|

市场调查报告书

商品编码

1690181

菲律宾 CEP(快递包裹):市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Philippines Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

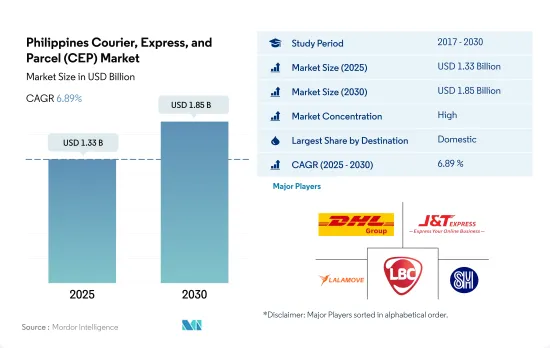

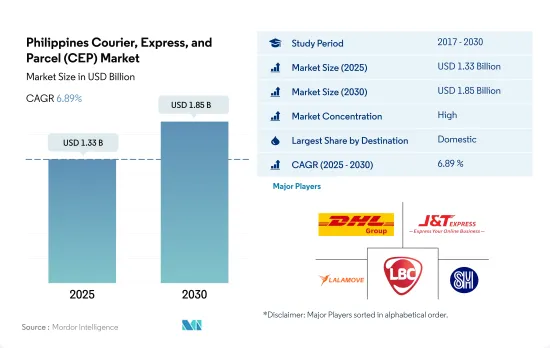

菲律宾快递包裹 (CEP) 市场规模预计在 2025 年将达到 13.3 亿美元,预计到 2030 年将达到 18.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.89%。

行业进步和电子商务的兴起推动了国内外 CEP 市场的需求不断增长。

- 为了加快国内外邮件和小包裹的投递,菲律宾邮政公司 (Philpott) 已于 2021 年停止使用成绩单。这种已有 75 年历史的做法导致了严重的投递延误。此前,邮件和小包裹的收件人必须收到通知卡才能到邮局领取小包裹,这通常需要大约两到三个月的时间。这导致了延误并使得送货上门变得不方便。菲律宾国内领先的宅配业者包括LBC和2GO Express,各拥有1000多家分店。 2022 年,美国是菲律宾服装出口的最大市场。 2022 年服饰和服饰配件整体出口额为 7.89 亿美元。

- 2023年10月,联邦快递扩大了在菲律宾的业务,建立了1,100多家门市,并为客户提供更多的包裹运输选择。联邦快递授权运送中心 (FASC) 的广泛网路为消费者提供了众多可以投递包裹的地点。网路由 792 家 2GO经销店、335 家 SM 商务中心和 25 家 Alfamart 商店组成,所有门市均提供免费包裹取货服务。

菲律宾CEP(快递包裹)市场趋势

受贸易仓储和工业成长推动,2022 年菲律宾 GDP 年增率将达 7.6%

- 2022年第四季,菲律宾GDP成长7.2%,年化成长率为7.6%。批发和零售贸易、汽车和摩托车维修业(8.7%)、金融和保险业(9.8%)以及製造业(4.2%)引领了2022年第四季的成长。 2022年年增率贡献最大的产业是製造业(5.0%)、建设业(12.7%)、批发和零售贸易(8.7%)以及汽车和摩托车维修业。

- 仓储业是菲律宾物流市场第二重要的组成部分。最重要的市场贡献者是工业和零售仓储业和电子商务公司。菲律宾市场的製造业正在崛起。国内消费和国际贸易活动的增加是菲律宾仓储业成长的主要动力。菲律宾仓储业近年来贸易量不断增长,带动了对运输和仓储设施的需求。菲律宾各地的累积货物量也逐年增加,这也对该国的仓储业产生了正面的影响。

预计菲律宾能源产业将在 2022 年萎缩 4.8%,然后在 2023 年成长 5.5%。

- 儘管俄罗斯袭击乌克兰导致油价上涨,菲律宾政府仍将在 2022 年为公共交通驾驶人提供 25 亿菲律宾比索(4,900 万美元)的燃油补贴。这些资金将用于运输部的燃油补贴计划,该计划将向 377,000 名驾驶人提供补贴券。 2022年,菲律宾每公升汽油的平均零售价约为1.55美元,较前一年的1.04美元零售价大幅上涨。

- 2022年至2031年,菲律宾石油需求预计成长3.4%,而净进口量预计成长约3.5%。预计菲律宾能源产业将在 2022 年萎缩 4.8%,然后在 2023 年成长 5.5%。但供应有限,该产业需要转向绿色能源。随着人口成长和国内天然气供应减少,预计该国对进口燃料的依赖将更加严重,并在 2024-2025 年陷入电力短缺。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口统计

- 按经济活动分類的 GDP 分布

- 经济活动带来的 GDP 成长

- 通货膨胀率

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业生产毛额

- 出口趋势

- 进口趋势

- 燃油价格

- 物流绩效

- 基础设施

- 法律规范

- 菲律宾

- 价值链与通路分析

第五章 市场区隔

- 目的地

- 国内的

- 国际的

- 送货速度

- 表达

- 非快递

- 模型

- 企业对企业 (B2B)

- 企业对消费者 (B2C)

- 消费者对消费者(C2C)

- 运输重量

- 重型货物

- 轻型货物

- 中等重量货物

- 运输方式

- 航空邮件

- 路

- 其他的

- 最终用户

- 电子商务

- 金融服务(BFSI)

- 卫生保健

- 製造业

- 一级产业

- 批发零售(线下)

- 其他的

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介

- Ayala Corporation

- DHL Group

- FedEx

- J&T Express

- Lalamove

- LBC Express Holdings, Inc.

- Ninja Van

- Philippine Postal Corporation(PHLPost)

- SM Investments Corporation(including 2GO)

- United Parcel Service of America, Inc.(UPS)

- Ximex Delivery Express Logistics Inc.(XDE)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 技术进步

- 资讯来源和进一步阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 70621

The Philippines Courier, Express, and Parcel (CEP) Market size is estimated at 1.33 billion USD in 2025, and is expected to reach 1.85 billion USD by 2030, growing at a CAGR of 6.89% during the forecast period (2025-2030).

Demand in the domestic and international CEP markets is increasing owing to industry advancements and increasing e-commerce

- In an attempt to speed up mail and parcel deliveries domestically and internationally in the country, the Philippine Postal Corporation (Philpott) eliminated notification cards in 2021. It was a 75-year-old practice causing significant delays in deliveries. Earlier, the mail or parcel recipient had to receive a notification card before a parcel could be picked up at the post office, which would usually take about two to three months in order to be received. This caused delays and thus made door-to-door deliveries inconvenient. Some major domestic courier service providers in Philippines are LBC and 2GO Express, with over 1,000 branches each. The United States was the biggest market for apparel exports for Philippines in 2022. Overall, exports of articles of apparel and clothing accessories amounted to USD 789 million in 2022.

- In October 2023, FedEx expanded its presence in the Philippines, establishing over 1,100 outlets to offer customers more choices for sending their packages. The extensive network of FedEx Authorized Ship Centers (FASC) offers consumers numerous locations where they can drop off their shipments. The network consists of 792 2GO outlets, 335 SM Business Centers, and 25 Alfamart stores, all authorized to accept packages without additional charges.

Philippines Courier, Express, and Parcel (CEP) Market Trends

The Philippine GDP rise 7.6% annual growth in 2022, driven by rise in trade warehouse and industrial growth

- In the fourth quarter of 2022, the Philippine GDP increased by 7.2%, leading to a 7.6% annual growth. Wholesale and retail trade, auto and motorcycle repair (8.7%), financial and insurance activities (9.8%), and manufacturing (4.2%) were the main drivers of the growth in the fourth quarter of 2022. The industries that made the most significant contributions to the annual growth for 2022 were manufacturing (5.0%), construction (12.7%), wholesale and retail trade (8.7%), and auto and motorcycle repair.

- Warehousing is the second most significant component of the Philippine logistics market. The most important market contributors are industrial and retail warehousing and e-commerce firms. Manufacturing activities are increasing in the Philippines market. Rising domestic consumption and international trade activities are the primary drivers of warehousing growth in the Philippines. Warehousing in the Philippines has seen an increase in trade flow in recent years, which has boosted demand for transportation and storage facilities. A yearly increase in cumulative cargo throughout the country has also positively impacted the Philippine warehousing industry.

Despite the decline in the Philippine energy sector by 4.8% in 2022, it is poised to grow by 5.5% in 2023

- The Philippine government allocated PHP 2.5 billion (USD 49 million) in fuel subsidies for public transportation drivers in 2022 despite rising oil prices as a result of Russia's attack on Ukraine. The funds would be used for the Department of Transportation's fuel subsidy program, providing vouchers to 377,000 drivers. In 2022, the average retail price of one-liter gas in the Philippines was around 1.55 USD, reflecting a significant increase from the previous year's retail price of 1.04 USD.

- During 2022-2031, the demand for oil in the Philippines is expected to increase by 3.4%, and net imports are estimated to increase by around 3.5%. The energy sector in the Philippines declined by 4.8% in 2022, but it is expected to grow by 5.5% in 2023. However, there are supply limitations, and the sector needs to shift toward green energy. As the population grows and the domestic gas supply decreases, the country is expected to rely heavily on imported fuel, leading to a power shortage from 2024 to 2025.

Philippines Courier, Express, and Parcel (CEP) Industry Overview

The Philippines Courier, Express, and Parcel (CEP) Market is fairly consolidated, with the major five players in this market being DHL Group, J&T Express, Lalamove, LBC Express Holdings, Inc. and SM Investments Corporation (including 2GO) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Philippines

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Ayala Corporation

- 6.4.2 DHL Group

- 6.4.3 FedEx

- 6.4.4 J&T Express

- 6.4.5 Lalamove

- 6.4.6 LBC Express Holdings, Inc.

- 6.4.7 Ninja Van

- 6.4.8 Philippine Postal Corporation (PHLPost)

- 6.4.9 SM Investments Corporation (including 2GO)

- 6.4.10 United Parcel Service of America, Inc. (UPS)

- 6.4.11 Ximex Delivery Express Logistics Inc. (XDE)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219