|

市场调查报告书

商品编码

1690940

非公路用车轮:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Off-Highway Wheels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

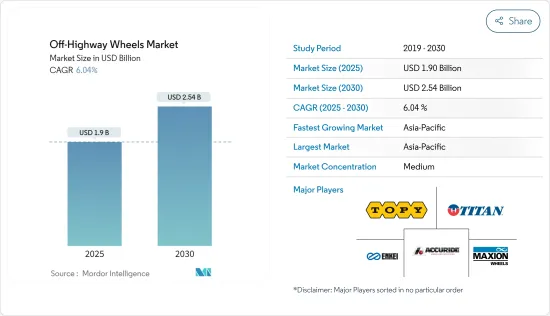

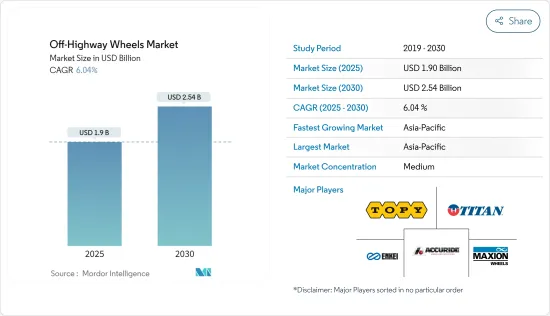

预计非公路用车轮市场规模在 2025 年将达到 19 亿美元,到 2030 年将达到 25.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.04%。

非公路用车轮市场正在经历强劲增长,这归因于车轮技术的进步、基础设施计划投资的增加以及农业、建筑和采矿业对耐用高效车轮的需求不断增长等几个关键因素。该报告分析了影响市场的关键驱动因素和近期趋势。

技术创新正在推动非公路车轮市场的发展。製造商专注于开发轻质、耐用的车轮,以提高性能和燃油效率。例如

主要亮点

- 马可迅车轮公司将于 2022 年 11 月推出新一代轻量钢製卡车车轮,每个车轮可减轻重量高达 3 公斤。这些进步不仅提高了燃油经济性,而且还提高了负载容量,这对于非公路应用至关重要。

此外,全球基础设施发展是非公路用车轮市场的主要驱动因素。大型建筑计划,尤其是新兴经济体的大型建筑项目,正在推动对配备先进车轮的坚固非公路用车辆的需求。世界各地的多个大型企划正在对非公路用车轮市场产生重大影响。例如

主要亮点

- 中国的「一带一路」倡议于 2013 年启动,旨在透过在亚洲、欧洲和非洲进行大规模基础设施建设来增强全球贸易路线,从而推动对建筑和采矿设备的需求。印度的Bharatmala Pariyojana于2017年启动,是一项全国性高速公路发展计划,预计将于2025年分阶段完成,这将推动对工程车辆和施工机械的需求。

- 同样,沙乌地阿拉伯的 Neom City计划于 2017 年宣布,预计将于 2030 年完工,这是一项雄心勃勃的智慧城市计划,需要大量的施工机械。

「一带一路」倡议、印度铁路和 Neom City 等大型基础设施计划预计将推动非公路用车轮市场的大幅成长。

非公路轮圈市场趋势

建筑业可望主导市场

建筑业是一个高度活跃的行业,整体经济、预算和全球经济状况等众多因素都会影响市场的成长。这些方面的波动将影响施工机械OEM的业务,进而影响非公路用车轮的需求。

由于全球计划项目对土木机械的需求庞大,非公路用车轮的需求主要由该产业主导。中国的「一带一路」计画和印度的「印度支那计画」等大型工程需要大量的施工机械,包括挖土机、装载机、推土机和反铲挖土机。这些计划涉及大量的土方工程,需要耐用、高性能的车轮,以确保在复杂地形上的效率和可靠性。随着各国继续投资建设和升级基础设施,对施工机械车轮的需求可能会保持强劲。

由于投资增加,一些国家的基础设施建设取得了显着成长。建筑、隧道、铁路网、道路和桥樑的建设吸引了全国各地大量投资。预测期内,全国基础设施建设的不断扩大可能会增加对施工机械的需求。例如

- 2024年3月,印度政府为跨邦的112个国家高速公路计划举行了揭幕仪式,总价值约120.4亿美元。这些计划包括主要高速公路扩建和引入 GNSS 等无障碍收费新技术。

此外,公共和私营部门的基础设施投资,如印尼的国家中期发展计画(4,600亿美元)、越南的社会经济发展计画(615亿美元)和菲律宾的发展计画「大建特建」(718亿美元),预计将增加该地区对非公路用车的需求。

全球建筑业的蓬勃发展可能会刺激未来几年对施工机械的需求,进而增加对车轮的需求。

预计亚太地区将主导市场

由于推动建筑、农业和工业领域成长的几个关键因素,亚太地区 (APAC) 继续引领非公路用轮圈市场。公路和铁路基础设施的显着发展,加上对新计画的大量投资,带动全部区域建筑业的显着增长。因此,对非公路用车和车轮的需求正在增加。

亚太国家正在大力投资基础设施,以支持其不断成长的工业和服务业。例如,中国宣布了一项重大基础设施计划,投资预算约为 4.8 兆美元,旨在建造新计画并加快现有建设进度。此项投资是中国加强公路、铁路和城市发展等基础设施网络的更广泛战略的一部分,推动了对坚固可靠的非公路用车轮的需求。

亚太地区,尤其是印度的农业部门也是非公路用车轮市场的主要推手。该产业对印度 GDP 的贡献大幅增加,23 财年拖拉机销量已超过 90 万辆。拖拉机销售的激增凸显了对农业机械的需求不断增长,这反过来可能推动对非公路用轮胎的需求。由于农业在许多亚太地区国家的经济中发挥关键作用,非公路用车轮的需求预计将持续成长。

亚太地区建筑业由私人企业和国有企业主导,对商业计划、可再生能源和公共基础设施的支出不断增加。由于正在进行和计划中的大型企划,日本、中国和印度等国家的施工机械和挖掘机市场正在增强。

非公路车轮产业概况

Titan International Inc.、Moveero Limited、Yokohama、Accuride Corporation、Rimex、Steel Strips Wheels Ltd 和 Maxion Wheels 等主要企业主导非公路车轮市场。市场参与者正专注于多种成长策略,以获得相对于其他参与者的竞争优势。例如

- 2022 年 3 月,Titan International Inc. 宣布已达成最终协议,将其澳洲车轮业务出售给当地着名的非公路用车辆轮胎、车轮及相关服务供应商 OTR Tyres。这项策略倡议是泰坦公司简化全球业务、专注于核心市场的努力的一部分。此次出售包括泰坦在澳洲的生产设施、库存和客户合同,使 OTR 轮胎能够加强其市场影响力和服务水准。

- 2022 年 2 月,Titan International 与久保田拖拉机公司 (KTC) 签署了一项重要协议,为久保田的多功能和紧凑型拖拉机型号供应新的 Trac Loader II 轮胎。该轮胎专为轻型建筑、农业、商业和住宅应用而设计,具有卓越的性能和耐用性。 Trac Loader II 轮胎采用先进的胎面设计和材料,可提高牵引力、减少土壤压实并提高拖拉机在各种非公路环境中的整体效率。与久保田的伙伴关係彰显了泰坦对非公路用车轮和轮胎技术创新的承诺,旨在满足各种应用领域客户不断变化的需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 依产品类型

- 合金车轮

- 钢製轮圈

- 按应用

- 农业

- 建筑业(土木机械)

- 物料输送(移动式起重机和堆高机)

- 采矿(行动采矿设备)

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Titan International Inc.

- Moveero Limited

- Accuride Corporation

- Rimex

- Steel Strips Wheels Ltd

- Maxion Wheels

- OTR Wheel Engineering

- Carrier Wheels Private Limited

- Bohnenkamp AG

- Citic Dicastal Co. Ltd

- Trident International

- Levypyora Oy

- JS Wheels

- Anyang Rarlong Machinery Co. Ltd

- STARCO

- Sun Tyre and Wheel Systems

- Baluchistan Wheels Limited

- Topy Industries Ltd

- SAF Holland Group

- Bhagwati Wheels

- Pronar Wheels

- Tej Wheels

- Camso Wheels

第七章 市场机会与未来趋势

The Off-Highway Wheels Market size is estimated at USD 1.90 billion in 2025, and is expected to reach USD 2.54 billion by 2030, at a CAGR of 6.04% during the forecast period (2025-2030).

The off-highway wheel market is experiencing robust growth driven by several key factors, including advancements in wheel technology, increased investment in infrastructure projects, and the growing demand for durable and efficient wheels in the agriculture, construction, and mining sectors. The report analyzes the primary drivers and recent developments influencing this market.

Technological innovations are significantly propelling the off-highway wheel market. Manufacturers are focusing on developing lightweight, durable wheels that offer enhanced performance and fuel efficiency. For example,

Key Highlights

- Maxion Wheels, in November 2022, launched a new generation of lightweight steel truck wheels, which provide weight savings of up to 3 kg per wheel. These advancements not only improve fuel efficiency but also allow for increased payload capacities, which is crucial for off-highway applications.

Furthermore, global infrastructure development is a major driver of the off-highway wheel market. Large-scale construction projects, particularly in developing economies, are increasing the demand for robust off-highway vehicles equipped with advanced wheels. Several mega projects around the world are significantly impacting the off-highway wheel market. For instance,

Key Highlights

- The Belt and Road Initiative (BRI) by China, launched in 2013, aims to enhance global trade routes through extensive infrastructure development across Asia, Europe, and Africa, driving demand for construction and mining equipment. India's Bharatmala Pariyojana, initiated in 2017, is a nationwide highway development project expected to be completed in phases by 2025, boosting the need for construction vehicles and equipment.

- Similarly, the Neom City Project in Saudi Arabia, announced in 2017 and expected to be completed by 2030, is an ambitious smart city initiative requiring vast quantities of construction machinery.

These large-scale infrastructure projects, such as the Belt and Road Initiative, Bharatmala Pariyojana, and Neom City, are set to drive substantial growth in the off-highway wheel market.

Off-Highway Wheels Market Trends

The Construction Segment is Expected to Dominate the Market Studied

The construction sector is highly dynamic, and numerous factors, such as the overall economy, budgets, and global economic scenario, are influencing the market's growth. Volatility in these aspects affects the businesses of construction equipment OEMs, which will, in turn, affect the demand for off-highway wheels.

The sector's demand for off-highway wheels is dominant due to the extensive need for earth-moving machinery in global infrastructure projects. Large-scale initiatives such as China's Belt and Road Initiative and India's Bharatmala Pariyojana necessitate a vast array of construction equipment, including excavators, loaders, bulldozers, and backhoes. These projects involve massive amounts of earth moving, which requires durable and high-performance wheels to ensure efficiency and reliability in challenging terrains. As countries continue to invest in building and upgrading their infrastructure, the demand for construction equipment wheels may remain robust.

Several countries are witnessing significant infrastructure growth owing to the increase in investments. The construction of buildings, tunnels, rail networks, roads, and bridges is attracting major investments across the country. Growing infrastructure development across the country is likely to increase the demand for construction equipment during the forecast period. For instance,

- In March 2024, the Indian government inaugurated and laid the foundation for 112 national highway projects across various states worth approximately USD 12.04 billion. These projects include major highway expansions and the introduction of new technologies like GNSS for barrier-free tolling.

In addition, the investments in infrastructure, both public and private, such as the Indonesian National Medium-term Development Plan (USD 460 billion), Vietnam Socio-Economic Development Plan (USD 61.5 billion), and the Philippine Development Plan "Build, Build, and Build" (USD 71.8 billion), are expected to increase the demand for off-highway vehicles in this region.

The increase in construction development across the globe is likely to enhance the demand for construction machinery, which, in turn, is likely to enhance the demand for wheels in the coming years.

Asia-Pacific is Anticipated to Dominate the Market

Asia-Pacific (APAC) continues to lead the off-highway wheel market due to several key factors driving growth in the construction, agricultural, and industrial sectors. The noteworthy development of road and rail infrastructure, coupled with significant investments in new projects, has resulted in substantial growth in the construction sector across the region. This has consequently increased the demand for off-highway vehicles and wheels.

APAC countries have been heavily investing in infrastructure to support their growing industrial and service sectors. For instance, China announced significant infrastructure plans involving an investment budget of approximately USD 4.8 trillion, aimed at new projects and speeding up existing construction efforts. This investment is part of China's broader strategy to enhance its infrastructure network, including roads, railways, and urban development, which drives the demand for robust and reliable off-highway wheels.

The agricultural sector in APAC, particularly in India, is another major driver of the off-highway wheel market. The sector's contribution to India's GDP increased significantly, with tractor sales reaching over 900 thousand units in FY 2023. This surge in tractor sales highlights the rising demand for agricultural machinery, which, in turn, may boost the need for off-highway wheels. With agriculture playing a crucial role in the economies of many APAC countries, the demand for off-highway wheels is expected to continue growing.

The construction sector in APAC is dominated by both private and state-owned enterprises, with increased spending on commercial projects, renewable energy, and public infrastructure. Countries like Japan, China, and India are seeing strengthening markets for construction machinery and excavators, driven by ongoing and planned mega-projects.

Off-Highway Wheels Industry Overview

Several key players, such as Titan International Inc., Moveero Limited, Yokohama, Accuride Corporation, Rimex, Steel Strips Wheels Ltd, and Maxion Wheels, dominate the off-highway wheels market. The players operating in the market are concentrating on several growth strategies to gain a competitive edge over other players. For instance,

- In March 2022, Titan International Inc. announced a definitive agreement to sell its Australian wheel business to OTR Tyres, a prominent local provider of tires, wheels, and related services for off-highway vehicles. This strategic move was part of Titan's efforts to streamline its global operations and focus on core markets. The sale included Titan's production facilities, inventory, and customer contracts in Australia, allowing OTR Tyres to enhance its market presence and service offerings.

- In February 2022, Titan International Inc. signed a significant agreement with Kubota Tractor Corporation (KTC) to supply its new Trac Loader II tires for Kubota's utility and compact tractor models. These tires are designed for light construction, agricultural, commercial, and residential applications, providing superior performance and durability. The Trac Loader II tires feature advanced tread designs and materials that improve traction, reduce soil compaction, and enhance the overall efficiency of tractors in various off-highway environments. This partnership with Kubota underscores Titan's commitment to innovation in off-highway wheels and tires, aiming to meet the evolving needs of customers in diverse applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Product Type

- 5.1.1 Alloy Wheels

- 5.1.2 Steel Wheels

- 5.2 By Application Type

- 5.2.1 Agriculture

- 5.2.2 Construction (Earth-moving Machinery)

- 5.2.3 Material Handling (Mobile Cranes and Forklift Trucks)

- 5.2.4 Mining (Mobile Mining Equipment)

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Titan International Inc.

- 6.2.2 Moveero Limited

- 6.2.3 Accuride Corporation

- 6.2.4 Rimex

- 6.2.5 Steel Strips Wheels Ltd

- 6.2.6 Maxion Wheels

- 6.2.7 OTR Wheel Engineering

- 6.2.8 Carrier Wheels Private Limited

- 6.2.9 Bohnenkamp AG

- 6.2.10 Citic Dicastal Co. Ltd

- 6.2.11 Trident International

- 6.2.12 Levypyora Oy

- 6.2.13 JS Wheels

- 6.2.14 Anyang Rarlong Machinery Co. Ltd

- 6.2.15 STARCO

- 6.2.16 Sun Tyre and Wheel Systems

- 6.2.17 Baluchistan Wheels Limited

- 6.2.18 Topy Industries Ltd

- 6.2.19 SAF Holland Group

- 6.2.20 Bhagwati Wheels

- 6.2.21 Pronar Wheels

- 6.2.22 Tej Wheels

- 6.2.23 Camso Wheels