|

市场调查报告书

商品编码

1690814

HIPPS:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)HIPPS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

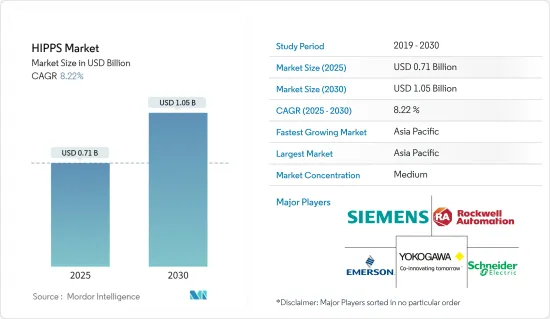

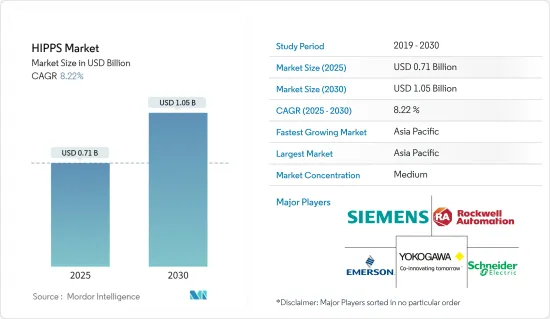

HIPPS(高完整性压力保护系统)市场规模预计在 2025 年为 7.1 亿美元,预计到 2030 年将达到 10.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.22%。

石油和天然气是高完整性压力保护系统 (HIPPS) 市场的主要目标领域之一。随着近期疫情爆发,该产业呈现下滑趋势,影响了市场成长。从需求角度来看,石油和天然气正受到新冠疫情影响的挑战。这导致生产商迅速减少资本支出和钻井计划。疫情影响了多个计划的进展,导致专案进度延误和停滞。

关键亮点

- 当新的天然气生产源连接到天然气工厂设施时,通常需要机械洩压装置来保护天然气生产设施和/或管道。任何连接到现有管道的新生产源都必须保护管道免受潜在的过压,过压可能导致碳氢化合物释放到大气中或透过火炬系统发生不良燃烧。工厂事故数量的增加导致政府监管标准不断提高,以确保工厂的安全,从而推动了市场的成长。

- 为了提高工作站的安全性,各行业关于排放水准的严格地方政府法规正在推动对各种 HIPPS 应用的需求。快速的市场发展、永续性倡议、新技术的兴起以及不断变化的消费者偏好正在推动终端用户产业的格局快速演变。

- 2020年7月,印度内韦利火力电厂发生锅炉爆炸,造成至少6人死亡,17人重伤。这是该电厂两个月内发生的第二起锅炉爆炸。印度泰米尔纳德邦一座发电厂发生爆炸,原因疑似过热高压。

- 受调查市场的参与企业正专注于与 HIPPS 应用相关的最尖端科技发展。例如,2019 年 12 月,高压设备公司(Graco Inc. 的子公司)推出了一种新型软座保险阀,旨在保护液体和气体管道系统免受过压损坏和故障。新型保险阀适用于 9/16' OD 管道,压力范围为 1,500 至 25,000 psi,并配有适用于其他尺寸的适配器。该公司新开发的阀门在工厂设定了指定的压力,并贴上相应的标籤。这些阀门具有 316 不銹钢阀体和可拆卸阀座压盖,并在标准应用中采用 17-4PH 阀桿和密封圈。

高可靠性压力保护系统市场趋势

预测期内,石油和天然气产业将占据主要份额

- 高可靠性压力保护系统是一种安全仪器系统,旨在保护石油和天然气生产、精製和管道系统免受过压。 HIPPS 利用石油和天然气公司的系统设计和整合专业知识。

- 市场参与企业正专注于开发创新产品和解决方案,这可能会在未来几年推动 HIPPS 市场的成长。近日,ATV HIPPS向阿联酋一家大客户交付了一台HIPPS。 ATV HIPPS 是 ATV 集团和 ATV SpA 的一部分,后者是石油和天然气行业海底和顶部关键服务阀门的领先供应商。该公司收购了井口设备和控制专家 Hydroneumatic。这可以利用 HIPPS 解决方案的增强技术组合。

- OCT SW 的开发受到海上石油和天然气运营商关于用于消防安全的海水服务阀的市场反馈的推动。这种新解决方案确保了石墨部件在暴露于海水时会增加附近金属的腐蚀敏感性。

- 井口压力过大可能会对下游人员、生产和生产资产以及环境造成严重后果。这使得实施符合 IEC 61511 的保护系统成为强制性要求。各公司正在实施不同的策略,但最常见的是 1oo2 或 2oo3 架构,以实现 SIL 2 或 SIL 3 合规性。

- 此前,印度领先工程公司Larsen & Toubro向阿萨姆邦迪天然气田开发计划提供了其自主研发的HIPPS。 L&T Valves 为 Dirok天然气田开发计划供应 HIPPS,该专案由印度斯坦石油勘探公司、印度石油公司和印度石油公司组成的财团领导。

- HIPPS的需求将进一步取决于永续发展措施,并可能进一步偏离工业应用要求。在永续发展情境中,坚决的政策干预可能导致全球石油需求在未来几年内达到高峰。 2018年至2040年间,已开发国家的需求预计将下降50%以上,新兴经济体的需求将下降10%。

预计亚太地区市场在预测期内将大幅成长

- 预计亚太地区 HIPPS 市场在预测期内将呈现最高的成长率。这是因为该地区注重发展其石油和气体纯化能力,以及化学工业的显着增长,其中中国、日本和印度是该地区的一些主要国家。例如,根据国际能源总署的预测,到2020年,亚洲仍将是液化天然气的主要供应地,占液化天然气进口总量的70%。

- 国际能源总署预计,未来五年亚太地区将引领天然气需求,到2024年将占总消费成长的近60%。由于石油工业扩张、生活水准提高和天然气基础设施建设,中国对天然气的需求在2019年激增。

- 亚太地区在石油天然气、化学和发电业务中安装 HIPPS 显示出巨大的潜力。中国、印度等国家对石化产品的需求激增,导致石油、天然气和化学产品的产量增加。

- 例如,根据印度化学和化肥部的数据,2018-19与前一年同期比较为4.70%,而主要化学品的八年复合成长率为3.02%。基础主要石化产品与前一年同期比较%,同期复合年增长率为3.54%。

HIPPS行业概览

HIPPS 市场竞争适中,有相当数量的全球和地区参与企业。这些企业占有相当大的市场份额,并致力于扩大基本客群。这些供应商专注于研发活动、策略伙伴关係以及其他有机和无机成长策略,以在预测期内获得竞争优势。

- 2020 年 7 月 - MOGAS Industries, Inc. 收购美国严苛工况阀门製造商 Watson Valve 的资产,并开始提供维修和涂层服务。 Watson Valve 已向全球交付了3,400 多个阀门,主要面向采矿业,但也针对化学、石油和天然气产业。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 由于工厂事故增多,政府提高了监管标准,以确保工厂的安全

- 市场问题

- 实施成本和缺乏所需技能

- 市场机会

- 产业监理状态(SIL、IEC 61511、IEC 61508 等)

第六章市场区隔

- 类型

- 成分

- 服务

- 最终用户产业

- 石油和天然气

- 化学

- 力量

- 金属与矿业

- 饮食

- 其他製程工业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章竞争格局

- 公司简介

- Rockwell Automation

- Emerson Electric Co.

- Severn Glocon Group

- Schneider Electric

- Yokogawa Electric Corporation

- ABB Ltd

- Siemens AG

- Schlumberger NV

- Mogas Industries Inc.

- Mokveld Valves BV

- SELLA CONTROLS Ltd

- ATV Hipps

- HIMA Paul Hildebrandt GmbH

- PetrolValves SpA

- L& T Valves Limited(Larsen & Toubro Limited)

- BEL Valves(British Engines Limited)

第 8 章供应商定位分析

第九章投资分析

第十章 市场机会与未来趋势

The HIPPS Market size is estimated at USD 0.71 billion in 2025, and is expected to reach USD 1.05 billion by 2030, at a CAGR of 8.22% during the forecast period (2025-2030).

Oil and gas are one of the significant target segments for the high integrity pressure protection system (HIPPS) market. With the recent outbreak, the industry has observed a downward trend, affecting market growth. From the demand perspective, oil and gas have been challenged by the effects of the COVID-19 outbreak. Owing to this, producers have rapidly slashed capital spending and drilling programs. The pandemic has impacted the progress of several projects, resulting in pipelines getting stalled or delayed.

Key Highlights

- The connection of new gas production sources to a gas plant facility has often required mechanical relief devices to protect gas production facilities or pipelines. New production sources connected to existing pipelines require the pipeline to be protected against potential overpressure, resulting in the release of hydrocarbons to the atmosphere or undesirable burning of these hydrocarbons via a flare system. Rising government regulatory standards to defend safety and security at industrial plants due to increasing accidents at plants drives the growth of the market.

- Strict government regulations in the regions on emission levels across industries to increase workstation safety have bolstered the demand for various HIPPS applications. Due to rapid developments in the emerging markets, sustainability policies, the rise of new technologies, and changing consumer preferences, the end-user industry landscape has been rapidly evolving.

- In July 2020, in a boiler blast at Neyveli Thermal Power Station (India), at least six people died, and as many as 17 others suffered serious injuries. This was the second boiler explosion in two months at the same plant. It is suspected that overheating and high pressure led to the power plant explosion in Tamil Nadu (India).

- Players operating in the market studied have been focusing on cutting-edge technology developments pertaining to HIPPS applications. For instance, in December 2019, High-Pressure Equipment Company (a subsidiary of Graco Inc.) introduced a new soft seat relief valve designed to protect liquid and gas tubing systems from overpressure damage and failure. The new relief valves are available in pressure ranges from 1,500 to 25,000 psi for 9/16' O.D. tubing, with adapters available for other sizes. The company's newly developed valves are factory set to the designated pressure and tagged accordingly. They feature 316 stainless steel bodies and removable seat glands, with a 17-4PH stem and seal ring for standard applications.

High Integrity Pressure Protection System Market Trends

Oil and Gas Segment Holds for a Major Share Throughout the Forecast period

- A high integrity pressure protection system is a safety instrumented system designed to protect oil and gas production, refining, and pipeline systems against over-pressurization. HIPPS leverages an oil and gas company's expertise in system design and integration.

- Players operating in the market are focusing on developing innovative products and solutions, which may bolster the growth of the HIPPS market in the coming years. In the recent past, ATV HIPPS delivered HIPPS to a major customer in the United Arab Emirates. ATV HIPPS is part of ATV Group and ATV SpA, a major player in Subsea and Topside critical service valves for the oil and gas industry. The company acquired Hydropneumatic, which is specialized in wellhead equipment and controls. This may leverage its enhanced technical portfolio of HIPPS solutions.

- The OCT SW development was driven by market feedback from offshore oil and gas operators concerning seawater service valves used for fire safety. The new solution ensures graphite parts, which can increase neighboring metals' susceptibility to corrosion when exposed to seawater.

- Excessive wellhead pressure can cause serious consequences to downstream personnel, production and production assets, and the environment. It is, therefore, mandatory to have IEC 61511 compliant protection systems. Companies implement various strategies, but the most common are 1oo2 or 2oo3 architectures for compliance to SIL 2 or SIL 3.

- In the past, the Indian engineering major, Larsen & Toubro, supplied the country's indigenously developed HIPPS to Dirok Gas Field Development Project in Assam. L&T Valves, a part of Larsen & Toubro, supplied indigenously developed HIPPS to Dirok, which is promoted by a consortium of Hindustan Oil Exploration Company, Oil India, and IOCL.

- HIPPS's demand further depends on sustainable development policies, which may deviate the industry application requirement further. In the sustainable development scenario, determined policy interventions may lead to a peak in the global oil demand within the next few years. The demand is estimated to fall by more than 50% in advanced economies and by 10% in developing economies between 2018 and 2040.

Asia Pacific Segment Expected to Grow at a Significant Rate Over the Forecast Period

- The Asia Pacific HIPPS market is anticipated to witness the highest growth rate during the forecast period due to the region's focus on developing oil and gas refining capacity and notable growth in the chemicals industry, with China, Japan India being some of the principal countries in this region. For instance, according to IEA, Asia continued to be the key destination for LNG, accounting for 70% of the total LNG imports by 2020.

- According to IEA, gas demand in the coming five years is set to be driven by Asia Pacific, and it is anticipated to account for almost 60% of the total consumption increase by 2024. In 2019, the requirement for gas in China surged sharply due to the expansion of the petroleum industry, improvement in living standards, and the development of gas infrastructure.

- Asia Pacific presents a tremendous potential for the installation of HIPPS in the oil and gas, chemicals, and power generation businesses. The burgeoning demand for petrochemicals in countries, such as China and India, is augmenting the production of oil, gas, and chemicals.

- For instance, according to the Ministry of Chemicals and Fertilizers, India, the annual growth of production during 2018-2019 was 4.70% over the preceding year, with a CAGR of 3.02% over a period of eight years, in case of major chemicals. The annual growth of basic major petrochemicals was 3.82% over preceding year, with a CAGR of 3.54% during the same period.

High Integrity Pressure Protection System Industry Overview

The high integrity pressure protection system (HIPPS) market is moderately competitive and consists of a significant number of global and regional players. These players account for a considerable share in the market and focus on expanding their customer base. These vendors focus on the research and development activities, strategic partnerships, and other organic & inorganic growth strategies to earn a competitive edge over the forecast period.

- July 2020 - MOGAS Industries, Inc. acquired the assets of Watson Valve, a US-based manufacturer of severe service valves, in order to have repairs and coating services. Watson Valve has a global install base of more than 3,400 valves, majorly in the mining industry, and encompasses the chemical and oil & gas industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Government Regulatory Standards to Defend Safety and Security at Industrial Plants, Owing to Increasing Accidents at Plants

- 5.2 Market Challenges

- 5.2.1 Implementation Cost and Lack of Required Skillsets

- 5.3 Market Opportunities

- 5.4 Regulatory Landscape of the Industry (SIL, IEC 61511, IEC 61508, etc.)

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Components

- 6.1.2 Services

- 6.2 End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemicals

- 6.2.3 Power

- 6.2.4 Metal and Mining

- 6.2.5 Food and Beverages

- 6.2.6 Other Process Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation

- 7.1.2 Emerson Electric Co.

- 7.1.3 Severn Glocon Group

- 7.1.4 Schneider Electric

- 7.1.5 Yokogawa Electric Corporation

- 7.1.6 ABB Ltd

- 7.1.7 Siemens AG

- 7.1.8 Schlumberger NV

- 7.1.9 Mogas Industries Inc.

- 7.1.10 Mokveld Valves BV

- 7.1.11 SELLA CONTROLS Ltd

- 7.1.12 ATV Hipps

- 7.1.13 HIMA Paul Hildebrandt GmbH

- 7.1.14 PetrolValves SpA

- 7.1.15 L&T Valves Limited (Larsen & Toubro Limited)

- 7.1.16 BEL Valves (British Engines Limited)