|

市场调查报告书

商品编码

1690773

印度电动自行车:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)India E-bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

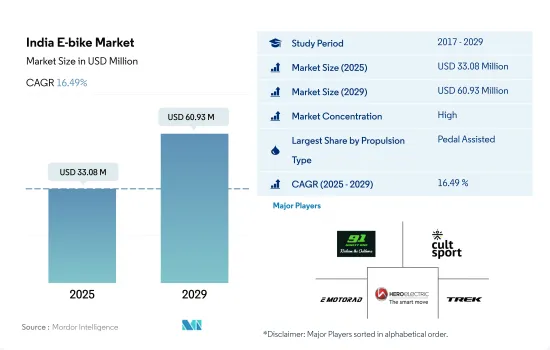

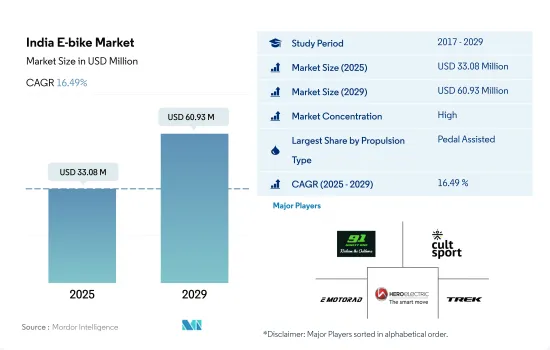

印度电动自行车市场规模预计在 2025 年为 3,308 万美元,到 2029 年预计将达到 6,093 万美元,预测期内(2025-2029 年)的复合年增长率为 16.49%。

推进系统细分市场概览

- 电动自行车有可能成为印度最佳的交通工具。而且由于它结合了汽车的便利性和行驶的刺激感,它是一种极好的交通方式,尤其适用于休閒活动。 SpeedPedelec预计在不久的将来成为最实用的短距离骑乘辅助自行车。随着未来几年印度在动力和速度方面的发展,人们可能会倾向于速度型电动自行车。同样,油门辅助电动自行车的日益普及可能会促进这一领域的成长,这种电动自行车将动力直接传输到马达,而无需手动踩踏。

- 与传统两轮车相比,电动自行车是一种更环保的选择,因为排放的二氧化碳较少。印度政府为减少车辆污染而采取的多项措施正在推动市场成长。由于拥有和维护成本较低,电动自行车日益普及,为该行业带来了好处。充电基础设施的发展和印度汽车产业的扩张为终端客户提供了相当吸引人的发展机会。

- 线上和线下商店提供的电动自行车越来越多,这推动了全国的电动自行车销售。在印度营运的领先市场组织正在对研发计划进行大量投资,以提高其产品品质。该公司也致力于改进电池技术,结合轻质材料,并投资广告宣传以提高整体销售量。这些努力预计将扩大市场,并可能推动未来几年印度电动自行车的成长。

印度电动自行车市场趋势

印度的电动自行车普及率从低基数开始,一直呈现稳定上升趋势,显示市场潜力不断扩大。

- 过去几年,电动自行车在印度越来越受欢迎。此外,人们越来越意识到骑自行车对健康的益处,印度尖峰时段的交通拥堵日益加剧,以及政府加强对电动自行车普及的支持,也促进了电动自行车在印度的普及。此外,由于燃料和维护成本的下降,2019 年印度人使用电动自行车的比例与 2018 年相比加速至 0.10%。

- 新冠案例的蔓延和不断增加对自行车业务产生了积极影响。不使用公共交通或租赁交通工具以保持社交距离等因素改变了消费者的通勤方式,进一步鼓励了人们对电动自行车的投资,因为与其他交通工具相比,电动自行车是每天往返办公室和附近地点的更便捷、价格更实惠的选择之一。这些因素导致2022年全国渗透率较2021年加速0.60%。

- 随着商业营运的恢復和贸易壁垒的取消,电动自行车的普及率增加。贸易限制的取消导致该国进出口活动改善。电动自行车的普及率预计将从 2022 年的 0.60% 上升至 2029 年的 5.00%。这是因为消费者被电动自行车的特征和优势所吸引,例如节省燃料和节省时间。

在印度,每天通勤距离在 5-15 公里之间的人口比例一直在稳定增加,这表明旅行距离正在改变。

- 随着各城市的人们逐渐接受自行车文化,过去几年印度对自行车的需求不断增加。然而,5-15公里的通勤距离与其他交通途径相比仍然相对较低,大多数人更喜欢乘坐两轮车和公共交通等各种交通途径出行。 2019年,不到5%的人口选择骑自行车前往半径5至15公里内的社区。然而,到2020年,5至15公里内的出行次数有所增加,因为许多人在封锁期间开始运动或骑自行车到附近的市场购买必需品。由于这些因素,2020 年印度对自行车的需求与 2019 年相比有所增加。

- 此次疫情对印度自行车市场产生了重大且有利的影响。与使用公共交通相比,更多印度人选择步行或骑自行车前往附近地点。此外,功能先进、电池寿命更长的电动自行车的推出鼓励人们选择骑自行车锻炼身体和进行週末休閒,2021 年印度 5-15 公里通勤距离的人数比 2020 年有了更大的增长。

- 人们已经养成了骑自行车到附近地方上班的习惯。目前,许多人每天骑自行车在半径5至15公里的范围内前往各个地方,包括当地的市场。越来越多的人选择骑自行车上班,因为它有益健康、碳排放和,还可以避免交通拥堵,节省时间。由于这些因素,预测期内印度的通勤距离预计将增加 5-15 公里。

印度电动自行车产业概况

印度电动自行车市场相当集中,前五大公司占了82.78%的市场。该市场的主要企业是:Alphavector (India) Pvt Ltd、Cultsport、EMotorad、Hero Cycles Limited 和 TREK BICYCLE INDIA PRIVATE LIMITED(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 自行车销量

- 人均国内生产毛额

- 通货膨胀率

- 电动自行车普及率

- 每天出游 5-15 公里的人口/通勤者百分比

- 自行车出租

- 电动自行车电池价格

- 电池化学价格表

- 超本地化配送

- 自行车道

- 徒步人数

- 电池充电容量

- 交通拥堵指数

- 法律规范

- 价值链与通路分析

第五章 市场区隔

- 推进类型

- 踏板辅助

- 高速电动自行车

- 油门辅助

- 应用程式类型

- 货运/公用设施

- 城市/城区

- 健行

- 电池类型

- 铅酸电池

- 锂离子电池

- 其他的

第六章 竞争格局

- 重大策略倡议

- 市场占有率分析

- 业务状况

- 公司简介

- Alphavector(India)Pvt Ltd

- Being Human

- Cultsport

- EMotorad

- Hero Cycles Limited

- Motovolt

- Nibe E-motor Limited

- SJ Electric Vehicles Pvt. Ltd(Polarity Smart Bikes)

- Stryder

- TREK BICYCLE INDIA PRIVATE LIMITED

- Tru E Bikes Pvt. Ltd

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 71555

The India E-bike Market size is estimated at 33.08 million USD in 2025, and is expected to reach 60.93 million USD by 2029, growing at a CAGR of 16.49% during the forecast period (2025-2029).

PROPULSION SEGMENT MARKET OVERVIEW

- E-bikes have the potential to become India's best means of mobility. They are also an excellent means of transportation since they mix the convenience of a car with the excitement of riding, making them especially useful for recreational activities. Speed pedelec is expected to soon become the most practical pedal-assist bicycle alternative for shorter distances. As India's power and speed capabilities develop over the next years, people may gravitate toward the speed pedelec category. Similarly, the increasing popularity of throttle-assisted e-bikes, which transmit power directly to the motor without the need for manual pedaling, could be attributed to the segment's expansion.

- E-bikes are an eco-friendly option than traditional two-wheelers because they emit less carbon into the atmosphere. Many initiatives taken by the Indian government to decrease automotive pollution are boosting the growth of the market. The rising popularity of e-bikes is benefiting the sector due to lower ownership and maintenance costs. Advancements in charging infrastructure and India's expanding car sector provide end customers with attractive development opportunities.

- The increased availability of e-bikes through online and offline outlets is driving e-bike sales across the country. Key market organizations operating in India are investing extensively in R&D projects to increase product quality. They also focus on refining battery technology, combining lightweight materials, and investing in advertising campaigns to increase overall sales. As a result of these initiatives, the market is projected to expand, which may fuel the growth of electric bicycles in India in the next few years.

India E-bike Market Trends

India's E-Bike adoption rates, though starting from a low base, show a consistent increase, indicating a growing market potential.

- The use of e-bikes has become increasingly popular in India over the past few years. Additionally, growing public awareness of the health benefits of cycling, increasing traffic congestion in India during rush hours, and expanding government initiatives to support e-bike adoption are all contributing to the country's e-bike adoption. Also, fuel expenditures and lower maintenance costs sped up the adoption rate of e-bikes among Indians to 0.10% in 2019 over 2018.

- The spreading of COVID cases and growth in the wave affected the bicycle business positively. Factors such as not using public or rented transportation to maintain social distancing have changed the commuting methods of the consumer, further encouraging people to invest in e-bikes, as it is one of the convenient and price-friendly options over other modes of commuting daily to offices and nearby places. Such factors accelerated the adoption rate by 0.60% in 2022 over 2021 across the country.

- E-bike adoption has increased with the return of commercial operations and the lifting of trade barriers of lockdown. The country's import and export activities have improved as a result of the removal of trade restrictions. The adoption rate for e-bikes is anticipated to increase to 5.00% in 2029 from 0.60% in 2022 as a result of customer attraction to e-bikes due to their features and advantages, such as fuel saving and time-saving.

India shows a steady increase in the percentage of population commuting 5-15 km daily, indicating evolving travel distances.

- People in various cities have embraced the bicycle culture, and the demand for bicycles in India has increased over the past few years. However, commuter travel of 5-15 kilometers is still relatively low compared to other modes of transportation, as most people prefer to travel via various modes such as two-wheelers and public transportation. Less than 5% of the population chose to commute via bicycles to nearby places within 5-15 kilometers in 2019. However, in 2020, traveling between 5 and 15 kilometers increased as many people started exercising and using bicycles to travel to nearby marketplaces for buying essentials during the lockdown. Such factors increased the demand for bicycles in India in 2020 over 2019.

- The pandemic had a significant and beneficial impact on the Indian bicycle market. More Indians walked or cycled instead of using public transportation to nearby places. The introduction of e-bikes with advanced features and longer battery lives also encouraged people to choose bicycles for exercising and recreational weekend activities, which further increased the number of commuters traveling 5-15 kilometers in India in 2021 over 2020.

- People developed the habit of using bicycles to commute to nearby places. Currently, many people travel daily by bicycle within a radius of 5-15 kilometers to get to various places such as local markets. Due to the increased health advantages, carbon-free commutes, and time savings from avoiding traffic bottlenecks, more people are choosing to commute by bicycle. These factors are expected to increase commuter travel between 5 and 15 kilometers in India during the forecast period.

India E-bike Industry Overview

The India E-bike Market is fairly consolidated, with the top five companies occupying 82.78%. The major players in this market are Alphavector (India) Pvt Ltd, Cultsport, EMotorad, Hero Cycles Limited and TREK BICYCLE INDIA PRIVATE LIMITED (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Bicycle Sales

- 4.2 GDP Per Capita

- 4.3 Inflation Rate

- 4.4 Adoption Rate Of E-bikes

- 4.5 Percent Population/commuters With 5-15 Km Daily Travel Distance

- 4.6 Bicycle Rental

- 4.7 E-bike Battery Price

- 4.8 Price Chart Of Different Battery Chemistry

- 4.9 Hyper-local Delivery

- 4.10 Dedicated Bicycle Lanes

- 4.11 Number Of Trekkers

- 4.12 Battery Charging Capacity

- 4.13 Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Pedal Assisted

- 5.1.2 Speed Pedelec

- 5.1.3 Throttle Assisted

- 5.2 Application Type

- 5.2.1 Cargo/Utility

- 5.2.2 City/Urban

- 5.2.3 Trekking

- 5.3 Battery Type

- 5.3.1 Lead Acid Battery

- 5.3.2 Lithium-ion Battery

- 5.3.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Alphavector (India) Pvt Ltd

- 6.4.2 Being Human

- 6.4.3 Cultsport

- 6.4.4 EMotorad

- 6.4.5 Hero Cycles Limited

- 6.4.6 Motovolt

- 6.4.7 Nibe E-motor Limited

- 6.4.8 SJ Electric Vehicles Pvt. Ltd (Polarity Smart Bikes)

- 6.4.9 Stryder

- 6.4.10 TREK BICYCLE INDIA PRIVATE LIMITED

- 6.4.11 Tru E Bikes Pvt. Ltd

7 KEY STRATEGIC QUESTIONS FOR E BIKES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219