|

市场调查报告书

商品编码

1690894

中东和北非金融科技 -市场占有率分析、行业趋势与统计、成长预测(2025-2030 年)MENA Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

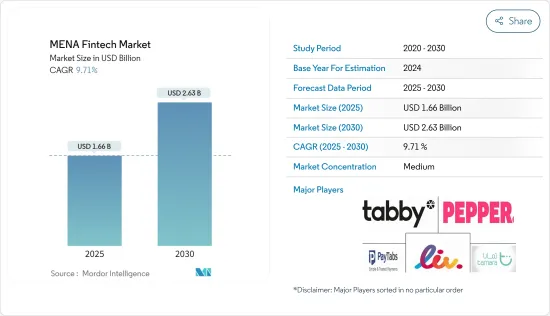

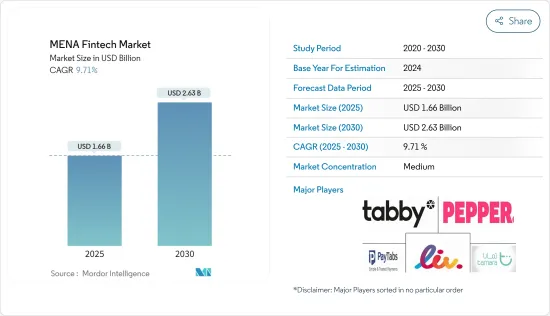

预计 2025 年中东和北非金融科技市场规模为 16.6 亿美元,到 2030 年将达到 26.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.71%。

中东地区的金融科技领域正在快速发展。付款处理商、金融科技公司和平台正在颠覆传统的金融格局,并渗透到国内和全球市场。这一增长的一个关键驱动力是该地区对技术的快速接受。

据报道,中东和北非地区,特别是阿拉伯联合大公国、沙乌地阿拉伯、巴林和埃及,是金融科技资金筹措的中心。这些国家占该地区投资的99%。在金融科技领域,付款解决方案处于领先地位,占总投资的 42%,并拥有高达 152% 的年增长率。报告也预测,到2030年,中东地区将成立超过45家金融科技新兴企业,每家估值超过10亿美元,其中沙乌地阿拉伯将处于领先地位。

截至 2023 年,中东和北非地区拥有超过 250 家金融科技新兴企业,预计到 2025 年将超过 250 家。中东和北非地区强大的创业生态系统使金融科技公司成为解决该地区紧迫金融障碍的关键参与企业。

在全球充满挑战的金融环境中,中东和北非的金融科技产业表现出比其他产业更强的韧性。儘管全球景气衰退,利率上升和技术中断,但中东和北非地区金融科技业的总资金筹措年减 47%,至 4.84 亿美元。不过,该板块的SEED估值保持稳定,证实了其稳定性。

中东和北非金融科技市场趋势

数位和无现金付款的成长推动了市场成长

在整个中东地区,数位付款、即时跨境付款、先买后付 (BPL) 服务和数位银行占据市场主导地位。在政府推动和经济数位化的推动下,中东和北非 (MENA) 地区的数位付款正在激增。中东和北非地区超过 85% 的金融科技公司专注于付款和汇款服务。

Gpay、Apple Pay、Samsung Pay等全球付款巨头的进入,促进了数位钱包在中东和北非地区的普及。值得注意的是,阿联酋已成为全球转向无现金社会的领导者。资料显示,阿联酋70%的中小企业已经实施无现金系统或计画在2024年前实施。

Visa 的最新资料凸显了阿联酋在采用无现金社会方面的先锋立场。值得注意的是,52% 的阿联酋消费者已经采用或计划在 2024 年转向无现金生活方式,高于 41% 的全球平均水平。在电子商务领域,信用卡占据核心地位并占交易的大部分。另一方面,根据 FIS Global Payments Wallet 的数据,签帐金融卡占了 11% 的市场份额。此外,包括行动钱包在内的线上付款占总交易额的 24%,巩固了其作为阿联酋第二大最受欢迎的付款方式的地位。

阿联酋主导金融科技市场

预计 2024 年阿联酋金融科技领域的投资将激增 92%,交易价值预计到 2028 年将翻倍。这一增长受到多种因素的推动,包括阿联酋的战略地理位置、当地人对金融科技解决方案日益增长的兴趣以及对外国直接投资 (FDI) 的吸引力。

阿联酋政府正透过税收优惠政策积极奖励绿色金融科技措施。此举旨在促进创新、加强经济成长并强调该国对环境永续性的承诺。阿联酋已成为金融服务供应商的青睐之地,包括加密货币交易所和外汇/差价合约仲介。阿联酋是世界上成长最快的经济体之一,政府正在采取政策支持创新和吸引投资。这些措施包括为外国投资者提供税收优惠,以及针对性广告宣传,重点是宣传该国的投资潜力和负担得起的生活水平。

中东和北非地区金融科技产业概况

中东和北非金融科技市场细分程度适中。全球各地的公司都在这一领域投入大量资金。中东和北非市场有许多金融科技公司,儘管市场占有率很小。金融科技平台的采用和升级到新技术的需求导致公司之间的竞争加剧。由于疫情和城市的兴起,人们开始接受新的支付方式和非接触式支付方式。创新和技术进步加快。一些主导市场的主要企业包括 Tamara、Rib、Pepper、Paytab、Tabby 和 Salwa。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概览

- 市场驱动因素

- 客户对电子商务和行动银行平台的需求不断增加

- 网路普及率和智慧型手机普及率的提高持续推动市场成长

- 市场限制

- 资料隐私问题

- 网路安全风险日益增加

- 市场机会

- 增加对金融科技新兴企业的投资

- 机器人顾问将继续成长

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 市场创新洞察

- 深入了解政府法规和政策

- COVID-19 市场影响

第五章市场区隔

- 按服务提案

- 汇款和付款

- 储蓄和投资

- 数位借贷和贷款市场

- 线上保险和保险市场

- 其他服务提案

- 按国家

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 巴林

- 卡达

- 伊朗

- 埃及

- 以色列

- 其他中东和北非国家

第六章竞争格局

- 市场集中度概览

- 公司简介

- Tamara

- Liv.

- Pepper

- PayTabs

- Tabby

- Sarwa

- Ila Bank

- Bayzat

- Eureeca

- Cwallet*

第七章 市场机会与未来趋势

第八章 免责声明和出版商

The MENA Fintech Market size is estimated at USD 1.66 billion in 2025, and is expected to reach USD 2.63 billion by 2030, at a CAGR of 9.71% during the forecast period (2025-2030).

The Middle East is witnessing a surge in its fintech sector. Payment processors, fintech firms, and platforms are disrupting the traditional financial landscape, penetrating both domestic and global markets. A key driver behind this growth is the region's swift embrace of technology.

According to a report, the MENA region, particularly the United Arab Emirates, Saudi Arabia, Bahrain, and Egypt, is the epicenter of fintech funding. These nations accounted for a staggering 99% of the region's investments. Within the fintech sector, payment solutions took the lead, capturing 42% of all investments and boasting a remarkable annual growth rate of 152%. The report also predicts the launch of over 45 fintech startups, each valued at USD 1 billion or more, in the Middle East by 2030, with Saudi Arabia spearheading this trend.

As of 2023, the MENA region boasted over 250 fintech startups, a number projected to surge beyond 250 by 2025. MENA's robust entrepreneurial ecosystem positions fintech as a key player in tackling the region's pressing financial hurdles.

In the face of a challenging global financial landscape, MENA's fintech industry showcased resilience, outpacing other sectors. Despite a global economic downturn marked by rising interest rates and technological disruptions, MENA's fintech sector witnessed a 47% Y-o-Y dip in total funding, settling at USD 484 million. However, the sector's SEED valuation remained steady, underscoring its stability.

MENA Fintech Market Trends

Rising Digital & Cashless Payments is Driving the Growth of The Market

Across the Middle East, digital payments, cross-border instant payments, BPL (buy-now-later) services, and digital banking reign the market. The MENA region witnesses a surge in digital payments, bolstered by government backing and a push towards a digital economy. Over 85% of fintech firms in the MENA region focus on payment and transfer services.

The entry of global payment giants like Gpay, Apple Pay, and Samsung Pay fueled a surge in the adoption of digital wallets in MENA. Notably, the United Arab Emirates has emerged as a frontrunner in the global shift towards cashless societies. Data suggests that 70% of SMEs in the UAE have already embraced or are poised to adopt cashless systems by 2024.

Recent data from Visa underscores the UAE's pioneering stance in adopting a cashless society. A notable 52% of UAE consumers, outpacing the global average of 41%, are either already embracing or planning to transition to a cashless lifestyle by 2024. Within the e-commerce realm, credit cards take center stage, dominating the landscape and accounting for the majority of transactions. Debit cards, on the other hand, make up 11% of the market, as highlighted by FIS Global Payments Wallet. Additionally, online payments, including mobile wallets, constitute a significant 24% of the total transaction value, solidifying its position as the UAE's second most popular payment method.

UAE is Dominating the Fintech Market

Investment in the UAE's fintech sector has surged by an impressive 92% in 2024, with projections indicating a doubling of transaction value by 2028. This surge is underpinned by multiple factors, including the UAE's strategic geographic location, a rising appetite for fintech solutions among locals, and its allure for foreign direct investment (FDI).

The UAE government is actively incentivizing green finTech initiatives through tax benefits. This move aims to foster innovation, bolster financial growth, and underscore the nation's commitment to environmental sustainability. The UAE, particularly, is emerging as a favored destination for financial service providers, including cryptocurrency exchanges and FX/CFD brokers. With one of the world's swiftest-growing economies, the UAE's government has embraced policies that champion innovation and attract investments. These measures span tax incentives for foreign investors and targeted ad campaigns highlighting the nation's investment potential and affordable living.

MENA Fintech Industry Overview

The MENA fintech market is moderately fragmented. Companies from all over the world are investing heavily in this segment. In the MENA market, there are many fintech companies with smaller market shares. The adoption of fintech platforms and the need to upgrade to new technology increases the competition among companies. Due to the pandemic and the rise of cities, people started to accept new methods of payment and contactless gateways. Innovation and technological progress accelerated. Some of the major players dominating the market include Tamara, Liv., Pepper, PayTabs, Tabby, and Sarwa.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Customers' Growing Need for E-Commerce and Mobile Banking Platforms

- 4.2.2 Rising Internet Penetration & Adoption of Smartphones will Continue to Lead the Growth of the Market

- 4.3 Market Restraints

- 4.3.1 Data Privacy Concerns

- 4.3.2 Increasing Cybersecurity Risks

- 4.4 Market Opportunities

- 4.4.1 Rising Investments in Fintech Startups

- 4.4.2 Robo-Advisors Will Continue to Grow in the Future

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights of Technology Innovations in the Market

- 4.7 Insights on Government Regulations and Industry Policies

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service proposition

- 5.1.1 Money Transfer and Payments

- 5.1.2 Savings and Investments

- 5.1.3 Digital Lending & Lending Marketplaces

- 5.1.4 Online Insurance & Insurance Marketplaces

- 5.1.5 Other Service Propositions

- 5.2 By Country

- 5.2.1 United Arab Emirates

- 5.2.2 Saudi Arabia

- 5.2.3 Bahrain

- 5.2.4 Qatar

- 5.2.5 Iran

- 5.2.6 Egypt

- 5.2.7 Israel

- 5.2.8 Rest of MENA

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Tamara

- 6.2.2 Liv.

- 6.2.3 Pepper

- 6.2.4 PayTabs

- 6.2.5 Tabby

- 6.2.6 Sarwa

- 6.2.7 Ila Bank

- 6.2.8 Bayzat

- 6.2.9 Eureeca

- 6.2.10 Cwallet*