|

市场调查报告书

商品编码

1690204

欧洲施工机械租赁市场:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Europe Construction Machinery Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

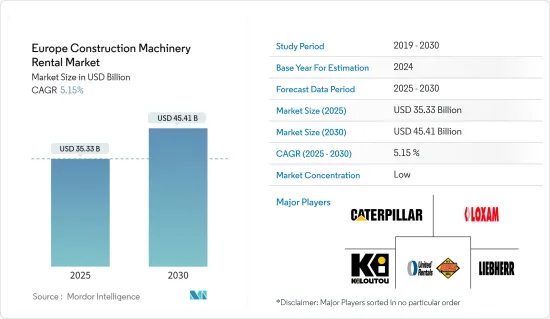

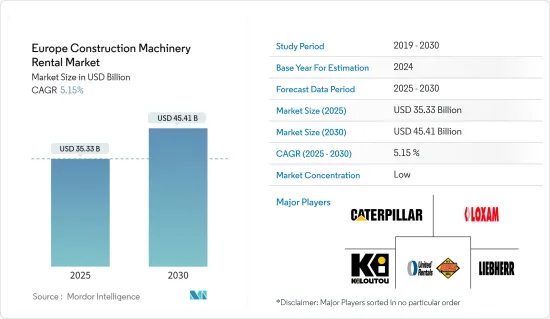

预计 2025 年欧洲施工机械租赁市场规模为 353.3 亿美元,到 2030 年将达到 454.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.15%。

在预测期内,预计欧洲建设产业将受到建筑业务向租赁施工机械转变的支持,以降低营运成本。预计该行业的持续復苏也将在未来几年推动研究市场的发展。

从长远来看,欧洲对新基础设施的持续需求、建筑和房地产行业的扩张以及大规模道路基础设施和智慧城市的快速建设预计将推动市场需求。此外,政府和建设公司致力于基础设施建设的措施也有助于推动该产业的扩张。

欧洲建筑市场的扩张受到都市区住宅需求上升、基础设施开发活动活性化以及为提高能源效率而加强建筑现代化和维修的推动。该地区强劲的经济成长正在推动商业基础设施建设的增加,包括办公室、学校、饭店、餐厅和休閒设施。

此外,政府为改善住宅基础设施和为社会弱势群体提供住宅而采取的各种优惠措施和投资正在支持欧洲施工机械租赁市场的成长。 2023 年 9 月,德国政府宣布计划暂停提案的建筑法规,这是 450 亿欧元(470 亿美元)救助计画的一部分,旨在帮助面临高利率和成本上升的陷入困境的建设产业。柏林计划在2027年前为经济适用住宅拨款180亿欧元,并从联邦州和市政当局获得额外资金。

欧洲施工机械租赁市场趋势

建设产业预计将继续成为焦点

欧洲建筑市场的扩张受到都市区住宅需求增加、基础设施建设改善以及建筑现代化和维修以提高能源效率的推动。该地区强劲的经济成长正在推动商业基础设施建设的增加,包括办公室、学校、饭店、餐厅和休閒设施。

政府为改善住宅基础设施和为社会弱势群体提供住宅而采取的各种优惠措施和投资也支持了欧洲施工机械租赁市场的成长。 2023年10月,捷克共和国更新了国家能源和气候计画(NCEP),表示打算在2030年建造6000兆瓦的太阳能发电厂,包括建造变电站以及安装光伏板、涡轮机、发电机和输电设备。 2024年3月,欧洲投资银行(EIB)核准超过1.11亿美元扩建立陶宛Kruonis抽水蓄能电站。

新兴经济体正在大力投资基础设施,以解决交通拥堵、人口成长、生产成本上升和交通基础设施老化等重大问题,而已开发经济体则正在投资抗震建筑和超级高铁等技术,以改善现有的基础设施。这些因素正在推动施工机械租赁市场的销售。

在预计预测期内,施工机械技术的不断进步和数数位化将为施工机械租赁市场提供巨大的成长机会。在预测期内,不断增加的产品发布和技术创新可能会进一步推动小型滑移装载机的普及。

对具有成本效益的机械的需求和低排放气体的监管压力迫使施工机械製造商选择电动式和混合动力汽车,而不是传统的液压和机械选项。因此,施工机械的电气化进程正在加速。例如,

- 2024年1月,日本施工机械製造商日本小松公司首先在日本推出了电动挖土机PC138E-11作为租赁机器,随后在欧洲推出。该机器重达 13 吨,特别适合都市区的建筑计划。

由于开发和建设活动的活性化,预计市场在预测期内将继续增长。

德国占最大市场占有率

由于德国对先进设备的需求不断增加、技术进步不断进步以及建设活动日益增多,建筑租赁机械市场正在不断增长。推土机、挖土机和起重机是德国最受欢迎的重型机械。透过租赁施工机械,建设公司可以避免高昂的开支,以低成本实现目标。

建设产业的成长主要推动了对租赁施工机械的需求。政府增加对基础设施计划的投资旨在促进经济成长并创造机会,这对德国建设产业来说是一个好兆头。此外,都市化化和人口增长可能会刺激施工机械租赁的需求。

新冠疫情对德国建设产业造成了重大影响,许多建筑计划被推迟或取消。然而,该行业已证明具有韧性,随着经济重新开放,建设活动正在逐步加快。受国家基础设施建设计划推动,预计未来几年施工机械租赁需求将会增加。例如

2024 年 2 月,萨克森州政府宣布了一项 1.05 亿欧元(1.075 亿美元)的一揽子计划,用于住宅建设和购买公寓的 25 年固定利率低于 1% 的低息贷款。

- 2023年12月,费马恩海峡附近的费马恩海峡隧道将动工建设,长18.5公里,将汉堡和哥本哈根之间的旅行时间从4.5小时缩短至2.5小时,预计2029年完工。

- 2023 年 7 月,NeuConnect Interconnector 宣布启动首个英德电力连接计划。乌克兰入侵后,欧洲正在寻求俄罗斯管道天然气的替代品,该计划旨在加强能源安全。

预计未来几年施工机械租赁需求将会成长。预计在评估期内,对可负担的设备解决方案的需求、政府对基础设施计划的支出增加以及建筑业的扩张将有助于德国施工机械租赁市场的成长曲线。

欧洲施工机械租赁业概况

欧洲施工机械租赁市场由几家主要企业主导,包括卡特彼勒、神钢建筑机械、迪尔公司、小松株式会社、沃尔沃集团、斗山工程机械和徐工集团。预计全部区域施工机械租赁服务的快速扩张和主要企业收购数量的增加将推动预测期内的市场成长。

- 2023 年 6 月,Boels Rental 透露,去年已投资 5.51 亿欧元用于扩大和多样化其租赁设备系列,目前该系列包括 84 万件租赁设备,其中 81% 为电动设备。大部分投资都投入了配备新电池、电动和混合动力技术的施工机械上,以减少碳排放并帮助客户满足不断变化的政府法规和净零目标。

- 2023 年 1 月,Ardent Hire 宣布将在贝德福德附近的肖斯顿开设一个新的超级枢纽仓库。新设施位于 A1 高速公路上,可方便前往伦敦和北部地区。该占地六英亩多的混凝土场地包括办公室、研讨会设施和目前正在建造的新培训中心。

- 2023 年 1 月,约翰迪尔推出了由 Microsoft Dynamics 365 提供支援的全新经销商业务系统,为经销商提供涵盖其业务诸多方面的通用技术平台,使他们能够抓住新的成长、创新和客户洞察机会。两家公司将利用各自的专业知识来提供这项最尖端科技。 Dynamics 365 应用程式将无缝整合 John Deere 经销商的销售、租赁、售后市场和管理功能,实现更高的流程自动化和决策洞察。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 机器类型

- 起重机

- 伸缩臂堆高机

- 挖土机

- 装载机

- 平土机马达

- 道路施工机械

- 其他机器

- 驱动器类型

- 油压

- 杂交种

- 按应用

- 建筑学

- 道路建设

- 其他用途

- 按国家

- 德国

- 英国

- 义大利

- 西班牙

- 法国

- 其他欧洲国家

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Caterpillar Inc.

- Liebherr Group

- Deere & Company

- Komatsu Ltd

- Loxam SAS

- Ardent Hire Solutions Ltd

- Sunbelt Rentals

- Kiloutou Group

- Hitachi Construction Machinery Co. Ltd

- Ahern Rentals

第七章 市场机会与未来趋势

The Europe Construction Machinery Rental Market size is estimated at USD 35.33 billion in 2025, and is expected to reach USD 45.41 billion by 2030, at a CAGR of 5.15% during the forecast period (2025-2030).

Over the forecast period, the European construction industry is expected to be supported by a shift in construction businesses toward renting equipment to lower operational costs. The ongoing recovery in the industry is also expected to drive the studied market positively in the coming years.

Over the long term, the market demand is expected to be fueled by the constant need for new infrastructure, increased business in the construction and real estate sectors, and the rapid construction of substantial road infrastructure and smart cities in Europe. The expansion of the industry is also aided by government and construction company initiatives aimed at infrastructural development.

The expansion of the European construction market can be attributed to rising demand for housing in urban areas, increased infrastructural development activities, and increased modernization and renovation of buildings to improve their energy efficiency. With the region's robust economic growth, commercial infrastructure construction, such as offices, schools, hotels, restaurants, and leisure facilities, is rising.

Additionally, various favorable initiatives and investments by governments to improve housing infrastructure and provide housing for the vulnerable section are supporting the growth of the European construction machinery rental market. In September 2023, the German government announced its plans to suspend proposed building regulations as part of a EUR 45 billion (USD 47 billion) relief package to support the struggling construction industry, which is facing high interest rates and rising costs. Berlin plans to allocate EUR 18 billion until 2027 for affordable housing, with additional funding from federal states and municipalities.

Europe Construction Machinery Rental Market Trends

The Building Construction Industry is Expected to Remain the Focal Point

The expansion of the European construction market can be attributed to rising demand for housing in urban areas, increased infrastructural development, and increased modernization and renovation of buildings to improve their energy efficiency. With the region's robust economic growth, commercial infrastructure construction, such as offices, schools, hotels, restaurants, and leisure facilities, is rising.

Various favorable initiatives and investments by governments to improve housing infrastructure and provide housing for the vulnerable section are also supporting the growth of the European construction machinery rental market. In October 2023, the Czech Republic updated its National Energy and Climate Plan (NCEP), intending to construct 6,000 MW of solar plants, including building a substation and installing PV panels, turbines, generators, and transmission lines by 2030. In March 2024, the European Investment Bank (EIB) approved over USD 111 million for expanding the Kruonis Pumped Storage Hydroelectric Power Plant in Lithuania, aiming to boost capacity from 900 MW in 2023 to 1 GW by 2026.

Developing economies are investing heavily in infrastructural development to address major issues such as traffic congestion, population growth, high manufacturing costs, and aging transportation infrastructure, while developed economies are investing in technologies such as earthquake-proof buildings and hyperloop to improve their current infrastructure. These factors are driving up sales in the construction machinery rental market.

Increasing technological advancements and digitalization in construction equipment are anticipated to offer enormous growth opportunities in the construction machinery rental market during the forecast period. Growing product launches and innovations may further enhance the adoption of small skid steer loaders during the forecast period.

Construction equipment manufacturers are pressured to choose electric and hybrid vehicles over traditional hydraulic and mechanical ones due to the demand for cost-effective machines and regulatory pressures for lower emissions. As a result, the electrification of construction equipment is gaining momentum. For instance,

- In January 2024, Japanese construction machinery manufacturer Komatsu introduced the PC138E-11 electric excavator as a rental machine, first in Japan, followed by Europe. The 13-ton machine is particularly suitable for urban construction projects.

Owing to such developments and rising construction activities, the market is expected to continue to grow during the forecast period.

Germany Holds the Largest Market Share

Construction rental machinery is a growing market in Germany due to the increasing need for advanced equipment, technological advancements, and the rise in construction activities in the country. Bulldozers, excavators, and cranes are among the most in-demand heavy machinery in Germany. Construction companies are meeting their objectives at a low cost while avoiding high expenses by renting construction equipment.

The growth of the construction industry primarily drives the demand for rental construction machinery. An increase in government investment in infrastructure projects is intended to spur economic growth and generate opportunities, which may be favorable to the German construction industry. Additionally, the rise in urbanization and the nation's expanding population may boost the demand for rental construction equipment.

The COVID-19 pandemic significantly impacted the German construction industry, with many construction projects being delayed or canceled. However, the industry has shown resilience, and construction activity has gradually picked up pace as the economy reopened. High demand for construction equipment rentals is expected on the back of infrastructure development projects in the country over the coming years. For instance,

In February 2024, the Saxony city government unveiled a EUR 105 million (USD 107.5 million) package for housing construction and low-interest loans under 1% with a 25-year fixed rate for purchasing condominiums.

- In December 2023, construction began on the Fehmarnbelt tunnel near the Fehmarn strait to develop an 18.5 km stretch to reduce travel time between Hamburg and Copenhagen from 4.5 hours to 2.5 hours, with completion expected by 2029.

- In July 2023, NeuConnect Interconnector announced the commencement of work on the first UK-German power link project. This project aims to enhance energy security as Europe looks for alternatives to Russian pipeline gas following the invasion of Ukraine.

The demand for construction equipment rentals is expected to grow in the coming years. The need for affordable solutions to address equipment requirements, rising government spending on infrastructure projects, and the expansion of the construction industry are expected to contribute to the growth curve of the German construction machinery rental market during the assessment period.

Europe Construction Machinery Rental Industry Overview

The European construction rental machinery market is dominated by several key players, including Caterpillar, Kobelco Construction Machinery, Deere & Company, Komatsu Ltd, Volvo Group, Doosan Infracore, and XCMG. The rapid expansion of construction machinery rental services across the region and the increasing acquisitions between key players are expected to boost the market's growth during the forecast period.

- In June 2023, Boels Rental disclosed that it spent EUR 551 million last year to expand and diversify its rental equipment range, now comprising 840,000 items, 81% of which are electric-powered. Much of the investment went into construction equipment with new battery, electric, and hybrid technologies, helping customers meet evolving government regulations and Net Zero targets by reducing their carbon footprints.

- In January 2023, Ardent Hire announced the opening of its new super-hub depot at Chawston, near Bedford. The new facility is on the A1 and offers excellent access to London and the North. With over 6 acres of concreted space, the site includes office and workshop facilities and a new training center that is being built.

- In January 2023, John Deere introduced a new dealer business system powered by Microsoft Dynamics 365 to provide a common technology platform for many aspects of a dealer's business, allowing dealers to capitalize on new opportunities for growth, innovation, and customer insights. Both companies will leverage their expertise to deliver this cutting-edge technology. Dynamics 365 applications will seamlessly integrate John Deere dealers' sales, rental, aftermarket, and administrative capabilities to enable higher levels of process automation and decision-making insights.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD Million)

- 5.1 Machinery Type

- 5.1.1 Cranes

- 5.1.2 Telescopic Handlers

- 5.1.3 Excavators

- 5.1.4 Loaders

- 5.1.5 Motor Graders

- 5.1.6 Road Construction Equipment

- 5.1.7 Other Machinery Types

- 5.2 Drive Type

- 5.2.1 Hydraulic

- 5.2.2 Hybrid

- 5.3 By Application

- 5.3.1 Building Construction

- 5.3.2 Road Construction

- 5.3.3 Other Applications

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 Italy

- 5.4.4 Spain

- 5.4.5 France

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Caterpillar Inc.

- 6.2.2 Liebherr Group

- 6.2.3 Deere & Company

- 6.2.4 Komatsu Ltd

- 6.2.5 Loxam SAS

- 6.2.6 Ardent Hire Solutions Ltd

- 6.2.7 Sunbelt Rentals

- 6.2.8 Kiloutou Group

- 6.2.9 Hitachi Construction Machinery Co. Ltd

- 6.2.10 Ahern Rentals