|

市场调查报告书

商品编码

1690774

欧洲生质柴油 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Biodiesel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

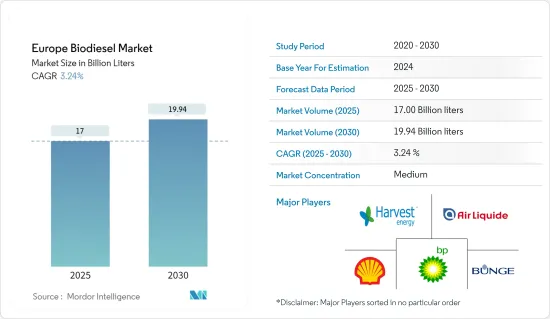

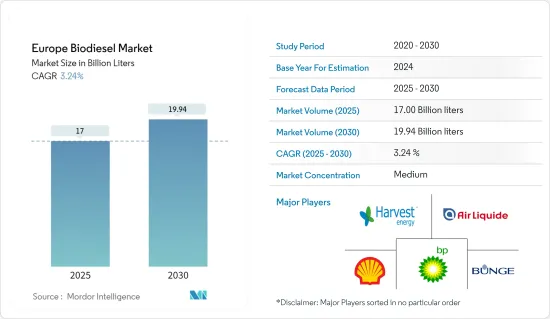

预计2025年欧洲生质柴油市场规模为170亿公升,到2030年将达到199.4亿升,预测期内(2025-2030年)的复合年增长率为3.24%。

关键亮点

- 从中期来看,预计政府支持政策法规和能源安全问题等因素将在预测期内推动市场发展。

- 另一方面,预测期内植物油和动物脂肪等原料的供应和价格预计将阻碍市场成长。

- 研究和开发工作主要集中在寻找生物柴油生产的替代原料。藻类和废油等先进原料具有提高永续性、减少土地影响和增加原料可用性的潜力,为生物柴油生产创造了新的机会。

- 预计在预测期内德国将占据市场主导地位。这是因为政府的政策支持它。

欧洲生质柴油市场趋势

棕榈油可望主导市场

- 棕榈油是世界上产量最广泛的植物油之一。印尼和马来西亚等主要棕榈油生产国拥有大片人工林和高效的提取工艺,从而拥有大量可靠的棕榈油供应。充足的供应使得棕榈油在可用性和成本方面比其他原料更具竞争优势。

- 棕榈油能量含量高,是生产生质柴油的高效原料。其高能量密度使得单位原料的生质柴油产量高,使生产具有成本效益。棕榈油的能源效率使其对生物柴油製造商具有吸引力,并可能为其带来市场优势。

- 此外,棕榈油具有低黏度和高润滑性等有利于生物柴油生产的特性。这些特性提高了生物柴油在柴油引擎中的性能,并使其与现有的柴油基础设施更加相容。棕榈油基生物柴油的优良性能使其具有极强的市场潜力和竞争力。

- 2021-2022年欧洲生质柴油进口量大幅增加。据Statista称,生物柴油进口总量增加了36%以上,显示该地区生物柴油消费量增加。

- 2022年12月,欧盟达成初步协议,将引入法规,要求企业提供证据证明其在欧盟销售的棕榈油和其他商品与森林砍伐无关。

- 因此,鑑于上述几点,棕榈油产业很可能在预测期内占据市场主导地位。

德国占据市场主导地位

- 德国推出了扶持政策和措施,推动包括生质柴油在内的可再生能源发展。该国制定了雄心勃勃的可再生能源目标,并为生物柴油生产提供财政奖励和补贴。这种支持鼓励了生物柴油产业的投资和成长,使德国成为关键参与企业。

- 德国以其先进的工程和技术专长而闻名。德国拥有强大的研发基础设施,使其能够开发和实施创新的生物柴油生产技术。德国公司在开发高效、经济的生物柴油生产流程方面处于领先地位,这使它们在市场上具有竞争优势。

- 2022 年 2 月,再生能源集团宣布计划增加其位于德国埃姆登的生物柴油精製的预处理能力。此次扩建的目的是为了能够获得可再生燃料原料,包括通常难以转化的原料。

- 德国拥有完善的生物柴油生产、分销和使用基础设施。该国拥有许多生物柴油生产厂、广泛的混合设施和加油站网路。现有的基础设施为德国生质柴油市场的成长和主导地位提供了坚实的基础。

- 2022年德国生质柴油消费量将为251.6万吨(约7.55亿加仑),低于2021年的256兆吨(约7.685亿加仑)。同时,混合乙醇的使用量将增加近2.9%,从115.3万吨(约3.86亿加仑)增加到118.6兆吨(约3.97亿加仑)。

- 因此,如上所述,德国很可能成为欧洲生质柴油市场的重要参与企业。

欧洲生质柴油产业概况

欧洲生质柴油市场呈半细分状态。市场上的主要企业(不分先后顺序)包括壳牌公司、英国石油公司、邦吉有限公司、液化空气集团和 Harvest Energy。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2028 年市场规模与需求预测

- 政府法规和政策

- 近期趋势和发展

- 市场动态

- 驱动程式

- 政府支持措施和政策

- 能源安全

- 限制因素

- 原料的供应和价格波动;

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 原料

- 菜籽油

- 棕榈油

- 废弃食用油

- 其他成分

- 生质柴油混合物

- B5

- B20

- B100

- 地区

- 德国

- 西班牙

- 英国

- 法国

- 其他欧洲国家

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Shell PLC

- BP PLC

- Bunge Limited

- Air Liquide SA

- Harvest Energy

- Abengoa Bioenergia SA

- Envien Group

- Greenergy International Ltd.

- GBF German Biofuels GMBH

第七章 市场机会与未来趋势

- 新型先进原料

简介目录

Product Code: 71558

The Europe Biodiesel Market size is estimated at 17.00 billion liters in 2025, and is expected to reach 19.94 billion liters by 2030, at a CAGR of 3.24% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as government-supportive policies and regulations and concerns over energy security are expected to drive the market during the forecasted period.

- On the other hand, the availability and price of feedstocks, such as vegetable oils and animal fats, are expected to hinder the market's growth during the forecasted period.

- Nevertheless, research and development efforts focus on finding alternative biodiesel production feedstocks. Advanced feedstocks, such as algae and waste oils, offer the potential for improved sustainability, reduced land-use impact, and increased feedstock availability, creating new opportunities for biodiesel production.

- Germany is expected to dominate the market during the forecasted period. Due to supportive government policies.

Europe Biodiesel Market Trends

Palm Oil Is Likely To Dominate The Market

- Palm oil is one of the most widely produced vegetable oils globally. Major palm oil-producing countries, such as Indonesia and Malaysia, have large-scale plantations and efficient extraction processes, leading to a significant and reliable palm oil supply. This abundant supply gives palm oil a competitive advantage in terms of availability and cost compared to other feedstocks.

- Palm oil has a high energy content, making it an efficient feedstock for biodiesel production. Its energy density allows for higher biodiesel yields per unit of feedstock, resulting in cost-effective production. The energy efficiency of palm oil contributes to its attractiveness for biodiesel manufacturers and can potentially drive its dominance in the market.

- Moreover, palm oil possesses favorable properties for biodiesel production, such as its low viscosity and high lubricity. These properties enhance the performance of biodiesel in diesel engines and make it compatible with existing diesel infrastructure. The favorable properties of palm oil-based biodiesel contribute to its market potential and competitiveness.

- The value of biodiesel imported into Europe has increased significantly between 2021 and 2022. According to Statista, the total import value for biodiesel increased by more than 36%, signifying increased biodiesel consumption in the regions.

- In December 2022, the European Union reached a preliminary agreement to introduce a regulation that would mandate companies to provide evidence that their palm oil and other commodities sold within the EU are not linked to deforestation.

- Therefore, per the points discussed above, the palm oil segment will likely dominate the market during the forecasted period.

Germany to Dominate the Market

- Germany has implemented supportive policies and regulations to promote renewable energy, including biodiesel. The country has ambitious renewable energy targets and offers financial incentives and subsidies for biodiesel production. This support encourages investment and growth in the biodiesel industry, positioning Germany as a key player.

- Germany is known for its advanced engineering and technological expertise. The country has a strong research and development infrastructure, enabling innovative biodiesel production technologies to be developed and implemented. German companies are at the forefront of developing efficient and cost-effective biodiesel production processes, giving them a competitive advantage in the market.

- In February 2022, Renewable Energy Group announced its plans to enhance the pretreatment capacity at its biodiesel refinery in Emden, Germany. This expansion aims to enable the processing of challenging feedstocks into renewable fuel feed, including those that are typically difficult to convert.

- Germany has a well-developed infrastructure for producing, distributing, and using biodiesel. The country has many biodiesel production plants, an extensive blending facility network, and fueling stations. This existing infrastructure provides a solid foundation for the growth and dominance of the biodiesel market in Germany.

- In 2022, Germany's biodiesel consumption amounted to 2.516 million metric tons (around 755 million gallons), decreasing from 2.560 million tons (approximately 768.5 million gallons) in 2021. In contrast, ethanol utilization in blends grew nearly 2.9 percent, rising from 1.153 million tons (386 million gallons) to 1.186 million tons (approximately 397 million gallons).

- Therefore, as per the points mentioned above, Germany is likely to be a significant player in the biodiesel market in Europe.

Europe Biodiesel Industry Overview

Europe's biodiesel market is semi fragmented. Some of the major players in the market (in no particular order) include Shell PLC, BP PLC, Bunge Limited, Air Liquide SA, Harvest Energy, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, until 2028

- 4.3 Government Policies and Regulations

- 4.4 Recent Trends and Developments

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Supportive Policies and Regulations

- 4.5.1.2 Energy Security

- 4.5.2 Restraints

- 4.5.2.1 Feedstock Availability and Price Volatility

- 4.5.1 Drivers

- 4.6 Supply-Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Feedstock

- 5.1.1 Rapeseed Oil

- 5.1.2 Palm Oil

- 5.1.3 Used Cooking Oil

- 5.1.4 Other Feedstocks

- 5.2 Biodiesel Blends

- 5.2.1 B5

- 5.2.2 B20

- 5.2.3 B100

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 Spain

- 5.3.3 United Kingdom

- 5.3.4 France

- 5.3.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Shell PLC

- 6.3.2 BP PLC

- 6.3.3 Bunge Limited

- 6.3.4 Air Liquide SA

- 6.3.5 Harvest Energy

- 6.3.6 Abengoa Bioenergia SA

- 6.3.7 Envien Group

- 6.3.8 Greenergy International Ltd.

- 6.3.9 GBF German Biofuels GMBH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Advanced Feedstocks

02-2729-4219

+886-2-2729-4219