|

市场调查报告书

商品编码

1692455

直流马达:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Direct Current (DC) Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

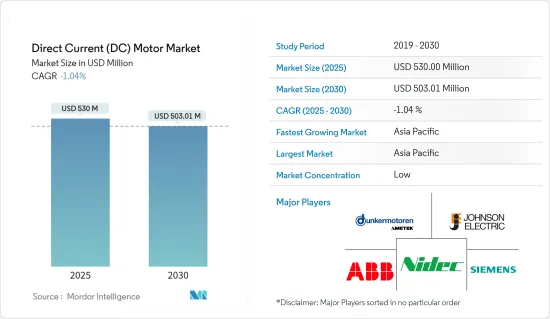

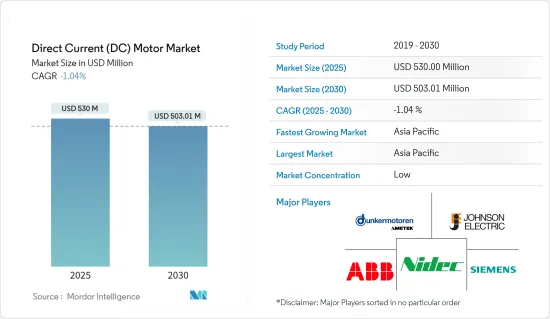

DC马达市场规模预计在 2025 年达到 5.3 亿美元,预计到 2030 年将下降至 5.0301 亿美元。

工业自动化程度的提高推动了对DC马达的需求,直流马达透过提供精确的控制和可靠的性能在自动化系统中发挥至关重要的作用。新兴经济体的劳动力短缺导致製造业采用机器人技术,这也产生了对不同类型DC马达,例如并联马达、他励马达和復励马达。

主要亮点

- DC马达广泛应用于汽车系统,例如雨刷马达、电动座椅马达、电动车窗马达、暖通空调系统等。此外,电动车的普及率正在上升,预计这将在预测期内支持市场成长。汽车业的日产量大幅增加。

- 石油和天然气、采矿、发电、化学和石化等行业通常涉及恶劣和易爆的环境,因此职业安全变得越来越重要,世界许多地方的政府都要求空气品质优良。因此,HVAC 系统透过管理和控制空气循环来帮助创造安全的工作环境。由于 HVAC 系统已成为工业领域不可或缺的一部分,对DC马达的需求也随之增加,因为它们用于 HVAC 系统中的鼓风机马达、变速驱动装置和 AHU,以提高效率并最大限度地延长鼓风机系统的使用寿命。

- 汽车产业正迅速采用无污染电动车(EV)。开发和改进电动车以取代传统汽车对于实现客户满意度和高科技成果至关重要。国际能源总署表示,电动车是全球新能源经济快速崛起的驱动力之一,正在为全球汽车製造业带来历史性变革。

- 有几个障碍阻碍了DC马达的广泛应用。主要挑战围绕着所涉及的成本:能源成本、维护成本和初始购买成本。这是因为DC马达的绕线转子和换向器比感应感应马达的绕线转子和换向器复杂得多。这些是由铜和铁製成的,而不是铝和铁。DC马达的转子更重,可能需要更昂贵的轴承。

- 新冠肺炎疫情对市场产生了影响,包括多个国家政府实施的各种遏制措施严重影响了工业部门的成长。因此,所研究的市场由于供应链问题而经历了放缓,尤其是在初始阶段。不过,随着主要终端用户产业全面復工,智慧DC马达的需求预计将会增加。

直流马达市场趋势

石油和天然气领域预计将强劲成长

- 在石油和天然气领域,马达对于向钻机系统和设备提供稳定可靠的电源至关重要。DC马达专门用于确保为钻孔机系统和设备提供稳定可靠的电力供应。这些马达有助于支援各种操作,包括原油、石油和天然气等商品的开采、加工、储存和运输。

- 石油和天然气产业依靠钻机设备从储存中提取石油和天然气,包括陆上和海上钻井活动。DC马达被广泛用作这些钻孔机的动力来源。这些DC马达的设计可承受石油和天然气环境中常见的挑战,包括振动、极端温度、频繁衝击和腐蚀环境。直流马达因其优异的性能,在陆上油气工业的应用具有特别重要的意义。

- 国际能源总署(IEA)预测,儘管有现有的政策设定,但全球对石油和天然气的需求将在2030年达到高峰。根据国际能源总署预测,到本世纪末,全球石油需求预计将增加 800 万桶/日,这将对海上活动带来更大的需求。因此,随着海外业务和投资的增加,AC马达市场预计将出现激增。这些马达用于各种海上应用,包括为绞车和捲扬机、水泥泵、推进器和推进器提供动力。

- DC马达非常适合海上钻井活动,因为它们可以为泥浆泵、绞车、转盘和顶部驱动器等关键设备提供可变速度。海上钻油平臺在全球石油钻机数量中扮演关键角色,贝克休斯报告称,2023 年 11 月全球将有 272 个钻机投入运作,其中超过 91 个位于亚太地区。重新进行海上石油勘探受到多种因素的推动,包括全球能源需求增加、乌克兰衝突造成的供应中断以及与疫情爆发前相比仍然较高的油价。

亚太地区预计将经历强劲成长

- 预计未来几年中国DC马达市场将显着成长。推动市场发展的因素有很多,包括对电动车的需求不断增加、中国製造业自动化程度不断提高以及中国对家用电器的需求不断增长。

- 在中国,智慧製造计划预计将推动工业DC马达的使用。根据资讯化部消息,将在全国启动一批智慧製造先导计画。此外,根据「十三五」智慧製造规划,政府计画在2025年加强智慧製造体系建设,实现重点产业的全面转型。透过这些努力,预计DC马达在全国各行业的应用将会成长。

- 印度人口和工业的快速成长导致污水量大幅增加。这种惊人的成长导致该国对污水处理厂的需求增加。这一增长主要受到全国各地市政当局和污水处理厂不断增长的需求的推动。水处理厂严重依赖泵浦和马达系统来有效率、有效地完成水的处理过程。因此,全国各地对这些处理厂的需求不断增加也将推动对DC马达的需求。

- 此外,该领域的市场扩张主要归功于技术进步和各个终端用户行业对自动化技术的日益广泛的使用。推动该国DC马达需求的其他关键因素包括快速的都市化、互补的技术改进、有利的政府法规以及强劲的直接投资流入。

直流马达市场概况

直流马达市场分散,企业间竞争日益激烈。市场的主要参与者包括 ABB 有限公司、AMETEK 公司(Dunkermotoren GmbH)、德昌电机控股有限公司、日本电产株式会社和西门子股份公司。从市场占有率来看,这些大公司目前占据着市场主导地位。然而,随着技术创新的不断增加,许多公司正在透过赢得新契约和开拓新市场来扩大其市场占有率。

- 2023 年 12 月 - 富兰克林电气公司富兰克林电气公司是一家为住宅、商业、农业和工业应用提供马达、驱动器和控制设备的供应商。此次收购使该公司能够加强和扩大其在主要地区的水处理管道和产品。

- 2023 年 7 月-Nidec 宣布已收购 TAR, LLC d/b/a Houma Armature Works 的全部所有权。该服务合作伙伴重新製造马达和发电机,并为路易斯安那州和德克萨斯州的石油和天然气生产商提供现场服务。此次收购使 NMC 能够加强其服务产品,包括扩大其在美国安装基数中的份额。霍马将能够为 NMC 的客户提供服务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 新冠疫情的后续影响以及其他宏观经济因素将影响市场

第五章市场动态

- 市场驱动因素

- 无刷直流马达的采用率不断提高

- 电动车日益普及

- 市场挑战

- 维护成本高

第六章市场区隔

- 按类型

- 永久磁/自励式

- 个体激励

- 按最终用户产业

- 石油和天然气

- 化工和石化

- 发电

- 用水和污水

- 金属与矿业

- 饮食

- 离散製造业

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第七章竞争格局

- 公司简介

- ABB Ltd

- AMETEK Inc.(Dunkermotoren GmbH)

- Johnson Electric Holdings Limited

- Nidec Corporation

- Siemens AG

- Franklin Electric

- Allied Motion Technologies Inc.

- Regal Rexnord Corporation

- North American Electric Inc.

- Maxon

- Buhler Motor GmbH

- MinebeaMitsumi Inc.

第八章投资分析

第九章:市场的未来

The Direct Current Motor Market size is estimated at USD 530.00 million in 2025, and is expected to decline to USD 503.01 million by 2030.

Increasing industrial automation drives the demand for DC motors, which play a vital role in automated systems by providing precise control and reliable performance. Labor shortages in emerging countries are leading to the adoption of robotics in the manufacturing industry, which is also creating demand for different types of DC motors, such as shunt motors, separately excited motors, and compound motors.

Key Highlights

- DC motors are widely used in automobile systems for wiper motors, power seat motors, power window motors, and HVAC systems. Additionally, the growing adoption of electric vehicles is expected to support the market's growth during the forecast period. The automotive sector has witnessed a significant increase in daily units produced.

- Owing to the rising importance of occupational safety in the global regions, the government has mandated quality air management as industries such as oil and gas, mining, power generation, chemicals, and petrochemicals often involve harsh and explosive atmospheres. Thus, HVAC systems aid in creating a safe working environment by managing and controlling air circulation. With HVAC systems turning out to be an integral part of the industrial sector, DC motors are also able to create a generous demand as they are used in HVAC systems' blower motors, variable speed drives, and AHUs to achieve high efficiency in airflow systems along with in maximizing their lives.

- The automotive industry has rapidly introduced pollution-free electric vehicles (EVs). The development and improvement of EVs to replace conventional vehicles has become crucial to obtaining customer satisfaction and high-tech achievements. As per the IEA, electric vehicles are one of the driving forces in the new global energy economy that is rapidly emerging, and they are bringing about a historic transformation of the car manufacturing industry worldwide.

- Several obstacles are preventing the widespread use of DC motors. The main challenges revolve around the associated expenses, including energy costs, maintenance costs, and initial purchase costs. This is because the wound rotor and commutator of a DC motor are quite a bit more complicated than the rotor of an induction motor. They are made out of copper and iron rather than aluminum and iron. The heavier rotor of the DC motor may require more expensive bearings.

- The impact of the COVID-19 pandemic was observed on the market as various containment measures taken by governments across multiple countries, such as the implementation of lockdown, significantly impacted the growth of the industrial sector. As a result, a slowdown was witnessed in the studied market, especially during the initial phase, due to supply chain issues. However, with significant end-user industries resuming operations at total capacity, the demand for smart DC motors is anticipated to increase.

Direct Current (DC) Motor Market Trends

The Oil and Gas Segment is Expected to Witness Major Growth

- Electric motors are crucial in oil and gas by delivering a steady and dependable power source to drill rig systems and equipment. DC motors are specifically utilized to ensure a consistent and reliable power supply to drilling rig systems and equipment. These motors are instrumental in supporting various operations, such as extracting, processing, storing, and transporting commodities like crude oil, petroleum, and natural gas.

- Oil and natural gas extraction from reservoirs in the oil and gas sector relies on drilling rig equipment for both onshore and offshore drilling activities. These drilling rigs extensively utilize DC motors as their power source. These DC motors are designed to withstand the challenging conditions commonly found in oil and gas settings, such as vibration, extreme temperatures, frequent impacts, and corrosive environments. Because of their exceptional performance, the utilization of DC electric motors in onshore oil and gas industries has notable significance.

- The International Energy Agency (IEA) has projected that global oil and gas demand will peak by 2030 despite the existing policy settings. According to the IEA, there will be an approximate increase of eight million barrels per day (bpd) in global demand by the decade's end, leading to a more significant requirement for offshore activities. Consequently, there is an anticipated surge in the market for AC motors due to the growth in offshore operations and investments. These motors are utilized in various offshore applications, including powering winches and windlasses, cement pumps, propulsion, and thrusters.

- DC motors are highly suitable for offshore drilling activities because they provide variable speeds to essential equipment such as mud pumps, draw works, rotary tables, and top drives. Offshore drilling rigs play a significant role in the global oil rig count, with 272 active rigs across the world in November 2023, over 91 of which are located in Asia-Pacific, as reported by Baker Hughes. The renewed search for offshore petroleum is driven by a combination of factors, including increased global energy demand, supply disruptions caused by the conflict in Ukraine, and crude oil prices that have remained elevated compared to pre-pandemic levels.

Asia-Pacific is Expected to Witness Significant Growth

- The Chinese DC motor market is poised for significant growth in the coming years. Several factors drive the market, including the increasing demand for EVs, the growing automation in the Chinese manufacturing sector, and the rising demand for consumer electronics in China.

- In China, smart manufacturing endeavors are anticipated to facilitate the utilization of industrial DC motors. The Ministry of Information Technology has reported initiating numerous smart manufacturing pilot projects in the country. Furthermore, as outlined in the 13th smart manufacturing five-year plan, the government intends to enhance its smart manufacturing system and achieve a comprehensive transformation of key industries by 2025. Such initiatives are expected to drive the adoption of DC motors across the country's sectors.

- With the rapid growth of India's population and its industrial sector, there has been a significant increase in the volume of wastewater. This alarming rise has prompted the country's need for wastewater treatment plants. The rising demand for nationwide municipal and sewage water treatment facilities primarily drives the growth. Water treatment plants heavily rely on pump and motor systems to efficiently and effectively move water through the treatment process. Consequently, the increasing demand for these treatment plants nationwide will also drive the demand for DC motors.

- Moreover, the market's expansion in this area is primarily due to technical advancements and the increased usage of automation technologies across various end-user industries. Other significant factors driving the demand for DC motors in the country include rapid urbanization, complementary technical improvements, favorable government regulations, and robust FDI inflows.

Direct Current (DC) Motor Market Overview

The direct current (DC) motor market is fragmented and is witnessing rising competitiveness among companies. The market consists of major players, such as ABB Ltd, AMETEK Inc. (Dunkermotoren GmbH), Johnson Electric Holdings Limited, Nidec Corporation, and Siemens AG. In terms of market share, these significant players currently dominate the market. However, with increasing technology innovations, many companies are increasing their market presence by securing new contracts and tapping new markets.

- December 2023 - Franklin Electric Co. Inc., which offers motors, drives, and controls for residential, commercial, agricultural, and industrial applications, announced that it had acquired the assets of Action Manufacturing & Supply Inc., a provider of control valves for commercial and industrial applications. This acquisition helps the company strengthen and expand its channels and products for water treatment in critical geographic areas.

- July 2023 - Nidec Corporation announced that it acquired full ownership of TAR, LLC d/b/a Houma Armature Works. This service partner remanufactures motors and generators and provides field service to oil and gas producers operating out of Louisiana and Texas. Through this acquisition, NMC will be able to enhance its service offering, including expanding its share within its own US installed base. Houma will be able to provide services to NMC's customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of the COVID-19 Pandemic's After effects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Brushless DC Motor

- 5.1.2 Growing Prevalence of Electric Vehicles

- 5.2 Market Challenges

- 5.2.1 High Cost of Maintenance

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Permanent Magnet and Self-Excited

- 6.1.2 Separately Excited

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical and Petrochemical

- 6.2.3 Power Generation

- 6.2.4 Water and Wastewater

- 6.2.5 Metal and Mining

- 6.2.6 Food and Beverage

- 6.2.7 Discrete Industries

- 6.2.8 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 AMETEK Inc. (Dunkermotoren GmbH)

- 7.1.3 Johnson Electric Holdings Limited

- 7.1.4 Nidec Corporation

- 7.1.5 Siemens AG

- 7.1.6 Franklin Electric

- 7.1.7 Allied Motion Technologies Inc.

- 7.1.8 Regal Rexnord Corporation

- 7.1.9 North American Electric Inc.

- 7.1.10 Maxon

- 7.1.11 Buhler Motor GmbH

- 7.1.12 MinebeaMitsumi Inc.