|

市场调查报告书

商品编码

1692471

全球消费性智慧穿戴装置市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Consumer Smart Wearable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

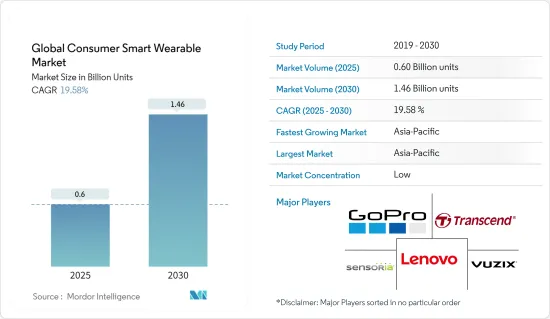

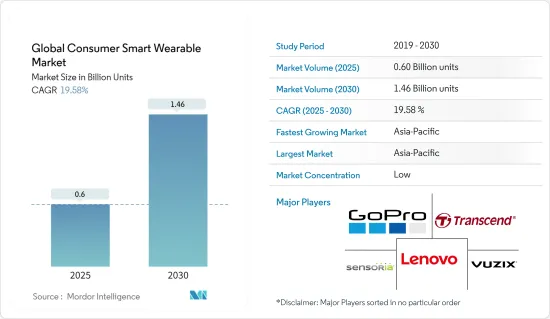

预计2025年全球消费智慧穿戴装置市场规模为6亿台,2030年预计将达到14.6亿台,预测期间(2025-2030年)的复合年增长率为19.58%。

穿戴式科技是一种新兴趋势,它将电子产品融入日常活动,并可以穿戴在身体的任何部位,以适应不断变化的生活方式。诸如连接到互联网以及提供网路和设备之间资料交换选项等趋势正在引领可穿戴技术的发展趋势。

主要亮点

- 全球都市化速度的加快推动了对先进、美观产品的需求,这些产品能够满足消费者的需求,例如单一设备中的多种功能、时间表等。此外,全球千禧世代是智慧型手錶的早期采用者,因为他们能够更好地追踪正常工作时间和奢侈标准的消费。

- 机器学习和人工智慧能力将使您的技能更上一层楼,尤其是在当今的医疗保健行业。与此相伴的是,与物联网相容的智慧穿戴式感测器的价格也在下降,这使得製造商能够以更实惠的价格提供智慧穿戴设备,并鼓励各行业采用适合自身系统和业务的产品。此外,近年来智慧穿戴式消费设备的销售量大幅成长。此外,穿戴式感测器设备已开始在运动产业中发挥重要作用,使客户能够坚持日常习惯,并提供有关各种可编程监控参数的重要资讯。

- 随着苹果和 Fitbit 等穿戴式装置製造商增加了吸引老年人的健康监测功能并即时更新他们的健康状况,智慧穿戴装置的新用户数量正在激增,其中包括老年人群。

- 过去几年,穿戴式装置的普及程度已越来越高,但对资料隐私的担忧依然存在。智慧型手錶带来了更大的风险,儘管此类装置的资料对攻击者来说可能没有什么价值。如果设备配备 LTE 连接,风险可能会更高,因为它可以在远离配对设备的地方操作。

- 全球范围内的新冠疫情和封锁规定正在影响全球消费者。封锁的影响包括供应链中断、製造过程中所用原材料的短缺、劳动力短缺、价格波动可能导致最终产品产量超出预算以及运输问题。

消费性智慧穿戴装置市场趋势

不断进步的技术正在推动市场成长

- 可支配收入的增加和生活方式的改变正在推动对穿戴式科技的需求。此外,物联网时代穿戴式装置所提供的日益增多的功能也推动了军事、运动健身、医疗保健和娱乐等产业的需求。

- 新产品的推出和新进入者进入市场推动了这项需求。随着越来越多的公司进入消费性智慧穿戴设备市场,其产品的差异化至关重要。例如,2022 年 6 月,Ambrane 宣布推出 Wise Roam智慧型手錶系列,扩大其产品组合。这款智慧型手錶具有蓝牙通话功能,提供超过 100 种云端基础的錶盘,防水等级为 IP68。

- Wise Roam智慧型手錶配备了心率、血压、SpO2、月经健康、睡眠和其他健康指标感测器。此外,它还提供呼吸训练、天气预报、高 AR 警报和久坐提醒。这款智慧型手錶拥有超过 60 种运动模式,并配备可在 Android 和 iOS 装置上运行的 Da Fit 软体。此外,这款手錶还可以与 Apple Health 和 Google Fit 连接。

- LG Chem 和Panasonic等公司已经帮助开发了可以为穿戴式装置供电的可印刷柔性电池。有了这种灵活而时尚的电池设计,市场上的供应商现在可以利用额外的空间来添加更多组件并提高电池容量。

- 感测器(尤其是压力感测器和激活器)的进步和小型化也扩大了消费性智慧穿戴设备市场的范围。许多公司正在投资开发先进的MEMS和数位感测器,这些感测器正变得越来越小型化,因此涵盖了市场上更广泛的应用。

亚太地区预计将创下最快成长

- 政府的支持使中国成为与低成本製造地相比突出的创新领导者之一,这也推动了市场的发展,因为许多中国公司正在大力投资研发。例如,KUMI 已成功供应 40 万隻智慧型手錶,并已走向国际,在印度、美国、欧洲和许多东南亚国家等多个市场竞争。

- 中国公司正在为健身带和智慧型手錶等内建连接功能的可穿戴设备新兴市场开发先进技术。小米和华为等设备製造商一直活跃于这个市场,与微信等线上服务供应商和行动电话电信商合作。

- 在日本,头戴式显示器(HMD)正变得越来越先进。 HMD 像护目镜一样佩戴,并将视讯影像直接投射到使用者眼前。日本公司越来越多地生产具有 3D 功能的 HMD 视讯娱乐系统。这些系统融合了日本在电脑图形(CG)和高清平板显示技术方面的优势。

- 根据印度品牌股权基金会(IBEF)的预测,到 2022 年,印度家用电器和消费性电子产品(ACE)市场规模预计将达到 3.15 兆印度卢比(约 483.7 亿美元),复合年增长率为 9%。预计这将在预测期内推动消费智慧穿戴设备市场的成长。

- 此外,亚洲纤维公司还提供其 iQmax 品牌的智慧纺织品,该品牌结合了纤维和电子产品,为各种市场的服装提供功能性、创新性的产品。 iQmax产品线采用照明模组开发,集LED纱灯、DC插孔、动力电池、控制器两种功能于一体。此产品系列提供可弯曲、柔软、轻盈、防水且可清洗的服装纺织品。

消费性智慧穿戴装置产业概览

全球消费性智慧穿戴设备市场竞争激烈。近年来,市场竞争愈加激烈。此外,为了在这个快速成长的市场中获得竞争优势,一些主要满足千禧世代需求的公司正在涌现。公司不断投资于产品开发以及合作伙伴关係和收购,以推出新产品并扩展市场。

- 2022 年 4 月 - Vuzix Corporation 与法国跨国高科技解决方案经销商 RobotiquesCyborg 签署了经销协议。作为协议的一部分,Vuzix 已收到并发送了来自其新合作伙伴的价值 30 万美元的智慧眼镜首笔订单。

- 2021 年 8 月-联想和 RealWear 宣布建立全球合作伙伴关係,为企业客户提供辅助现实解决方案。两家公司的综合资源和技术将使客户能够在全球范围内选择、部署和扩展他们所需的扩增实境(XR) 技术。根据合作协议,联想将认证 RealWear HMT-1 设备,利用其 ThinkReality 平台扩大第一线工人对优化的免持 2D 应用程式的存取。此外,联想将透过其国际分销网络提供其 RealWearHMT-1 系列辅助实境穿戴装置。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 价值链分析

- COVID-19 对消费性智慧穿戴装置市场的影响

第五章市场动态

- 市场驱动因素

- 技术进步不断推动市场成长

- 市场挑战

- 高成本和资料安全问题

第六章市场区隔

- 按产品

- 智慧型手錶

- 头戴式显示器

- 智慧穿戴

- 耳挂式

- 健身追踪器

- 随身摄影机

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章竞争格局

- 公司简介

- Vuzix Corporation

- Lenovo

- Transcend Information Inc.

- GoPro Inc.

- Sensoria Inc.

- AIQ Smart Clothing Inc.

- Axon Enterprise Inc.

- Withings

- Huami Corporation

- Omron Healthcare Inc.

- Nuheara Limited

- Polar Electro Oy

- Microsoft Corporation

- Sony Corporation

- Huawei Technologies Co. Ltd

- Fitbit LLC

- Fossil Group Inc.

- Garmin Ltd

- Samsung Electronics Co. Ltd

- Apple Inc.

第八章投资分析

第九章:市场的未来

The Global Consumer Smart Wearable Market size is estimated at 0.60 billion units in 2025, and is expected to reach 1.46 billion units by 2030, at a CAGR of 19.58% during the forecast period (2025-2030).

Wearable technology, an emerging trend, integrates electronics into daily activities and addresses the changing lifestyles with the ability to be worn on any part of the body. Factors such as the ability to connect to the internet and provide data exchange options between a network and a device are leading to the trend of wearable technology.

Key Highlights

- The rising penetration rates of urbanization in various parts of the world have driven the demand for advanced, aesthetically appealing products that possess the ability to serve the consumers' requirements better, such as multiple features in one device and time schedules. Moreover, the vast millennial population across the globe has been quick to adopt smartwatches, owing to the increased spending ability on their regular work hours tracking and luxury standards.

- Machine learning and AI capabilities take skills to the next level, especially in the current healthcare industry. In support of this, IoT compatibles smart wearable sensors are also witnessing a decline in pricing, which leads to manufacturers offering smart wearable devices at a more affordable rate, thus, encouraging various industries to adopt products catered to their systems and operations. Additionally, there has been a significant increase in consumer smart wearable devices being sold over the past few years. Additionally, wearable sensor devices have emerged to be a significant part of the sports industry, thereby helping customers to stick to daily routines and providing crucial information regarding the different parameters it is programmed to monitor.

- Smart wearables are further witnessing a surge in the number of new users, including the older age population, owing to the fact that wearable makers, such as Apple and Fitbit, among others, are adding health-monitoring features that appeal to old age people and keep them updated about their health status in real-time.

- Although the adoption of wearables has been widely gaining traction over the past few years, the concern over data privacy persists. Even though data from smart wearables may be of little value to attackers, the risk increases for smart wearables like smartwatches. Risks are likely to increase further if the device comes with an LTE connection, as they can be operated away from the paired device.

- The COVID-19 outbreak and the lockdown restrictions across the globe have affected the consumer across the world. Some of the effects of lockdown include supply chain disruptions, lack of availability of raw materials used in the manufacturing process, labor shortages, fluctuating prices that could cause the production of the final product to inflate and go beyond budget, and shipping problems, among others.

Consumer Smart Wearable Market Trends

Incremental Technological Advancements Aiding the Market Growth

- Increasing disposable incomes and changing lifestyles have led to the demand for wearable technology. Demand from industries like military, sports and fitness, healthcare, and entertainment, among others., have also increased due to the increased functionality wearables offer in the era of IoT.

- This demand has been supported by new product launches and new entrants into the market. As more companies venture into the consumer smart wearables market, the need for differentiating their product offerings becomes essential. For instance, in June 2022, Ambraneannounced its portfolio expansion with the Wise Roam smartwatch series launch. The smartwatch is offered with Bluetooth calling and provides 100+ cloud-based watch faces and is IP68 water-resistant.

- The Wise Roam smartwatch has sensors for heart rate, blood pressure, SpO2, menstrual health, sleep, and other wellness metrics. Additionally, it offers breath training, weather forecasts, High AR Alert, and sedentary reminders. The smartwatch offers more than 60 different sports modes and the Da Fit software, which works with both Android and iOS devices. Additionally, the wristwatch can be linked to Apple Health and Google Fit.

- Companies like LG Chem and Panasonic have been instrumental in developing printable and flexible batteries that can power wearable devices. Using these flexible and sleek designs of the batteries, vendors in the market were able to utilize the additional space to add more components and improve battery capacity, which translates into longer battery life.

- The growing advancement and reduction in the size of sensors, especially pressure sensors and activators, also expanded the scope of the consumer smart wearables market. Many companies are investing in developing advanced MEMS and digital sensors, which are further decreasing their sizes, hence covering a wide range of market applications.

Asia Pacific is Expected to Register the Fastest Growth

- The government's support for making China one of the prominent innovation leaders compared to a low-cost manufacturing hub is also driving the market, as many Chinese companies are investing tremendously in research and development. For instance, KUMI successfully supplied 400 thousand smartwatches and moved internationally to compete in various markets, including India, the United States, Europe, and many Southeast Asian nations.

- Chinese companies are developing advanced technologies for the emerging market of wearable devices, such as fitness bands and smartwatches, with built-in connectivity. Device manufacturers, such as Xiaomi and Huawei, are very active in the market and are partnering with, as are online service providers, such as WeChat and mobile operators.

- In Japan, head-mounted displays (HMD) are becoming more advanced. An HMD, worn like a pair of goggles, projects video pictures directly in front of the user. Japanese firms have been producing HMD video entertainment systems with 3D capabilities one after the other. These systems combine computer graphics (CG), which Japan specializes in, with high-definition flat-panel display technology.

- According to the India Brand Equity Foundation (IBEF), the Indian appliances and consumer electronics (ACE) market is expected to register a 9% CAGR to reach INR 3.15 trillion (USD 48.37 billion) in 2022. This is expected to boost the consumer smart wearable market growth over the forecast period.

- Further, Asiatic FiberCorporation offers the iQmaxbrand of smart textiles, which aims to combine fiber with electronics to offer a functional, innovative product for use in apparel for a variety of markets. The iQmaxproduct line was developed with a lighting module, and it features an LED Yarn, a DC jack, and a two-in-one power battery and controller. The product line offers a textile for bendable, soft, lightweight, waterproof, and washable clothing that is also designed to endure folding over time.

Consumer Smart Wearable Industry Overview

The Global Consumer Smart Wearable Market is highly competitive. The market has gained a competitive edge in recent years. Additionally, the players are being taken to gain a competitive edge in this fast-growing market, mainly catering to the demand from the millennial generation population. The companies are introducing new offerings and continuously investing in making partnerships and acquisitions along with product development to increase the market share.

- April 2022 - VuzixCorporation signed a distribution agreement with RobotiquesCyborg, a France-based multi-national distributor of high-technology solutions. As a part of the agreement, Vuzixhas received and shipped against an initial USD 300,000 order from the new partner for its smart glasses.

- August 2021 - Lenovo and RealWearannounced an international collaboration to bring assisted reality solutions to enterprise customers. The combination of resources and technologies of both companies will enable customers to select, deploy and scale the required extended reality (XR) technologies globally. According to the collaboration, Lenovo has certified the RealWearHMT-1 devices to utilize its ThinkRealityplatform to expand frontline workers' access to optimized, hands-free 2D applications. Further, the company will offer RealWear'sHMT-1 family of assisted reality wearable devices through its international sales network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Value Chain Analysis

- 4.4 Impact of COVID-19 on the Consumer Smart Wearable Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Incremental Technological Advancements Aiding the Market Growth

- 5.2 Market Challenges

- 5.2.1 High Cost and Data Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Smartwatches

- 6.1.2 Head-mounted Displays

- 6.1.3 Smart Clothing

- 6.1.4 Ear Worn

- 6.1.5 Fitness Trackers

- 6.1.6 Body-worn Cameras

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 South Korea

- 6.2.3.5 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vuzix Corporation

- 7.1.2 Lenovo

- 7.1.3 Transcend Information Inc.

- 7.1.4 GoPro Inc.

- 7.1.5 Sensoria Inc.

- 7.1.6 AIQ Smart Clothing Inc.

- 7.1.7 Axon Enterprise Inc.

- 7.1.8 Withings

- 7.1.9 Huami Corporation

- 7.1.10 Omron Healthcare Inc.

- 7.1.11 Nuheara Limited

- 7.1.12 Polar Electro Oy

- 7.1.13 Microsoft Corporation

- 7.1.14 Sony Corporation

- 7.1.15 Huawei Technologies Co. Ltd

- 7.1.16 Fitbit LLC

- 7.1.17 Fossil Group Inc.

- 7.1.18 Garmin Ltd

- 7.1.19 Samsung Electronics Co. Ltd

- 7.1.20 Apple Inc.