|

市场调查报告书

商品编码

1692490

智慧货架-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Smart Shelf - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

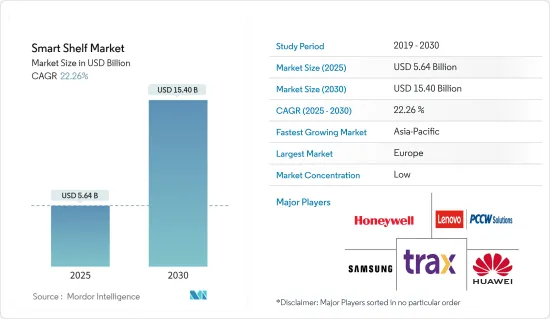

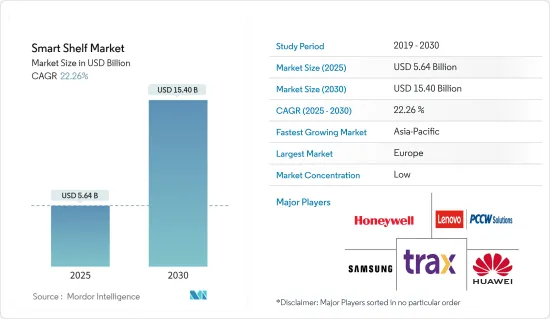

智慧货架市场规模预计在 2025 年为 56.4 亿美元,预计到 2030 年将达到 154 亿美元,预测期内(2025-2030 年)的复合年增长率为 22.26%。

智慧货架是用于追踪零售店库存的电子连接货架。智慧货架结合使用数位显示器、RFID 标籤和感测器来提供详细的产品资讯、交叉销售建议和行销。它还为零售商提供了有关顾客购物模式和偏好的宝贵见解。

主要亮点

- 推动智慧货架市场发展的关键因素是零售商改善库存管理,提供智慧补货选项和即时参与,以及零售商利用智慧和自动化技术为客户提供更好的购物体验。

- 都市化和消费者购买力不断增强推动了对天然材料和优质产品的需求不断增长,推动市场的发展。零售自动化越来越普遍,零售商透过优化定价和即时产品展示来提高销售效率。这些只是推动全球市场崛起的一些主要因素。

- 电子商务平台的销售额正在快速成长。这项发展为电子商务仓库提供了另一种有效的库存管理方式,为研究产业带来了蓬勃发展的机会。根据美国人口普查局的数据,2022年7月至9月美国商业电子商务规模约为2,660亿美元,较上一季成长3%。此外,零售额的成长也推动了该产业的发展。

- 当顾客离开商店时,RFID 追踪不会停止。当顾客使用信用卡或签帐金融卡付款或在结帐时扫描会员折扣卡时,零售商可以将该购买历史记录与 RFID 资料关联起来,并使用该资讯来绘製单一顾客在商店甚至整个购物中心的旅程。这表明RFID正在侵犯用户的隐私,这对市场成长构成了障碍。

- 后疫情时代,随着零售商寻求利用先进技术的优势来改善库存管理并优化供应链,预计超市货架市场将加速成长。随着电子商务的兴起和消费行为的改变,零售商正在寻找创新方法来改善店内体验并提高客户忠诚度。

智慧货架市场趋势

预计采用增强库存管理将推动市场

- 随着网路销售的兴起,企业必须投资强大的管道,以合理的价格提供一致、高品质的商品。在这种新情况下,管理安全库存和优化业务效率比以往任何时候都更加重要。因此,近年来电子商务企业增加了对库存管理软体的使用。世界各地的零售企业都需要库存管理系统来追踪现有库存并满足突然增加的需求。

- 零售商正在寻找更好、更省时、更经济的方式来管理库存。传统的库存管理系统非常耗时,而且容易出现人为错误,为企业带来时间和金钱的浪费。透过利用智慧货架、自主库存机器人和 RFID 等智慧库存管理技术,零售商可以最大限度地减少损耗并提高整个企业的效率。

- 自主库存机器人、智慧货架和RFID等智慧库存管理技术正在帮助零售商提高业务效率并减少损失。

- 此外,智慧库存管理 (SIM) 的广泛采用有助于透过利用数据和软体以最少的库存满足不断增长的消费者需求,从而最大限度地降低开支并推动成长。数据提供了预测需求和提高效率的洞察力,而自动化技术可以跨多个销售管道同步库存,以实现收益最大化。

欧洲占有较大的市场占有率

- 英国是全球智慧货架市场最重要的地区之一。该地区的主要需求来源包括零售、物流和医疗保健行业。该地区的智慧货架市场已经见证了各主要领先企业的几次重大合併、收购和投资,这是他们改善业务、接触客户和扩大影响力以满足各种应用需求的策略的一部分。

- 欧洲零售商,尤其是德国的零售商,是世界上最早采用电子货架标籤(ESL)的零售商之一,以降低营运成本,为零售数位化奠定基础。在2022年5月同周举办的EuroCIS 2022展览会上,德国数位解决方案供应商汉寿宣布推出其全新的物联网平台“Allstar”,预计将引领欧洲实体零售业进入高效盈利的新时代。

- 同样在 2022 年 5 月,快速发展的德国电子货架标籤公司 Digety 与能源采集专家 Nowi 合作开髮用于零售店的太阳能电子货架标籤。此次合作主要是为了满足不断增长的市场需求,提供创新解决方案,帮助零售商最大限度地提高产量比率,并更有效地管理整个供应链流程。

- 在全球智慧货架市场中,义大利在欧洲国家中呈现出令人瞩目的成长率。这主要是由于主要企业的存在以及全部区域电子货架标籤的高普及率。

- 随着零售商越来越多地采用智慧货架技术来改善业务并提升客户体验,法国的智慧货架市场正在快速成长。在法国,家乐福、欧尚和卡西诺等大型零售商已在部分门市推出智慧货架,其他零售商也可能会跟进。法国智慧货架市场受到多种因素的推动,包括对即时库存管理日益增长的需求以及零售商优化业务和减少浪费的需求。

- 由于零售量不断增加以及各连锁超级市场越来越多地采用智慧货架,预计欧洲对智慧货架的需求将会增加。

智慧货架产业概况

智慧货架市场竞争激烈,全球多家公司都在积极布局。主要企业包括艾利丹尼森公司、AWM Smart Shelf、华为技术有限公司、Dreamztech Solutions Inc.、E Ink Holdings Inc.、Focal Systems Inc. 和 Happiest Minds Technologies Limited。该市场的主要企业正在推出创新的新产品并建立伙伴关係关係以获得竞争优势。

- 2023 年 6 月 - Bibliotheca 宣布推出 smartShelf 借阅服务,这是一种适用于各种规模图书馆的智慧、整合的归还和借阅解决方案。 SmartShelf Rowing 将智慧退货架与自我检测功能结合,可立即重新循环最近退回的物品。图书馆顾客只需将归还的图书放在书架上,技术就会识别它,将其从顾客的帐户中删除,启用安全保护,并透过整合的自助结帐解决方案 selfCheck即时结帐。

- 2024 年 4 月——三星在「欢迎来到 BESPOKE AI」全球发表会上推出了具有增强连接性和 AI 功能的最新家用电器系列。此外,全新 AI Home 是一款联网的 7 吋 LCD 显示屏,可添加到多种产品中,为您的整个联网生态系统提供直觉、轻鬆的存取和控制。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 采用增强库存管理

- 零售业对即时库存资讯和管理的需求日益增加

- 市场挑战

- 关于内建资料标籤的隐私问题

第六章市场区隔

- 按组件

- 硬体

- 物联网感测器

- RFID标籤和阅读器

- 电子货架标籤(ESL)

- 相机

- 软体

- 服务

- 硬体

- 按应用

- 库存管理

- 价格管理

- 内容管理

- 规划图管理

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 义大利

- 法国

- 亚洲

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 北美洲

第七章竞争格局

- 公司简介

- Honeywell International Inc.

- Huawei Technologies Co. Ltd

- Trax Technology Solutions

- Lenovo PCCW Solutions Limited

- Samsung Electronics Co. Ltd

- AWM Smart Shelf

- Happiest Minds Technologies Limited

- E Ink Holdings Inc.

- Avery Dennison Corporation

- Intel Corporation

- NXP Semiconductors NV

第八章投资分析

第九章:市场的未来

The Smart Shelf Market size is estimated at USD 5.64 billion in 2025, and is expected to reach USD 15.40 billion by 2030, at a CAGR of 22.26% during the forecast period (2025-2030).

Smart shelves are electronically connected shelves used in retail outlets to track inventory. Smart shelves use a combination of digital displays, RFID tags, and sensors to provide detailed product information, cross-selling recommendations, and marketing. They also provide retailers with valuable insights into customer shopping patterns and preferences.

Key Highlights

- The primary reasons driving the Smart Shelf Market are the commission of improved inventory management by retail to make smarter restocking options and real-time involvement, as well as the use of intelligence and automation technologies by retail to provide a better shopping experience for customers.

- Rising demand for natural and premium products promotes market development due to increased urbanization and consumer buying power. Retail automation is growing more popular, and there is a strong demand among retailers for pricing optimization and enhanced operating effectiveness with real-time product placement. These are only a few of the major factors fueling the market's global rise.

- E-commerce platform sales are rapidly increasing; this development provides a chance for the researched industry to flourish by giving new items to e-commerce warehouses to manage effective inventory management. According to the US Census Bureau, commercial e-commerce in the United States was about USD 266 billion from July to September 2022, a 3% increase over the past quarter. Furthermore, rising retail sales is also propelling the industry.

- RFID tracking does not stop when a customer leaves the store. If customers pay with a credit or debit card or scan a loyalty discount card at checkout, retailers may link the purchases to the RFID data and use the information to map out individual customers' travels around the store, or even an entire shopping complex. This indicates it is harming the user's privacy, which acts as an obstacle to the growth of the market.

- Post-COVID-19, the mart shelves market is expected to grow faster as retailers seek to leverage advanced technologies' benefits to improve inventory management and optimize their supply chain. With the rise of e-commerce and changing consumer behavior, retailers are looking for innovative ways to enhance the in-store experience and increase customer loyalty.

Smart Shelf Market Trends

Adoption of Enhanced Inventory Management is Expected to Drive the Market

- With increasing online sales, it is important for businesses to invest in a robust pipeline of fairly priced, consistent, and high-quality goods. In this new context, managing safety inventories and optimizing operational efficiency is more important than ever. As a result, e-commerce businesses have increased their usage of inventory management software in recent years. Inventory management systems are required by retail companies all around the globe to assist them in keeping track of their existing inventory and meet escalating demand.

- Retailers are seeking better, more time-efficient, and cost-effective inventory management methods. Traditional inventory management systems are time-consuming and prone to human mistakes, both of which cost firms time and money. Retailers can minimize shrinkage and enhance overall company efficiency by using smart inventory management technologies, such as smart shelves, autonomous inventory robots, RFID, and so on.

- Smart inventory management methods, such as autonomous inventory robots, smart shelves, and RFID, are assisting retailers in becoming more operationally effective and reducing loss.

- Additionally, this increased adoption of Smart Inventory Management (SIM) helps to minimize expenses and drive growth by utilizing data and software to assist in meeting rising consumer demand with the least amount of inventory. Data provides greater insight, allowing to estimate demand and enhance efficiency, while automated technology synchronizes the inventory across numerous sales channels, maximizing revenues.

Europe Holds Significant Market Share

- The United Kingdom is one of the most significant regions in the global smart shelf market. The major sources of demand in the region include the retail, logistics, and healthcare sectors. The smart shelf market within the region is witnessing various several significant mergers, acquisitions, and investments by the key major players as part of its strategy to improve business and their presence to reach customers and meet their requirements for various applications.

- European retailers, especially Germany, are some of the world's earliest adopters of electronic shelf labels (ESLs) to reduce operations costs as a foundation for retail digitalization. In May 2022, at the week's EuroCIS 2022 trade show, the new IoT platform All-Star was released and introduced by the digital solutions provider Hanshow, with operations in Germany, which is expected to drive Europe's brickandmortar retail into a new era of efficiency and profitability.

- Also, in May 2022, Digety, a fast-growing electronic shelf label company from Germany, partnered with Nowi, which specializes in energy harvesting, to develop solar-powered electronic shelf labels used in retail stores. This collaboration primarily aims to meet the surging market demand to offer retail stores an innovative solution that would further enable them to maximize their yield and manage their overall supply chain processes more effectively.

- Italy has a significant growth rate in the global smart shelf market among the various European countries. It is mainly due to the presence of key major players as well as a higher penetration rate of electronic shelf labels within the entire region.

- The smart shelves market in France is growing rapidly as retailers increasingly adopt smart shelf technology to improve their operations and enhance the customer experience. In France, major retailers such as Carrefour, Auchan, and Casino have already implemented smart shelves in some of their stores, with others likely to follow suit. The market for smart shelves in France is being driven by several factors, including the increasing demand for real-time inventory management and the need for retailers to optimize their operations and reduce waste.

- The growing retail sales volume, along with the rising adoption of smart shelves in various chains of supermarkets, is expected to increase the demand for smart shelves in Europe.

Smart Shelf Industry Overview

The Smart Shelf Market is competitive in nature because of the presence of several global companies. Some of the key players are Avery Dennison Corporation, AWM Smart Shelf, Huawei Technologies Co. Ltd, Dreamztech Solutions Inc., E Ink Holdings Inc., Focal Systems Inc., Happiest Minds Technologies Limited, and many others. Key players in this market are introducing new innovative products and forming partnerships and collaborations to gain competitive advantages.

- June 2023 - Bibliotheca has announced the global availability of smartShelf borrowing, an integrated intelligent return and lending solution for libraries across all sizes. SmartShelf borrow is a combination of intelligent return shelves and the power of self check to allow an instant recirculation of recently returned goods. Library users simply place returns on the shelf and technology does the rest - identifying the items, removing them from the user's account, enabling security, and making them immediately available for borrowing through the integrated selfCheck self-service checkout solution.

- April 2024 - Samsung Introduces Latest Home Appliance Lineup featuring Enhanced Connectivity and AI Capabilities at the 'Welcome to BESPOKE AI' Global Launch Event, where Samsung's latest Bespoke AI appliances come with enhanced features and connectivity to lay the foundation for a truly smart home. Also, the new AI Home, a connected 7-inch LCD display that has been added to multiple products, provides intuitive, easy access and control over the whole connected ecosystem.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Enhanced Inventory Management

- 5.1.2 Growing Demand for Real-Time Stock Information and Inventory Management in the Retail Sector

- 5.2 Market Challenges

- 5.2.1 Privacy Concerns Regarding Inbuilt Data Tags

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.1.1 IoT Sensors

- 6.1.1.2 RFID Tags and Readers

- 6.1.1.3 Electronic Shelf Lables (ESL)

- 6.1.1.4 Cameras

- 6.1.2 Software

- 6.1.3 Service

- 6.1.1 Hardware

- 6.2 By Application

- 6.2.1 Inventory Management

- 6.2.2 Pricing Management

- 6.2.3 Content Management

- 6.2.4 Planogram Management

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Mexico

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Huawei Technologies Co. Ltd

- 7.1.3 Trax Technology Solutions

- 7.1.4 Lenovo PCCW Solutions Limited

- 7.1.5 Samsung Electronics Co. Ltd

- 7.1.6 AWM Smart Shelf

- 7.1.7 Happiest Minds Technologies Limited

- 7.1.8 E Ink Holdings Inc.

- 7.1.9 Avery Dennison Corporation

- 7.1.10 Intel Corporation

- 7.1.11 NXP Semiconductors NV