|

市场调查报告书

商品编码

1690781

美国资料中心建置:市场占有率分析、产业趋势与成长预测(2025-2030 年)United States (US) Data Center Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

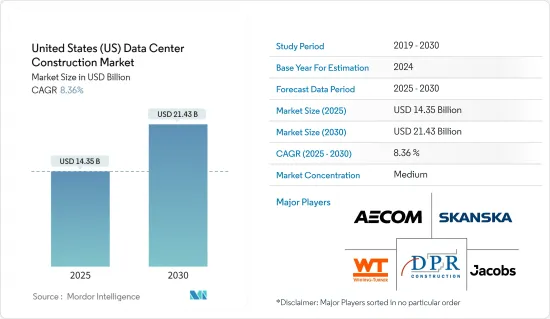

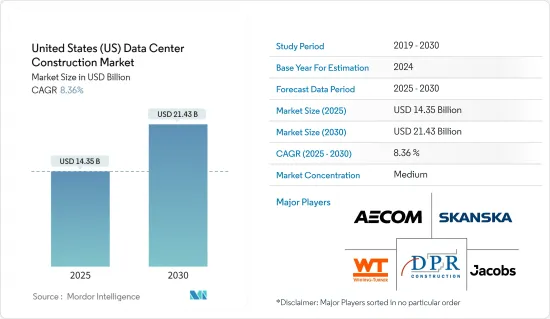

美国资料中心建设市场规模预计在2025年为143.5亿美元,预计到2030年将达到214.3亿美元,预测期内(2025-2030年)的复合年增长率为8.36%。

关键亮点

- 美国市场最为成熟,在成长和营运方面均呈现稳定成长。美国资料中心建设市场的成长归因于物联网的日益普及、5G网路的市场开放以及企业对云端基础的服务的采用。各行各业数位化的采用将促进主机託管、云端、互联网和通讯提供商增加资料中心投资,以及对线上娱乐内容高速串流媒体的需求。

- 由于机架功率密度的提高、与其他国家连接性的改善、资料中心微电网的安装、5G 连接、边缘资料中心技术以及新的 UPS 电池技术,该国的资料中心市场预计将成长。

- 美国政府正在透过一系列措施鼓励资料中心投资,包括确保开发土地、降低电费、鼓励购买可再生能源等。

- 例如,亚利桑那州为在其对外贸易区开展业务的公司提供各种激励措施。贸易区内的企业可享有 72.9% 的州不动产税和动产税减免。这些措施可能会促进未来十年美国资料中心建设市场的成长。

- 儘管需求不断增长,但资料中心产业在满足高需求方面仍面临许多挑战。与许多其他房地产行业一样,资料中心产业也因供应链中断而面临新建筑建设延误的问题。人事费用、建材和其他成本的增加也推高了资本支出。

- COVID-19 疫情给各行业的经济带来了额外压力,也凸显了资料中心所能提供的云端基础的工作环境的价值和潜力。在新冠疫情期间,53% 的美国人表示网路至关重要。这使得该国使用更多的资料中心。

美国资料中心建设市场趋势

UPS系统引领电力基础设施领域

- 不断电系统(UPS) 系统对于资料中心至关重要,以确保伺服器和所有敏感运算设备不受电源线波动和电能品质问题的影响。断电导致资料中心停机,影响资料中心效率。 UPS 系统还可以帮助在停电时自动保存宝贵的资料。平均而言,UPS 系统提供 8-10 分钟的备用时间。

- 近期,该国恶劣天气导致资料中心营运中断。 2024年1月至3月,美国遭遇冰冻天气,影响了加州和德克萨斯州电网的发电能力和运作。此次停电给该州的资料中心运作带来了问题。使用UPS系统有助于减少因天气变化而造成的此类损害。由于全国各地的各种企业都依赖资料中心,不断电系统至关重要。

- 由于寿命长、体积小等多种因素,资料中心倾向采用锂离子 UPS 系统。该国资料中心能源消耗的增加正在推动锂离子UPS系统的采用。

- 根据劳伦斯伯克利国家实验室的数据,超大规模资料中心通常需要每个机架 10-14kW,但对于配备资源丰富的 GPU 的支援 AI 的机架,这一数字将上升到 40-60kW。这意味着美国资料中心的总消费量将从 2022 年的 17GW 成长到 2030 年的 35GW。锂离子 UPS 系统将彻底改变大型和小型资料中心的 UPS 系统。

- 政府也采取新措施解决资料中心的能源消耗问题,鼓励引入模组化UPS系统。美国政府在2.3兆美元的2021年综合拨款法案中列入了资料中心的能源效率目标和指标。该法案还要求对资料中心的能源和水消耗以及提高此类资料效率的方法进行新的研究。

- 管理资料中心的财务影响也很大,因为资料中心将其营运费用的 30% 到 50% 用于电力。根据美国美国资源保护委员会预测,到2023年,北维吉尼亚资料中心的总合电力消耗容量将达到2.6GW,位居全球第一。据Cloudscene称,美国拥有全球最多的资料中心,数量为5,381个,而上年度为5,375个。

医疗领域将经历显着成长

- 透过电子健康记录(EMR)实现医疗记录数位化,为大量资料的产生做出了重大贡献。医疗设备的最新技术创新和传统操作系统的现代化(例如改进的劳动力管理和患者护理系统)正在产生大量资料,并进一步增加了对安全资料中心的需求。

- 物联网等技术在医疗保健领域有许多应用,从远端监控到医疗设备整合。它还可以让患者更健康、更安全,并改善医生的照护方式。然而,感测器、穿戴式装置、远端监视器和其他医疗设备正在产生大量资料。

- 远端医疗在美国的使用日益增多,因为它具有多种优势,包括允许任何地区的消费者联繫他们需要的医生。这是透过改变通常安排的咨询来节省金钱和时间的有效方法,这反过来又会产生大量资料,突出资料中心和资料中心建设计划的必要性。

- 根据美国卫生研究院的数据,2020 年 3 月至 2022 年 2 月期间,进行了超过 85 万次远端医疗,其中约 62% 透过视讯进行,约 38% 透过电话进行。根据《製药业高管》对 398 名医疗保健专业人士的调查,即使在冠状病毒 (COVID-19) 大流行之后,预计仍有近 20% 的患者预约将透过远端医疗进行。

- 从技术层面来看,医学影像和基因组研究的进步正在带来新型更大文件尺寸的出现。这些因素正在促进医疗保健产业资料量的增加,推动预测期内该地区资料中心建设的发展。

- 此外,政府继续认识到数位健康和技术创新在医疗保健中的作用,将其作为成功医疗保健基础设施的重要组成部分。该国政府在推动卫生部门技术进步方面取得了长足进步,并不断增加卫生支出以支持卫生部门的发展。例如,根据美国精算师办公室(CMS)的资料,美国全国医疗保健支出预计将从 2021 年的 4.29 兆美元增长到 2030 年的 6.751 兆美元。

美国资料中心建设市场概况

美国资料中心建设市场半固体,主要参与者包括 AECOM、Whiting-turner Contracting Company、Jacobs Solutions Inc.、DPR Construction 和 Skanska USA。市场参与企业正在采取收购和联盟等各种策略来丰富其产品阵容并保持市场竞争力。

- 2024年3月,瑞典着名建筑开发公司Skanska宣布已在美国维吉尼亚州签署了新契约。

- 2024 年 1 月,Google的完全子公司Design LLC 选择了位于马里兰州巴尔的摩的 Whiting Turner Contracting 公司在奥勒冈州瓦斯科县建造一个价值 6 亿美元的资料中心。拟建的这座占地 29 万平方英尺的工厂是俄亥俄州、爱荷华州、密苏里州和亚利桑那州一系列类似投资的一部分。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 市场动态

- 市场驱动因素

- 云端应用、人工智慧和巨量资料的成长

- 超大规模资料中心的采用率不断提高

- 市场限制

- 房地产成本上涨

- 市场驱动因素

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 美国主要资料中心建设统计数据

- 美国资料中心数量

- 美国在建资料中心(单位:兆瓦)

- 美国资料中心建设的平均资本支出和营运支出

- 资料中心电力吸收能力(MW)(美国选定城市)

- COVID-19 市场影响评估

第五章市场区隔

- 按基础设施

- 电力基础设施

- UPS系统

- 其他电力基础设施

- 机械基础设施

- 冷却系统

- 架子

- 其他机械基础设施

- 一般建筑

- 电力基础设施

- 按层级类型

- 层级和二级

- 第三层级

- IV层级

- 按最终用户

- 银行、金融服务和保险

- 资讯科技/通讯

- 政府和国防

- 医疗保健

- 其他的

第六章 竞争格局

- 公司简介

- AECOM

- Whiting-turner Contracting Company

- Jacobs Solutions Inc.

- DPR Construction

- Skanska USA

- Balfour Beatty US

- Hensel Phelps

- McCarthy Building Companies Inc.

- Gilbane Building Company

- Brasfield & Gorrie LLC

第七章投资分析

第八章 市场机会与未来趋势

The United States Data Center Construction Market size is estimated at USD 14.35 billion in 2025, and is expected to reach USD 21.43 billion by 2030, at a CAGR of 8.36% during the forecast period (2025-2030).

Key Highlights

- The US market is the most mature and shows steady growth in terms of growth and operations. The growth of the US data center construction market is attributed to the increasing adoption of IoT, the development of 5G networks, and the adoption of cloud-based services by businesses. Adopting digitalization across industries would contribute to a rise in data center investments by colocation, cloud, internet, and telecommunication providers, as well as the demand for the streaming of online entertainment content at high speeds.

- The country's data center market is expected to grow owing to a rise in rack power density, connectivity improvements with other nations, the installation of microgrids in data centers, 5G connectivity, edge data center technology, and new UPS battery technologies.

- The US government is encouraging data center investments by a various means, including increasing the availability of land for development, lowering electricity tariffs, and encouraging the procurement of renewable energy.

- For example, Arizona state offers various incentives to businesses that operate in the foreign trade zone. Businesses in a trade zone are entitled to a 72.9% exemption in state real and personal property taxes. Consequently, such initiatives would contribute to the growth of the data center construction market in the United States over the next decade.

- Despite the escalating demand, the data center industry is found to be prone to some challenges when it comes to satisfying high demand. The data center industry faces new construction delays due to supply chain disruptions, as in many other real estate verticals. Increasing labor, building materials, and other costs have also boosted capital expenditures.

- The COVID-19 pandemic placed additional pressure on the overall economy across sectors and highlighted the value and potential of the cloud-based work environment provided by data centers. During the COVID-19 pandemic, 53% of Americans said that the internet had been vital. This has increased the use of more data centers in the country.

United States (US) Data Center Construction Market Trends

UPS Systems to Lead the Electrical Infrastructure Segment

- An uninterruptible power supply (UPS) system is imperative for data centers to ensure that servers and all sensitive computing equipment are never susceptible to power line fluctuations and power quality issues. Any power failure can result in data center downtime, affecting the data center's efficiency. UPS systems also assist in saving valuable data automatically during a power outage. On average, a UPS system offers backup for 8-10 minutes.

- Lately, the unfavorable weather conditions in the country have caused interruptions in data center operations. From January 2024 to March 2024, the country was hit by freezing weather, which affected the grid generation capacity and operating frequency of California and Texas. The disruption in the power supply led to issues with the state's operation of data centers. The adoption of UPS systems results in mitigating such damages by weather changes. Various companies nationwide rely on data centers, which makes an uninterrupted power source crucial.

- There is a trend in adopting lithium-ion UPS systems in data centers due to several factors, such as longer life, small form factor, etc. The increasing consumption of energy by data centers in the country has been promoting the adoption of lithium-ion UPS systems.

- As per the Lawrence Berkeley National Laboratory, while the hyperscalers typically need 10-14 kW per rack in existing data centers, this is likely to rise to 40-60 kW for AI-ready racks equipped with resource-equipped GPUs. This means that overall consumption of data centers across the United States is expected to reach 35 GW by 2030, up from 17 GW in 2022. Lithium-ion UPS systems are set to revolutionize UPS systems for large and micro data centers.

- The government has also been taking new initiatives toward energy consumption by data centers, triggering modular UPS systems. In the USD 2.3 trillion-backed Consolidated Appropriations Act 2021, the US government included data center energy efficiency targets and metrics. The act calls for a new study on energy and water consumption by data center use and ways to improve the efficiency of such data centers.

- The financial impact for data center management is also huge as a data center spends between 30% and 50% of its operational expenditure on electricity. According to the United States National Resources Defense Council, the combined electricity consumption capacity of data centers in Northern Virginia, United States, amounted to 2.6 GW in 2023, the highest globally. According to Cloudscene, the United States also has the largest number of data centers globally with 5381 currently ccompared to 5375 data centers in the previous year.

Healthcare Sector to Witness Major Growth

- Digitization of consumer health records in the form of electronic medical records (EMR) has significantly contributed to massive data generation. The latest innovations in the medical equipment and the modernization of legacy operating systems, such as management of personnel and improvement in patient response systems, generate multitude of data, further boosting the demand for secured data centers.

- Technologies like IoT have a lot of applications in healthcare, from remote monitoring to medical device integration. It has also potential to keep patients healthy and safe and improve how physicians deliver care. However, a massive amount of data is being produced by sensors, wearables, remote monitors, and other medical devices.

- Telemedicine is increasing in usage in the United States, owing to various advantages, such as consumers from any region being able to gain access to required doctors. It is an efficient method, as both money and time are being saved due to the change in typically scheduled visits, thereby generating a lot of data and thus emphasizing the need for data centers and data center construction initiatives.

- As per the National Institutes of Health, between March 2020 and February 2022, more than 850,000 telemedicine visits occurred, with approximately 62% of visits by video and 38% by telephone. Besides, according to a survey of 398 healthcare professionals conducted by the Pharmaceutical Executive magazine, it has been predicted that after the coronavirus (COVID-19) pandemic, almost 20% of patient appointments will still be conducted via telemedicine compared to 2% beforehand and 61% perhaps during the pandemic.

- At the technical level, advances in medical imaging and genomic research are introducing new types of file types that are larger in size. These factors contribute to the increasing amount of data in the healthcare industry, which boosts the data center construction developments in the region during the forecast period.

- Moreover, the government of the country continuously recognizes the role of digital health and technological innovation in healthcare as an integral part of successful healthcare infrastructure. The government is making significant strides to make the healthcare sector technologically advanced and continuously increasing its healthcare expenditure to support the healthcare sector. For instance, according to the data from CMS (Office of the Actuary), the forecasted U.S. national health expenditure was expected to reach USD 6.751 trillion in 2030 from USD 4.29 trillion in 2021.

United States (US) Data Center Construction Market Overview

The US data center construction market is semi-consolidated with the presence of major players like AECOM, Whiting-turner Contracting Company, Jacobs Solutions Inc., DPR Construction, and Skanska USA. The market players are adopting various strategies, including acquisitions and partnerships to enhance their product offerings and remain competitive in the market.

- In March 2024, Sweden-based Skanska, a prominent construction and development company, announced a new contract worth approximately USD 242 million in Virginia, the United States.

- In January 2024, Design LLC, a wholly-owned subsidiary of Google, selected Baltimore, Maryland, based Whiting-Turner Contracting Co. to build a USD 600 million data center in Wasco County, Oregon. The facility is planned for 290,000 sq. ft. and will be the latest in a string of similar investments in Ohio, Iowa, Missouri, and Arizona.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Growing Cloud Applications, AI, and Big Data

- 4.2.1.2 Rising Adoption of Hyperscale Data Centers

- 4.2.2 Market Restraints

- 4.2.2.1 Increase in Real Estate Costs

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Key United States Data Center Construction Statistics

- 4.4.1 Number of Data Centers in the United States

- 4.4.2 Data Center Under Construction in the United States, in MW

- 4.4.3 Average Capex and Opex for the United States Data Center Construction

- 4.4.4 Data Center Power Capacity Absorption, in MW, Selected Cities, United States

- 4.5 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Infrastructure

- 5.1.1 Electrical Infrastructure

- 5.1.1.1 UPS Systems

- 5.1.1.2 Other Electrical Infrastructure

- 5.1.2 Mechanical Infrastructure

- 5.1.2.1 Cooling Systems

- 5.1.2.2 Racks

- 5.1.2.3 Other Mechanical Infrastructure

- 5.1.3 General Construction

- 5.1.1 Electrical Infrastructure

- 5.2 By Tier Type

- 5.2.1 Tier-I and -II

- 5.2.2 Tier-III

- 5.2.3 Tier-IV

- 5.3 By End User

- 5.3.1 Banking, Financial Services, and Insurance

- 5.3.2 IT and Telecommunications

- 5.3.3 Government and Defense

- 5.3.4 Healthcare

- 5.3.5 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AECOM

- 6.1.2 Whiting-turner Contracting Company

- 6.1.3 Jacobs Solutions Inc.

- 6.1.4 DPR Construction

- 6.1.5 Skanska USA

- 6.1.6 Balfour Beatty US

- 6.1.7 Hensel Phelps

- 6.1.8 McCarthy Building Companies Inc.

- 6.1.9 Gilbane Building Company

- 6.1.10 Brasfield & Gorrie LLC