|

市场调查报告书

商品编码

1690072

飞行时间 (TOF) 感测器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Time-of-Flight (TOF) Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

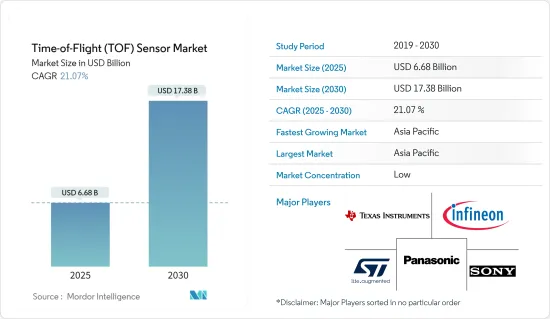

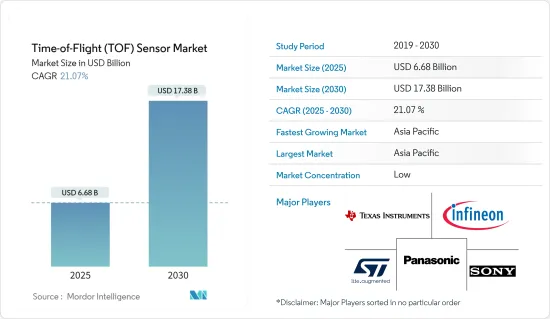

飞行时间 (TOF) 感测器市场规模预计在 2025 年为 66.8 亿美元,预计到 2030 年将达到 173.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 21.07%。

主要亮点

- 市场对配备 3D 相机的智慧型手机的需求不断增长,从而推动了市场的发展。智慧型手机最显着和最受欢迎的功能之一是 ToF 相机。此外,值得注意的是,全球范围内越来越多的人为他们的智慧型手机订购行动网路。根据爱立信预测,2022年全球智慧型手机行动网路用户数将达到约66亿,到2028年将突破78亿,其中智慧型手机行动网路用户数最多的国家为中国、印度和美国。

- 推动这一市场扩张的关键因素是汽车行业对 ToF 感测器的需求不断增长、智慧型手机中 3D 相机的使用不断增加以及智慧型手机使用率的上升。随着工业 4.0 和 3D 机器视觉系统的应用在各行业不断扩展,ToF 感测器市场具有巨大的成长潜力。

- 根据爱迪生投资研究公司和OICA的数据,2016年至2025年间,西欧车载前置摄影机的销售量将会增加。到2025年,西欧预计将售出约1,550万套前置汽车摄影机系统,其中包括3D摄影机。

- 此外,在预期期内,3D 成像和扫描将主导 ToF 感测器市场。利用 3D 扫描技术可以将物件转换成 3D 模型。收集物体的特定区域和尺寸,并且这些映射资料可用于深度感应设计。 3D扫描技术使用起来很方便,未来可能会越来越普及。飞行时间技术是一种主动式3D成像和扫描技术。另外两种 3D 成像技术——结构光和立体视觉,比 ToF 速度更慢、可靠性更低、能耗更高。由于其易于使用,ToF 技术预计在 3D 成像和扫描应用方面的需求将会增加。

- TOF技术具有作用距离长、适用范围广、距离精度高的优点。但其也存在许多缺点。例如目前主流行动电话中的ToF感测器解析度相对较低(180*240、240*320、240*480等),这会导致近距离的精度和X/Y解析度相对较低。

- AR和VR领域摄影机的使用增加或将为后疫情时代的市场復苏开闢新的可能性。Sony Corporation推出了具有强大处理能力和记忆体的 IMX500。影像感测器执行机器学习(ML)来强力协助电脑视觉过程,而无需外部硬体。 3D ToF影像感测器很可能用于智慧型手机,为AR/VR应用提供对环境的3D感知。

飞行时间 (TOF) 感测器市场趋势

最大的终端用户是消费性电子产品

- 由于 TOF 感测器在智慧型手机、平板电脑、家用机器人、数位相机、智慧扬声器、PC 投影机等领域的应用,对 TOF 感测器的需求正在增加。然而,与游戏和娱乐产业相关的设备并不属于这一领域。 ToF 相机感应器可测量距离和体积,并提供物件扫描、室内导航、避障、手势姿态辨识、物件追踪和响应式高度计。

- 在智慧型手机中,ToF 感测器用于多种用途,包括生物识别安全(脸部辨识、相机和运动追踪等)。 ToF 感光元件让智慧型手机相机变得更好。它用于行动装置的模糊效果和自动对焦等摄影功能,使相机能够捕捉移动物体、背景和身体部位。它还提供了一些引人注目的特效,尤其是在快速动作场景中。

- 据爱立信称,到 2026 年,全球智慧型手机用户数量预计将达到 75.16 亿部。这导致高阶智慧型手机的普及度上升,智慧型手机製造商纷纷推出先进的功能,以在竞争中脱颖而出。这有助于TOF感测器市场的成长,预计在研究期间将继续成长。同时,2022 年 8 月,三星宣布正在开发一款 3D ToF 感测器,可能会在 Galaxy S21 系列中首次亮相。这款智慧型手机上的感应器有望带来更好的脸部辨识和深度感应功能。

- 几家在新兴市场运营的主要製造商正致力于开发新产品以满足日益增长的需求。例如,2022 年 6 月,意法半导体 (STMicroelectronics NV) 发布了其最新的 FlightSense ToF 测距感测器,用于智慧型手机相机管理和虚拟/扩增实境。它采用创新的超表面镜头技术和节能架构,可减少电池消耗、扩大相机的自动对焦范围并提高场景理解能力。

- 此外,智慧家庭概念的快速扩张正在推动已开发国家对家用和服务机器人的需求。服务机器人中的 ToF 感测器可侦测移动并确定物体和人的存在。该感测器还可在所有光照条件下工作,包括充足的阳光,提供不依赖目标颜色或光学清晰度的精确距离测量。此外,生活方式的改变、都市化进程的加快以及智慧消费产品的日益普及为预测期内市场的成长创造了有利的前景。

亚太地区可望占据主要市场占有率

- 中国是世界上最大的家用电子电器生产国和出口国,该领域拥有巨大的发展潜力。此外,该地区的电子製造业继续稳步扩张。根据中国资讯通讯研究院调查,2022年1-2月,与前一年同期比较增12.7%,而全国工业业增加值年增7.5%。

- 中国消费性电子市场正快速扩张,主要电子企业的附加价值不断提高,国内对电子设备的需求也不断成长。透过实现脸部辨识、手势控制和深度感应等功能,ToF 感测器大大提高了这些设备的可用性和功能性。随着家用电子电器市场的成长,对 ToF 感测器的需求预计会增加。

- 日本拥有强劲的家电市场。 ToF 感应器用于虚拟实境 (VR) 耳机、游戏机、智慧型手机和平板电脑。市场扩张可能是由消费者对这些产品及其与 ToF 感测器的整合的需求所推动的。

- 由于对增强型相机功能、AR/VR 应用、手势姿态辨识、脸部解锁、游戏和 AI 功能的需求增加,印度对高阶和旗舰智慧型手机的需求不断增长,推动了 ToF 感测器市场的发展。随着客户越来越重视这些功能,智慧型手机製造商预计将增加对 ToF 感测器的使用。这有望扩大印度的 ToF 感测器市场规模。

- 本研究考虑的亚太地区的其他国家包括澳洲、东南亚国家等。这些国家也可能获得相当大的市场占有率。韩国、新加坡等国家对高阶智慧型手机和其他消费性电子产品的需求不断增长,促使许多公司在亚太地区建立生产基地。台湾等国家及地区原料充足、设备安装及人事费用低廉,也有助于企业建立本地生产基地。

飞行时间 (TOF) 感测器产业概况

飞行时间(TOF)感测器市场高度分散。Sony Corporation和意法半导体公司等老牌公司的品牌形象对这个市场有显着的影响。强大的品牌是卓越业绩的代名词,因此拥有长期良好业绩记录的公司有望占据优势。鑑于其市场渗透率和投资新技术的能力,竞争对手之间的竞争预计将持续下去。此外,竞争加剧导致供应商在市场上投入大量资金。

- 2023 年 6 月,德克萨斯宣布计划在吉隆坡和马六甲建立新的组装和测试设施,扩大在马来西亚的内部製造地。此次扩张将支持该公司在 2030 年将 90% 的组装和测试业务转移到内部的计划,并使其对供应具有更大的控制权。

- 2023 年 1 月,Teledyne Technologies 旗下的 Teledyne e2v 推出了 Hydra3D+,这是一款新型飞行时间 (ToF) CMOS 影像感测器,解析度为 832 x 600 像素,专为灵活的 3D 侦测和测量而设计。独特的片上多系统管理能力使得感测器能够与许多主动系统并行工作,而不会产生干扰或不准确的资料。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 宏观经济趋势如何影响市场

- 市场驱动因素

- 各行各业越来越多地采用机器视觉系统

- 配备 3D 相机的智慧型手机的需求不断增加

- 市场挑战

- ToF 感测器的局限性

- 价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 按类型

- 带有相位检测器的射频调变光源

- 距离门成像器

- 直接飞行时间成像仪

- 按应用

- 扩增实境和虚拟现实

- LiDAR

- 机器视觉

- 3D 成像和扫描

- 机器人和无人机

- 按行业

- 消费性电子产品

- 车

- 娱乐和游戏

- 产业

- 卫生保健

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司简介

- Texas Instruments Incorporated

- STMicroelectronics NV

- Infineon Technologies AG

- Panasonic Corporation

- Sony Corporation

- Teledyne Technologies International Corp.

- Keyence Corporation

- Sharp Corporation

- Omron Corporation

- Invensense Inc.(TDK Corporation)

第七章投资分析

第 8 章:市场的未来

The Time-of-Flight Sensor Market size is estimated at USD 6.68 billion in 2025, and is expected to reach USD 17.38 billion by 2030, at a CAGR of 21.07% during the forecast period (2025-2030).

Key Highlights

- The market under study is driven by the rising demand for smartphones equipped with 3D cameras. One of the smartphones' most notable and popular features is their toF cameras. Additionally, it is noted that more people worldwide are subscribing to mobile networks for smartphones. According to Ericsson, smartphone mobile network subscriptions worldwide reached approximately 6.6 billion in 2022 and are expected to surpass 7.8 billion by 2028. The nations with the most smartphone mobile network subscriptions are China, India, and the United States.

- This market's expansion is primarily fueled by rising automotive industry demand for ToF sensors, rising 3D camera use in smartphones, and rising smartphone usage. The market for ToF sensors contains a lot of room to develop because of the expanding use of Industry 4.0 and 3D machine vision systems across various industries.

- As per Edison Investment Research and OICA, forward-facing automotive camera unit sales will increase in Western Europe from 2016 to 2025. By 2025, some 15.5 million forward-facing automotive camera systems are expected to be sold in Western Europe, which also includes 3D cameras altogether.

- Additionally, 3D imaging and scanning will rule the market for ToF sensors throughout the expected timeframe. An object can be turned into a 3D model using 3D scanning technology. The specific area and dimensions of the object are collected, and this mapping data can be used for designing using depth sensing. Future years will see a rise in the adoption of 3D scanning technology because it is easy to use. Time-of-flight technology is an active type of 3D image and scanning technology. Structured light and stereo vision, the other two 3D imaging techniques, are slower, less trustworthy, and use more energy than ToF. ToF technology is anticipated to experience an increase in demand for 3D imaging and scanning applications because of its accessibility.

- TOF technology includes the benefits of long working distances, wide application range, and high distance accuracy. However, there are many disadvantages. For instance, the current mainstream ToF sensor on the mobile phone includes a relatively low resolution (180*240, 240*320, 240*480, etc.), so the accuracy and X/Y resolution in the close range may be relatively low.

- The rising use of cameras in AR and VR may open up new opportunities for the market in post-COVID-19 recovery. Sony Corporation introduced the IMX500, which includes both processing power and memory. This image sensor performs machine learning (ML) and aids in powering computer vision processes without using any external hardware. 3D ToF image sensors could be used in smartphones to provide 3D awareness of the environment for AR/VR applications.

Time-of-flight (TOF) Sensor Market Trends

Consumer Electronics to be the Largest End User

- The demand for Time-of-Flight sensors is increasing owing to their applications in smartphones, tablets, household robots, digital cameras, smart speakers, and PC projectors. However, devices concerning the gaming and entertainment industry are excluded from the segment. A ToF camera sensor measures the distance and volume and offers object scanning, indoor navigation, obstacle avoidance, gesture recognition, object tracking, and reactive altimeters.

- In smartphones, ToF sensors are used for various purposes, including biometric security (particularly facial recognition, cameras, movement tracking, and others. ToF sensors make the smartphone camera superior. It is used in mobile devices for photography features such as blurring effects and auto-focus and enables the camera to capture objects, background, and movement of human body parts. Moreover, it also provides an eye-catching special effect, particularly in fast-action scenes.

- According to Ericsson, worldwide smartphone subscription is expected to reach 7,516.0 million units by 2026. Thus, the increasing adoption of high-end smartphones led smartphone manufacturers to introduce advanced features to stay ahead of the competitors. It contributed to the TOF sensors market growth and is expected to do so over the study period. In line with this, in August 2022, Samsung announced it is working on its version of the 3D ToF sensor, which may debut with the Galaxy S21 series. The sensor in the smartphone will bring better face recognition and depth sensing capabilities.

- Several leading manufacturers operating in the market studied are focusing on developing new products to meet the growing demand. For instance, in June 2022, STMicroelectronics NV announced its newest FlightSense ToF ranging sensor for smartphone camera management and virtual/augmented reality. It features innovative metasurface lens technology and an energy-efficient architecture that reduces battery drain, extends the camera's autofocus range, and improves scene understanding.

- Furthermore, the rapidly growing smart home concept increased the demand for household/service robots in developed countries. ToF sensors in service robots detect motion to determine the presence of objects and people. The sensor can also work in any lighting conditions, including full sunlight, and provides accurate range measurements independent of the target's color and optical transparency. Moreover, the changing lifestyle, growing urbanization, and increasing penetration of smart consumer products created a favorable scenario for the studied market growth during the forecast period.

Asia-Pacific is Expected to Hold Significant Market Share

- China is the world's largest producer and exporter of consumer electronics, providing the sector with numerous potential for expansion. Additionally, the region's electronics manufacturing sector continued expanding steadily. According to research by the China Academy of Information and Communications Technology, major electronics manufacturers' added value increased 12.7% year over year between January and February 2022, as opposed to the country's total industrial sector's 7.5% rise.

- The consumer electronics market in China is expanding rapidly, reflected in the leading electronics companies' rising added value and rising demand for electronics in the nation. By enabling capabilities like facial recognition, gesture control, and depth sensing, ToF sensors significantly improve the usability and functionality of these gadgets. The need for ToF sensors is projected to rise as the consumer electronics market grows.

- Japan includes a robust consumer electronics market. ToF sensors are used in virtual reality (VR) headsets, gaming consoles, smartphones, and tablets. Market expansion was likely encouraged by consumer demand for these products and their integration with ToF sensors.

- In India, the ToF sensors market is fueled by the rising demand for premium and flagship smartphones and the rising demand for enhanced camera features, AR/VR apps, gesture recognition, face unlock, gaming, and AI capabilities. As customers place greater value on these functionalities, manufacturers of smartphones are anticipated to use ToF sensors more frequently. It will increase the size of the ToF sensors market in India.

- The other countries considered in the Asia Pacific region in this study are Australia, and all Southeast Asian Countries, among others. These countries also include a high potential for gaining a considerable market share. Growing demand for high-end smartphones and other consumer electronics products from countries such as the Republic of Korea and Singapore encourages many companies to set up production establishments in the Asia-Pacific region. The abundant availability of raw materials in countries such as Taiwan, the low establishment of facilities, and labor costs also helped the companies launch their regional production centers.

Time-of-flight (TOF) Sensor Industry Overview

The Time-of-Flight (TOF) Sensor Market is highly fragmented. The brand identity associated with established companies, like Sony Corporation and STMicroelectronics NV, includes a major influence in this market. Strong brands are synonymous with good performance, so long-standing players are expected for an upper hand. Considering their market penetration and the ability to invest in new technologies, the competitive rivalry is expected to continue to be high. Moreover, vendors are investing significantly in the market due to increasing competition.

- June 2023: Texas Instruments Inc. announced plans to expand its internal manufacturing footprint in Malaysia with two new assembly and test factories in Kuala Lumpur and Melaka. Through this expansion, the company aims to support its plan to bring 90% of its internal assembly and test operations by 2030 and include greater supply control.

- January 2023: Hydra3D+, a new Time-of-Flight (ToF) CMOS image sensor with 832 x 600 pixel resolution designed for flexible 3D detection and measurement, is released by Teledyne e2v, a division of Teledyne Technologies. Due to an inventive on-chip multi-system management function, the sensor can operate alongside numerous active systems without interference, resulting in inaccurate data.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of Macroeconomics Trend on the Market

- 4.3 Market Drivers

- 4.3.1 Growing Adoption of Machine Vision Systems Across Various Industries

- 4.3.2 Increasing Demand for Smartphones Enabled with 3D Cameras

- 4.4 Market Challenges

- 4.4.1 Limitations of ToF Sensors

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 RF-modulated Light Sources with Phase Detectors

- 5.1.2 Range-Gated Imagers

- 5.1.3 Direct Time-of-Flight Imagers

- 5.2 By Application

- 5.2.1 Augmented Reality and Virtual Reality

- 5.2.2 LiDAR

- 5.2.3 Machine Vision

- 5.2.4 3D Imaging and Scanning

- 5.2.5 Robotics and Drones

- 5.3 By End-user Vertical

- 5.3.1 Consumer Electronics

- 5.3.2 Automotive

- 5.3.3 Entertainment and Gaming

- 5.3.4 Industrial

- 5.3.5 Healthcare

- 5.3.6 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Texas Instruments Incorporated

- 6.1.2 STMicroelectronics NV

- 6.1.3 Infineon Technologies AG

- 6.1.4 Panasonic Corporation

- 6.1.5 Sony Corporation

- 6.1.6 Teledyne Technologies International Corp.

- 6.1.7 Keyence Corporation

- 6.1.8 Sharp Corporation

- 6.1.9 Omron Corporation

- 6.1.10 Invensense Inc. (TDK Corporation)