|

市场调查报告书

商品编码

1692137

半导体产业的流量控制-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Flow Control In The Semiconductor Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

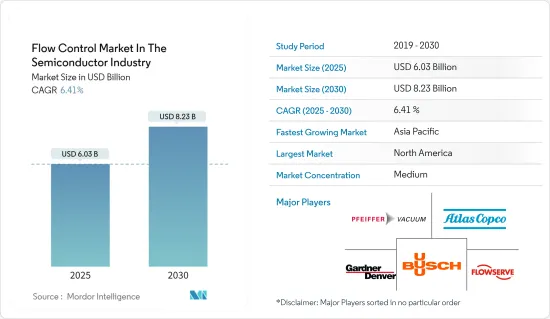

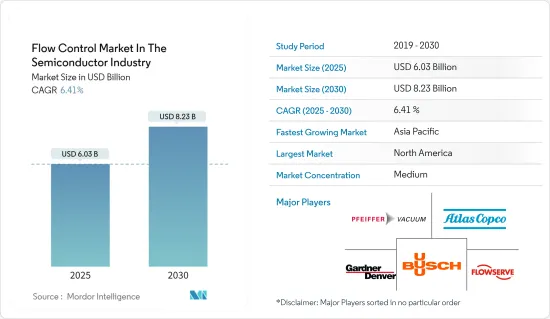

半导体工业流控制市场预计将从 2025 年的 60.3 亿美元成长到 2030 年的 82.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.41%。

主要亮点

- 不断增长的需求强调了严格製程控制的必要性,推动了对新半导体製造设施的投资。在半导体产业中,精确的流量控制至关重要。在电浆蚀刻和化学气相沉积 (CVD) 等製程中,多种气体以精确的方式相互作用,形成必要的层或薄膜。准确的气体计量至关重要,因为即使气体流量的微小偏差也可能导致製程失败。

- 半导体和电子产业的重大进步预计将推动产业成长。由于新冠疫情的影响,在家工作生活方式的建立也可能刺激电子设备需求的激增。此外,技术进步和成熟的分销网络也鼓励西方电子製造商扩大在新兴国家的业务。此外,中国和印度年轻人对消费性电子产品的日益普及也有望推动对半导体晶片的需求,从而对市场成长产生正面影响。

- 半导体行业不断增长的需求正在支持市场成长。例如,2024 年 5 月,半导体产业协会报告称,由于预测期内全球半导体市场的成长,预计到 2032 年美国的半导体製造能力将增加两倍。这将增加半导体产业对流量控制设备的需求,从而为所研究的市场提供帮助。

- 然而,半导体製造的高成本预计仍将是市场成长的主要挑战。此外,考虑到与半导体产业相关的应用的关键性,设计流量控制设备/组件所涉及的复杂性也对所研究市场的成长构成了挑战。市场正在整合,大型企业正在采取收购策略,这将对小型企业的成长构成挑战并影响整体市场的成长。

- 在新冠疫情爆发初期,市场面临全球封锁等干扰,严重扰乱了晶片製造商的供应链和生产能力。然而,在疫情期间和疫情之后,半导体晶片的需求激增,预计这一趋势将在整个预测期内持续下去。需求的成长刺激了对新生产设施的投资,并推动了对流量控制解决方案的需求。

流量控制市场趋势

机械轴封市场成长最快

- 机械轴封的主要作用是防止流体和气体通过轴和容器之间的间隙洩漏。机械轴封由碳环隔开的两个面组成。旋转设备与静止的第一个表面接触。此外,密封圈(第一面)是密封的主要部件,弹簧、波纹管或设备内的流体产生的机械力作用于此密封圈。在半导体产业中,密封件始终位于处理系统的区域内,这些区域必须承受高腐蚀性气体、液体、蒸气和等离子体,并且通常在真空和高温下进行。

- 近年来,机械轴封行业经历了显着增长,预计未来将继续增长,这主要得益于对半导体製造设施的投资增加。在新兴国家,人工智慧、机器学习和物联网的兴起,以及智慧型手机和家用电器的发展,预计将推动半导体产业的进一步发展政策和投资。集装式密封、平衡式密封、非平衡式密封、推动式密封、非推动式密封和传统密封是推动市场扩张的一些机械轴封。

- 密封可靠性和减少污染在半导体产品製造中极为重要。化学过滤、化学品转移、AODD 泵浦密封、硅晶片製造是一些关键的半导体应用,其中机械轴封已被证明是最佳选择。

- 沉淀、蚀刻、灰化/剥离、等离子、热处理或退火是构成弹性密封材料最具挑战性的环境的协同製程技术。这些是在半导体积体电路製造过程中经常遇到的。洁净室製造的密封件不含颗粒和微量金属污染,最大限度地减少了产量比率损失和化学侵蚀率。这些密封件具有许多优势,例如可增加系统运作、延长平均故障间隔时间 (MTBF)、减少湿式和机械清洁频率、降低耗材成本 (CoC),从而降低拥有成本 (CoO)。

- 数位化和自动化趋势正在显着增加对半导体的需求。例如,2023 年 9 月,广州杰斯特密封件科技推出了 FFKM O 形圈,该材料在所有橡胶 O 形圈和垫圈材料中具有最高的耐温度(高达 620°F)和最常见的耐化学性。可用于半导体製造製程的高温热风环境,最高工作温度为315°C。这种发展表明半导体产业对机械轴封设备的需求不断增长,这与半导体製造业投资的增加和全球销售额的成长一致。

美国对市场成长贡献庞大

- 在美国,自《美国晶片与科学法案》提案以来,建立国内晶片製造设施的提案有所增加。新工厂建设和研发计划正在接受投资,以吸引原始晶片製造商(OCM)进入美国,美国各州正在颁布立法,要求额外融资以支持市场开发对流量控制组件的需求。

- 美国宣布计划透过在晶片设计、电子设计自动化(EDA)和半导体製造设备等半导体技术高价值领域展示强大的领导地位,继续为全球价值链做出贡献。预计这将支持国内半导体製造设备企业的成长并促进市场成长。

- 全球半导体公司正在扩大在美国的业务,这可能为美国市场创造成长机会。例如,2024年4月,晶片公司台湾半导体製造股份有限公司(TSMC)宣布计划在亚利桑那州建造第三家晶圆厂,使其在美国的总投资额从400亿美元增至650亿美元。

- 美国政府优先发展半导体製造业,并加强晶片供应链。它还宣布了进一步加强供应链、支持研发和晶片设计、增加半导体劳动力的政策行动,以确保晶片从国家经济和国家安全中获得最大利益,这将有助于国家的半导体生态系统并推动未来的市场成长。

- 美国消费科技美国将成长 2.8%,达到 5,120 亿美元。半导体在製造家用电子电器、智慧型手机和个人运算设备的应用将推动对半导体的需求。这可能会在预测期内为美国半导体产业的流量控制市场创造成长机会。

流量控制行业概况

由于全球范围内存在多个领先品牌争夺市场占有率,因此流量控制设备供应商之间的竞争较为温和。近年来,随着新兴国家家电和智慧型手机的普及,真空帮浦的需求急剧增加。这使得客户获取和销售管道创建成为关键策略重点。主要市场参与企业包括 Pfeiffer Vacuum GmbH、Atlas Copco AB、Gardner Denver 和 Busch Holding GmbH。

- 2024 年 2 月 Busch Holding GmbH 的 Busch 真空解决方案部门扩大了其 O11O 数位服务范围,以涵盖真空系统。 O11O for Systems 可让您同时监控真空系统中的多个真空产生器,以确保您的生产流程在正确的真空水平下运作。这有效地降低了生产停机风险并显着节省了成本。 O11O IoT 仪表板可透过 PC 或行动装置存取,提供用户友好的介面,用于全面的系统监控,并支援市场上流量控制组件的交叉销售机会。这些发展表明供应商正在投资产品创新以保持市场竞争力。

- 2023 年 12 月,阿特拉斯科普柯集团宣布计划收购 KRACHT GmbH,后者是一家提供外嚙合齿轮泵、流量测量、阀门、液压驱动器和分配系统等高品质技术的供应商。预计这将推动流量控制设备市场未来的成长。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业分析—波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 透过工业物联网数位化电子产业发展

- 市场挑战

- 市场一体化进程加剧竞争

第六章真空帮浦与阀门在半导体产业的主要应用

- 真空帮浦

- 物理气相淀积/溅镀

- 化学沉淀(等离子体/亚大气压力)

- 扩散/低压化学沉淀(LPCVD)

- 原子层沉淀

- 干燥剥离并清洁

- 介电蚀刻

- 导体和多晶硅蚀刻

- 原子层蚀刻

- 离子布植

- 负载锁和传输

- 临界尺寸扫描电子显微镜

- 前开式通用舱内的颗粒监测

- 空气中的分子污染

- 阀门

- 化学品供应

- 多晶硅工艺

- 晶圆製造

- 化学製造

- 泥浆供应

- 溶剂供应

- 水疗

- 光刻

- 蚀刻

- CMP

- 化学品和泥浆回收

第七章市场区隔

- 组件类型

- 真空

- 阀门

- 球

- 蝴蝶

- 门

- 手套

- 其他阀门

- 机械轴封

- 按国家

- 美国

- 中国

- 台湾

- 韩国

- 日本

- 世界其他地区

第八章竞争格局

- 公司简介-真空泵

- Pfeiffer Vacuum GmbH

- Atlas Copco AB

- Gardner Denver(ingersoll Rand Inc.)

- Flowserve Corporation

- Busch Holding Gmbh

- Kurt J. Lesker Company

- 公司简介 – Valve

- Fujikin Incorporation

- GEMU Holding GmbH & Co.KG

- VAT Vakuumventile AG

- Swagelok Company

- Festo SE & Co. KG

- GCE Group

- 公司简介 -机械轴封

- DuPont De Nemours Inc.

- EKK Eagle SC Inc.

- EnPro Industries Inc.

- Freudenberg Group

- AESSEAL PLC

- Parker-Hannifin Corporation

- Greene, Tweed & Co. Inc.

第九章 投资与未来展望

The Flow Control Market In The Semiconductor Industry is expected to grow from USD 6.03 billion in 2025 to USD 8.23 billion by 2030, at a CAGR of 6.41% during the forecast period (2025-2030).

Key Highlights

- Increased demand highlighting the need for stringent process control drives investments in new semiconductor production facilities. Precise flow control is crucial in the semiconductor industry. Processes like plasma etch and chemical vapor deposition (CVD) depend on the exact interaction of multiple gases to create essential layers or films. Even a slight deviation in gas flow can cause process failure, making accurate gas metering essential.

- Significant advancements in the semiconductor and electronics industries are expected to drive industrial growth. The strong adoption of the work-from-home lifestyle may also add to the surge in demand for electronic equipment caused by the COVID-19 pandemic. Furthermore, with technological advancements and well-established distribution networks, European and US electronics manufacturers strive to expand operations in emerging nations. Furthermore, the increasing popularity of consumer electronics among China's and India's youth is expected to boost the demand for semiconductor chips, which, in turn, will have a positive impact on the market's growth.

- The growing demand for the semiconductor industry supports the market's growth. For instance, in May 2024, the Semiconductor Industry Association reported that the United States is projected to triple its semiconductor manufacturing capacity by 2032, in line with the semiconductor market's growth worldwide during the forecast period. This would support the market studied by enhancing the demand for flow control equipment in the semiconductor industry.

- However, the higher cost involved with semiconductor manufacturing is anticipated to remain among the major challenging factors for the growth of the market. Additionally, the complexity involved in designing flow control devices/components, considering the critical nature of applications associated with the semiconductor industry, also challenges the growth of the market studied. The market has become consolidated, and significant players are following an acquisition strategy, creating a challenge for the growth of small companies, which would impact the overall market growth.

- During the initial phase of the COVID-19 pandemic, the market faced disruptions, including global lockdowns, which notably hampered chip manufacturers' supply chains and production capacities. Yet, the demand for semiconductor chips surged during and after the pandemic, a trend expected to persist through the forecast period. This increasing demand is poised to spur investments in new production facilities, fueling the need for flow control solutions.

Flow Control Market Trends

Mechanical Seals to Register the Fastest Market Growth

- A mechanical seal's primary function is to prevent fluid or gas leakage through the clearance between the shaft and the container. Mechanical seals are made up of two faces separated by carbon rings. The revolving equipment comes in touch with the initial face, which is stationary. Furthermore, the seal ring (first face) is the main component of the seal on which the mechanical force generated by springs, bellows, or fluids in the equipment acts. In the semiconductor industry, seals are invariably housed in areas of the processing system where they need to withstand highly corrosive gases, liquids, gases, and plasmas, often in vacuum conditions or at elevated temperatures.

- The mechanical seal segment has grown substantially in recent years and is expected to continue growing over the coming years, primarily due to increasing investments in semiconductor manufacturing facilities. In emerging nations, the rise of AI, ML, and IoT, as well as smartphone and consumer electronics development, is predicted to prompt further development policies and investments in the semiconductor industry. Cartridge seals, balanced and unbalanced seals, pusher and non-pusher seals, and conventional seals are examples of mechanical seals driving the market's expansion.

- In the fabrication of semiconductor products, seal reliability and contamination reduction are crucial. Chemical filtration, chemical transfer, AODD pump sealing, and silicon wafer fabrication are essential semiconductor applications where mechanical seals have proven to be the best option.

- Deposition, etch, ash/strip, plasma, and heat processing or annealing are synergistic process technologies that constitute some of the most difficult environments for elastomer seal materials. These are frequently encountered during the fabrication of semiconductor-integrated circuits. Clean-room manufactured seals with low particle and trace metal contamination are used to minimize yield loss and chemical erosion rates. These seals can provide benefits such as increased system up-time, increased mean time between failure (MTBF), decreased wet clean or mechanical clean frequency, and reduced cost of ownership (CoO) through lower consumable costs (CoC).

- The digitization and automation trends have significantly enhanced the demand for semiconductors. For instance, in September 2023, Guangzhou JST Seals Technology Co. Ltd launched its FFKM O-rings to provide the highest temperature (up to 620 °F) and the most common chemical resistance among all rubber O-ring and gasket materials. These can be used in the environment of high-temperature hot air in the semiconductor manufacturing process, and the maximum operating temperature is 315 °C. Such developments show the growth in the demand for mechanical sealing equipment in the semiconductor industry, which is in line with the growing investments in semiconductor manufacturing and their increasing sales worldwide.

The United States Expected to Contribute Significantly to Market Growth

- The United States has registered increased domestic chip manufacturing facility proposals since the US CHIPS and Science Act was proposed. Developing new plants and research and design projects have received investments to entice original chip manufacturers (OCMs) to the country, and US states have implemented legislation requiring them to provide additional financing, which would support the demand for flow control components in the market.

- The United States has announced plans to continue contributing to the global value chain with strong leadership positions in high-value-added areas of semiconductor technology, including chip design, electronic design automation (EDA), and semiconductor manufacturing equipment. This would support the growth of semiconductor manufacturing units' establishments in the country and fuel market growth.

- Global semiconductor companies are expanding their footprints in the country, which would create a growth opportunity for the US market. For instance, in April 2024, chip company Taiwan Semiconductor Manufacturing Company (TSMC) announced plans to build a third factory in Arizona, raising its total investment in the United States from USD 40 billion to USD 65 billion, which shows future market growth opportunities for flow control components in the country.

- The country's government has prioritized semiconductor manufacturing in the United States and reinforced chip supply chains. It also identifies policy actions that will further strengthen supply chains, support R&D and chip design, grow the semiconductor workforce, and ensure CHIPS delivers maximum benefits to the country's economic and national security, which would help the semiconductor ecosystems in the country and fuel market growth in the future.

- The Consumer Technology Association estimated US retail sales of consumer technologies to rise 2.8% and reach USD 512 billion in 2024, supported by the increasing sales of personal computers, smartphones, and other gadgets. This would fuel the demand for the semiconductor market due to the application of semiconductors in manufacturing consumer electronics, smartphones, and personal computing devices. This would create growth opportunities for the flow control market in the semiconductor industry in the United States during the forecast period.

Flow Control Industry Overview

The competitive rivalry among flow control equipment providers is moderate, owing to the presence of various dominant brands competing for market share globally. The demand for vacuum pumps has spiked in recent years due to the massive penetration of consumer electronics and smartphones across developing countries. This has led to an increased focus on customer acquisition and formulating distribution channels as key strategies. Some key market players include Pfeiffer Vacuum GmbH, Atlas Copco AB, Gardner Denver, and Busch Holding GmbH.

- February 2024: Busch Holding GmbH's Busch Vacuum Solutions segment expanded its range of O11O Digital Services to include vacuum systems. O11O for systems enables the simultaneous monitoring of multiple vacuum generators in a vacuum system and the supervision of the production process to ensure it runs reliably and with the correct vacuum levels. This effectively minimizes production downtime risk and leads to significant cost savings. Accessible via a PC or a mobile device, the O11O IoT dashboard presents a user-friendly interface for comprehensive system monitoring and to support the company's cross-selling opportunity for flow control components in the market. Such developments demonstrate market vendors' investments in product innovations to remain competitive.

- December 2023: Atlas Copco Group announced plans to acquire KRACHT GmbH (Kracht), a manufacturer of high-quality technologies, including external gear pumps, fluid measurement, valves, hydraulic drives, and dosing systems. This is expected to support the company's future growth in the flow control equipment market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Analysis - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Electronics Industry Driven by IIoT Digitalization

- 5.2 Market Challenges

- 5.2.1 Increasing Market Consolidation Expected to Create Stiff Competition

6 MAJOR APPLICATIONS OF VACUUM PUMPS AND VALVES IN THE SEMICONDUCTOR INDUSTRY

- 6.1 Vacuum Pumps

- 6.1.1 Physical Vapor Deposition/Sputtering

- 6.1.2 Chemical Vapor Deposition (Plasma/Sub-atmospheric)

- 6.1.3 Diffusion/Low Pressure Chemical Vapor Deposition (LPCVD)

- 6.1.4 Atomic Layer Deposition

- 6.1.5 Dry Stripping and Cleaning

- 6.1.6 Dielectric Etch

- 6.1.7 Conductor and Polysilicon Etch

- 6.1.8 Atomic Layer Etching

- 6.1.9 Ion Implantation

- 6.1.10 Load Lock and Transfer

- 6.1.11 Critical Dimension Scanning Electron Microscope

- 6.1.12 Particle Monitoring in Front Opening Universal Pods

- 6.1.13 Airborne Molecular Contamination

- 6.2 Valves

- 6.2.1 Chemical Supply

- 6.2.2 Polysilicon Process

- 6.2.3 Wafer Manufacturing

- 6.2.4 Chemical Manufacturing

- 6.2.5 Slurry Supply

- 6.2.6 Solvent Supply

- 6.2.7 Water Treatment

- 6.2.8 Lithography

- 6.2.9 Etching

- 6.2.10 CMP

- 6.2.11 Chemical and Slurry Recovery

7 MARKET SEGMENTATION

- 7.1 Type of Component

- 7.1.1 Vacuum

- 7.1.2 Valves

- 7.1.2.1 Ball

- 7.1.2.2 Butterfly

- 7.1.2.3 Gate

- 7.1.2.4 Globe

- 7.1.2.5 Other Valves

- 7.1.3 Mechanical Seals

- 7.2 By Country

- 7.2.1 United States

- 7.2.2 China

- 7.2.3 Taiwan

- 7.2.4 South Korea

- 7.2.5 Japan

- 7.2.6 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles - Vacuum Pumps

- 8.1.1 Pfeiffer Vacuum GmbH

- 8.1.2 Atlas Copco AB

- 8.1.3 Gardner Denver (ingersoll Rand Inc.)

- 8.1.4 Flowserve Corporation

- 8.1.5 Busch Holding Gmbh

- 8.1.6 Kurt J. Lesker Company

- 8.2 Company Profiles - Valves

- 8.2.1 Fujikin Incorporation

- 8.2.2 GEMU Holding GmbH & Co.KG

- 8.2.3 VAT Vakuumventile AG

- 8.2.4 Swagelok Company

- 8.2.5 Festo SE & Co. KG

- 8.2.6 GCE Group

- 8.3 Company Profiles - Mechanical Seals

- 8.3.1 DuPont De Nemours Inc.

- 8.3.2 EKK Eagle SC Inc.

- 8.3.3 EnPro Industries Inc.

- 8.3.4 Freudenberg Group

- 8.3.5 AESSEAL PLC

- 8.3.6 Parker-Hannifin Corporation

- 8.3.7 Greene, Tweed & Co. Inc.