|

市场调查报告书

商品编码

1689952

热解油:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Pyrolysis Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

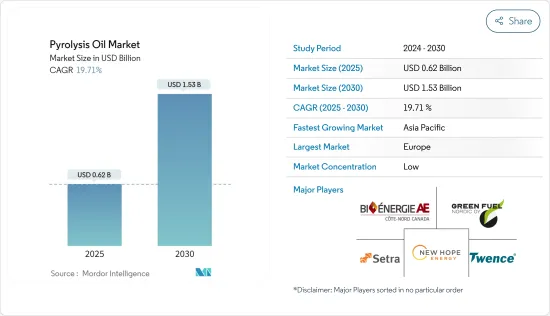

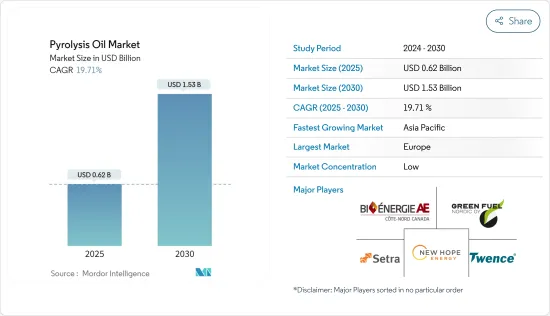

预计 2025 年热解油市场规模为 6.2 亿美元,到 2030 年将达到 15.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 19.71%。

由于政府实施的停工和限制措施,COVID-19 疫情严重抑制了 2020 年和 2021 年的工业活动,限制了热解油市场的成长。化学工业和热电行业因原材料供应减少、工作时间和劳动力结构限制以及资金限製而陷入瘫痪。这阻碍了这些行业采用热解油,因为它是一种永续但非常规燃料,在储存和运输方面面临挑战。然而,自2021年中疫情消退以来,这些产业已经走上了復苏和成长的道路。石油和天然气、化学和电力行业的復苏、放鬆管制导致的下游消费增加以及永续性的增强,重新激发了市场相关人员对热解油的兴趣。

从中期来看,对环保燃料和原料替代品的需求不断增长,以及对热能和发电中使用热解油的需求不断增长,是推动研究市场成长的关键驱动因素。

另一方面,预计预测期内与热解油的储存、运输和使用相关的限制将抑制市场的成长。

然而,生物炼製厂中热解油的新兴用途可能很快就会为全球市场创造有利可图的成长机会。

欧洲已成为最大的热解油市场。然而,预计亚太地区在预测期内的复合年增长率最高。欧洲占据主导地位的原因是锅炉燃烧、运输升级和化学生产应用对热解油的需求旺盛。

热解油的市场趋势

燃料使用需求增加

- 热解油在多种应用中用作燃料。热解的燃料价值是石油基燃料的50-70%,可用作锅炉燃料或升级为可再生运输燃料。

- 热解油被广泛用作工业燃料来取代炉油。主要用于建筑暖气、钢铁厂、玻璃厂、水泥厂、发电厂、锅炉厂、饭店暖气等重工业。

- 热解油可能用于加热锅炉(作为燃烧燃料),并在未来用于发电。此外,以热解油为基础的精製或升级产品也可用于燃气涡轮机和柴油发电机。目前许多国家正在考虑使用燃气涡轮机发电机取代燃煤发电厂,以生产二氧化碳排放较低的电力。此外,热解油可用作各行业的燃烧燃料,包括水泥、钢铁、玻璃和砖厂。

- 随着全球工业化进程不断推进,未来几年对锅炉以及锅炉燃料和燃油的需求预计会增加。例如,中东国家正在进一步扩大其炼油厂,建造新的炼油厂,如阿尔祖尔新炼油厂(160 亿美元)、阿布达比国家石油公司原油弹性计画(35 亿美元)、巴林石油公司现代化计画(60 亿美元)和杜库姆炼油厂和石化综合体(70 亿美元)。

- 除了直接燃烧外,热解油还可以作为精製柴油的原料。如果将热解在蒸馏器中精製成柴油,则所得柴油可用于卡车、拖拉机、船舶和柴油发电机等机械。

- 儘管使用柴油会带来有害影响,但由于能源需求的增加,全球对柴油的需求可能会逐年增加。例如,根据国际能源总署(IEA)《印度石油市场展望》,印度的柴油需求预计将从2023年的每天180万桶增加到2030年的每天230万桶,年增长率为4.5%。

- 由于发电、工业锅炉、柴油引擎和燃气燃气涡轮机机等发电机等各种工业应用中消耗大量燃料,预计预测期内对热热解基燃料的潜在需求将会增加。

欧洲主导市场

- 欧洲在全球市场占有相当大的市场占有率,预计在预测期内仍将保持其主导地位。在欧洲,热解油主要用于锅炉燃烧、作为引擎和涡轮机的燃料、升级为运输燃料以及作为化学品和材料的可再生原料。该地区利用热解油应用的主要产业是钢铁、水泥和运输。

- 法国是欧盟第三大粗钢生产国。 2022年前10个月,法国钢铁企业粗钢产量为1,054万吨,较去年同期下降10.7%。

- 德国政府正在尝试制定一系列新的奖励和法规,以迅速减少碳排放。此外,德国也越来越依赖进口来满足其石油和天然气需求。同样,该国也是最大的天然气进口国之一。 95%的天然气需求依赖进口来满足。为了减少进口,德国政府为国内生质燃料生产提供补贴和其他优惠。

- 根据欧盟统计局资料库与估计,2023年前三季度,欧盟能源产品进口量月均下降33.9%,净进口量与2022年同期相比下降7.6%。

- 在英国,政府将于 2022 年 4 月 1 日起推出生质燃料和其他替代燃料的指导意见(即消费税通知 179e),作为其中的一部分,政府将推广各种生质燃料的使用,预计这将在该国创造对热解油的需求。

- 热解油的生产可能会为该国的市场提供重大机会,因为它有可能缓解塑胶废弃物管理问题并满足加热应用的能源需求。订单,2022年8月,义大利Maire Tecnimont SpA公司宣布,其子公司NextChem赢得了欧洲市政塑胶废弃物先进机械化回收工厂的前端工程设计(FEED)合同,透过热解製程建立聚烯热解(废弃物处理能力为每年7.5万吨)。

- 预计预测期内所有上述因素都将推动欧洲热解油市场的成长。

热解油产业概况

全球热解油市场较为分散,主要企业各自并不占有较大的份额以影响市场需求。市场的主要企业(不分先后顺序)包括 Twence、Green Fuel Nordic Oy、Bioenergy AE Cote-Nord、New Hope Energy 和 Setra Group。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 对绿色燃料和替代原料的需求不断增加

- 热电产业需求增加

- 限制因素

- 热解油的储存、运输和应用问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 原料

- 废弃塑胶

- 废橡胶

- 木头

- 油泥

- 其他成分

- 应用

- 燃料

- 化学品

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 泰国

- 越南

- 马来西亚

- 印尼

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 北欧的

- 西班牙

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 摩洛哥

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 奈及利亚

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Alterra Energy, LLC

- Bioenergy Ae Cote-Nord

- Ensyn

- Green Fuel Nordic Oy

- Mk Aromatics Limited

- New Energy Kft.

- New Hope Energy

- Nexus Circular

- Plastic Advanced Recycling Corp.

- PLASTIC ENERGY

- Setra Group

- Quantafuel ASA

- Trident Fuels Pty Ltd.

- Twence

第七章 市场机会与未来趋势

- 生物炼製厂的新兴应用

The Pyrolysis Oil Market size is estimated at USD 0.62 billion in 2025, and is expected to reach USD 1.53 billion by 2030, at a CAGR of 19.71% during the forecast period (2025-2030).

The COVID-19 pandemic drastically curtailed industrial activities during 2020 and 2021 due to imposed government lockdowns and restrictions, thereby limiting the growth of the pyrolysis oil market. The chemical industry and heat and power generation sector were paralyzed owing to less raw material supply, limited working hours/labor strength, and constrained financials. This halted the adoption of pyrolysis oil, a sustainable yet unconventional fuel that dwells with storage and transportation challenges in these sectors. However, the industries have been on the recovery as well as growth tracks ever since the retraction of the pandemic in mid-2021. The recovering oil and gas, chemicals, and power sectors with increased downstream consumption due to the lifting of restrictions and the growing sustainability drive have reinstated the interests of market players in pyrolysis oil.

Over the medium term, the rising demand for eco-friendly fuel and raw material alternatives and the increasing demand for pyrolysis oil application in the generation of heat and power are the major driving factors augmenting the growth of the market studied.

On the other hand, the constraints associated with the storage, transportation, and application of pyrolysis oil are anticipated to restrain the growth of the market studied over the forecast period.

Nevertheless, the emerging applications of pyrolysis oil in biorefineries are likely to create lucrative growth opportunities for the global market soon.

Europe emerged as the largest market for pyrolysis oil. However, Asia-Pacific is expected to record the highest CAGR during the forecast period. This dominance of Europe is attributed to the bullish demand for pyrolysis oil in combustion in boilers, upgrading of transportation, and chemical production applications.

Pyrolysis Oil Market Trends

Increasing Demand for Fuel Application

- Pyrolysis oil has one of its major applications as fuel in various sectors. Pyrolysis oil has a fuel value of 50-70% of that of petroleum-based fuels and can be used as boiler fuel or upgraded to renewable transportation fuels.

- Pyrolysis oil is widely used as industrial fuel to substitute furnace oil. It is mainly used in heavy industries such as construction heating, steel factories, glass factories, cement factories, power factories, boiler factories, and hotel heating.

- Pyrolysis oil can be potentially used to heat boilers (as a combustion fuel), which can be used to produce electricity in the future. Further, refined or upgraded pyrolysis oil-based products can also be used in gas turbine generators and diesel generators. Currently, various nations are considering using gas turbine generators in place of coal-fired plants to produce electricity with fewer carbon emissions. Moreover, pyrolysis oil can be used as combustion fuel in various industries such as cement, steel, glass, brick plants, and others.

- The growing industrialization around the globe is expected to increase the demand for boiler and, thus, boiler fuel or oil in the coming years. For instance, the refining sector in the Middle Eastern countries is being expanded even further with the construction of new refineries such as Al Zour New Refinery (USD 16 billion), ADNOC's Crude Flexibility Project (USD 3.5 billion), BAPCO Modernisation Program (USD 6 billion), and Duqm Refinery & Petrochemical Complex (USD 7 billion).

- In addition to direct combustion, pyrolysis oil can be used as a feedstock for refining diesel fuel. It can be refined into diesel by a distillation machine once the pyrolysis oil is refined into diesel by a pyrolysis oil distillation machine, the obtained diesel can be used in some machinery, such as trucks, tractors, ships, and diesel generators.

- Also, despite the harmful impacts caused by the usage of diesel, its demand will likely increase year-on-year globally due to increasing energy demands. For instance, according to the India Oil Market Outlook of the International Energy Agency (IEA), India's demand for diesel is expected to rise from 1.8 million barrels per day in 2023 to 2.3 million barrels per day in 2030, registering an increase of 4.5% annually.

- Owing to the large volume of fuel consumed by various industrial applications, such as power, industrial boilers, diesel engines, and power generators like gas turbines, the potential demand for pyrolysis oil-based fuels is likely to increase in the forecast period.

Europe to Dominate the Market

- Europe dominated the worldwide market with a significant market share and is projected to maintain its dominance during the forecast period. In Europe, pyrolysis oil is majorly used for applications such as combustion in boilers, fueling in engines and turbines, upgrading to transportation fuels, and as a renewable feedstock for chemicals and materials. The major industries in the region that leverage pyrolysis oil applications are the steel industry, the cement industry, and transportation.

- France is the third largest crude steel producer among the European Union countries. Between January to October 2022, French steelmakers produced 10.54 million tons of crude steel, 10.7% less compared to the same period in 2021.

- The German government is putting together various new incentives and regulations to cut carbon emissions quickly. Moreover, Germany is increasingly dependent on imports to meet its demand for oil and gas. Similarly, the country is one of the largest importers of natural gas. Imports meet 95% of their gas requirements. In order to reduce the imports in the country, the German government is offering incentives and other benefits to biofuel production in the country.

- According to the Eurostat database and estimates, the European Union (EU) imports of energy products in the first three quarters of 2023 dropped by 33.9 % in average monthly values, and the net mass dropped by 7.6 % compared to the same period in 2022.

- In the United Kingdom, the government has begun guidance for Biofuels and other fuel substitutes (i.e., Excise Notice 179e) from 1 April 2022, as part of which the government is promoting the usage of various biofuels, which is likely to create demand for pyrolysis oil in the country.

- The potential of pyrolysis oil production in reducing plastic waste management issues as well as in fulfilling the demand for energy used for heating applications is likely to offer a huge opportunity for the market in the country. For instance, in August 2022, Italian Company Maire Tecnimont SpA announced that its subsidiary NextChem had been awarded a Front-End Engineering Design (FEED) contract for an advanced mechanical recycling plant of municipal plastic waste in Europe to establish a recycling plant for polyolefins by the pyrolysis process, with a waste processing capacity of 75,000 tons per year.

- All factors mentioned above are likely to fuel the growth of the pyrolysis oil market in Europe over the forecast period.

Pyrolysis Oil Industry Overview

The global pyrolysis oil market is fragmented, with top players holding insignificant shares to affect market demand individually. Some of the major players in the market (in no particular order) include Twence, Green Fuel Nordic Oy, Bioenergy AE Cote-Nord, New Hope Energy, and Setra Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand For Environment-friendly Fuel and Raw Material Alternatives

- 4.1.2 Increasing Demand From Heat and Power Generation Sectors

- 4.2 Restraints

- 4.2.1 Problems Associated With Storage, Transportation, and Application of Pyrolysis Oil

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Raw Material

- 5.1.1 Waste Plastic

- 5.1.2 Waste Rubber

- 5.1.3 Wood

- 5.1.4 Oil Sludge

- 5.1.5 Other Raw Materials

- 5.2 Application

- 5.2.1 Fuels

- 5.2.2 Chemicals

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 Thailand

- 5.3.1.5 Vietnam

- 5.3.1.6 Malaysia

- 5.3.1.7 Indonesia

- 5.3.1.8 South Korea

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 NORDIC

- 5.3.3.6 Spain

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Morocco

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Nigeria

- 5.3.5.8 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alterra Energy, LLC

- 6.4.2 Bioenergy Ae Cote-Nord

- 6.4.3 Ensyn

- 6.4.4 Green Fuel Nordic Oy

- 6.4.5 Mk Aromatics Limited

- 6.4.6 New Energy Kft.

- 6.4.7 New Hope Energy

- 6.4.8 Nexus Circular

- 6.4.9 Plastic Advanced Recycling Corp.

- 6.4.10 PLASTIC ENERGY

- 6.4.11 Setra Group

- 6.4.12 Quantafuel ASA

- 6.4.13 Trident Fuels Pty Ltd.

- 6.4.14 Twence

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications in Biorefineries