|

市场调查报告书

商品编码

1690203

自动卸货卡车和矿用卡车:市场占有率分析、行业趋势和成长预测(2025-2030 年)Dump Trucks and Mining Trucks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

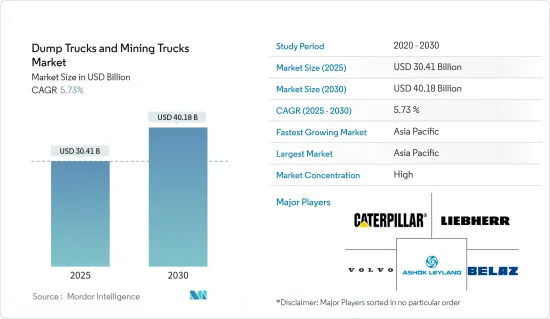

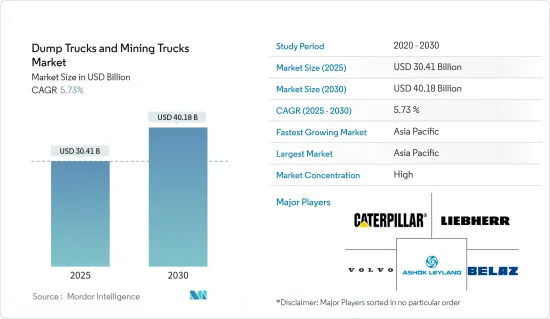

自动卸货卡车和采矿卡车市场规模预计在 2025 年为 304.1 亿美元,预计到 2030 年将达到 401.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.73%。

由于各行业和基础设施计划发展对矿物和矿石的需求持续增加,预计采矿活动活性化将带动采矿卡车的需求增加。全球采矿业需要更多技术人才。此外,新冠疫情和工业停工预计将推动矿业公司提高生产效率,进而推动对更多采矿卡车的需求。此外,2021年是转型之年,采矿活动再次进入復苏阶段,展现出巨大的成长潜力。

采矿业目前面临政府严格的排放和进出口管制。要提高利润率,就需要提高生产力。这就是为什么公司越来越多地透过安装感测器和分析资料来实现采矿卡车的自动化和电气化。随着全球电气化持续发展,OEM)正在提供电动动力传动系统。此外,包括远端资讯处理在内的技术方面也在推动需求。

预计亚太地区在采矿设备方面拥有最大的成长潜力,其中包括自卸车和采矿卡车等物料输送设备。该地区在采矿生产和矿山方面具有巨大的潜力,增加了对自动卸货卡车和采矿卡车的需求。由于露天采矿产量的增加、设备维护的可预测性以及露天采矿的更换週期,该地区采矿设备产量增加。

矿用自动卸货卡车市场趋势

预计电动卡车在预测期内将实现高成长

过去几年,中国、印度和欧洲等自动卸货卡车和矿用卡车的主要市场都采用了严格的排放气体标准,如印度的巴拉特6标准、中国的中国6标准和欧洲的欧盟6标准。电气化和混合动力化正变得越来越必要,特别是对于柴油引擎汽车,必须配备选择性催化还原(SCR)和废气再循环(EGR)技术。这减少了柴油引擎排放的硫烟和其他含硫排放气体的数量。这些系统在柴油引擎上的安装,进一步提高了自动卸货卡车等柴油车的价格。美国等许多国家也透过最近通过的《通货膨胀削减法案》为购买电动卡车提供直接税额扣抵,以鼓励电动卡车的销售。这些措施预计将加速电动卡车在采矿业的应用,因为采矿卡车占矿山总排放的 60% 以上。例如

2022 年 9 月,瑞典 Kaunis Iron 公司开始与沃尔沃卡车合作测试一辆 74 吨的电动卡车。这辆卡车在瑞典北部考尼斯瓦拉 (Kaunisvaara) 和皮特卡耶尔维 (Pitkajärvi) 之间 160 公里长的公路上进行了运输铁矿石的测试。 Kaunis Iron 计划投资 5 亿瑞典克朗(4,800 万美元),使其卡车车队全面实现电气化。此外,矿业公司和OEM之间签署了重要合同,以在其矿山中测试和部署电动运输卡车,进一步推动了全球范围内电动自卸卡车和电动采矿卡车的采用。例如

2022 年 9 月,总部位于澳洲的 Newcrest Mining 宣布,它正逐步倾向于用电池电动卡车取代其位于加拿大不列颠哥伦比亚省 Brucejack 金银矿的所有柴油卡车车队。预计这一转变将使 Newcrest Mining 在 2030 年减少 65,000 吨二氧化碳排放。 Newcrest Mining 预计其全部 12 辆柴油卡车将于 2022 年底前完成向电气化的转变。 Newcrest Mining 的子公司 Pretium Resources 于 2020 年在其矿场完成了山特维克 Z50 电池电动运输卡车的试验。

由于上述案例和基础设施领域的发展,预计市场在预测期内将出现乐观增长。

预计亚太地区将在预测期内引领市场

亚太地区自动卸货卡车和采矿卡车市场成长的关键因素之一是中国、印度、日本和澳洲等国家采矿活动的增加。在中国东部,政府已经铺设了通往居民住宅的天然气管道,但居民仍无法获得稳定的天然气供应。因此,越来越多的人使用煤炭取暖。随着政府放鬆严格的政策,中国最大的煤炭生产省份山西省计划增加近 1,100 万吨焦炭产能,以满足日益增长的需求。

中国的目标是尽量减少对进口煤炭的依赖。国家发展改革委员会(原国家计委、国家发展计画委员会)日前宣布,2021年煤炭产量将突破40亿吨。此外,也计画增加煤炭产量3亿吨,相当于中国每年的进口量。预计这将大幅减少对煤炭进口的依赖。在俄罗斯入侵乌克兰后,该国受到全球价格创纪录的衝击,预计生产能力的提高将使该国减少对外国进口的依赖。此外,中国是最大的钢铁生产国,全球约有一半的钢铁产自中国。中国也生产全球约90%的稀土。

此外,印度也同样为亚太地区矿业生产的提升做出了贡献。据印度矿业部称,截至 22 财年,已有 1,245 个矿山註册,并且在当前情况下积极报告稳定的产量。由于采矿活动庞大,采矿业的各个相关人员正在引入新一代技术来从矿场运输矿物。例如

2021 年 9 月,印度煤炭有限公司与国营天然气公司 GAIL 和印度采矿机械公司 OWM BEML 签署了一份谅解备忘录,开展先导计画,使用液化天然气作为该国现有采矿自动卸货卡车双燃料运行的替代燃料。为了减少二氧化碳排放,两家公司已开始在自动卸货卡车上安装液化天然气改装套件,该矿隶属于马哈纳迪煤田有限公司 (MCL)。

当地企业正在赢得建设公司和采矿公司的新合约。预计上述发展将在预测期内推动市场成长。

矿用自动卸货卡车产业概况

全球自动卸货卡车和矿用卡车市场适度整合,国内外活跃参与者数量有限。市场的主要企业包括卡特彼勒公司、斗山工程机械、日立建筑机械和利勃海尔集团。公司正在开发和添加新技术到现有模型中,推出新模型,并探索新的尚未开发的市场。

随着矿业公司投资推出运营,这可能为一些矿业设备製造商带来机会。例如,2021年3月,力拓宣布将开始在其位于美国的肯尼科特矿场生产碲。该公司表示,将在金属回收製程上投资 290 万美元,年产能为 20 吨。这种金属用于生产太阳能电池。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 按卡车类型

- 侧自动卸货卡车

- 后自动卸货卡车

- 按燃料类型

- 内燃机

- 电动式的

- 按容量类型

- 少于200吨

- 超过200吨

- 按应用

- 矿业

- 建造

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 澳洲

- 其他亚太地区

- 世界其他地区

- 巴西

- 墨西哥

- 阿拉伯聯合大公国

- 其他国家

- 北美洲

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Caterpillar, Inc.

- Hitachi Construction Machinery Co. Ltd.

- Komatsu Ltd.

- Liebherr Group

- BAS Mining Trucks

- Sany Heavy Industry Co., Ltd.

- Volvo Group

- Daimler Group

- BelAZ

- Ashok Leyland Ltd.

- Doosan Infracore

第七章 市场机会与未来趋势

The Dump Trucks and Mining Trucks Market size is estimated at USD 30.41 billion in 2025, and is expected to reach USD 40.18 billion by 2030, at a CAGR of 5.73% during the forecast period (2025-2030).

The demand for mining trucks is expected to rise on the backdrop of increased mining activity due to continuous demand for minerals and ores, which are necessary for various industries and infrastructural project development. The global mining industry needs more skilled human resources. Moreover, in the wake of the COVID-19 outbreak and industries shut down, the situation is expected to drive the mining companies to improve their production efficiency, which in turn is expected to drive the demand for more mining trucks. Moreover, 2021 was the year of transition where the mining activities again took their recovery phase exhibiting immense growth potential.

The mining industry is now witnessing the government's stringent emission and import-export regulations. Productivity must get improved to increase the profit margins. It is causing companies to automate and electrify mining trucks by installing sensors and analyzing their data. OEM is offering electric power trains amid rising electrification globally. In addition, technological aspects, including telematics, have also elevated the demand positively.

The Asia-pacific region is expected to hold the highest potential for the growth of mining equipment, including material handling equipment like Dump and mining trucks. The area offers immense potential in mining output and mineral mines, elevating the demand for dump trucks and mining trucks. With the increased production in surface mining, the predictable nature of equipment maintenance, and the replacement cycle in surface mining, the region observed an increase in the production of mining equipment.

Mining Dump Truck Market Trends

Electric Trucks are Projected to Witness a High Growth Rate During the Forecast Period

Over the past few years, significant markets for dump and mining trucks like China, India, and Europe have adopted stringent emissions norms, like Bharat 6 in India, China 6 standards in China, and Euro 6 in Europe. They have made electrification and hybridization necessary, especially for diesel engine vehicles, as they must be equipped with Selective Catalytic Reduction (SCR) and Exhaust Gas Recirculation (EGR) technologies. It will reduce the sulfur soot and other sulfur-based emissions from diesel engines. These systems' installation into diesel engines further pushed diesel vehicle prices, including dump trucks and mining trucks. Many countries like the United States are also promoting electric truck sales by providing direct tax credits for electric truck purchases through the recently passed Inflation Reduction Act. These measures are expected to boost electric truck adoption in the mining sector since mining trucks account for more than 60% of the total emissions from mines. For instance,

In September 2022, Kaunis Iron in Sweden began testing 74-ton electric trucks in association with Volvo Trucks. The trucks were tested to transport iron ore over a 160 km road between Kaunisvaara and Pitkajarvi in northern Sweden. Kaunis Iron plans to invest SEK 500 million (USD 48 million) to electrify its truck fleet completely. Additionally, significant contracts between mining companies and OEMs to test and deploy electric haul trucks at their mines are further boosting the adoption of electric dump and mining trucks worldwide. For instance,

In September 2022, Australia-based Newcrest Mining announced that it is slowly inclining its way towards electrifying its entire diesel truck fleet to battery-electric at its Brucejackgold-silver mine in British Columbia, Canada. This transition is expected to save 65000 tons CO2 emissions by 2030 for Newcrest Mining. Newcrest Mining expects the evolution of its entire fleet of 12 diesel-powered trucks to electrification to be completed by the end of 2022. Newcrest Mining's subsidiary Pretium Resources Inc. completed the Sandvik Z50 battery-electric haul truck trials at their mine in 2020.

Due to the abovementioned instances and developments in the infrastructure sector, the market is expected to witness optimistic growth over the forecast period.

Asia-Pacific is Projected to Lead the Market During the Forecast Period

One of the critical factors in the growth of the Asia-Pacific dump trucks and mining trucks market is the increase in mining activities in countries such as China, India, Japan, Australia, etc. In eastern China, the government fitted gas pipelines in households but had not yet supplied gas regularly. It increases the consumption of coal by people for heating purposes. China's largest coal-producing province, Shanxi, provided relaxation on stringent government policies and plans to add nearly 11 million tons of coke-producing capacities to meet growing demand.

China is aiming to minimize its coal import dependency. The NDRC (National Development and Reform Commission), formerly State Planning Commission and State Development Planning Commission, stated that the country produced more than 4 billion tons of coal in 2021. Further, they are striving to increase their coal output by 300 million tons, equal to China's annual import. It is expected to cut the reliance on coal imports dramatically. A rise in capacity would reduce the country's dependence on overseas imports after record-high world prices were hit in the wake of Russia's invasion of Ukraine. In addition, China is the largest steel producer, and about half of the world's steel is produced in the country. China also produces around 90% of the world's rare earth metals.

Moreover, India contributed equally to elevating the Asia-Pacific region's mining output. According to the Ministry of Mines in India, as of FY 2022, 1,245 mines were registered to report and produce steady throughput in the current scenario actively. Due to the immense activity from the mining industry, various stakeholders operating in the industry have been introducing new generation technologies for mineral hauling from the mine sites. For instance,

In September 2021, Coal India Limited signed an MoU with state gas utility GAIL and Indian mining equipment OWM BEML for a pilot project to use LNG as an alternative fuel for dual fuel operation of existing mining dump trucks in the country. Intending to reduce carbon emissions, the companies say they have initiated the process of fitting LNG conversion kits on two 100-ton class dump trucks at the Lakhanpurmine in Jharsuguda district, Odisha, part of Mahanadi Coalfields Ltd (MCL).

Regional players are getting new contracts from construction and mining companies. All the developments above are expected to help the market growth over the forecast period.

Mining Dump Truck Industry Overview

The global dump trucks and mining trucks market is moderately consolidated, with a limited number of active local and international players. Some major players in the market are Caterpillar, Inc., Doosan Infracore, and Hitachi Construction Machinery Co., Ltd., Liebherr Group, amongst others. The companies are developing and adding new technologies to their existing models, launching new models, and tapping into new and unexplored markets.

Mining companies are investing in setting up their operation, which might act as an opportunity pocket for several mining equipment manufacturers. For instance, in March 2021, Rio Tinto Company announced that it would start Tellurium production in Kennecott mine, US. The company announced an investment of USD 2.9 million for the metal recovery process and will have a production capacity of 20 tons per year. This metal is used in the production of photovoltaic cells.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 By Truck Type

- 5.1.1 Side dump truck

- 5.1.2 Rear Dump truck

- 5.2 By Fuel Type

- 5.2.1 IC Engine

- 5.2.2 Electric

- 5.3 By Capacity Type

- 5.3.1 Less than 200 metric ton

- 5.3.2 More than 200 metric ton

- 5.4 By Application Type

- 5.4.1 Mining

- 5.4.2 Construction

- 5.4.3 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 Mexico

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Caterpillar, Inc.

- 6.2.2 Hitachi Construction Machinery Co. Ltd.

- 6.2.3 Komatsu Ltd.

- 6.2.4 Liebherr Group

- 6.2.5 BAS Mining Trucks

- 6.2.6 Sany Heavy Industry Co., Ltd.

- 6.2.7 Volvo Group

- 6.2.8 Daimler Group

- 6.2.9 BelAZ

- 6.2.10 Ashok Leyland Ltd.

- 6.2.11 Doosan Infracore