|

市场调查报告书

商品编码

1690162

电力 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

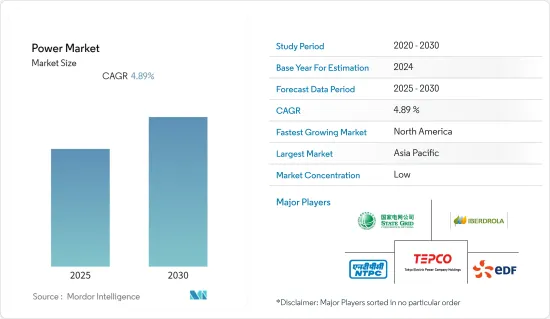

预计预测期内电力市场将以 4.89% 的复合年增长率成长。

2020 年,新冠疫情对市场产生了负面影响。目前市场已恢復至疫情前的水准。

主要亮点

- 从中期来看,预计发电量的成长、能源消耗需求的增加以及发电产业动态的变化将推动电力市场的需求。

- 同时,占全球发电量很大一部分的燃煤电厂的逐步淘汰,以及油价波动导致多个上游计划延期,预计将阻碍电力市场的成长。

- 然而,石化燃料发电厂的日益关闭,风能、太阳能、小型水力和其他可再生能源发电的涌入,对电动车和热泵的需求不断增长,以及透过联网电缆出口需求的不断增加,增加了对输配电 (T&D) 线路安装的要求,为主要参与者创造了许多商机。

- 由于都市化高以及电力需求不断增加(主要来自中国和印度),预计亚太地区将成为预测期内最大的市场。

电力市场趋势

发电热源成为最大市场

- 发电使用多种能源来源,包括煤炭和石油等石化燃料以及风能和太阳能等可再生能源。发电能源结构以煤炭、石油和天然气等石化燃料为主,三者占全球能源结构的近65%。

- 发电结构严重偏向煤炭,煤炭是主要贡献者。由于水电、核能、燃气等其他传统电源新增量的限制,煤电比重逐年增加。

- 燃煤发电厂是应用最广泛的火力发电厂,预计2025年将占世界电力供应的最大份额。超超临界煤技术等效率更高、每千瓦污染更少的技术可能取代老化的发电厂。

- 根据能源研究所《2023年世界能源统计评论》,到2022年,燃煤发电厂。在全球整体,到2022年,煤炭将继续占发电燃料的大部分,其份额将从2020年的35.1%增加到35.37%。 2022年煤炭发电量将达10,317.2 TWh。

- 2022年3月,墨西哥国营电力公司联邦电力委员会(CFE)宣布直接订单五个计划,预计将增加226万千瓦的天然气发电容量。它们是位于下加利福尼亚州的 429 兆瓦 CCI Mexicali Oriente 发电厂和位于索诺拉州的 202 兆瓦 CCI Parque Industrial 发电厂。另外三座为复合迴圈发电厂:位于圣路易斯波托西的CCC San Luis Potosi(442 兆瓦)和位于瓜纳华託的CCC Salamanca(932 兆瓦),均由三菱电机订单。最终,克雷塔罗的CCC El South II(256兆瓦)被订单TSK和西门子能源。

- 2022年9月,位于德国北部汉诺威附近彼得斯哈根的燃煤备用发电厂海登发电厂运作。海登发电厂装置容量为 875 兆瓦,是德国最强大的燃煤发电厂之一。

- 德国计画最迟在2038年逐步淘汰燃煤发电。然而,乌克兰战争及由此引发的能源市场动盪,导致一些发电厂暂时运作。因此,由于上述因素,预计火力发电将成为预测期内电力市场最大的组成部分。

亚太地区占市场主导地位

- 亚太地区拥有全球 50% 以上的人口和 60% 以上的特大城市,随着人口快速增长和工业化导致数百万新用户获得电力,该地区的电力需求将不断增长。例如,根据能源研究所《2023年世界能源统计评论》,该地区的初级能源消费量将从2013年的220.48艾焦耳增加到2022年的277.60艾焦耳。

- 在许多亚太国家,输配电(T&D)网路不足意味着一些偏远和农村地区无法用电。为了向这些地区提供电力,该地区的国家正在大力投资建造输电网路。

- 中国主导该地区的电力市场,能源产业正在重新定位,朝向更清洁、更永续的能源来源转型,以减少碳排放,并在 2060 年实现净零碳排放。

- 此外,截至2022年,中国已成为全球可再生能源装置容量最大的国家。根据中国国家能源局的预测,2022年底,中国可再生能源发电装置容量将达到1,213吉瓦,约占全国发电总装置容量的47.3%。

- 例如,2022年,中国政府宣布计画在戈壁沙漠地区建造450吉瓦的太阳能和风力发电场,以实现2030年的可再生能源目标。

- 根据国际能源总署(IEA)的数据,受收入水准上升和生活水准提高的推动,印度是世界第三大能源消费国。未来几年,数百万印度家庭将购买新电器产品和空调,为了支持这一成长,预测期内将需要大量增加电力系统。

- 此外,印度政府正在大力投资可再生能源以减少碳排放,并透过实施各种大型永续电力计划大力推动绿色能源。截至 2023 年 2 月,印度的可再生能源装置容量为 168.96 吉瓦,该国的目标是到 2030 年将可再生能源装置容量达到 450 吉瓦 (GW) 左右,这将直接支持市场。

- 例如,2022年,国家火力发电公司(NTPC)和印度重型电气公司(BHEL)将在特伦甘纳邦运作印度最大的浮体式太阳能发电厂,装置容量为100兆瓦,每年可减少二氧化碳排放21万吨。

- 因此,预计随着扩张和升级等因素导致的电力需求增加,尤其是在亚太地区,它将对电力市场产生积极影响。

电力业概况

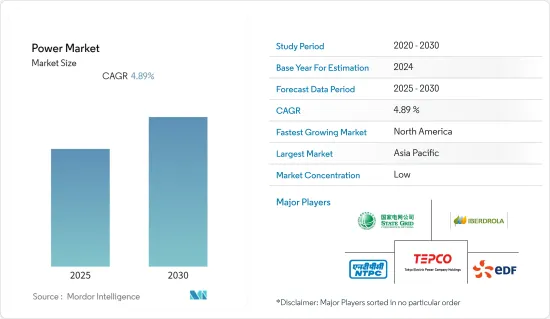

电力市场分散。市场的主要企业(不分先后顺序)包括中国国家电网公司、伊维尔德罗拉公司、东京电力公司控股公司、NTPC 和法国电力公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概述

- 介绍

- 全球发电装置容量(GW)及2028年预测

- 2028年全球发电量及预测

- 可再生能源结构(2022年)

- 2011-2022年初级能源消费量(百万吨油当量)

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 增加发电量以满足能源消耗需求

- 可再生能源的采用日益增多

- 限制因素

- 淘汰燃煤电厂

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 发电 - 电源

- 火力

- 水力发电

- 核能

- 可再生能源

- 输配电(T&D)

- 地区

- 北美洲

- 亚太地区

- 欧洲

- 南美洲

- 中东和非洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- State Grid Corporation of China

- Engie SA

- Electricite de France SA

- Iberdrola, SA

- National Thermal Power Corporation Limited

- NTPC Ltd

- Tokyo Electric Power Company Holding Inc

- Enel SpA

- Korea Electric Power Corporation(KEPCO)

- Chubu Electric Power Co., Inc.

第七章 市场机会与未来趋势

- 透过联网电缆不断增加的出口需求导致输电和配电 (T&D) 线路的安装要求不断增加。

简介目录

Product Code: 70503

The Power Market is expected to register a CAGR of 4.89% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as the growing electricity generation along with energy consumption demand, with changing power generation industry dynamics, are expected to drive the demand for the power market.

- On the other hand, the phasing out of coal-based power plants, which account for a major share of power generation around the globe, and volatile crude oil prices leading to delays in several upstream projects are expected to hinder the growth of the Power Market.

- Nevertheless, the increasing closures of fossil-fueled generation, an influx of wind, solar, small hydro, and other renewables-based power generation, rising electric vehicle and heat pump demand, and increasing export requirements via interconnectors have resulted in increased requirements for installation of Transmission and Distributions (T&D) lines, creating several opportunities for the major companies.

- Asia-Pacific is expected to be the largest market during the forecast period, owing to the high urbanization growth rate and growing electricity demand, mainly from China and India.

Power Market Trends

Thermal Source for Power Generation to be the Largest Market

- Power generation uses a variety of sources ranging from fossil fuels like coal and oil to renewable sources like wind and solar. The energy mix for electricity generation is dominated by fossil fuels like coal, oil, and natural gas, with the three constituting almost 65% of the global energy mix.

- The power generation mix is heavily skewed toward coal, with a major contribution, because of cheaper domestic fuel availability. Its share in the mix has increased over the years due to constraints in adding other conventional generation sources-hydro, nuclear, and gas.

- Coal thermal power plants are the most widely used thermal power plant and are expected to have the largest share in the electricity power (global) supply, in 2025, in the world. More efficient technologies like Ultra Supercritical Coal Technology, which reduces pollution (per KW), are likely to replace aging power plants.

- As per Energy Institute Statistical Review of World Energy 2023, in 2022, a coal-based thermal power plant holds the largest share in total global power generation. Globally, the amount of power generated from coal remained the dominant fuel for power generation in 2022, with its share increasing to 35.37%, up from 35.1% in 2020. In 2022, coal-based power generation had reached 10317.2 TWh.

- In March 2022, Comision Federal de Electricidad (CFE), the state-owned electric utility of Mexico, issued direct awards on five projects expected to add 2.26 GW of gas-based power generation capacity. Wartsila was awarded contracts to build two internal combustion engine power plants: the 429 MW CCI Mexicali Oriente plant in Baja California, and the 202 MW CCI Parque Industrial in Sonora. The other three are combined cycle plants: CCC San Luis Potosi (442MW) in CCC San Luis Potosi and the 932MW CCC Salamanca plant in Guanajuato, both awarded to Mitsubishi Power; and finally, CCC El Sauz ll (256MW) in Queretaro, with the contract going to TSK and Siemens Energy.

- In September 2022, Germany re-started a coal-fired reserve power plant, The Heyden plant in Petershagen, near Hanover in northern Germany, With a capacity of 875 megawatts, Heyden is one of the most powerful coal-fired power plants in Germany.

- Germany plans to phase out coal-fired power generation by 2038 at the latest. However, the war in Ukraine and the resulting disruptions to the energy market are causing some plants to be temporarily reactivated.Therefore, based on the factors mentioned above, the thermal source for power generation is expected to be the largest segment of the Power Market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is home to more than 50% of the global population and 60% of the large cities, and in the future, the continent will face increasing demand for power as millions of new customers are gaining access to electricity, with rapid population growth and industrialization. For instance, according to the Energy Institute Statistical Review of World Energy 2023, the primary energy consumption in the region increased from 220,48 exajoules in 2013 to 277.60 exajoules in 2022.

- Many countries in Asia-Pacific have inadequate transmission and distribution (T&D) networks, and hence, electricity is not available in some of the remote and rural areas. To bring electricity to these areas, the countries in the region are investing heavily in building a transmission line network.

- China dominates the power market in the region, and the energy sector is moving in a new direction by transitioning toward cleaner and sustainable energy sources to reduce carbon emissions and achieve net zero carbon emissions by 2060.

- Furthermore, as of 2022, China has the most significant renewable installed capacity globally. According to China's National Energy Administration, the country's renewable installed capacity reached 1,213 GW by the end of 2022, accounting for about 47.3% of the total installed generation capacity.

- For instance, in 2022, the government of China announced that it plans to build 450 gigawatts of solar and wind energy power plants in the Gobi desert regions to achieve the renewable energy target by 2030.

- According to the International Energy Agency (IEA), India is the third largest energy-consuming country globally, owing to the rising income levels and improving standards of living, which directly aids the power market in the nation. Over the coming years, millions of Indian households will buy new appliances and air-conditioners, and to support the growth, the nation will have to add a large amount of power systems in the forecast period.

- In addition, the Government of India is investing heavily in renewable energy to reduce carbon emissions and undertaking various large-scale sustainable power projects, and promoting green energy heavily. As of February 2023, India's installed renewable energy capacity stood at 168.96 GW, and the country is targeting about 450 Gigawatt (GW) of installed renewable energy capacity by 2030, which will directly aid the market.

- For instance, in 2022, National Thermal Power Corporation (NTPC) and Bharat Heavy Electricals (BHEL) commissioned the largest floating solar power plant in India with a capacity of 100 MW in the state of Telangana, which will reduce the carbon dioxide emission by 2,10,000 tonnes per year.

- Therefore, based on the factors like expansions and upgrades, especially in the Asia-Pacific region, along with increased power demand, is expected to have a positive impact on the power market.

Power Industry Overview

The Power Market is fragmented. Some of the major players (not in particular order) in the market include State Grid Corporation of China, Iberdrola, S.A., Tokyo Electric Power Company Holding Inc, NTPC Ltd, and Electricite de France S.A., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Power Generation Capacity and Forecast in GW, till 2028

- 4.3 Electricity Generation and Forecast ,in TWh, Global, till 2028

- 4.4 Renewables Energy Mix, Global, 2022

- 4.5 Primary Energy Consumption, in MTOE, 2011-2022

- 4.6 Recent Trends and Developments

- 4.7 Government Policies and Regulations

- 4.8 Market Dynamics

- 4.8.1 Drivers

- 4.8.1.1 Growing Electricity Generation along with Energy Consumption Demand

- 4.8.1.1.1 Increasing adoption of Renewable Energy

- 4.8.2 Restraints

- 4.8.2.1 Phasing out of Coal-Based Power Plants

- 4.8.1 Drivers

- 4.9 Supply Chain Analysis

- 4.10 Porter's Five Forces Analysis

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Consumers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitutes Products and Services

- 4.10.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Power Generation - Source

- 5.1.1 Thermal

- 5.1.2 Hydroelectric

- 5.1.3 Nuclear

- 5.1.4 Renewables

- 5.2 Power Transmission and Distribution (T&D)

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 State Grid Corporation of China

- 6.3.2 Engie SA

- 6.3.3 Electricite de France S.A.

- 6.3.4 Iberdrola, S.A.

- 6.3.5 National Thermal Power Corporation Limited

- 6.3.6 NTPC Ltd

- 6.3.7 Tokyo Electric Power Company Holding Inc

- 6.3.8 Enel S.p.A.

- 6.3.9 Korea Electric Power Corporation (KEPCO)

- 6.3.10 Chubu Electric Power Co., Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Export Requirements via Interconnectors have Resulted in Increased Requirements for Installation of Transmission and Distributions (T&D) Lines

02-2729-4219

+886-2-2729-4219