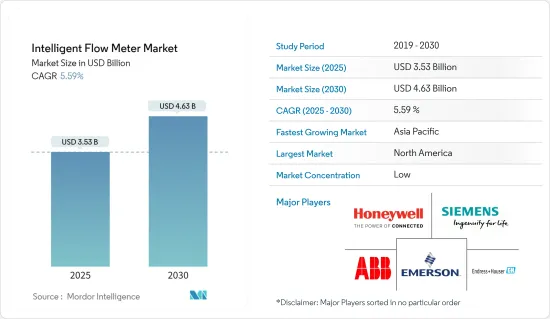

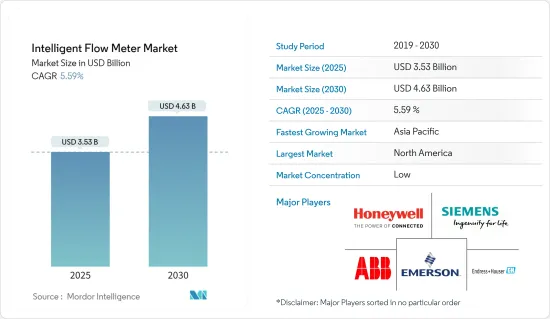

智慧流量计市场规模预计在 2025 年为 35.3 亿美元,预计到 2030 年将达到 46.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.59%。

随着最终用户领域的变化需要更准确和即时的观察,该行业将从中受益。

主要亮点

- 市场成长的主要驱动力是对工业流体进行可靠测量和监控以实现最佳利用的需求不断增长。未来,石油和天然气行业的復苏以及用水和污水行业基础设施的扩张也可能使该行业受益。

- 由于科氏流量计在线上品管中的应用,预计在预测期内将占据智慧流量计市场的很大份额。例如,流量计的精确密度功能可以测量白利度和柏拉图值,以确保原料品质。黏度测量提供连续测量,以最大限度地减少生产不合格产品的机会。智慧科氏流量计越来越多地被用于支持需要准确性和稳定性的苛刻氢气应用。

- 霍尼韦尔 2021 年 1 月发布的一项研究显示,近四分之一的工人可能会在返回不安全的工作场所之前辞职。全球约有 68% 的工人在其雇主的场所感到不完全安全。受访的工人最担心的是建筑管理人员不会一致地执行健康和安全准则(42%),其次是不会总是投资新技术来使现场工作更安全(30%)。因此,使用流量计等在操作的各个方面提供安全的设备已成为强制性要求。

- 高精度仪表价格昂贵,即使精度略有提高也可能代价高昂,具体取决于仪表类型和流量。科氏流量计和电磁式流量计通常具有较高的初始成本,特别是对于较大的管道尺寸。据流量控制器公司 AlicatScientific 称,科氏流量计约为 4,000 至 6,000 美元,而层流流量计的成本约为 1,000 美元。

- 新冠疫情给多个经济体的各个领域带来了额外的压力。石油和天然气产业是一个关键的应用类别,其非计画停机是影响全球智慧流量计市场成长的主要障碍之一。这对智慧流量计市场产生了重大的负面影响,因为智慧流量计用于石油和天然气行业测量管道中的液体流量。

智慧流量计市场趋势

食品饮料产业成长最快

- 原材料的测量和控制对于食品和饮料製造业至关重要。食品工业的流量计可以降低成本,同时提高产量。在食品业,某些製程需要卫生条件。其中包括乳製品、葡萄酒、饮料、糖浆、巧克力和食用油。食品和饮料行业需要食品级自动化设备。使用食品级流量计确保卫生和安全条件,无需拆卸即可消毒设备。

- 食品流量计也可用于测量食用油。在食用油生产过程中,许多步骤都需要使用流量计来测量从管道流出的油的体积和重量。生产和加工食用油的公司需要使用流量计来追踪初始精製和最终精製的流量。

- 在啤酒、果汁等饮料产业中,一般会采用电磁流量计测量大管线内的流量。这可以在大型饮料生产设施中准确量化。同样,这些仪表也用于酿酒厂、糖浆生产等。

- 随着工业 4.0 的到来,许多行业都在努力从数据中获得能够提高生产的见解。这些见解有助于提高营运效率、增加运作、降低维护成本并提高食品和饮料产业的接受度。这推动了食品和饮料行业对智慧流量计的需求。

- 2021 年 5 月,领先的水、卫生和感染预防解决方案和服务提供商艺康集团 (Ecolab Inc.) 推出了“水流智慧”,这是一款数位工具,可即时了解企业、站点和资产层面的用水情况。水流智慧将智慧水錶和感测器与先进的水流测量和监测、资产性能洞察和机器学习相结合,帮助食品和饮料製造商改善整个营运过程中的水资源管理,实现永续性目标并寻找降低营运成本的机会。

亚太地区成为成长最快的市场

- 预计亚太地区将继续占据流量计市场的大部分份额。中国、印度、日本、韩国、印尼、澳洲和新加坡等国家持续对全球市场产生重大影响。中国和印度等新兴经济体在供水和用水和污水、能源和电力、石油精製、化学和工业基础设施活动方面的投资不断增加,这推动了对物联网整合的需求。这需要部署智慧流量测量解决方案,以准确、经济高效地测量流量计感测器内外流动的液体、气体或蒸气量。

- 日本是亚太地区转型为自动化工业经济的先驱。工业4.0版本正在加速普及。该地区已成为自动化和数位解决方案的重要製造地,为国际市场以及亚太地区的其他市场提供产品。

- 印度有潜力成为全球製造业中心,2030年每年为全球经济贡献超过5,000亿美元。 2021年7月,天然气产量成长18.9%,煤炭产量成长18.7%,石油精製成长6.7%,化肥产量成长0.5%,钢铁产量成长9.3%,水泥产量成长21.8%,电力产量成长9%。

- 根据工业和国内贸易促进部(DPIIT)的数据,2000 年 4 月至 2021 年 6 月,製造业累积外国直接投资流入额为 1,003.5 亿美元。印度21财年获得的外国直接投资(FDI)流入为817.2亿美元,与前一年同期比较去年同期成长10%。因此,预计该地区製造业的成长以及自动化的广泛采用将在预测期内推动智慧流量计市场的成长率。

智慧流量计产业概况

全球智慧流量计市场较为分散,每个供应商都为各行业提供多种流量计。现有公司之间的竞争非常激烈。此外,大型企业的产品创新和扩大策略预计将推动智慧流量计市场的需求。流量计市场包括西门子股份公司、艾默生电气和盛思锐等主要製造商,加剧了企业之间的竞争。此类供应商在流量计市场具有强大的影响力和深度。该领域的主要发展包括:

- 2022 年 2 月,KROHNE 推出了其革命性的 FOCUS-1 原型,该原型将阀门和测量技术与独特的诊断和控制功能相结合。 FOCUS-1 将作为标准产品提供,该公司声称这是世界上第一个专为流程工业开发的智慧流程节点。

- 2021年12月,ABB推出了全球首款双向连接电磁流量计,实现智慧水损管理。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- 扩大先进流量计在石油天然气、水和用水和污水管理领域的应用

- 物联网在流量测量解决方案中的普及

- 市场限制

- 智慧流量计与传统流量计相比成本较高

- 科氏流量计和电磁式流量计的初始成本较高

- 评估新冠疫情对产业的影响

第五章市场区隔

- 按类型

- 科里奥利

- 磁的

- 超音波

- 多相流

- 涡流型

- 可变面积类型

- 差压式

- 热感型

- 涡轮类型

- 按通讯协定

- Profibus

- Modbus

- 心

- 其他的

- 按最终用户产业

- 石油和天然气

- 製药

- 用水和污水

- 纸和纸浆

- 发电

- 饮食

- 其他的

- 按地区

- 北美洲

- 拉丁美洲

- 欧洲

- 亚太地区

- 中东和非洲

第六章竞争格局

- 公司简介

- KROHNE Messtechnik GmbH

- Teledyne Isco Inc.

- Sierra Instruments, Inc.

- Fuji Electric

- General Electric Company

- Brooks Instrument

- Azbil Corporation

- Yokogawa Electric Corporation

- Siemens AG

- Honeywell International Inc.

- Endress+Hauser AG

- Emerson Electric Co.

- ABB Ltd.

第七章投资分析

第八章 市场机会与未来趋势

The Intelligent Flow Meter Market size is estimated at USD 3.53 billion in 2025, and is expected to reach USD 4.63 billion by 2030, at a CAGR of 5.59% during the forecast period (2025-2030).

The industry is bound to be benefitted from the changing end-user sectors, demanding more accurate and real-time observations for better results.

Key Highlights

- The market growth is majorly driven by the growing need for reliable measurement and monitoring of industrial fluids for optimum utilization. The Industry is also likely to be benefitted from the revival of the oil and gas industry and the expanding infrastructure in the water and wastewater industry in the future.

- The market for Coriolis flowmeter is expected to hold a large share of the intelligent flow meter market during the forecast period because of its applications in inline quality control. For instance, the flow meters' accurate density function can measure Brix and Plato values to ensure the quality of ingredients. Viscosity readings provide continuous measurement to minimize the chance of producing an off-spec product. There is a growing usage of intelligent Coriolis flowmeters to support the demanding hydrogen applications, where accuracy and stability are imperative.

- According to the survey results launched by Honeywell in January 2021, nearly a quarter of workers may quit before returning to a dangerous worksite. About 68% of the global workforce does not feel completely safe in the employers' buildings. Surveyed workers are most worried that the building management may not consistently enforce health and safety guidelines (42%), followed by worry that they may not always invest in new technology to make working in-person safer (30%). Thus, using devices such as flowmeters that provide safety in different aspects of operation is becoming imperative.

- The cost of higher accuracy meters is high, and depending on meter type and flow rate, even a slight increase in accuracy can be expensive. Coriolis flowmeters and magnetic flow meters typically have high initial costs, especially for large pipe sizes. According to AlicatScientific, a flow controller company, the Coriolis flowmeters costs around USD 4,000-6,000, while the laminar flowmeter costs around USD 1,000.

- The recent outbreak of COVID-19 posed additional stress on multiple economies across various sectors. The unexpected breakdown in the oil and gas industry, which is a crucial application category, is one of the significant setbacks affecting the growth of the global intelligent flowmeter market. As smart flow meters are used in the oil and gas industry to measure liquid flow in pipes, there is a significant negative influence on the intelligent flowmeter market.

Intelligent Flow Meter Market Trends

Food and Beverages Industry to Witness the Highest Growth

- Raw material measurement and control are crucially significant in the food and beverage manufacturing business. Flow meters for the food industry reduce costs while increasing output. In the food sector, specific processes necessitate sanitary conditions. These include dairy goods, wine, drinks, syrup, chocolate, edible oil, etc. Food-grade automation equipment is required in the food and beverage industry. Ascertain hygienic and safe conditions. The equipment can be sterilized without disassembly using a food-grade flow meter.

- Food grade flow meters can be used to measure edible oil. Many steps in the edible oil manufacturing process necessitate the use of a flow meter to measure the volume and weight of oil flowing out of the pipeline. Flow meters are required for data on the crude oil that is originally refined and the essential oil that is finally refined by companies that produce and process edible oils.

- The beverage industry includes beer, fruit juice, etc., and the flow of big pipes is usually measured with electromagnetic flowmeters. It can be precisely quantified in a large beverage manufacturing facility. Similarly, these meters are also used in breweries, syrup manufacturing, and so on.

- Many industries are going to significant lengths to identify production-enhancing insights from data in the advent of Industry 4.0. These insights aid in enhancing operational efficiency, increasing uptime and lowering maintenance costs, and acceptance in the food and beverage industry. This is bolstering the demand for intelligent flow meters in the food and beverage industry.

- In May 2021, Ecolab Inc., the prominent in water, hygiene, and infection prevention solutions and services, launched Water Flow Intelligence, a digital tool that offers industry real-time awareness of water usage at the enterprise, site, and asset levels. Water Flow Intelligence combines smart water meters and sensors with advanced water flow measurement and monitoring, asset performance insights, and machine learning to help food and beverage producers identify opportunities to improve water management across their operations, meet sustainability goals, and reduce operational costs.

Asia Pacific to Emerge as the Fastest Growing Market

- The Asia Pacific region is expected to continue occupying a significant share of the flowmeter market. Countries such as China, India, Japan, South Korea, Indonesia, Australia, and Singapore continue to impact the global market significantly. The number of investments in water & wastewater, energy and power, refining, chemicals, and industrial infrastructure activities is increasing in the developing economies such as China and India, which drives the demand for integration of IoT, which requires the implementation of intelligent flow measurement solutions for accurate and cost-effective measurement of liquid, gas, or steam flowing through or around the flow meter sensors.

- Japan has been a pioneer in transforming into an automated industrial economy in the Asia-Pacific region. The Industrial version 4.0 is being adopted at a faster pace. The region has emerged as a significant manufacturing hub for automation and digital solutions and is also supplying them to other markets in the Asia-Pacific region alongside international markets.

- India holds the potential to emerge as a global manufacturing hub, with an annual contribution to the global economy of more than USD 500 billion by 2030. Natural gas output climbed by 18.9%, coal by 18.7%, petroleum refinery output by 6.7%, fertilizers by 0.5%, steel by 9.3%, cement by 21.8%, and electricity by 9% in July 2021.

- The cumulative FDI inflows, between April 2000 and June 2021, into manufacturing subsectors, reached USD 100.35 billion, according to the Department for Promotion of Industry and Internal Trade (DPIIT). India received total foreign direct investment (FDI) inflows of UD$ 81.72 billion in FY21, up 10% Y-o-Y. Therefore, the growing manufacturing sectors in the region, alongside the significant adoption of automation, are analyzed to boost the intelligent flow meters market growth rate during the forecast period.

Intelligent Flow Meter Industry Overview

The global intelligent flow meter market is fragmented, with each vendor providing multiple flowmeters for various industries. The competitive rivalry among existing competitors is high. Moreover, the demand in the intelligent flowmeter market is expected to be boosted by large companies' product innovation and expansion strategies. The flowmeter market has some major manufacturers, such as Siemens AG, Emerson Electric, Sensirion, and others, contributing to the competitive rivalry. Such vendors are established and have deep penetration in the market for flow meters. Some of the key developments in the area are:

- February 2022 - KROHNE unveiled the FOCUS-1 prototype as an innovation that unites valve and measuring technology with unique diagnostics and control functions in one device. FOCUS-1 is available as a standard product, which is claimed by the company as the world's first intelligent process node specifically developed for the process industries.

- December 2021 - ABB introduced the world's first electromagnetic flowmeter with bidirectional connectivity to enable intelligent water loss management.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Growing Penetration of Advanced Flow Meters in the Oil and Gas Sector and Water & Wastewater Management

- 4.4.2 Penetration of IoT in Flow Rate Measurement Solutions

- 4.5 Market Restraints

- 4.5.1 Higher Cost of Intelligent Flow Meters Compared to Traditional Flow Meters

- 4.5.2 High Initial Cost for Coriolis and Magnetic Flow Meters

- 4.6 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Coriolis

- 5.1.2 Magnetic

- 5.1.3 Ultrasonic

- 5.1.4 Multiphase

- 5.1.5 Vortex

- 5.1.6 Variable Area

- 5.1.7 Differential pressure

- 5.1.8 Thermal

- 5.1.9 Turbine

- 5.2 By Communication Protocol

- 5.2.1 Profibus

- 5.2.2 Modbus

- 5.2.3 Hart

- 5.2.4 Others

- 5.3 By End-User Industry

- 5.3.1 Oil and Gas

- 5.3.2 Pharmaceuticals

- 5.3.3 Water and Wastewater

- 5.3.4 Paper and Pulp

- 5.3.5 Power Generation

- 5.3.6 Food and Beverages

- 5.3.7 Other End-User Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Latin America

- 5.4.3 Europe

- 5.4.4 Asia Pacific

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 KROHNE Messtechnik GmbH

- 6.1.2 Teledyne Isco Inc.

- 6.1.3 Sierra Instruments, Inc.

- 6.1.4 Fuji Electric

- 6.1.5 General Electric Company

- 6.1.6 Brooks Instrument

- 6.1.7 Azbil Corporation

- 6.1.8 Yokogawa Electric Corporation

- 6.1.9 Siemens AG

- 6.1.10 Honeywell International Inc.

- 6.1.11 Endress + Hauser AG

- 6.1.12 Emerson Electric Co.

- 6.1.13 ABB Ltd.