|

市场调查报告书

商品编码

1692087

义大利黏合剂:市场占有率分析、行业趋势和成长预测(2025-2030 年)Italy Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

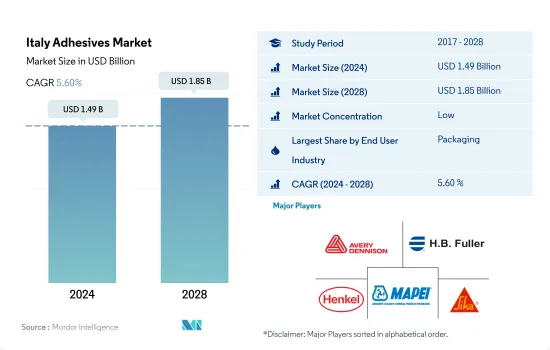

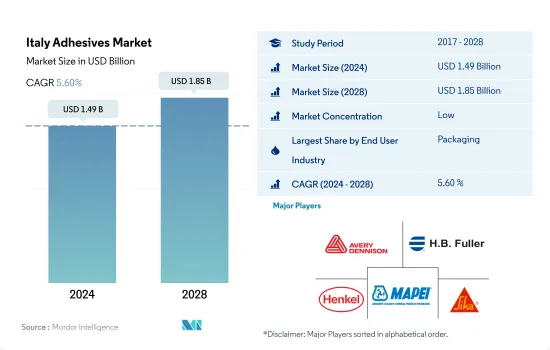

义大利黏合剂市场规模预计在 2024 年达到 14.9 亿美元,预计到 2028 年将达到 18.5 亿美元,预测期内(2024-2028 年)的复合年增长率为 5.60%。

家具市场的崛起和软包装趋势的演变将推动义大利黏合剂的消费

- 黏合剂在各行各业所使用的各种基材的黏合和连接中发挥着重要作用。这些黏合剂可帮助製造商减轻零件和组件的重量,并快速、轻鬆、准确地形成接头。 2020年,受新冠疫情影响,消费量较2019年下降10.38%。

- 该国的包装行业正在经历显着增长。包装产业有特定的应用,例如电子、消费品、医疗和食品产业的低温运输解决方案和运输包装。义大利包装产业是欧洲最大的包装产业之一。全国有大、中、小型包装企业近7000家。超级市场零售日益增长的重要性以及消费者购买习惯的改变正在推动该国对包装应用黏合剂的需求。

- 义大利以其义大利家具而闻名,其家具在世界各地广受欢迎。因此,这种黏合剂在义大利木工行业消耗量很大。 2021年,该产业消耗了约63,030吨黏合剂,成为当年该国第二大黏合剂终端用户。水基黏合剂在该行业中被大量使用,因为它们环保且比其他类型的黏合剂更便宜。这些黏合剂的成本几乎是其他黏合剂的一半。

- 预计未来几年义大利软包装和住宅装修的兴起将推动其对黏合剂的需求。

义大利黏合剂市场趋势

义大利日益流行的廉价、轻质包装趋势推动了对软质和硬质塑胶包装的需求

- 义大利人均GDP为34,780美元,2022年与前一年同期比较成长2.3%。包装产业对该国GDP的贡献约为0.36%。义大利的包装产业规模位居欧洲第二,仅次于德国。影响义大利包装产业的因素包括贸易交流、就业、葡萄酒生产和政府政策支持。

- 受新冠疫情影响,义大利经济放缓。当年的产量与 2019 年相比下降了 3.75%。这是由于供应链中断、劳动力短缺以及近三个月的全国封锁造成的。 2021年,为促进经济復苏,国际边境开放,生产原料供应恢復正常,同年增加了3,500吨。

- 在欧盟,每年的包装产量达4,000亿美元,其中15%产自义大利。该国的包装工业以纸和纸板包装产业为中心,是欧洲第二大包装产业。包装的主要应用是食品和饮料(29%)以及医疗保健和美容产品包装(26%)。

- 就瓦楞纸箱包装而言,义大利在欧洲排名第二。在法国,越来越倾向于更便宜、更轻的包装,预计未来几年将推动对软塑胶和硬质塑胶包装的需求。因此,预计这将推动该国包装产业的成长。义大利是世界上最大的葡萄酒生产国。然而,该国葡萄酒产量的下降可能会阻碍未来包装产品的发展。 2021年葡萄酒产量与前一年同期比较下降了9%。

电动车需求增加可能促进汽车产量

- 义大利是欧洲主要汽车製造国之一。与2017年相比,2018年该国汽车产量下降了9.26%,2019年下降了22.2%。美国脱欧的影响、更复杂的环境法规的实施以及中美之间的紧张关係都对2018年和2019年的义大利汽车市场产生了负面影响。

- 2020年汽车产量与2019年同期相比下降了20%。新冠疫情扰乱了汽车製造业,对整个供应链产生了负面影响。许多供应商也面临原材料成本(如钢铁、塑胶和树脂)和能源价格上涨的困扰,这些因素正在影响该国的汽车市场。

- 2020年电动车的成长将进一步加速。 2020年上半年纯电动车註册量与2019年相比成长了86%。 2020年截至6月底,纯电动车销量约3.1万辆。所有插电式汽车的总销量增加至50,500辆。 Pure EV的平均市场占有率也大幅提升,领先于该国的黏合剂和密封剂市场。

- 同样,2021 年,义大利电动车市场持续成长。近年来,电动车销量在短短三年内成长了六倍。同样,电动车的市场占有率也在2021年增加到4.6%。因此,该国的黏合剂和密封剂市场预计将有所改善。

义大利黏合剂产业概况

义大利黏合剂市场较为分散,前五大企业占34.73%。市场的主要企业有:AVERY DENNISON CORPORATION、HB Fuller Company、Henkel AG & Co. KGaA、MAPEI SpA 和 Sika AG(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 包装

- 木製品和配件

- 法律规范

- 义大利

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 卫生保健

- 包装

- 木製品和配件

- 其他最终用户产业

- 科技

- 热熔胶

- 反应性

- 溶剂型

- 紫外线固化胶合剂

- 水

- 树脂

- 丙烯酸纤维

- 氰基丙烯酸酯

- 环氧树脂

- 聚氨酯

- 硅胶

- VAE・EVA

- 其他树脂

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介.

- 3M

- Arkema Group

- AVERY DENNISON CORPORATION

- DURANTE ADESIVI SpA

- FRATELLI ZUCCHINI SpA

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- MAPEI SpA

- Sika AG

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、阻碍因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 90429

The Italy Adhesives Market size is estimated at 1.49 billion USD in 2024, and is expected to reach 1.85 billion USD by 2028, growing at a CAGR of 5.60% during the forecast period (2024-2028).

Emerging furniture market and evolving trend of flexible packaging expected to boost the consumption of adhesives in Italy

- Adhesives play an important role in bonding and joining various substrates that are used across industries. These adhesives help manufacturers lower the weight of their components and assemblies and form joints quickly, easily, and accurately. The COVID-19 pandemic impacted the country in 2020, which reduced consumption by 10.38% compared to 2019.

- The packaging sector has been experiencing significant growth in the country. The packaging industry has specific applications, such as cold chain solutions and transport packaging for electronics, consumer goods, medical, and food industries. The Italian packaging industry is one of the largest industries in Europe. There are nearly 7,000 active major and minor packaging companies in the country. The increasing importance of supermarket retailing and the changing consumer buying habits are increasing the demand for adhesives in packaging applications in the country.

- Italy is known for its Italian furniture, which is popular around the world. Therefore, adhesives are largely consumed in the woodworking industry in Italy. In 2021, around 63,030 tons of adhesives were consumed by this industry, which is the second-largest end user of adhesives in the country during that year. Water-borne adhesives are largely consumed in this industry, as they are eco-friendly and cheaply available compared to other types of adhesives. The cost of these adhesives is nearly half compared to other adhesives.

- The rising trend of flexible packaging and home renovation in the country is expected to drive the demand for adhesives in the coming years in Italy.

Italy Adhesives Market Trends

Rising trend of cheap and lightweight packaging in Italy drives the demand for flexible and rigid plastic packaging

- Italy has a GDP of USD 34,780 per capita with a growth rate of 2.3% Y-o-Y in 2022. The packaging industry sector contributes to around 0.36% of the country's GDP. Italy is the second-largest packaging industry in Europe after Germany. Factors that are affecting the Italian packaging industry are trade exchange, employment, wine production, government policy support, etc.

- The country witnessed an economic slowdown because of the impact of the COVID-19 pandemic. The production volume was reduced by 3.75% in the same year compared to 2019. This happened due to a supply chain disruption, labor shortages, and a lockdown in the country for nearly three months. International borders were opened in 2021 because of the economic recovery, which resulted in a regular supply of raw materials for production that increased by 3500 tons in 2021.

- In the European Union, packaging production reaches USD 400 billion annually, out of which 15% of the share is produced in Italy. The packaging industry in the country is dominated by the paper and paperboard packaging segment, which is the second largest in Europe. Packaging is majorly used in food and beverages (29%) and healthcare and beauty products packaging (26%).

- Italy is the second largest in corrugated box packaging in Europe. The rising trend of cheap and lightweight packaging in France is expected to drive the demand for flexible packaging and rigid plastic packaging in the coming years. Hence, it is expected to lead to the growth of the packaging industry in the country. Italy is the world's largest producer of wine. However, declining wine production in the country may hinder packaging products in the future. Wine production was reduced by 9% Y-o-Y in 2021.

Rising electric vehicles demand is likely to boost automotive production

- Italy is one of the major automotive manufacturers in Europe. Compared to 2017, automotive vehicle production in the country contracted by 9.26% in 2018 and 22.2% in 2019, as in 2018 and 2019, factors like the fallout from Brexit, the implementation of more complex environmental regulations, and the tensions between the United States and China negatively affected the market for automotive vehicles in Italy.

- The automotive vehicle production volume contracted by 20% in 2020 compared to the same period in 2019. The COVID-19 pandemic resulted in disruptions in car manufacturing and had a negative impact on the whole supply chain. Many suppliers additionally suffer from increased raw material costs (e.g., for steel, plastics, and resin) and higher energy prices, affecting the automotive market in the country.

- In 2020, the country's electric vehicle growth further increased. Registrations for pure EVs in the first six months of 2020 were up by 86% compared to 2019. Almost 31,000 pure EVs were sold in 2020 till the end of June. Total sales of all plug-in vehicles rose to 50,500 units. The average pure-electric market share also increased significantly, driving the market for adhesives and sealants in the country.

- Similarly, the year 2021 witnessed continued growth in the Italian EV market. In recent years, electric vehicle sales increased by six-fold in just three years. Similarly, the market share of electric vehicles increased to 4.6% in 2021. Thus, it is expected to improve the market for adhesives and sealants in the country.

Italy Adhesive Industry Overview

The Italy Adhesives Market is fragmented, with the top five companies occupying 34.73%. The major players in this market are AVERY DENNISON CORPORATION, H.B. Fuller Company, Henkel AG & Co. KGaA, MAPEI S.p.A. and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Italy

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured Adhesives

- 5.2.5 Water-borne

- 5.3 Resin

- 5.3.1 Acrylic

- 5.3.2 Cyanoacrylate

- 5.3.3 Epoxy

- 5.3.4 Polyurethane

- 5.3.5 Silicone

- 5.3.6 VAE/EVA

- 5.3.7 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 AVERY DENNISON CORPORATION

- 6.4.4 DURANTE ADESIVI S.p.A.

- 6.4.5 FRATELLI ZUCCHINI S.p.A.

- 6.4.6 H.B. Fuller Company

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Huntsman International LLC

- 6.4.9 MAPEI S.p.A.

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219