|

市场调查报告书

商品编码

1690848

露营拖车和旅居车:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Caravan And Motorhome - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

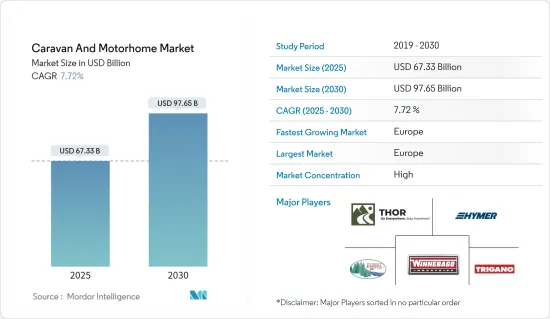

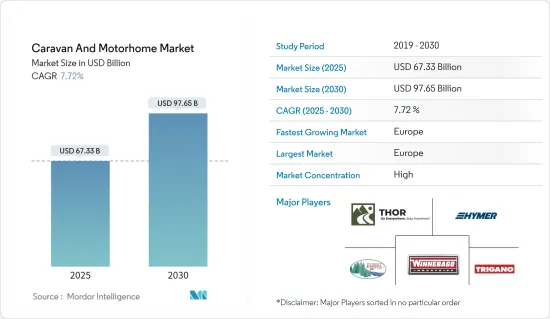

露营拖车和旅居车市场规模预计在 2025 年为 673.3 亿美元,预计到 2030 年将达到 976.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.72%。

近年来,露营拖车和旅居车市场经历了显着的成长和发展,反映了消费者偏好和生活方式趋势的变化。一个显着的趋势是,乘坐露营拖车或旅居车出行越来越受到人们的青睐,成为假日旅行的首选方式。消费者希望这些休閒车能提供自由和灵活性,让他们能够以自己的步调探索不同的目的地。旅行偏好的变化,加上人们对户外和自然体验日益增长的兴趣,促进了露营拖车和旅居车市场的扩张。

在产品多样性方面,製造商为了满足日益增长的需求,推出了各种各样的露营拖车和旅居车型号,以满足不同的偏好和要求。现代设计通常采用创新功能、技术进步和改进的设施,以增强整体旅行体验。此外,该行业非常重视永续性和环保实践,製造商采用更节能的系统和材料,以适应消费者日益增强的环境责任意识。

迷你露营拖车因其紧凑的设计而日益流行,其通常具有流线型车身和较小的占地面积。儘管体积小,製造商仍致力于最大限度地利用内部空间并配备必要的设施。迷你露营拖车通常配备舒适的睡眠空间、基本的厨房设施和巧妙的收纳解决方案。它注重功能性和空间的有效利用,以紧凑的设置提供舒适的露营体验。

迷你露营拖车,也称为层级拖车、微型露营拖车或折迭露营车,比大型拖车更实惠。入门级选配起价约为 5,000 欧元,而配置更齐全的车型售价在 15,000 欧元至 20,000 欧元之间。这种价格优势吸引了注重预算的旅客和首次购买露营拖车的车主。

截至 2023 年 3 月的一个季度,旅客数量大幅增加,澳洲境内个人旅行人数达到 450 万人次,成长了 24%。此外,人们也喜欢旅行大篷车和露营,在这些车辆中度过的夜晚共计1800万个,大幅增加了22%。旅游和休閒的激增促成了全年1,550万人次出游、6,230万人次住宿和112亿美元的旅游消费。值得注意的是,这些数字超过了疫情前的1400万人次旅行和5900万人次过夜的统计数据。

旅居车在世界各地越来越受欢迎,尤其是在欧洲。越来越多的高净值人士(HNWI)和充足的房车停车选择使得房车在北美和欧洲越来越受欢迎。

露营拖车和旅居车的市场趋势

预计未来几年旅居车将变得更加受欢迎。

露营和旅行已经成为千禧世代越来越受欢迎的休閒。 C 型旅居车比 A 型和 B 型旅居车更节省燃料。许多休閒车製造商正在推出基于福特和宾士底盘的 C 型车。

小型厢式(B 型)旅居车的需求正在不断增长,尤其是在德国市场,许多新兴企业和新参与企业提供将OEM库存车辆或现有厢型车改装成露营车的服务。

- 2023 年 3 月,专门从事货车改装的公司 Krug Expedition 推出了旅居车。 Rhino XL 是一款坚固的越野旅居车,能够承受最恶劣的条件。

- 2024年2月,Goboonie与瑞士再保险子公司iptiQ合作推出了旅居车保险解决方案。

预计 A、B 和 C 型旅居车的发展将在未来几年促进整体市场的成长。

预计欧洲将在市场中发挥关键作用

欧洲在露营拖车和旅居车市场中发挥着至关重要的作用。

- 露营拖车和旅居车深植于欧洲文化。几十年来,乘坐露营拖车旅行和探索不同目的地的概念一直被人们所接受,反映了人们对移动生活和户外探险的文化亲和性。这种文化接受度创造了对露营拖车和旅居车的持续需求,它们已成为欧洲旅行和休閒活动不可或缺的一部分。

- 欧洲拥有丰富多彩的风景和旅游目的地,从风景如画的乡村到充满活力的城市。这种地理多样性鼓励旅行者探索不同的地方,而露营拖车和旅居车提供了理想的交通方式。这些车辆所提供的自由和灵活性符合寻求个人化和沈浸式旅行体验的欧洲旅行者的偏好。

到 2022年终,欧洲註册的露营拖车和旅居车将超过 630 万辆,较五年前的 520 万辆有显着增加。在此期间,露营拖车占所有露营设备的近三分之二。然而,露营车的数量明显增加,欧洲旅居车数量达到 280 万辆,与 2017 年相比增加了 50%。因此,露营拖车和旅居车的比例为 56%,而前者为 44%。在过去五年中,露营拖车公园的数量增加了 5% 多一点,这意味着旅居车超过露营拖车数量的情况即将出现。在荷兰,露营车的数量预计将从 2017 年的 105,000 辆增长到 2022年终的近 180,000 辆,而露营拖车的数量仍为 424,000 辆,因此这种转变仍然遥遥无期。去年,KCI 报告称,荷兰的露营拖车和房车总合已超过 60 万辆,案例首个里程碑。在欧洲国家中,荷兰的旅居车和露营持有数量最多,其次是德国(约 160 万辆)、法国(115 万辆)和英国(83.5 万辆)。

露营拖车和旅居车产业概况

露营拖车和旅居车市场正在高度整合,多家製造商提供具有先进功能的产品。企业正在透过併购、联盟、合作等策略扩大市场占有率。例如

- 2023 年 10 月,Mink Campers 推出了其露营车系列的最新成员:MINK-E。 MINK-E 是一款环保全电动汽车,专为穿越户外景观中具有挑战性和不可预测的地形而设计。 13.5 英尺(4.1 公尺)长的 Mink Camper 保留了经典的动态层级造型,重量仅为 1,150 磅(520 公斤),体积小巧。

- ARB Earth Camper 将于 2023 年 7 月推出,这将有力地证明探险家可以选择更轻的旅行拖车,而无需牺牲露营拖车生活方式的刺激。

- 2022 年 1 月,Ford-Werke GmbH 与 Erwin Hymer Group (EHG) 签署了一项框架协议,以交付Ford Transit 和 Ford Transit Custom 作为客户级休閒车和旅居车的基础。该协议将允许两家公司在不断增长的休閒车市场中占有股权。供应协议包括福特 Transit 厢型车和骨架底盘驾驶室车型,以及福特 Transit Custom Combi 自订 ,用于改装成 EHG 品牌下的露营车、半整合式和凹室旅居车。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 产品类型

- 露营拖车

- 旅行拖车

- 第五轮拖车

- 折迭露营拖车

- 卡车露营

- 旅居车

- A型

- B型

- C型

- 按最终用户

- 直接买家

- 车队车主

- 露营拖车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Thor Industries Inc.

- Swift Group

- Forest River Inc.

- Winnebago Industries Inc.

- Burstner GmbH & Co. KG

- Triple E Recreational Vehicles

- Hymer GmbH & Co. KG

- Jayco Inc.

- Dethleffs GmbH & Co. KG

- Knaus Tabbert AG

- Trigano SA

第七章 市场机会与未来趋势

The Caravan And Motorhome Market size is estimated at USD 67.33 billion in 2025, and is expected to reach USD 97.65 billion by 2030, at a CAGR of 7.72% during the forecast period (2025-2030).

The caravan and motorhome market has witnessed significant growth and evolution in recent years, reflecting changing consumer preferences and lifestyle trends. One notable trend is the increasing popularity of caravan and motorhome travel as a preferred mode of vacationing. Consumers are seeking the freedom and flexibility that these recreational vehicles provide, allowing them to explore diverse destinations at their own pace. This shift in travel preferences, coupled with a growing interest in outdoor and nature-based experiences, has contributed to the expansion of the caravan and motorhome market.

In terms of product diversity, manufacturers have responded to the rising demand by introducing a wide range of caravan and motorhome models, catering to various preferences and requirements. Modern designs often incorporate innovative features, technological advancements, and improved amenities to enhance the overall travel experience. Additionally, there is a notable emphasis on sustainability and eco-friendly practices within the industry, with manufacturers incorporating energy-efficient systems and materials to align with the growing awareness of environmental responsibility among consumers.

The trend of mini caravans is picking up pace as they are characterized by their compact design, typically featuring a streamlined body with a reduced footprint. Despite their smaller size, manufacturers focus on maximizing interior space to include essential amenities. Mini caravans often come equipped with a cozy sleeping area, basic kitchen facilities, and clever storage solutions. The emphasis is on functionality and efficient use of space to provide a comfortable camping experience within a compact setup.

Mini caravans, also known as teardrop trailers, micro caravans, or folding campers, offer affordability compared to larger models. Entry-level options start around EUR 5,000, with well-equipped versions reaching EUR 15,000 - EUR 20,000. This price advantage attracts budget-conscious travelers and first-time caravanners.

In the quarter spanning March 2023, there was a substantial rise in travel figures, with individuals undertaking 4.5 million trips, marking a 24% increase across Australia. Additionally, the delights of caravanning and camping were savored, with 18 million nights spent, reflecting a substantial 22% surge. This surge in travel and leisure activities contributes to an annual rolling total of 15.5 million trips, 62.3 million nights, and an impressive USD 11.2 billion in visitor expenditure. Notably, these figures surpass the pre-pandemic statistics, which stood at 14 million trips and 59 million nights.

Motorhomes are becoming increasingly popular around the world, particularly in Europe. The rising number of high-net-worth individuals (HNWI), combined with the availability of ample RV parking, is driving its adoption in North America and Europe.

Caravan And Motorhome Market Trends

Motorhomes are Anticipated to Gain Prominence Over the Coming Years

Camping and travel are becoming increasingly popular recreational activities among millennials. Type C motorhomes outperform type A and B motorhomes in terms of fuel efficiency. Many recreational vehicle manufacturers are introducing type C vehicles based on Ford and Mercedes-Benz chassis.

With the increasing demand for small van (type B) motorhomes, especially in the German market, many new companies and start-ups are offering services to convert stock OEM vehicles and existing vans into campervans.

- In March 2023, Krug Expedition, a company specializing in van conversions, revealed its motorhome referred to as the "Rhinoceros on Wheels. The Rhino XL is a robust off-road motorhome built to withstand extreme conditions.

- In February 2024, Goboony collaborated with iptiQ, a subsidiary of Swiss Re, to introduce a motorhome insurance solution.

Such developments across type A, B, and C motorhomes are expected to contribute to the overall growth of the market in the coming years.

Europe is Likely to Play a Key Role in the Market

Europe plays a pivotal role in the market of caravans and motorhomes due to several factors that contribute to the region's prominence in this industry.

- Caravanning and motorhoming have deep cultural roots in Europe. The concept of touring and exploring different destinations using caravans has been embraced for decades, reflecting a cultural affinity for mobile living and outdoor adventures. This cultural acceptance has created a sustained demand for caravans and motorhomes, making them an integral part of travel and leisure activities in Europe.

- Europe boasts diverse landscapes and destinations, ranging from picturesque countryside to vibrant cities. This geographical diversity encourages travelers to explore various locations, and caravans and motorhomes offer an ideal means for this. The freedom and flexibility provided by these vehicles align with the preferences of European travelers who seek personalized and immersive travel experiences.

By the end of 2022, Europe witnessed registrations of over 6.3 million caravans and motorhomes, a notable increase from 5.2 million five years prior. During that period, caravans constituted almost two-thirds of all camping equipment. However, the remarkable surge in campers is evident, with the count of motorhomes reaching 2.8 million in Europe, marking a 50% rise compared to the figures recorded in 2017. Consequently, the proportion between caravans and motorhomes now stands at 56% compared to 44%. Over the past five years, the caravan park has experienced a growth of slightly over 5%, suggesting an impending scenario where motorhomes may surpass caravans in numbers. While this shift is still a distant prospect in the Netherlands, where the camper count rose from 105,000 in 2017 to nearly 180,000 by the end of 2022, there are still 424,000 caravans in the country. Last year, KCI reported a combined count of over 600,000 caravans and campers in the Netherlands, marking the first instance of such a milestone. Among European countries, the Netherlands boasts the highest ownership of motorhomes and caravans, following Germany with almost 1.6 million units, France with 1.15 million, and Great Britain with 835,000.

Caravan And Motorhome Industry Overview

The caravan and motorhomes market is intensely consolidated, with several manufacturers offering products with advanced features. Companies are increasing their market share through strategies such as mergers and acquisitions, partnerships, and collaborations. For instance,

- In October 2023, Mink Campers revealed the latest iteration of its camper series with the MINK-E, an environmentally friendly, fully electric version designed for navigating the challenging and unpredictable terrains of outdoor landscapes. The Mink Camper, measuring 13.5 ft (4.1 meters), maintains its classic and aerodynamic teardrop shape, ensuring a compact size with a weight of 1,150 lbs (520 kg).

- In July 2023, the introduction of the ARB Earth Camper serves as compelling evidence that adventure seekers can opt for a lighter travel trailer without sacrificing the thrill of the caravanning lifestyle.

- In January 2022, Ford-Werke GmbH and Erwin Hymer Group (EHG) signed a framework agreement for the delivery of Ford Transit and Ford Transit Custom as the foundation for customer-ready recreational vehicles and motorhomes. The agreement will allow both companies to capitalize on the growing leisure vehicle market. The supply agreement includes Ford Transit panel van and skeletal chassis cab models, as well as Ford Transit Custom kombi vans, for conversion into camper vans, semi-integrated motorhomes, and alcove motorhomes by EHG brands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market size in value USD Billion)

- 5.1 Product Type

- 5.1.1 Caravan

- 5.1.1.1 Travel Trailers

- 5.1.1.2 Fifth-wheel Trailers

- 5.1.1.3 Folding Camp Trailers

- 5.1.1.4 Truck Campers

- 5.1.2 Motorhome

- 5.1.2.1 Type A

- 5.1.2.2 Type B

- 5.1.2.3 Type C

- 5.1.3 By End User

- 5.1.3.1 Direct Buyers

- 5.1.3.2 Fleet Owners

- 5.1.1 Caravan

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 South America

- 5.2.4.2 Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Thor Industries Inc.

- 6.2.2 Swift Group

- 6.2.3 Forest River Inc.

- 6.2.4 Winnebago Industries Inc.

- 6.2.5 Burstner GmbH & Co. KG

- 6.2.6 Triple E Recreational Vehicles

- 6.2.7 Hymer GmbH & Co. KG

- 6.2.8 Jayco Inc.

- 6.2.9 Dethleffs GmbH & Co. KG

- 6.2.10 Knaus Tabbert AG

- 6.2.11 Trigano SA