|

市场调查报告书

商品编码

1690914

全球非公路用车辆远端资讯处理市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Off-Highway Vehicle Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

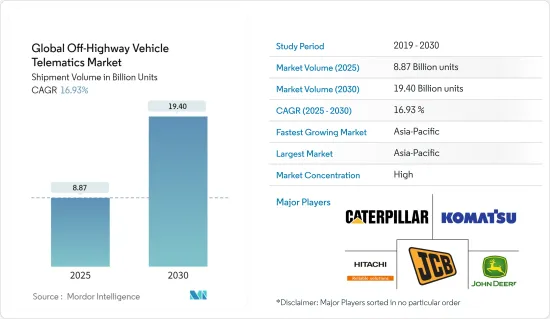

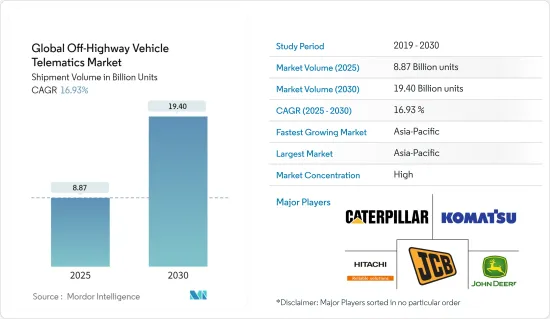

全球非公路用车辆远端资讯处理市场规模(基于单位出货量)预计将从 2025 年的 88.7 亿台扩大到 2030 年的 194 亿台,预测期间(2025-2030 年)的复合年增长率为 16.93%。

非公路用车辆远端资讯处理市场涵盖广泛的设备,包括专用重型机械、轻型设备以及用于建筑、采矿、农业和林业的其他车辆。非公路用车辆(OHV) 远端资讯处理设备透过 GPS、行动电话和卫星通讯提供对即时设备资料的访问,从而使非公路用车辆远端资讯处理解决方案能够持续监控设备位置、状况、健康和利用率。

关键亮点

- 非公路用车辆市场包括各种各样的工具,包括专用重型机械、轻型设备以及用于建筑、采矿、农业和林业的其他车辆。非公路用车辆远端资讯处理是指部署远端资讯处理硬体和相关软体解决方案,用于远端监控和管理这些领域中使用的机器和设备车队。

- 该行业的主要驱动力是增加对 OHV资料分析的需求、提高生产力和利用率以及降低与维护和维修相关的营运成本。随着技术的进步,远端资讯处理行业也得到了快速发展。 4G 和 5G 网路的升级提供了全新的体验,频宽,资料上传和反馈下载更快,从而带来更多的即时资料集、即时驾驶员安全、车辆维护和车队效率。市场领导提供强大的定位服务(LBS) 和远端资讯处理功能,作为其直觉、全面的 OHV 远端资讯处理解决方案的一部分。

- 非公路用车辆远端资讯处理市场受到已开发地区法规的推动,这些法规要求非公路用车辆资讯处理功能,以更好地追踪车辆排放气体、燃料排放气体、驾驶时间法规和事故检测。远端资讯处理解决方案在重型车辆、公路和非公路设备行业越来越受欢迎。目前各大汽车製造商都已将远端资讯处理系统作为其车辆的标准配置,并且这一趋势正在蔓延至其他车型和设备类别。

- 远端资讯处理设备可以实现对非公路用车辆及其驾驶员的即时监控。大多数车队经理和越野车操作员认为这是对隐私的侵犯,并且不愿意在其车队中部署远端资讯处理设备。远端资讯处理系统收集和传输有关速度变化、挑战性驾驶习惯、即时追踪、车辆诊断等方面的资料。此外,由于车队营运商对于安装追踪器相关的法律影响的不确定性日益增加,预计全球非高压车辆(OHV)远端资讯处理市场的成长将很快受到抑制。

- COVID-19 的不确定性影响了所有车辆领域,导致当地封锁、路线关闭和运输组织崩坏。此外,由于封锁和病毒传播迫使人们待在室内,非公路用车辆远端资讯处理市场在此次疫情中面临的财务脆弱性比以往疫情期间要高得多。随着企业车队拥有的车辆数量不断增加,在艰难的商业环境中有效管理车辆的挑战和压力也越来越大,这可能会推动 OHV 远端资讯处理市场的发展。

非公路用车辆远端资讯处理市场趋势

建筑业仍是最大产业

- 随着公共和私营部门建设活动的增加,市场成长预计将很快加速。世界各地都在进行或计划进行基础设施计划,包括印度、菲律宾、阿拉伯联合大公国、沙乌地阿拉伯、埃及、奈及利亚和美国。此类基础设施计划的快速发展预计将推动对施工机械的需求,从而支持非公路用车辆远端资讯处理市场的成长。

- 建筑业正在进行的数位转型正在推动技术应用并为远端资讯处理市场创造新的机会。根据 NBS Enterprises Ltd 的《2021 年数位化建筑报告》,46% 的受访者已经开始数位转型一段时间,其中 17% 的受访者已顺利完成数位转型。

- 建筑业占最大份额,其中以重型设备製造商提供的OEM远端资讯处理系统为主。施工机械远端资讯处理使建设公司能够追踪设备位置和性能、监控施工机械运转率并确保资产得到有效利用。在印度等新兴经济体,儘管遭遇第二波新冠疫情,但根据印度统计和计划实施部(MoSPI)的数据,印度建筑业在2021年第三季度仍同比增长68.3%,为市场增长做出了重大贡献。

- 由于资产管理和驾驶员管理问题,车队管理解决方案已成为建筑业必不可少的一部分。根据中小型企业的车队管理软体公司 Vimcar 的一项调查(2021 年 8 月),三分之一的建筑经理曾偷窃过车队车辆,87% 的建筑经理在没有整体情况车队运营情况的情况下限制员工车辆使用。

- 根据《2021 年 Verizon Connect 车队技术趋势报告》,51% 的建设业终端用户使用 GPS 车辆跟踪,57% 重视车辆视频以降低事故成本并提高驾驶员安全性,43% 实现了保险成本的降低。

- 建筑业事故数量的增加推动了车队管理行业的需求。根据英国健康与安全执行局 2021 年的一项研究,英国建设业发生了 39 起致命事故(比英国任何其他行业都多)。

亚太地区成长率最高

- 中国和印度等亚洲国家人口不断增长,但远端资讯处理普及率较低,对更好的公共基础设施的需求日益增加。人们对 OHV 远距资讯处理系统重要性的认识不断提高以及这些国家的快速发展预计将在不久的将来提供巨大的成长机会。此外,为了利用该地区利润丰厚的市场,许多製造商正在推出配备远端资讯处理系统的 OHV。

- 新兴经济体政府正积极投资基础建设计划。例如,「Bharatmala Yojana」计画包含改善全国公路网络的规定。同样,印尼政府有 20 多个计划,透过提供道路、住宅、医院和其他必要的基础设施来发展 52,000 多个农村。此类基础设施开发计划正在进行且提案的投资预计将增加对非公路用车辆的需求,从而推动非公路用车辆远端资讯处理解决方案市场的成长。

- 预计预测期内中国挖掘机等施工机械市场将会成长。政府对地方政府基础建设计划的支出是2021年施工机械销售强劲的主要原因。例如,全国各地的城市都在扩大地铁和其他城市交通系统。

- 此外,国家发展和改革委员会的数据显示,2021年前10个月,重型卡车销量成长40%,达到137万辆。预计年销量将成长至160万台。在供应商方面,威伯科控股公司和 G7 宣布达成协议,在中国建立合资企业,开发和销售卡车和拖车的先进车辆管理系统。

- MFTBC 已经为卡车提供 Truck Connect 服务一段时间了。该合作平台为车队管理人员提供车辆位置、安全评分、车辆运转率、燃油消费量等即时资讯。此外,它还能够透过即时远距离诊断来检测技术故障。根据与 Wise Systems 达成的协议,MFTBC 计划增加路线和调度解决方案,以优化最后一哩的交付。我们可以灵活地使用任何品牌或类型的车辆,包括非公路用车辆。

非公路用车辆远端资讯处理产业概况

竞争对手之间的竞争非常激烈,多个参与企业在竞争激烈的领域中争夺市场占有率。随着新进业者寻求提供专业化产品和创新经营模式,竞争预计将更加激烈。原始设备製造商(OEM)正在透过向车队所有者提供其内部开发的远端资讯处理硬体和软体作为捆绑解决方案,进军远端资讯处理领域。这使得售后市场供应商陷入困境。

- 2022 年 1 月,喜利得与 Trackunit 宣布建立策略伙伴关係,以有效消除停机时间。 Hilti 和 Trackunit伙伴关係推动建筑业的数位转型,并致力于将全球规模的互联工具和设备推向世界。它还将扩展 Trackunit 的远端资讯处理连接设备。

- 2021 年 11 月 - 日立建筑机械英国公司正在交付日立 ZX135US-7,以帮助建设公司实现零碳建筑工地的目标。 ZX135US-7 标配最新的 Stage V 引擎和 TRIAS III 帮浦技术,以及徕卡测量系统半自动机器控制、Xwatch 5 高度和迴转限制器、日立即时 CT Fleet Link 远端资讯处理系统,并使用 HVO(加氢植物油)。

- 2021 年 10 月 - 小鬆有限公司及其全资子公司小松欧洲国际公司宣布,他们将在欧洲最大的露天铜矿之一 Aitik 矿的 11 辆 930E-5 超级运输卡车上安装小松 FrontRunner 自动运输系统 (AHS)。 FrontRunner AHS 方法位于瑞典北部,由瑞典 Boliden Komatsu 拥有,将超高端自动卸货卡车与 ModulaMining 业界领先的管理系统 DISPATCH 车队管理系统结合。该系统透过成熟的优化技术实现了 100% 合规。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 监管与OEM的崛起

- 不断提升的技术发展

- 市场限制

- 最终用户越来越不愿意改变他们的商业惯例

- 缺乏重型机械使用培训

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争强度

- 替代品的威胁

- 法规和义务

- COVID-19 市场影响评估

第五章非公路用车辆远端资讯处理技术与解决方案

第六章市场区隔

- 按最终用户产业

- 建造

- 农业

- 矿业

- 林业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Caterpillar

- Komatsu

- JCB

- Hitachi Construction Machinery

- Deere & Company

- SANY Group

- Volvo Construction Equipment

- Doosan Corporation

- Liebherr

- CNH Industrial

- CLAAS Group

- Hyundai Motor Group

- Tadano Ltd

- AGCO

- Geotab Inc.

- MiXTelematics International

- Verizon Connect

- Trimble Inc.

- Omnitracs LLC

- ACTIA group

- Airbiquity Inc.

- UK Telematics

- Bridgestone Europe NV/SA(TomTom)

- Webfleet Solutions BV(Bridgestone Corp.)

- Teletrac Navman

- KeepTruckin Inc.

- Skylo Technologies

- Geoforce Inc.

- Orbcomm Inc.

- Samsara Networks Inc.

第八章投资分析

第九章 市场机会与未来趋势

The Global Off-Highway Vehicle Telematics Market size in terms of shipment volume is expected to grow from 8.87 billion units in 2025 to 19.40 billion units by 2030, at a CAGR of 16.93% during the forecast period (2025-2030).

The off-highway vehicle telematics market covers a wide range of equipment utilized in the construction, mining, agriculture, and forestry industries, including specialist heavy machinery, lighter gear, and other vehicles. By using off-highway vehicle (OHV) telematics devices that allow GPS, cellular, or satellite connectivity for access to real-time equipment data, off-highway vehicle telematics solutions offer continuous monitoring of the position, condition, health, and utilization of equipment.

Key Highlights

- The market for off-highway vehicles consists of various tools, including specialized heavy machinery, lighter equipment, and other vehicles used in the construction, mining, agriculture, and forestry industries. Off-highway vehicle telematics refers to telematics hardware and associated software solutions deployed for remote monitoring and managing fleets of machinery and equipment used in these sectors.

- The main drivers of this industry are the increasing demand for OHV data analysis, increased productivity and utilization, and decreased operational costs related to maintenance and repairs. The telematics industry has been developing quickly as a result of technological improvements. An entirely new experience in terms of bandwidth, faster data uploads, and feedback downloads are provided by upgrading to 4G and 5G networks, leading to more real-time data sets, real-time driver safety, fleet maintenance, and fleet efficiency. Market leaders provide robust location-based services (LBS) and telematics capabilities as part of an intuitive, all-inclusive OHV telematics solution.

- The off-highway vehicle telematics market is driven by regulations in developed regions to equip off-highway vehicles with telematics for improved tracking of vehicle emissions, fuel emissions, driver hour regulation, and accident detection. Telematics solutions are becoming more popular in the heavy-duty, on-highway, and off-highway equipment industries. Major automakers are now including telematics systems as standard equipment on their vehicles, and this trend is spreading to additional models and equipment categories.

- Real-time monitoring of off-highway vehicles and their drivers is made possible by telematics devices. Most fleet managers and off-road vehicle drivers view this as an invasion of privacy and are hesitant to deploy telematics devices in their fleets. Telematics systems gather and send data about, among other things, changes in speed and difficult driving habits, real-time tracking, and vehicle diagnostics. Furthermore, the worldwide off-high vehicle (OHV) telematics market growth is anticipated to be constrained shortly because of growing uncertainty among fleet operators regarding the legal implications associated with the installation of trackers.

- The uncertainty of COVID-19 impacted all vehicle segments and has resulted in regional lockdowns, line closures, and the disintegration of transportation organizations. Furthermore, the financial vulnerability of the off-highway vehicle telematics market due to the pandemic is much higher than it was in previous outbreaks as the lockdown and the virus spread are forcing people to stay indoors. With the increasing number of vehicles owned by corporate fleets, the challenges and pressures to effectively manage the fleet in a challenging business environment are increasing, which could drive the OHV Telematics Market.

Off-Highway Vehicle Telematics Market Trends

Construction Segment remains the biggest sector

- Growing construction activities in private as well as public sectors are expected to boost market growth soon. There are several infrastructure-related projects underway or planned across the globe in countries such as India, the Philippines, UAE, Saudi Arabia, Egypt, Nigeria, and the U.S. For Instance, the government of India is expected to invest US$ 650 billion in various urban and infrastructure projects in the country to build one hundred smart cities. This rampant development in infrastructure projects is expected to boost the demand for construction equipment, which in turn, is expected to support the growth of the Off-Highway vehicle telematics market.

- The ongoing digital transformation in the construction industry is driving the adoption of technologies and creating new opportunities for the telematics market. According to the Digital Construction Report 2021 by NBS Enterprises Ltd, 46% of the respondents have been on a digital transformation journey for some time, with 17% well on the way to completion.

- The construction sector accounts for the largest share, driven by OEM telematics systems offered by heavy equipment manufacturers. Construction equipment telematics allows construction firms to track the equipment's location and performance and monitor construction equipment utilization and ensure that assets are being used efficiently. In developing countries, such as India, despite the outbreak of the second wave of the COVID-19 pandemic, the construction industry in India registered a year-on-year growth of 68.3% in Q3 2021, according to the Ministry of Statistics and Programme Implementation (MoSPI), which significantly added to the market growth.

- Fleet management solutions have become essential in construction due to the issues of asset management and driver management. According to a survey conducted by Vimcar (August 2021), a fleet management software company for SMEs, one in three construction managers stole fleet vehicles, while 87% restrict employee vehicle usage without a full picture of how the fleet operates.

- According to Verizon Connect Fleet Technology Trends Report 2021, 51% of the construction end-users utilize GPS fleet tracking, 57% credit in-cab video for reduced accident costs and improved driver safety, and 43% saw reduced insurance costs.

- The increasing number of accidents in the construction industry is driving the demand for the fleet management industry. According to a 2021 survey by Health and Safety Executive, in Great Britain, there were 39 fatalities in the construction industry (the most of any sector in the United Kingdom).

Asia Pacific To Exhibit The Highest Growth Rate

- The growing population in Asian countries, such as China and India, drives the need for better public infrastructure as the penetration of telematics is low. Increasing awareness regarding the significance of telematics systems in OHV and rapid development in these countries is expected to provide major growth opportunities in the near future. Moreover, numerous manufacturers are launching OHV equipped with telematics systems, in order to capitalize on the lucrative market in the region.

- Governments of these economies are aggressively investing in infrastructure development projects. For example, the "Bharatmala Yojana" includes provisions for improving road networks throughout the country. Similarly, The Indonesian government has more than 20 projects for developing more than 52,000 rural villages by building better roads, houses, hospitals, and other necessary infrastructure. These ongoing and proposed investments in infrastructure development projects are expected to drive the demand for off-highway vehicles, which is expected to boost the growth of the market for off-highway vehicle telematics solutions.

- The market for excavators and other construction machinery is expected to grow in China during the forecast period. Government expenditure on municipal infrastructure projects is the key reason for healthy construction machinery sales in 2021. For instance, the cities around the country are expanding subways and other urban transportation systems.

- Further, according to the National Development and Reform Commission, heavy-duty truck sales grew by 40% to 1.37 million in the first ten months of 2021. Allied sales are expected to grow to 1.6 million for the year. On the vendor front, WABCO Holdings Inc. and G7 announced an agreement to form a joint venture in China to develop and sell advanced fleet management systems for trucks and trailers.

- MFTBC has, since long, been offering its trucks Truckonnect. The allied platform allows the operators to check real-time information, such as vehicle location, safety scores, vehicle utilization, and fuel consumption. Additionally, it was developed to detect technical failures through real-time remote diagnosis. After an agreement with Wise Systems, MFTBC plans to add routing and dispatching solutions that optimize the last mile of deliveries. It offers flexibility to use vehicles of all brands and types, including off-highway vehicles.

Off-Highway Vehicle Telematics Industry Overview

The intensity of competitive rivalry is high, with multiple players vying for market share in a fairly contested space. The competition is expected to increase further with newer players looking to offer specialized offerings and innovative business models. The OEMs are venturing into the telematics space by offering in-house development of telematics hardware and software as a bundled solution to the fleet owners. This is creating a tough spot for aftermarket vendors.

- In Jan 2022, Hilti and Trackunit announced a strategic partnership to eliminate downtime effectively. Hilti and Trackunit have formed a partnership to advance digital transformation in the construction industry focused on bringing global scale to the tool and equipment connectivity domain. It will also enable Trackunit to expansion in their telematics connectivity devices.

- November 2021 - Hitachi Construction Machinery UK is providing a Hitachi ZX135US-7, which will help the construction company move towards its goal of a zero-carbon construction site. The ZX135US-7 has the latest Stage V engine and TRIAS III pump technology that is standard on the machine; it was also equipped with semi-automated Leica Geosystems machine control, Xwatch 5 height, and slew limiter Hitachi's real-time CT fleet link telematics system and fueled with Hydrotreated Vegetable Oil (HVO) fuel; demonstrating that HCMUK can help to pave the way for sustainability.

- October 2021 - Komatsu Ltd and its wholly-owned subsidiary, Komatsu Europe International NV, announced that Komatsu FrontRunner, an autonomous haulage system (AHS), will be deployed on 11 930E-5 ultra-class haul trucks at Aitik, one oEurope's'soEurope's's largest open-pit copper mines, located in northern Sweden and owned by the Swedish company BolidenKomatsu's'sBolidenKomatsu's's approach for FrontRunner AHS brings together ultra-class dump trucks with ModulaMining's'sModulaMining's's industry-leading DISPATCH Fleet Management System, the preferred management system. The system enables 100% compliance with its proven optimization methodology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulations and OEM Proliferation

- 4.2.2 Increase in Technological Developments

- 4.3 Market Restraints

- 4.3.1 Growing Reluctance of End Users to Change Business Practices

- 4.3.2 Lack of Training for the Use in Heavy Equipment

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Intensity of Competitive Rivalry

- 4.4.5 Threat of Substitutes

- 4.5 Regulations and Mandates

- 4.6 Assessment of Impact of COVID-19 on the Market

5 OFF-HIGHWAY VEHICLE TELEMATICS TECHNOLOGIES AND SOLUTIONS

6 MARKET SEGMENTATION

- 6.1 By End-User Industry

- 6.1.1 Construction

- 6.1.2 Agriculture

- 6.1.3 Mining

- 6.1.4 Forestry

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Caterpillar

- 7.1.2 Komatsu

- 7.1.3 JCB

- 7.1.4 Hitachi Construction Machinery

- 7.1.5 Deere & Company

- 7.1.6 SANY Group

- 7.1.7 Volvo Construction Equipment

- 7.1.8 Doosan Corporation

- 7.1.9 Liebherr

- 7.1.10 CNH Industrial

- 7.1.11 CLAAS Group

- 7.1.12 Hyundai Motor Group

- 7.1.13 Tadano Ltd

- 7.1.14 AGCO

- 7.1.15 Geotab Inc.

- 7.1.16 MiXTelematics International

- 7.1.17 Verizon Connect

- 7.1.18 Trimble Inc.

- 7.1.19 Omnitracs LLC

- 7.1.20 ACTIA group

- 7.1.21 Airbiquity Inc.

- 7.1.22 UK Telematics

- 7.1.23 Bridgestone Europe NV/SA (TomTom)

- 7.1.24 Webfleet Solutions BV (Bridgestone Corp.)

- 7.1.25 Teletrac Navman

- 7.1.26 KeepTruckin Inc.

- 7.1.27 Skylo Technologies

- 7.1.28 Geoforce Inc.

- 7.1.29 Orbcomm Inc.

- 7.1.30 Samsara Networks Inc.