|

市场调查报告书

商品编码

1906155

欧洲旅居车:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Europe Motor Home - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

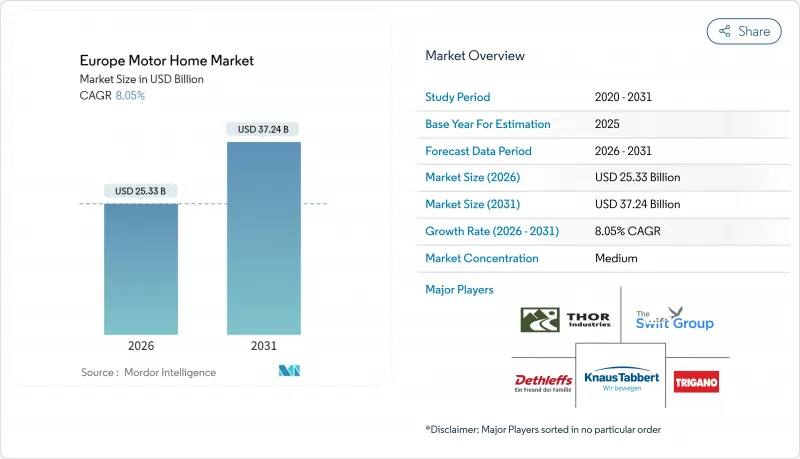

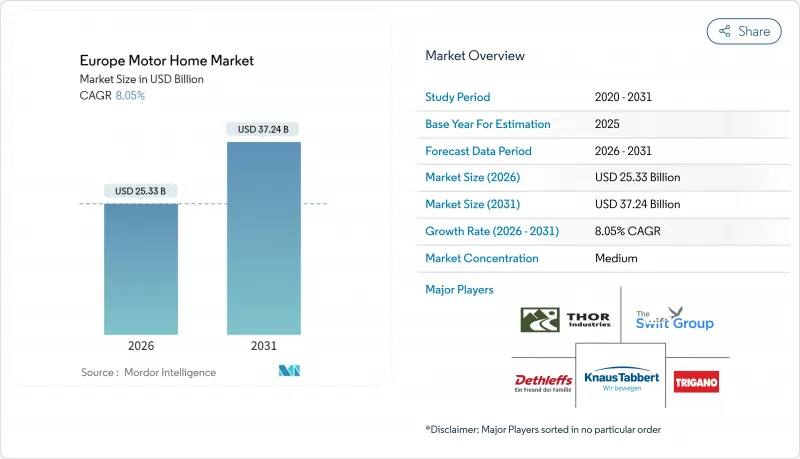

预计到 2026 年,欧洲旅居车市场价值将达到 253.3 亿美元,高于 2025 年的 234.4 亿美元。

预计到 2031 年将达到 372.4 亿美元,2026 年至 2031 年的复合年增长率为 8.05%。

在欧洲,休閒、工作和交通的整合日益加深,推动了房车市场成长,其成长超过了整个汽车产业。旅居车因其隐私、柔软性和成本控制优势,正在取代饭店。随着婴儿潮世代退休,他们拥有丰厚的退休金收入,因此更加重视旅途舒适度;而数位游牧者则利用车载互联功能,将旅行延伸到传统假期之外。欧盟对低排放交通途径的监管日益严格,促使欧盟加强对露营地和公共充电基础设施电气化的投入,从而提升了消费者对新兴纯电动车款的信心。平台租赁服务的普及使得人们无需拥有车辆即可享受驾驶乐趣,从而加剧了市场竞争,推动了销售增长,并为製造商带来了持续的车队订单。生活方式的改变、环境政策的推行以及数位化零售的蓬勃发展,使得欧洲休閒车市场的发展轨迹比传统乘用车更为稳健。

欧洲旅居车市场趋势与洞察

休閒旅游与「居家度假」文化的蓬勃发展

2024年,欧盟旅游业的住宿突破30亿,创下历史新高。国内旅游的成长延长了平均旅行时长,淡化了季节性,从而带动了淡季期间对露营车的需求。虽然地中海地区仍吸引53%的露营者,但随着监管的放鬆,北欧的野外露营也越来越受欢迎,偏远地区的可及性也随之提高。通货膨胀和地缘政治风险正促使人们将自由裁量权支出转向区域旅行,进一步推动了对旅居车(无论是自有还是租赁)的需求。这些趋势在经济不确定性中支撑了房车销售的持续成长。

婴儿潮世代与提早退休者的老化

2025年,欧洲五分之一的人口将达到61至79岁,随着退休人员将舒适性、健康和成本控制置于速度之上,汽车需求将大幅增加。目前,老年人在欧盟住宿中约占四分之一,他们通常选择全年使用的车辆而非季节性租赁。退休时间的延长扩大了潜在客户群,而多代同堂的旅行也让年轻的亲属加入用户层。这项人口结构变化有利于延长产品生命週期,并稳定二手车价格,从而鼓励退休人员升级到更大或更适合长期旅行的车款。

高昂的初始购买和维护成本

疫情期间的供应限制导致标价较2020年以前上涨了近三分之一。虽然与经销商的谈判缓解了部分影响,但对于首次购车者而言,价格仍然是一大障碍。随着车辆配备驾驶辅助技术(需要锂电池、热泵和专用维护工具),运作成本也不断上升。这种影响在东欧和南欧尤为显着,因为这些地区的居民可支配所得低于西欧。儘管融资管道有所改善,但跨境融资的分散意味着潜在车主必须依赖与房车折旧曲线不匹配的普通汽车贷款。

细分市场分析

到2025年,C级旅居车将占欧洲旅居车市场的49.12%,反映出消费者对宽敞内部空间以满足家庭需求的持续需求。同时,B级露营车预计将以13.61%的复合年增长率增长,这反映了都市化的加快以及消费者希望拥有一辆既能通勤又能住宅的车辆。历史中心的停车限制和道路宽度限制推动了可停放在标准停车位的紧凑型厢型车的需求。製造商正在利用现有的轻型商用车平台来降低生产成本并加速电气化转型。欧洲旅居车市场正朝着多功能化方向发展,吸引着注重易用性和类似智慧型手机的数位介面的年轻消费群体。

大型A级房车价格仍居高不下,但却面临基础设施方面的障碍:很少有露营地能够容纳超过8公尺的车辆,而且低排放区(LEZ)的规定通常也禁止重型车辆底盘。为了避免这些风险,製造商正在试验自主拖车轴,使牵引车辆能够在狭小空间内自主定位。在所有车型类别中,整合式太阳能发电系统、锂电池和基于应用程式的诊断技术的引入,进一步模糊了传统的车辆分类,因为买家的关注点已从简单的面积转向能源自主性和用户体验。

由于柴油车拥有丰富的加油站、强大的扭力输出和久经考验的可靠性,预计到2025年,柴油车将占据欧洲房旅居车市场87.65%的份额。然而,纯电动车型的商业化进程最为迅猛,年复合成长率高达13.85%。欧盟计画在2030年安装350万个公共充电桩,并为露营地提供补贴,这项措施直接瞄准了欧洲旅居车市场。 Thor Industries的A级混合动力概念车实现了500英里(约800公里)的综合续航里程,预示着房车在重量能量效率方面即将取得突破性进展。

汽油车仍将是那些担心柴油车禁令但又无法完全转向电动车的消费者的另一种选择。混合动力系统填补了这一空白,为区域旅行者提供柔软性的充电方式,同时又不牺牲负载容量。随着电池能量密度的提高,设计师们正在缩短后悬并降低地板高度,弥补早期电动原型车在内部布局方面存在的不足。因此,我们预计,一旦人们对车辆残值充满信心,并且公共快速充电网路日趋成熟,动力系统构成比将迅速重新平衡。

欧洲旅居车市场报告按类型(A级、B级、C级)、动力类型(柴油、汽油、其他)、最终用户(个人买家、租赁/共享车队、其他)、销售管道(OEM授权经销商、线上市场、其他)、长度/尺寸(6米以下、6-7.5米、7.5米以上)和国家/地区(例如德国)进行细分。市场预测以价值(美元)和销售(辆)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 休閒旅游的激增和「居家度假」文化的兴起

- 婴儿潮世代老化与提早退休人口结构

- 拓展数位化房车市场

- 远距办公的普及导致了长期移动居住的出现。

- 由欧盟旅游津贴资助的露营基础建设

- 北欧露营法规的放宽刺激了潜在需求。

- 市场限制

- 高昂的初始购买和维护成本

- 城市层级的柴油车禁令以及低排放区(LEZ)的扩张限制了车辆通行。

- 停车限制和露营地使用限制

- 2024-2025年由于供应过剩,价格将下降

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模和成长预测(价值和数量)

- 按类型

- A级

- B级(露营车)

- C类(壁龛式/半整合式)

- 透过推广

- 柴油引擎

- 汽油

- 杂交种

- 电池式电动车

- 最终用户

- 个人直接买家

- 租赁和共享车辆

- 企业/活动/饭店车队

- 按销售管道

- 原厂授权经销商

- 网路市集

- 直接面向消费者(工厂直销)

- 按长度和尺寸

- 6米或以下

- 6至7.5米

- 超过7.5米

- 按国家/地区

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 荷兰

- 瑞典

- 挪威

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Erwin Hymer Group

- Trigano SA

- Thor Industries Inc.

- Knaus Tabbert AG

- Rapido Group

- Swift Group

- Dethleffs GmbH and Co. KG

- Eura Mobil GmbH

- Groupe Pilote

- Rimor

- Adria Mobil

- Auto-Trail

- Burstner GmbH

- Laika Caravans

- Hobby Wohnwagenwerk

- Carthago Reisemobilbau

- Westfalia Mobil

- Possl Group

- Chausson(Groupe Trigano)

- Sunlight GmbH

- Malibu GmbH

第七章 市场机会与未来展望

The European motor homes market size in 2026 is estimated at USD 25.33 billion, growing from 2025 value of USD 23.44 billion with 2031 projections showing USD 37.24 billion, growing at 8.05% CAGR over 2026-2031.

Market momentum outpaces the broader automotive landscape because Europeans are blending leisure, work, and mobility, choosing motorhomes over hotels for privacy, flexibility, and cost control. Aging baby boomers with healthy pensions favor comfort on the move, while digital nomads rely on on-board connectivity to extend trips beyond classic holiday windows. Regulatory emphasis on lower-emission transport channels EU funding toward campground electrification and public charging, lifting buyer confidence in emerging battery-electric formats. Competition intensifies as platform-based rentals broaden access without upfront ownership, fueling unit volumes and giving manufacturers recurring fleet orders. The tight interplay between lifestyle shifts, environmental policy and digital retail puts the Europe recreational vehicle market on a structurally higher growth path than conventional passenger cars.

Europe Motor Home Market Trends and Insights

Rapid Rise in Recreational Travel And "Staycation" Culture

In 2024, the European Union achieved a record milestone in tourism, with accommodations hosting over 3 billion nights. Higher domestic travel has lengthened average trips, reduced seasonality, and pushed camper demand into the shoulder months. Mediterranean destinations still attract 53% of campers, yet Nordic wild-camping gains traction as deregulation makes remote sites easier to access. Inflation and geopolitical risk redirect discretionary spending toward local journeys, reinforcing the appeal of privately owned or rented motorhomes. These patterns support sustained volume growth even during economic uncertainty.

Aging Baby-Boomer and Early-Retirement Demographics

Citizens aged 61-79 will represent one-fifth of Europe's population in 2025, driving predictable demand because retirees prioritize comfort, health and cost control over speed. Seniors already account for nearly one-quarter of all EU tourism nights, frequently choosing vehicles they can drive year-round rather than paying for seasonal rentals. Extended retirement horizons enlarge the addressable base, while multi-generational trips bring younger relatives into the user pool. The demographic tailwind underpins long product cycles and stabilizes resale values, encouraging fresh purchases when pensioners upgrade to larger or electrified models suited for longer stays.

High Upfront Purchase and Maintenance Costs

Pandemic-era supply constraints forced sticker prices up to one-third above pre-2020 levels, and though dealer negotiations soften the hit, affordability remains an acute barrier for first-time buyers. Running expenses climb as models add lithium batteries, heat pumps and driver-assist technology requiring specialized service tools. Eastern and Southern Europe feel the impact most because disposable incomes lag Western standards. Financing options are improving, yet fragmented across borders, leaving potential owners reliant on general automotive loans that rarely match RV depreciation curves.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Digital RV-Rental Marketplaces

- Remote-Work Lifestyles Enabling Long-Term Mobile Living

- City-Level Diesel Bans and LEZ Expansion Curbing Access

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Class C motorhomes represented 49.12% of Europe's motorhome market size in 2025, illustrating continued appetite for spacious interiors that meet family needs. However, Class B campervans are projected to post a 13.61% CAGR, reflecting rising urbanization and user desire for a single vehicle that can serve as both commuter and holiday home. Parking regulations and road-width limits in historic European centers tilt momentum to compact vans that fit standard spaces. Manufacturers leverage existing light-commercial platforms, reducing production cost and enabling faster electrification rollouts. The European motor homes market thus pivots toward versatility, drawing younger buyers who value maneuverability and smartphone-like digital interfaces.

Large Class A units still command premium pricing but confront infrastructure barriers: few campsites host >8 m rigs, and LEZ rules often exclude heavy chassis. To hedge, builders experiment with self-driving caravan axles that let towable units reposition autonomously within cramped plots. Across all categories, integrated solar, lithium storage, and app-based diagnostics shift buyer focus from raw square meters to energy autonomy and user experience, further blurring traditional type distinctions.

Diesel retains 87.65% of the European motor homes market share in 2025, explained by abundant refueling, torque, and proven reliability, yet battery-electric models show the fastest commercialization path with a 13.85% CAGR. EU plans for 3.5 million public chargers by 2030, plus campground-level grants, directly target the European motor homes market. Thor Industries' hybrid Class A concept demonstrates 500-mile combined range, signaling impending breakthroughs in weight-to-energy ratios.

Gasoline remains a niche alternative for users wary of diesel bans but unwilling to commit to full electrification. Hybrid-electric drive trains bridge gaps, giving rural travelers charging flexibility without sacrificing payload. Designers shorten rear overhangs and lower floor height as battery density improves, correcting historic compromises that limited interior layouts on early electric prototypes. The propulsion mix is therefore poised for rapid rebalancing once residual-value confidence firms and public fast-charge coverage mature.

The Europe Motor Homes Report is Segmented by Type (Class A, Class B, and Class C), Propulsion (Diesel, Gasoline, and More), End User (Direct Individual Buyers, Rental and Sharing Fleets, and More), Sales Channel (OEM-Authorized Dealers, Online Marketplaces, and More), Length/Size (Up To 6m, 6-7. 5m, and Above 7. 5m), and Country (Germany and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Erwin Hymer Group

- Trigano S.A.

- Thor Industries Inc.

- Knaus Tabbert AG

- Rapido Group

- Swift Group

- Dethleffs GmbH and Co. KG

- Eura Mobil GmbH

- Groupe Pilote

- Rimor

- Adria Mobil

- Auto-Trail

- Burstner GmbH

- Laika Caravans

- Hobby Wohnwagenwerk

- Carthago Reisemobilbau

- Westfalia Mobil

- Possl Group

- Chausson (Groupe Trigano)

- Sunlight GmbH

- Malibu GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Rise in Recreational Travel And "Staycation" Culture

- 4.2.2 Aging Baby-Boomer and Early-Retirement Demographics

- 4.2.3 Expansion of Digital RV-Rental Marketplaces

- 4.2.4 Remote-Work Lifestyles Enabling Long-Term Mobile Living

- 4.2.5 Campground Infrastructure Upgrades Funded by EU Tourism Grants

- 4.2.6 Nordic Wild-Camping Deregulation Unlocking Latent Demand

- 4.3 Market Restraints

- 4.3.1 High Upfront Purchase and Maintenance Costs

- 4.3.2 City-Level Diesel Bans and LEZ Expansion Curbing Access

- 4.3.3 Parking Constraints and Limited Campsite Availability

- 4.3.4 Oversupply-Led Price Depreciation In 2024-25

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Type

- 5.1.1 Class A

- 5.1.2 Class B (Camper Van)

- 5.1.3 Class C (Alcove/Semi-integrated)

- 5.2 By Propulsion

- 5.2.1 Diesel

- 5.2.2 Gasoline

- 5.2.3 Hybrid

- 5.2.4 Battery-Electric

- 5.3 By End User

- 5.3.1 Direct Individual Buyers

- 5.3.2 Rental and Sharing Fleets

- 5.3.3 Corporate / Event and Hospitality Fleets

- 5.4 By Sales Channel

- 5.4.1 OEM-Authorized Dealers

- 5.4.2 Online Marketplaces

- 5.4.3 Direct-to-Consumer (Factory Delivery)

- 5.5 By Length/Size

- 5.5.1 Up to 6 m

- 5.5.2 6 to 7.5 m

- 5.5.3 Above 7.5 m

- 5.6 By Country

- 5.6.1 Germany

- 5.6.2 France

- 5.6.3 United Kingdom

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Netherlands

- 5.6.7 Sweden

- 5.6.8 Norway

- 5.6.9 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Erwin Hymer Group

- 6.4.2 Trigano S.A.

- 6.4.3 Thor Industries Inc.

- 6.4.4 Knaus Tabbert AG

- 6.4.5 Rapido Group

- 6.4.6 Swift Group

- 6.4.7 Dethleffs GmbH and Co. KG

- 6.4.8 Eura Mobil GmbH

- 6.4.9 Groupe Pilote

- 6.4.10 Rimor

- 6.4.11 Adria Mobil

- 6.4.12 Auto-Trail

- 6.4.13 Burstner GmbH

- 6.4.14 Laika Caravans

- 6.4.15 Hobby Wohnwagenwerk

- 6.4.16 Carthago Reisemobilbau

- 6.4.17 Westfalia Mobil

- 6.4.18 Possl Group

- 6.4.19 Chausson (Groupe Trigano)

- 6.4.20 Sunlight GmbH

- 6.4.21 Malibu GmbH

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment