|

市场调查报告书

商品编码

1844372

非公路车辆远端资讯处理市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Off-Highway Vehicle Telematics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

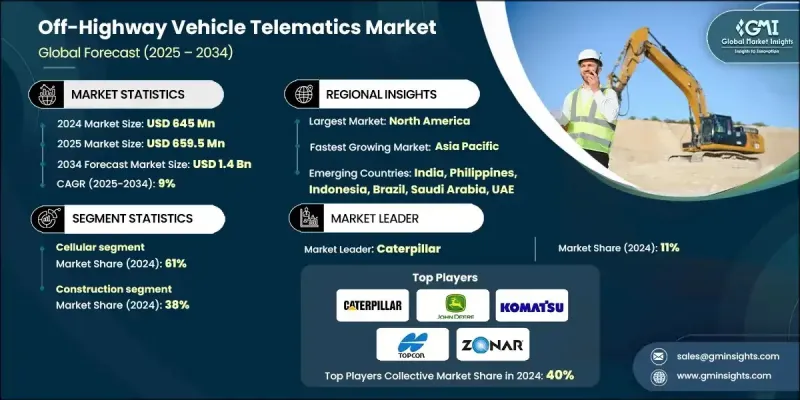

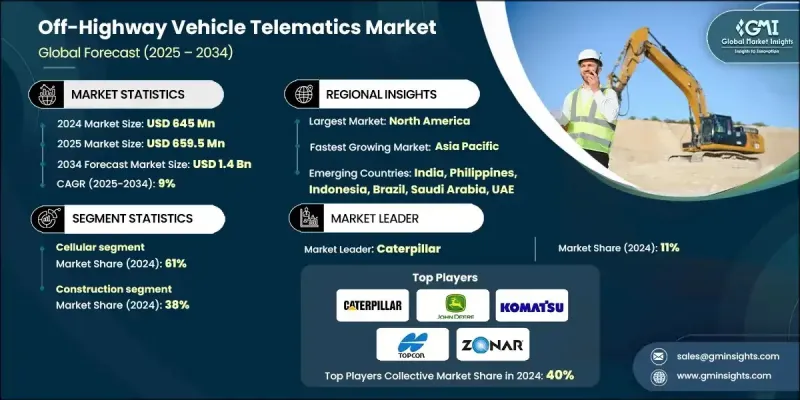

2024 年全球非公路车辆远端资讯处理市场价值为 6.45 亿美元,预计到 2034 年将以 9% 的复合年增长率成长至 14 亿美元。

随着脱碳浪潮的兴起以及电动和混合动力非公路设备的应用日益普及,市场正在快速发展。原始设备製造商和营运商正在转向远端资讯处理技术,以增强能源管理、延长电池寿命并更好地利用充电网路。这些系统在各个领域发挥着至关重要的作用,能够实现更智慧的资源配置、减少停机时间并提高机器效率。例如,农业作业受益于支援精准作业的智慧监控系统。整体而言,随着各行各业向更清洁、数据驱动的营运模式转型,先进的远端资讯处理技术正成为不可或缺的基础设施组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.45亿美元 |

| 预测值 | 14亿美元 |

| 复合年增长率 | 9% |

疫情显着加速了非公路用车产业的数位转型,企业越来越依赖基于云端的车队工具、预测性诊断和自动化分析来保持营运顺畅。这导致对数位孪生、安全资料环境和远端营运中心的投资不断增加。智慧农业、采矿自动化和下一代建筑技术的发展,催生了对可扩展、精确且与营运平台深度整合的远端资讯处理系统的需求。 5G、人工智慧驱动的维护和M2M通讯持续吸引投资,重点在于提高安全性、减少设备閒置时间和提高产量。在监管规定、先进基础设施和广泛的OEM合作伙伴关係的支持下,北美和欧洲保持着强劲的市场地位。

2024年,蜂窝网路占据了61%的市场份额,预计到2034年将以8.5%的复合年增长率成长。这些网路对于维持重型机械与集中式车队管理系统之间的持续连接至关重要。即时存取资产位置、燃油油位、性能指标和服务警报等资料,使操作员能够更好地控制非公路应用,并提高营运可见度。

建筑业在2024年占据了38%的份额,预计到2034年将以7.6%的复合年增长率成长。该行业高度依赖远端资讯处理来管理在多个工地作业的各种设备,例如推土机、起重机、装载机和挖掘机。简化资产管理并保持进度的能力是满足紧迫期限和预算的关键。

美国非公路车辆远端资讯处理市场占了85%的市场份额,2024年市场规模达2.096亿美元。受资产追踪、安全标准和营运效率提升需求的推动,美国在采矿、建筑和农业领域对远端资讯处理的采用持续强劲成长。基础设施的增强、数位化就绪度的提升以及企业数位化程度的提高,使得企业更容易在非公路车辆营运中采用和扩展远端资讯处理技术。

活跃于非公路车辆远端资讯处理市场的主要公司包括Teletrac Navman、卡特彼勒、小松、Zonar Systems、迪尔公司、拓普康公司、日立建机、Orbcomm、Trimble和Trackunit。为了巩固市场地位,各公司正积极投资研发,以开发模组化、可扩展的远端资讯处理平台,相容于各种车型和应用。与原始设备製造商(OEM)的合作允许在製造阶段进行集成,从而提高系统效率和普及率。此外,各公司正专注于人工智慧和预测分析,以提供更智慧的维护计划和机器洞察。许多公司也正在扩展其软体即服务 (SaaS) 产品和资料安全框架,以吸引企业买家。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 供应链生态系图

- 产业衝击力

- 成长动力

- 快速工业化和基础设施发展

- 非公路车辆自动化程度的成长

- 越野车辆运行效率的需求不断增加

- 更重视工人的安全保障

- 产业陷阱与挑战

- 非公路车辆远端资讯处理的前期成本高昂

- 准确性和可靠性挑战

- 市场机会

- 预测性维护需求不断成长

- 5G与卫星物联网连接的集成

- 永续性和绿色车队计划

- 新兴市场的扩张

- 成长动力

- 成长潜力

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利分析

- 数据分析和情报能力

- 机器学习应用评估

- 边缘运算基础设施需求

- 即时处理能力

- 预测分析框架

- 数据视觉化和仪表板要求

- 电源管理和连接基础设施

- 电池和电力系统分析

- 无线通讯可靠性

- 偏远地区连接解决方案

- 混合通讯系统设计

- 基础建设投资需求

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

- 成本分解分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 蜂巢

- 卫星

第六章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 车队管理

- 车辆追踪

- 燃料管理

- 安全保障

- 其他的

第 8 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 建造

- 农业

- 矿业

- 林业

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 印尼

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球参与者

- AGCO Corporation

- Caterpillar

- CNH Industrial

- Continental

- Deere & Company

- Komatsu

- Kubota

- Orbcomm

- Teletrac Navman

- Topcon

- Trackunit A/S

- Trimble

- Volvo Group

- Zonar Systems

- 区域参与者

- Atlas Copco

- CLAAS Group

- Doosan Group

- Escorts Limited

- Hitachi Construction Machinery

- Liebherr Group

- Mahindra & Mahindra

- Sandvik

- Volvo Construction Equipment

- Yanmar Holdings

- 新兴玩家

- Cartrack Holdings

- Epiroc

- MONTRANS

- Raven Industries

- TTControl

The Global Off-Highway Vehicle Telematics Market was valued at USD 645 million in 2024 and is estimated to grow at a CAGR of 9% to reach USD 1.4 billion by 2034.

The market is evolving rapidly as the push for decarbonization and the adoption of electric and hybrid-powered off-highway equipment intensifies. OEMs and operators are turning to telematics to enhance energy management, extend battery performance, and better utilize charging networks. These systems play a crucial role in various sectors by enabling smarter resource allocation, reducing downtime, and improving machine efficiency. Agricultural operations, for example, benefit from intelligent monitoring systems that support precision activities. Overall, as industries transition toward cleaner, data-driven operations, advanced telematics is becoming an essential infrastructure component.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $645 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 9% |

The pandemic significantly accelerated digital transformation in off-highway industries, with companies increasingly relying on cloud-based fleet tools, predictive diagnostics, and automated analytics to keep operations moving. This led to rising investments in digital twins, secure data environments, and remote operations hubs. The growth of smart farming, automation in mining, and next-gen construction technologies has created demand for telematics systems that are scalable, accurate, and deeply integrated with operational platforms. 5G, AI-driven maintenance, and M2M communications continue to attract investment, with a focus on improving safety, reducing idle equipment time, and boosting output. North America and Europe maintain strong market positions, supported by regulatory mandates, advanced infrastructure, and widespread OEM partnerships.

In 2024, the cellular segment held a 61% share and is forecast to grow at a CAGR of 8.5% through 2034. These networks are critical to maintaining constant connectivity between heavy machines and centralized fleet management systems. Real-time access to data such as asset location, fuel levels, performance metrics, and service alerts gives operators more control and operational visibility across off-highway applications.

The construction segment held a 38% share in 2024 and is expected to grow at a CAGR of 7.6% through 2034. The segment relies heavily on telematics to manage diverse fleets of equipment like bulldozers, cranes, loaders, and excavators that operate across multiple job sites. The ability to streamline asset management and maintain schedules is key to meeting tight deadlines and budgets.

United States Off-Highway Vehicle Telematics Market held an 85% share and generated USD 209.6 million in 2024. The U.S. continues to see strong growth in telematics adoption across mining, construction, and agriculture, driven by a need to improve asset tracking, safety standards, and operational efficiency. Enhanced infrastructure, high digital readiness, and increasing enterprise digitalization are making it easier for companies to adopt and scale telematics across off-highway operations.

Key companies active in the Off-Highway Vehicle Telematics Market include Teletrac Navman, Caterpillar, Komatsu, Zonar Systems, Deere & Company, Topcon Corporation, Hitachi Construction Machinery, Orbcomm, Trimble, and Trackunit. To strengthen their market presence, companies are actively investing in R&D to develop modular and scalable telematics platforms compatible across a variety of vehicle types and applications. Collaborations with OEMs allow integration at the manufacturing stage, enhancing system efficiency and adoption. Additionally, players are focusing on AI and predictive analytics to offer smarter maintenance scheduling and machine insights. Many are also expanding their software-as-a-service (SaaS) offerings and data security frameworks to appeal to enterprise buyers.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Sales channel

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.1.7 Supply chain ecosystem mapping

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid industrialization and infrastructure development

- 3.2.1.2 Growth of automation in off-highway vehicles

- 3.2.1.3 Rising need for operational efficiency of OHVs

- 3.2.1.4 Increased focus on the safety and security of workers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront costs of off-highway vehicle telematics

- 3.2.2.2 Accuracy and reliability challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for predictive maintenance

- 3.2.3.2 Integration of 5G and satellite IoT connectivity

- 3.2.3.3 Sustainability and green fleet initiatives

- 3.2.3.4 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Data analytics & intelligence capabilities

- 3.9.1 Machine learning application assessment

- 3.9.2 Edge computing infrastructure requirements

- 3.9.3 Real-time processing capabilities

- 3.9.4 Predictive analytics framework

- 3.9.5 Data visualization & dashboard requirements

- 3.10 Power management & connectivity infrastructure

- 3.10.1 Battery & power system analysis

- 3.10.2 Wireless communication reliability

- 3.10.3 Remote area connectivity solutions

- 3.10.4 Hybrid communication system design

- 3.10.5 Infrastructure investment requirements

- 3.11 Sustainability & environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Cost-breakdown analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Cellular

- 5.3 Satellite

Chapter 6 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 OEM

- 6.3 Aftermarket

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Fleet management

- 7.3 Vehicle tracking

- 7.4 Fuel management

- 7.5 Safety and security

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Construction

- 8.3 Agriculture

- 8.4 Mining

- 8.5 Forestry

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Philippines

- 9.4.7 Indonesia

- 9.4.8 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 AGCO Corporation

- 10.1.2 Caterpillar

- 10.1.3 CNH Industrial

- 10.1.4 Continental

- 10.1.5 Deere & Company

- 10.1.6 Komatsu

- 10.1.7 Kubota

- 10.1.8 Orbcomm

- 10.1.9 Teletrac Navman

- 10.1.10 Topcon

- 10.1.11 Trackunit A/S

- 10.1.12 Trimble

- 10.1.13 Volvo Group

- 10.1.14 Zonar Systems

- 10.2 Regional Players

- 10.2.1 Atlas Copco

- 10.2.2 CLAAS Group

- 10.2.3 Doosan Group

- 10.2.4 Escorts Limited

- 10.2.5 Hitachi Construction Machinery

- 10.2.6 Liebherr Group

- 10.2.7 Mahindra & Mahindra

- 10.2.8 Sandvik

- 10.2.9 Volvo Construction Equipment

- 10.2.10 Yanmar Holdings

- 10.3 Emerging Players

- 10.3.1 Cartrack Holdings

- 10.3.2 Epiroc

- 10.3.3 MONTRANS

- 10.3.4 Raven Industries

- 10.3.5 TTControl