|

市场调查报告书

商品编码

1690967

美国胶原蛋白:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)United States Collagen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

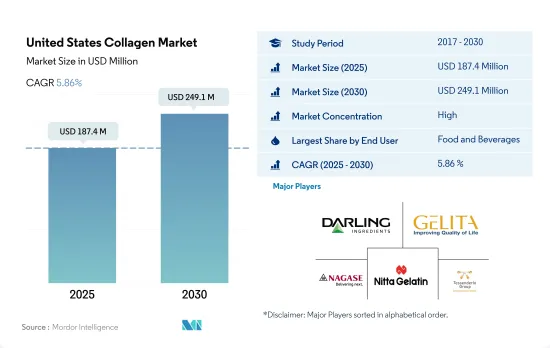

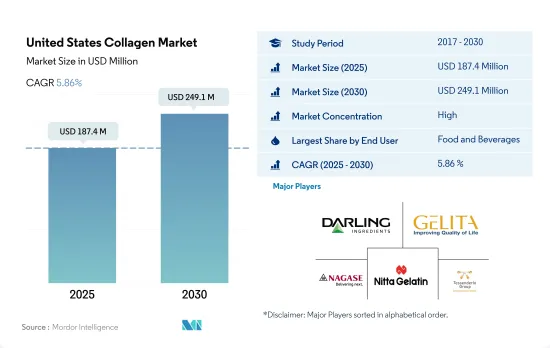

预计 2025 年美国胶原蛋白市场规模将达到 1.874 亿美元,到 2030 年将达到 2.491 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.86%。

由于消费者对采用天然成分製成的美容产品的偏好日益增加,预计预测期内个人护理和化妆品领域的销售额将增加。

- 在研究期间,按应用划分,食品和饮料领域占据最大的市场占有率。在该领域,零食占据较大的金额份额,按用途计算,2022年为41.4%,而食品和饮料则占34.4%,促进了食品和饮料行业的成长。胶原蛋白肽易于溶解,可注入白开水、汽水、果汁和饮料中,在饮料中用途广泛。

- 个人护理和化妆品领域预计将成为市场上成长最快的领域,预测期内复合年增长率为 7.53%。这种增长是由于该国人们对美容产品中胶原蛋白等天然成分的偏好日益增长。胶原蛋白是北美,尤其是美国美容产品中的关键功能成分。 2021年,胶原蛋白在天然化妆品领域最畅销的25种功能成分中排名第二。

- 尤其是胶原蛋白肽,具有公认的美容功效,有助于使皮肤和头髮看起来更健康、更年轻。消费者现在非常了解营养美容和护肤产品中的胶原蛋白产品,并根据多种原因做出购买决定,包括动物来源类型和品牌提供的供应链资讯。在美国,胶原蛋白蛋白粉/胜肽在 18-24 岁族群中最受欢迎(37%),而 2021 年 25-34 岁族群中这一比例为 27%。

- 运动营养领域预计也将获得发展动力,复合年增长率为 7.20%。运动营养中的胶原蛋白可增强蛋白质并提高运动表现。这就是为什么越来越多的健身房和教练推荐这种产品来补充高蛋白。

美国胶原蛋白市场趋势

作为最大的牛肉生产国之一,美国的胶原蛋白製造商正在成长。

- 美国是世界上最大的鸡肉生产国,2023年占全球鸡肉产量的20%。预计肉类生产和加工业将受益于「拜登-哈里斯政府行动计画」等政府措施。推出该行动计画是为了帮助建立更公平、有竞争力和有弹性的肉类和家禽供应链。此外,美国农业部已向 167 家现有的肉类和家禽加工厂提供 3,200 万美元的补助金,以帮助他们接触更多的客户。

- 牛肉是最常见的胶原蛋白来源之一,提供大量这种独特的蛋白质。平均而言,牛肉含有约2-3%的胶原蛋白。美国是世界上最大的饲养牛产业国,也是世界上最大的牛肉生产国,主要生产高品质的谷饲牛肉供国内销售和出口。美国所有 50 个州都饲养肉牛,截至 2023 年 7 月,德克萨斯州、奥克拉荷马州、密苏里州、内布拉斯加州、南达科他州、堪萨斯州和蒙大拿州是美国主要的牛肉生产州。

- 美国是世界第三大猪肉及猪肉製品生产国和消费国。近年来,美国一直是全球第二大猪肉出口国,出口量平均一直占商业猪肉产量的20%以上。到2023年,它将占全球猪肉出口的26%。

美国胶原蛋白产业概况

美国胶原蛋白市场相当集中,前五大公司占了68.16%的市场。市场的主要企业是:Darling Ingredients Inc.、Gelita AG、Nagase &、Nitta Gelatin Inc. 和 Tessenderlo Group(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第 2 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第三章 产业主要趋势

- 最终用户市场规模

- 婴儿食品和婴儿配方奶粉

- 麵包店

- 饮料

- 早餐用麦片谷类

- 调味品/酱料

- 糖果零食

- 乳製品和乳製品替代品

- 老年营养与医学营养

- 肉类、家禽、鱼贝类和肉类替代品

- RTE/RTC 食品

- 小吃

- 运动/运动营养

- 动物饲料

- 个人护理和化妆品

- 蛋白质消费趋势

- 动物

- 生产趋势

- 动物

- 法律规范

- 美国

- 价值链与通路分析

第 4 章 市场细分

- 形式

- 动物

- 海洋

- 最终用户

- 动物饲料

- 饮食

- 按次级最终用户

- 麵包店

- 饮料

- 早餐用麦片谷类

- 小吃

- 个人护理和化妆品

- 补充

- 按次级最终用户

- 老年营养与医学营养

- 运动/运动营养

第五章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 业务状况

- 公司简介.

- Cooke Inc.

- Darling Ingredients Inc.

- Gelita AG

- Holista Colltech

- Italgelatine SpA

- Lapi Gelatine SpA

- Nagase & Co. Ltd

- Nitta Gelatin Inc.

- NutriScience Innovations LLC

- Tessenderlo Group

第六章 执行长的关键策略问题

第七章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 90060

The United States Collagen Market size is estimated at 187.4 million USD in 2025, and is expected to reach 249.1 million USD by 2030, growing at a CAGR of 5.86% during the forecast period (2025-2030).

Personal care and cosmetics segment is expected to gain higher sales in forecast period due to growing consumers preferences for natural ingredients beauty products

- The F&B sector held the largest market share, by application, during the study period. Under the segment, snacks and beverages held the major value share of 41.4% and 34.4% by application, respectively, in 2022, which contributed to the growth of the food and beverage sector. Collagen peptides have wide applications in beverages as they are easily dissolvable and can be infused into plain water, soft drinks, juices, and beverages.

- The personal care and cosmetics segment is expected to be the fastest-growing segment in the market, with a CAGR of 7.53% during the forecast period. This growth is due to an increasing preference for natural ingredients, such as collagen, in beauty products in the country. Collagen is a leading functional ingredient of beauty products in the North American region and more so in the United States. In 2021, collagen was ranked second among the 25 best-selling functional ingredients in the natural cosmetics segment.

- Collagen peptides, in particular, have proven skin beauty benefits and contribute to healthier and younger-looking skin and hair. Consumers are now well aware of the benefits of collagen for Nutri-beauty and skincare products are made of collagen products and are purchasing decisions based on a variety of reasons, including what type of animal source and supply chain information the brand provided. In the United States, collagen powder/peptides were most prominent between the ages of 18 and 24 (37%) compared to 25 to 34 at 27% in 2021.

- The sports nutrition segment is also expected to gain traction, registering a CAGR of 7.20%. Collagen in sports nutrition offers protein fortification and improved athletic performance. Thus, an increasing number of gyms and trainers recommend this product for high protein intake.

United States Collagen Market Trends

As one of the top beef producers, US collagen manufacturers are witnessing growth

- The meat production and processing sector is estimated to benefit from government initiatives such as 'Biden-Harris Administration's Action Plan," which has been introduced to support the development of a fairer, more competitive, and more resilient meat and poultry supply chain in the country. In addition, the US Department of Agriculture has made USD 32 million in grants to 167 existing meat and poultry processing facilities to help them reach more customers.

- Cattle meat is one of the most common sources of collagen, providing a significant amount of this unique protein. On average, beef has approximately 2-3% collagen in its composition. With the largest fed-cattle industry in the world, the United States is also the world's largest producer of cattle meat, primarily high-quality, grain-fed cattle meat for domestic and export use. Beef cattle are raised in all 50 states of the United States, with Texas, Oklahoma, Missouri, Nebraska, South Dakota, Kansas, and Montana being the leading cattle meat-producing states in the country as of July 2023.

- The United States is the world's third-largest producer and consumer of pork and pork products. In recent years, the United States has been the world's second-largest exporter of pork muscle meats, with exports consistently averaging over 20% of commercial pork production. In 2023, the country accounted for 26% share of the global pig meat export.

United States Collagen Industry Overview

The United States Collagen Market is fairly consolidated, with the top five companies occupying 68.16%. The major players in this market are Darling Ingredients Inc., Gelita AG, Nagase & Co. Ltd, Nitta Gelatin Inc. and Tessenderlo Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 End User Market Volume

- 3.1.1 Baby Food and Infant Formula

- 3.1.2 Bakery

- 3.1.3 Beverages

- 3.1.4 Breakfast Cereals

- 3.1.5 Condiments/Sauces

- 3.1.6 Confectionery

- 3.1.7 Dairy and Dairy Alternative Products

- 3.1.8 Elderly Nutrition and Medical Nutrition

- 3.1.9 Meat/Poultry/Seafood and Meat Alternative Products

- 3.1.10 RTE/RTC Food Products

- 3.1.11 Snacks

- 3.1.12 Sport/Performance Nutrition

- 3.1.13 Animal Feed

- 3.1.14 Personal Care and Cosmetics

- 3.2 Protein Consumption Trends

- 3.2.1 Animal

- 3.3 Production Trends

- 3.3.1 Animal

- 3.4 Regulatory Framework

- 3.4.1 United States

- 3.5 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Form

- 4.1.1 Animal Based

- 4.1.2 Marine Based

- 4.2 End User

- 4.2.1 Animal Feed

- 4.2.2 Food and Beverages

- 4.2.2.1 By Sub End User

- 4.2.2.1.1 Bakery

- 4.2.2.1.2 Beverages

- 4.2.2.1.3 Breakfast Cereals

- 4.2.2.1.4 Snacks

- 4.2.3 Personal Care and Cosmetics

- 4.2.4 Supplements

- 4.2.4.1 By Sub End User

- 4.2.4.1.1 Elderly Nutrition and Medical Nutrition

- 4.2.4.1.2 Sport/Performance Nutrition

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 5.4.1 Cooke Inc.

- 5.4.2 Darling Ingredients Inc.

- 5.4.3 Gelita AG

- 5.4.4 Holista Colltech

- 5.4.5 Italgelatine SpA

- 5.4.6 Lapi Gelatine SpA

- 5.4.7 Nagase & Co. Ltd

- 5.4.8 Nitta Gelatin Inc.

- 5.4.9 NutriScience Innovations LLC

- 5.4.10 Tessenderlo Group

6 KEY STRATEGIC QUESTIONS FOR PROTEIN INGREDIENTS INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219