|

市场调查报告书

商品编码

1685882

资料中心建置:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Data Center Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

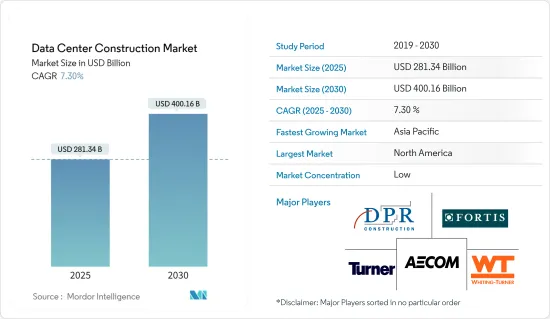

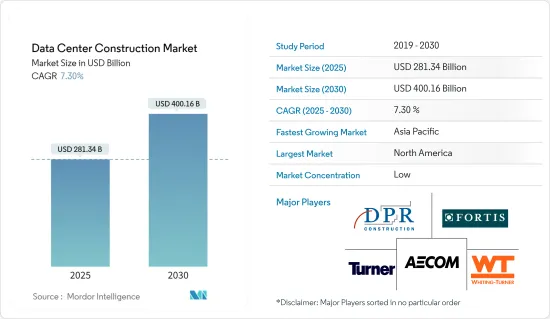

2025年资料中心建设市场规模估计为2,813.4亿美元,预计2030年将达到4,001.6亿美元,预测期间(2025-2030年)的复合年增长率为7.3%。

主要亮点

- 在建IT负载容量:预计到2029年全球资料中心市场即将到来的IT负载容量将超过73,000MW。

- 在建架空地板面积:预计到 2029 年,全球架空地板面积将超过 2.85 亿平方英尺。

- 计画安装的机架:预计到 2029 年安装的机架总数将超过 1,400 万台。预计到 2029 年,北美将安装最多的机架。

- 世界各地正在建造超大规模资料中心来储存大量资料,为企业创造丰厚的利润机会。许多产业正在转向超大规模资料中心来增加运算能力、记忆体、网路能力和储存资源。有效地大规模扩展计算工作负载的能力以及支援资料中心的实体基础设施和分发系统是超大规模资料中心的众多组成部分中的两个。

- 此外,根据 Flexera 2023 年云端运算状况报告,72% 的企业受访者表示他们已在业务中采用了混合云。转向混合云端解决方案通常以运行私有云端云和公共云端为代价。

资料中心建设市场趋势

第四层级资料中心设施的日益普及将推动市场成长

- Tier-IV 认证目前是资料中心设施的最高等级。这些设施与美国政府使用的资料中心相当。它安全、可靠且冗余。 Tier-IV 提供者在所有流程和资料保护流中均具有冗余(2N+1)。任何单一的中断或错误都不会导致系统崩溃,每年可提供 99.995% 的运转率。但是,IV 级基础设施必须拥有至少 96 小时的独立电力才有资格达到此层级。此电源必须完全专用,且不能连接到任何外部电源。

- 这种层次结构也确保了最佳效率。伺服器被放置在最有利的实体位置。保持温度和湿度恆定将大大延长硬体的使用寿命。甚至备份和冗余电源也被视为主要讯息。 层级 IV资料中心需要高达 3:1 的空间比例来容纳其 IT 空间。对于层级 IV,IT 冗余 UPS 容量的千瓦成本部分为 25,000 美元/kWh。

- 此外,各公司正在投资超大规模资料中心,这推动了该领域的成长。例如,中东和北非最大的超大规模 Tier 4资料中心网路 Kazuna 资料中心(Kazuna)于 2023 年 5 月宣布计划与埃及领先的综合解决方案、数位化转型和 ICT 基础设施供应商 Benya 集团合作进入中东和非洲以及埃及区域市场。这个耗资 2.5 亿美元的全新先进资料中心将成为埃及首个超大规模资料中心,并将建于埃及首个专门投资区马迪科技园区。

- 2023 年 7 月,领先的营运商和云端中立资料中心、互连和主机託管解决方案供应商 Digital Realty 宣布与 GI Partners 合作成立一家实体,出售两栋稳定的超大规模资料Tier 4 中心大楼 65% 的权益。该公司预计将从合资企业和相关融资中获得约7.43亿美元的总收益。

- 随着人工智慧、物联网、5G等技术进步引领数位转型,政府、金融、媒体、製造等各行各业都开始需要高可靠、先进的资料中心。该地区的知名技术供应商利用其多年的专业知识,推出服务来帮助最终用户更好地管理资料中心营运。

北美占很大份额

- 北美在全球资料中心建设市场占据主导地位。强劲的经济和先进的网路基础设施是推动市场扩张的关键因素。美国在该地区市场占据主导地位,拥有许多重要的云端服务供应商,包括亚马逊、Google和 Facebook。由于这些公司投资建造大型资料中心以增加资料储存和处理能力,市场前景庞大。

- 此外,对资料安全和隐私的需求不断增加,也推动了对资料中心的需求。根据身分盗窃资源中心的数据,2022 年美国发生了 1,802 起资料外洩事件。然而,同年约有 4.22 亿人受到资料外洩的影响,包括资料外洩、破坏和暴露。这是三个不同的事件,但它们有一个共同的特征。未经授权的恶意行为者可以在三种情况下存取敏感资料:随着资料外洩和网路威胁的增加,组织和企业正在寻找只有先进的资料中心才能提供的安全可靠的资料处理和储存解决方案。

- 预计美国将占很大份额。该国新资料中心的兴起可能会推动市场的发展。例如,波兰软体公司 Comarch 于 2023 年 5 月在亚利桑那州凤凰城开设了一个 32,000 平方英尺(3,000平方公尺)的资料中心。新资料中心预计将从其宣布的当年起全面运作。提案的资料中心将由四个伺服器机房组成,共有 160 个机架,并将提供託管服务、主机託管、云端託管、灾难復原和备份服务等服务。也计划提供 Meet Me Rooms (MMR)。这些发展为美国资料中心电力市场创造了成长机会。

- 此外,2024 年 1 月,Vertiv Group Corp. 宣布,自 2021 年收购 E&I Engineering 和 PowerBar Gulf LLC 的开关设备、母线槽和 IMS 业务以来,其开关设备、母线槽和整合模组化解决方案 (IMS) 业务的生产能力已提高 100% 以上,并计划进一步扩建设施。

- 北美通讯业者和商业技术经销商对整合通讯即服务(UCaaS) 解决方案的需求也在推动市场成长。为了最大限度地提高 MSP、VAR、ISP 和互连商的系统弹性,SkySwitch 等公司从地理位置不同的站点提供白牌UCaaS。

资料中心建设产业概况

资料中心建设市场较为分散,由几家大型企业组成。随着技术进步和产品创新,许多公司透过赢得新契约和探索竞争激烈的新市场来扩大其市场影响力。主要公司包括 AECOM、Whiting-Turner Contracting Company 和 DPR Construction。

2023 年 5 月,欧洲资料中心营运和投资领域的法国领导者 Data4 集团宣布将在法国埃松省诺泽的原诺基亚工厂上建造一个新的资料中心园区。该计划预计到 2030 年投资约 10 亿欧元,旨在振兴 22 公顷的工业和办公空间,并强调该集团在巴黎的强大影响力。

2023年4月,微软宣布将在波兰开设其在中东欧地区首个值得信赖的现代化云端中心。微软波兰云端区域由华沙周围的三个实体位置组成,每个位置由一个或多个资料中心组成。这可确保资料储存在遵守最高安全、隐私和监管合规标准的国家/地区。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

- 研究框架

- 二次调查

- 初步调查

- 资料三角测量与洞察生成

第三章执行摘要

第四章 市场洞察

- 市场概览

- 市场动态

- 市场驱动因素

- 云端应用、人工智慧和巨量资料的成长

- 超大规模资料中心的采用率不断提高

- 市场限制

- 房地产成本上涨,安装和维修成本飙升

- 市场驱动因素

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 全球主要资料中心建设专案统计

- 全球资料中心数量(2023年)

- 在建资料中心数量(2024-2029)

- 全球资料中心建置平均资本支出与资本支出

- 2022 年及 2023 年各地区资料中心容量吸收量(MW)

- 全球投资资料中心基础设施的顶级公司

第五章市场区隔

- 市场区隔-按基础设施

- 市场区隔-电力基础设施

- 配电解决方案

- PDU - 基本型和智慧型 - 计量和开关解决方案

- 传输开关

- 静止的

- 自动(ATS)

- 开关设备

- 低压

- 高压

- 电源面板和组件

- 其他的

- 电源备援解决方案

- UPS

- 发电机

- 服务——设计与咨询、整合、支援与维护

- 市场区隔-按机械基础设施

- 冷却系统

- 浸入式冷却

- 直接晶片冷却

- 后门热交换器

- 行内和机架内冷却

- 架子

- 其他机械基础设施

- 整体结构

- 市场区隔-电力基础设施

- 市场区隔-依层级类型

- 层级和二级

- 第三层级

- IV层级

- 市场区隔:按最终用户

- 银行、金融服务和保险

- 资讯科技/通讯

- 政府和国防

- 卫生保健

- 其他最终用户

- 市场区隔-按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

第六章竞争格局

- 公司简介

- AECOM

- Whiting-turner Contracting Company

- Turner Construction Co.

- Jacobs Solutions Inc.

- DPR Construction

- Skanska USA

- Balfour Beatty US

- Hensel Phelps

- PT Jaya Obayashi

- Hibiya Engineering Ltd

- Goodman Group

- Fortis Construction Inc.

第七章投资分析

第八章 市场机会与未来趋势

第九章:关于出版商

The Data Center Construction Market size is estimated at USD 281.34 billion in 2025, and is expected to reach USD 400.16 billion by 2030, at a CAGR of 7.3% during the forecast period (2025-2030).

Key Highlights

- Under Construction IT Load Capacity: The upcoming IT load capacity of the Global data center market is expected to reach above 73,000 MW by 2029.

- Under Construction Raised Floor Space: The global construction of raised floor areas is expected to exceed 285 million sq. ft. by 2029.

- Planned Racks: The total number of racks to be installed is expected to reach more than 14 million units by 2029. North America is expected to house the maximum number of racks by 2029.

- Hyper-scale data centers are being built more often worldwide to store massive volumes of data, opening up lucrative opportunities for business players. Many industries use hyper-scale data centers to increase computing power, memory, networking capabilities, and storage resources. The ability to effectively scale up computer workloads at a large scale and the physical infrastructure and distribution systems supporting the data centers are two of the many components of hyper-scale data centers.

- Moreover, According to Flexera State of the Cloud Report 2023, 72% of companies' respondents stated they had deployed a hybrid cloud in their business. Migrating to hybrid cloud solutions often comes at the expense of operating private and public clouds.

Data Center Construction Market Trends

Growing Adoption of Tier 4 Data Center Facilities is Driving the Market's Growth

- The Tier-IV certification is currently the highest classification among data center facilities. These facilities are equivalent to data centers used by the US government. They are highly secure, reliable, and redundant. Tier-IV providers have redundancies (2N+1) for every process and the data protection stream. No single outage or error can shut down the system, and it provides 99.995% uptime per annum, which is the highest guaranteed uptime. However, the level IV infrastructure should have at least 96 hours of independent power to qualify for this tier. This power must not be connected with any outside source and is entirely proprietary.

- This tier also ensures optimized efficiency. The servers are housed in the most physically advantageous locations. This drastically extends the life of the hardware if temperature and humidity levels are kept consistent. Even the backups and dual power sources are treated like primaries. The Tier-IV data center can require up to 3 to 1 of the space required to facilitate the IT footprint. For tier IV, the kW Cost Component is USD 25,000/kW of redundant UPS capacity for IT.

- Moreover, market players are investing in hyperscale data centers, which is, in turn, driving segment growth. For instance, in May 2023, Kazuna Data Centers (Kazuna), the largest hyperscale Tier 4 data center network in the Middle East and North Africa, announced its plans to partner with Benya Group, a leading provider of integrated solutions, digital transformation, and ICT infrastructure in Egypt to enter the markets of the Middle East and Africa and Egypt region. The new USD 250 million state-of-the-art data center will be Egypt's first hyperscale data center built in Maadi Technology Park, Egypt's first dedicated investment area.

- In July 2023, Digital Realty, a leading provider of carrier- and cloud-neutral data center, interconnection, and colocation solutions, announced its partnership with GI Partners in order to start a corporation for the sale of a 65% interest in two hyperscale data Tier 4 center buildings, which are stabilized. The company will receive around USD 743 million in gross proceeds from the joint venture and the associated financing.

- As with technological advancements such as AI, IoT, and 5G leading the digital transformation, various industry sectors, such as government, finance, media, and manufacturing, are starting to demand advanced data centers with high reliability. A few prominent technological vendors in the region, leveraging their years of expertise, are launching services that allow the end user to manage data center operations better.

North America Accounts for a Major Share

- North America dominates the global market for building data centers. A strong economy and cutting-edge network infrastructure are critical drivers for the market's expansion. The United States dominates the regional market and has many significant cloud service providers, including Amazon.com, Google Inc., and Facebook. These businesses invest in building massive data centers and increased data storage and processing capabilities, which present enormous market prospects.

- Furthermore, the growing demand for data security and privacy is driving the demand for data centers. According to the Identity Theft Resource Center, the count of data breaches in the United States in 2022 was 1,802. However, around 422 million individuals were affected by data breaches in the same year, including data leaks, breaches, and exposures. Although these are three separate events, they have one feature. An unauthorized malicious actor can access sensitive data under three circumstances. With the rise of data breaches and cyber threats, organizations and businesses seek secure and reliable data handling and storage solutions that only advanced data centers can offer.

- The United States is analyzed to hold a significant share. The rise in the new data centers in the country would drive the market. For instance, in May 2023, Polish software organization Comarch launched a data center of around 32,000 square feet (3,000 sqm) in the city of Phoenix, Arizona. The new data center is anticipated to be fully active starting the year of its announcement. The proposed data center comprises four server rooms with 160 racks and is expected to offer services with managed services, colocation, cloud hosting, disaster recovery, and backup services. It is also projected to provide meet-me rooms (MMR). Such developments are creating growth opportunities for the data center power market in the United States.

- Moreover, in January 2024, Vertiv Group Corp. announced that it increased the production capacity of its switchgear, busway, and integrated modular solutions (IMS) business by more than 100% since it acquired E&I Engineering and PowerBar Gulf LLC, switchgear, busway, and IMS business in 2021 and further, it is planning to expand its existing facilities through the end of 2025.

- The demand for Unified Communications-as-a-Service (UCaaS) solutions from telecom and business technology resellers in North America is also a factor in the market's expansion. To maximize system resilience to MSPs, VARs, ISPs, and interconnects, a player like SkySwitch offers white-label UCaaS from geographically varied sites.

Data Center Construction Industry Overview

The data center construction market is fragmented, consisting of several major players. With technological advancements and product innovations, many companies are increasing their presence in the market by securing new contracts and tapping new markets that cater to an intense rivalry. A few of the key players are AECOM, Whiting-Turner Contracting Company, and DPR Construction.

May 2023: Data4 Group, the French leader in data center operations and investments in Europe, announced that it would build a new data center campus on the former Nokia site in Nosee, Essonne, France. The project, which plans to invest around EUR 1 billion by 2030, aims to revitalize 22 hectares of industrial and office land and underscore the Group's strong presence in Paris.

April 2023: Microsoft announced the opening of its newest trusted cloud center in Poland, which will be the first in Central and Eastern Europe. Microsoft Poland's cloud region consists of three physical locations around Warsaw, each consisting of a single or several data centers. It ensures that data are stored in a country that is in compliance with the highest standards of security, privacy, and regulatory compliance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Growing Cloud Applications, AI, and Big Data

- 4.2.1.2 Rising Adoption of Hyperscale Data Centers

- 4.2.2 Market Restraints

- 4.2.2.1 Rising Real Estate Cost Coupled with High Cost of Installment and Maintenance

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Key Global Data Center Construction Statistics

- 4.4.1 Number of Data Centers, Global, 2023

- 4.4.2 Data Center Under Construction, Global, n MW, 2024 - 2029

- 4.4.3 Average Capex and Opex For the Global Data Center Construction

- 4.4.4 Data Center Power Capacity Absorption in MW, Selected Region, 2022 and 2023

- 4.4.5 The Top CAPEX Spenders on Data Center Infrastructure in the World

5 MARKET SEGMENTATION

- 5.1 Market Segmentation - By Infrastructure

- 5.1.1 Market Segmentation - Electrical Infrastructure

- 5.1.1.1 Power Distribution Solution

- 5.1.1.1.1 PDU - Basic & Smart - Metered & Switched solutions

- 5.1.1.1.2 Transfer Switches

- 5.1.1.1.2.1 Static

- 5.1.1.1.2.2 Automatic (ATS)

- 5.1.1.1.3 Switchgear

- 5.1.1.1.3.1 Low-voltage

- 5.1.1.1.3.2 Medium-voltage

- 5.1.1.1.4 Power Panels and Components

- 5.1.1.1.5 Others

- 5.1.1.2 Power Back up Solutions

- 5.1.1.2.1 UPS

- 5.1.1.2.2 Generators

- 5.1.1.3 Service - Design & Consulting, Integration, Support & Maintenance

- 5.1.2 Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1 Cooling Systems

- 5.1.2.1.1 Immersion Cooling

- 5.1.2.1.2 Direct-To-Chip Cooling

- 5.1.2.1.3 Rear Door Heat Exchanger

- 5.1.2.1.4 In-row and In-rack Cooling

- 5.1.2.2 Racks

- 5.1.2.3 Other Mechanical Infrastructure

- 5.1.3 General Construction

- 5.1.1 Market Segmentation - Electrical Infrastructure

- 5.2 Market Segmentation - By Tier Type

- 5.2.1 Tier-I and II

- 5.2.2 Tier-III

- 5.2.3 Tier-IV

- 5.3 Market Segmentation - By End User

- 5.3.1 Banking, Financial Services, and Insurance

- 5.3.2 IT and Telecommunications

- 5.3.3 Government and Defense

- 5.3.4 Healthcare

- 5.3.5 Other End Users

- 5.4 Market Segmentation - By Region

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.5 Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AECOM

- 6.1.2 Whiting-turner Contracting Company

- 6.1.3 Turner Construction Co.

- 6.1.4 Jacobs Solutions Inc.

- 6.1.5 DPR Construction

- 6.1.6 Skanska USA

- 6.1.7 Balfour Beatty US

- 6.1.8 Hensel Phelps

- 6.1.9 PT Jaya Obayashi

- 6.1.10 Hibiya Engineering Ltd

- 6.1.11 Goodman Group

- 6.1.12 Fortis Construction Inc.