|

市场调查报告书

商品编码

1692091

英国瓦楞包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)United Kingdom Corrugated Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

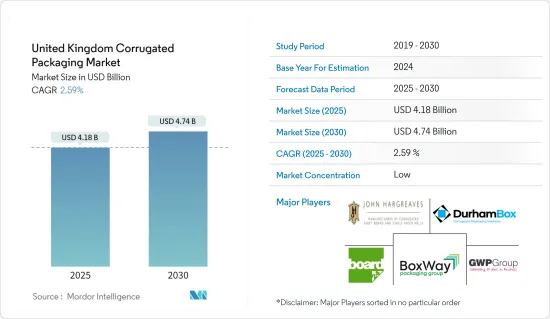

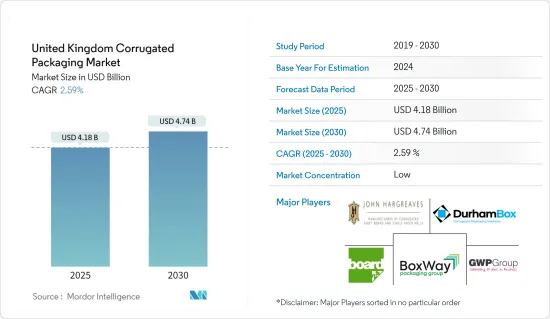

预计 2025 年英国瓦楞包装市场规模将达到 41.8 亿美元,预计到 2030 年将达到 47.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 2.59%。

根据用途不同,瓦楞包装有不同的样式、形状和尺寸。由于它 100% 可回收且具有成本效益,因此被广泛应用于包装行业。

主要亮点

- 纸板用途广泛,除了盒子之外,还可以製成许多不同的形状。它至今仍是英国最常用的包装材料。由于永续性问题,它们正在逐渐取代柔性塑胶袋。此外,纸板是容纳多种印刷技术的完美基础。因此,企业倾向于选择纸板包装作为行销工具。它也用于各种产品,包括食品、杂货和製成品。

- 根据英国造纸工业联合会(CPI)预测,2021年英国纸与纸板消费量将达1,000万吨,较2020年略有成长。英国纸与纸板的最大消费领域是包装。

- 英国鼓励製造商承担使用永续包装解决方案的责任。瓦楞纸板由于其强度、缓衝性、保护性、柔韧性和可回收性等特性,一直是受欢迎的包装选择。

- 此外,瓦楞包装正迅速成为该地区各行各业的首选包装,从运输和电子商务服务到食品和饮料行业。由于人们的生活方式忙碌,对方便食品的需求不断增加。电子商务的兴起,尤其是由于新冠疫情,增加了该国对瓦楞包装解决方案的需求。

- 越来越多的政府法规要求企业采用永续包装材料以减少包装废弃物,这进一步推动了对瓦楞包装的需求。例如,2021年11月,代表包括英国在内的整个欧洲瓦楞包装行业的欧洲瓦楞包装製造商联合会(FEFCO)发布了《瓦楞包装可回收性指南》,旨在透过纸和纸板包装的设计参数来优化可回收性。

- 然而,纸张不能无限期地回收,因为回收会削弱纤维,需要补充。造纸业严重依赖从永续来源负责任地采购的高品质纤维的供应。这可能会阻碍预测期内的市场成长。

- 英国对瓦楞纸包装的需求正在显着增长,这主要得益于食品和其他消费品、医疗和药品、纸巾和卫生产品包装等必需品的运输包装需求。

英国瓦楞包装市场的趋势

电子商务行业可望刺激需求

- 由于新冠疫情的影响,英国电子商务产业的消费行为正在发生重大变化。消费者购物方式的改变正在推动电子商务业务的发展。消费者喜欢在网上购物而不是在实体店购物。此外,虽然最近的经济放缓对电子商务包装/零售产生了负面影响,但电子商务零售额仍在继续增长,为瓦楞包装供应商创造了巨大的潜力。

- 此外,亚马逊、乐购、Argos 和 Currys 等多家电子商务公司都已从使用纸板包装中受益。这些瓦楞纸箱可协助节省 7% 至 36% 的成本(取决于纸箱尺寸),并可生产出堆迭强度和抗压性提高 30% 的纸箱,同时使用更轻的材料作为纸箱底板。

- 根据 Web Retailer 的数据,2021 年,英国是全球第三大电子商务市场。网路零售额每年达1,310亿美元,仅次于中国和美国,位居第三。此外,英国是全球最发达的电子商务市场之一,线上销售额占英国零售总额的23%。

- 此外,根据英国统计局的数据,英国是欧洲领先的网路购物市场之一。预计 2021 年英国电子商务销售额将达到 1,290 亿英镑,而 2015 年为 1,127 亿英镑,年增 15%。

生鲜食品和农产品产业将获得巨大发展

- 食品业正透过采用瓦楞包装解决方案迅速向环保包装迈进。人们对食品包装卫生问题的日益关注,促使包装行业制定了多项标准,并刺激了环保包装解决方案的采用。

- 包装水果需要小心,因为产品易碎且易腐烂。对于硬质水果运输包装来说,瓦楞纸板(CFB)是最环保的解决方案。瓦楞纸箱因其对空运、海运和陆运的适应性提高,最近在水果出口商中获得了显着的吸引力。

- 最新销售数据显示,注重健康的英国对水果和蔬菜的需求在本世纪达到最高水准。自 2020 年第一次封锁开始以来,英国的全职妈妈们有了更多的空閒时间,花了更多时间在家做饭。

- 同样,苹果、梨子和浆果等水果在 2021 年也出现了创纪录的增长,而富含维生素 D 的栗布在过去 12 个月中也大受欢迎。因此,英国水果产业呈现出庞大的瓦楞纸箱包装市场。

- 此外,根据国家统计局的数据,到 2025 年,英国英国板、纸板以及纸和纸板包装製造业的收益将达到 6,150 亿美元。自 2015 年以来,瓦楞纸板需求稳步增长,这是由于其在许多行业中用于包装用途的用途日益增加。

英国瓦楞包装行业概况

由于有多家区域性参与者以及该地区新解决方案供应商的迅速涌现,英国瓦楞包装市场的竞争格局较为分散。此外,一些跨国公司正在透过扩大在英国的业务来扩大其全球影响力。市场公司也正在建立策略伙伴关係关係,以扩大其市场占有率并最大限度地提高其市场吸引力。

- 2021 年 10 月-Smurfit Kappa 集团以 3.6 亿欧元收购了义大利北部一家 60 万吨箱板纸厂。该工厂补充了我们现有的业务,其靠近萨沃纳港的战略位置提供了显着的物流和营运优势。

- 2021 年 6 月 - Smurfit Kappa 集团宣布将投资 2,400 万欧元扩建位于法国东北部莱特莱斯的瓦楞纸包装厂。这项投资将有助于整合工厂现有的两个设施,并安装新的瓦楞机和加工设备。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 电子商务领域需求强劲

- 轻量材料的日益普及和潜在的印刷创新将推动电子和个人护理行业的成长

- 市场挑战

- 对瓦楞产品材料可得性和耐用性的担忧

- 产业供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 按最终用户产业

- 加工食品

- 生鲜食品和农产品

- 饮料

- 纸製品

- 电器

- 其他最终用户产业

第六章竞争格局

- 公司简介

- Mondi Group

- Smurfit Kappa Group

- Ds Smith Plc

- Westrock Company

- Gwp Group

- The Box Factory Limited

- Cbs Packaging Group

- Saxon Packaging(Smurfit Kappa Group)

- Nuttall Packaging

- International Paper Company

第七章投资分析

第八章 市场机会与未来趋势

The United Kingdom Corrugated Packaging Market size is estimated at USD 4.18 billion in 2025, and is expected to reach USD 4.74 billion by 2030, at a CAGR of 2.59% during the forecast period (2025-2030).

Depending on the application, corrugated packaging is found in different styles, shapes, and sizes. Due to its 100% recyclability and cost-effectiveness, it is widely used in the packaging industry.

Key Highlights

- Corrugated boards are highly versatile and can take various forms other than the box. It still is the most commonly used packaging material in the UK. They are slowly replacing flexible plastic bags due to sustainability issues. Moreover, corrugated boxes act as a perfect base to hold several types of printing techniques. Due to this, companies tend to prefer corrugated packaging as a marketing tool. Also, it is used for a very wide range of food, grocery, and manufactured products.

- According to the Confederation of Paper Industries (CPI ), association Papers and board consumption in the United Kingdom reached 10 million metric tons in 2021, a slight increase compared to 2020. Packaging is the most consumed type of paper and board in the UK.

- The United Kingdom has encouraged manufacturers to take responsibility for using sustainable packaging solutions. Corrugated boards have always been a popular choice of packaging due to their strength, cushioning, and protective, flexible, and recyclable properties.

- Moreover, corrugated boxes are becoming the packaging of choice across a wide range of industries, from transportation and e-commerce services to the food and drinks industry in the region. The demand for convenience foods is on the rise due to the busy lifestyle of people. The rise of e-commerce, especially due to the COVID-19 pandemic, has heightened the need for corrugated packaging solutions in the country.

- Growing government regulations for companies to adopt sustainable packaging materials to reduce packaging waste further drives the demand for corrugated board packaging. For instance, in November 2021, the European Federation of Corrugated Board Manufacturers (FEFCO), which represents the corrugated packaging industry across Europe, including the United Kingdom, released its corrugated packaging recyclability guidelines aimed at optimizing recyclability via design parameters for paper and board packaging.

- However, paper cannot be recycled indefinitely, as the fibers get weaker when recycled and need to be replenished. The paper industry heavily depends on a supply of high-quality fibers that come from sustainable sources and are responsibly sourced. This, in turn, could hinder market growth in the forecast timeframe.

- The demand for corrugated packaging in the UK is witnessing significant growth due to the demand for transport packaging of essential products, such as packaging for food and other consumer products, medical and pharmaceutical and tissues, and hygiene products.

United Kingdom Corrugated Packaging Market Trends

E-commerce Industry Expected to Stimulate Demand

- The e-commerce industry in the UK is witnessing a significant transformation in consumer behavior owing to the COVID-19 pandemic. It has boosted e-commerce business as it has changed the way consumers shop. Consumers prefer to buy online rather than shopping at physical stores. Also, the recent economic slowdown has negatively influenced e-commerce package/retail sales; e-commerce retail sales have continued to rise, providing significant potential for corrugated packaging suppliers.

- Additionally, several e-commerce firms such as Amazon, Tesco, Argos, Currys, and others have benefited from using corrugated-based packaging. These corrugated boxes can help the company achieve savings of 7%-36%, depending on the box size, and can manufacture boxes with 30% greater stacking strength and crush resistance while using lighter-weight materials for the bottom panel of the box.

- According to Web retailer, in 2021, the United Kingdom was the third-largest e-commerce market globally. Online retail sales reached USD 131 billion annually, behind only China and the United States. Additionally, the UK is one of the most developed markets for e-commerce globally, with online sales making up 23% of total UK retail sales.

- Moreover, according to Office for National Statistics (UK), The United Kingdom is one o the leading market in Europe for online shopping. The revenue of e-commerce in the United Kingdom amounted to GBP 129 billion in 2021, compared to GBP 112.7 billion in 2015, which is 15% higher than in 2015.

Fresh Food and Produce Industry Expected to Gain Significant Traction

- The food industry is rapidly moving towards eco-friendly packaging by adopting corrugated board packaging solutions. The increasing concern towards hygiene in food packaging has mandated several standards for the packaging industry and stimulated the adoption of eco-friendly packaging solutions.

- Fruit packing necessitates extreme caution due to the product's fragile and perishable nature. Regarding rigid fruit transport packaging, corrugated fiberboard (CFB) is the most environmentally friendly solution. Corrugated boxes have recently gained a large following among fruit exporters because of their improved adaptability for air, sea, and road transport.

- According to the most recent sales figures, health-conscious Britons drive the highest demand for fruit and vegetables this century. Stay-at-home Brits with more free time have spent more at home cooking since the first lockdown began in 2020.

- Similarly, fruit such as apples, pears, and berries witnessed record growth in 2021, while chestnut mushrooms, strong in vitamin D, saw a significant surge in popularity over the last 12 months. Therefore, the United Kingdom's fruit industry presents a huge corrugated box packaging market.

- Additionally, according to Office for National Statistics (UK), the revenue of the industry's manufacture of corrugated paper and paperboard and containers of paper and paperboard in the United Kingdom will amount to USD 6,15 billion by 2025. The steady increase in the demand for corrugated paper and paperboard from 2015 is supported by increasing utilization in numerous industries for packaging.

United Kingdom Corrugated Packaging Industry Overview

The competitive landscape of the United Kingdom Corrugated Packaging Market is fragmented owing to the presence of several regional players and the rapid emergence of new solution providers in the region. Also, several global players are expanding their global presence by expanding their operations in the United Kingdom. The market players are also forming strategic partnerships and collaborations to boost their market presence and gain maximum market traction.

- October 2021 - Smurfit Kappa Group acquired a 600,000-ton containerboard mill Verzuolo in Northern Italy, for a purchase price of EUR 360 million. This mill complements the company's existing operations and is strategically located close to the port of Savona, which delivers significant benefits for the company in logistics and operations.

- June 2021 - Smurfit Kappa Group announced an investment of EUR 24 million to expand its corrugated plant in Rethel, North-East France. The investment will facilitate the consolidation of two existing facilities at that plant and the installation of a new corrugator and conversion equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strong Demand from the E-commerce Sector

- 4.2.2 Growing Adoption of Light Weighing Materials and Scope for Printing Innovations Propelling Growth in Electronics and Personal Care Segment

- 4.3 Market Challenges

- 4.3.1 Concerns Over Material Availability and Durability of Corrugated Board-based products

- 4.4 Industry Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By End-user Industry

- 5.1.1 Processed Food

- 5.1.2 Fresh Food And Produce

- 5.1.3 Beverages

- 5.1.4 Paper Products

- 5.1.5 Electrical Products

- 5.1.6 Other End-user Industry

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Mondi Group

- 6.1.2 Smurfit Kappa Group

- 6.1.3 Ds Smith Plc

- 6.1.4 Westrock Company

- 6.1.5 Gwp Group

- 6.1.6 The Box Factory Limited

- 6.1.7 Cbs Packaging Group

- 6.1.8 Saxon Packaging (Smurfit Kappa Group)

- 6.1.9 Nuttall Packaging

- 6.1.10 International Paper Company