|

市场调查报告书

商品编码

1692510

北美空调:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Air Conditioning Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

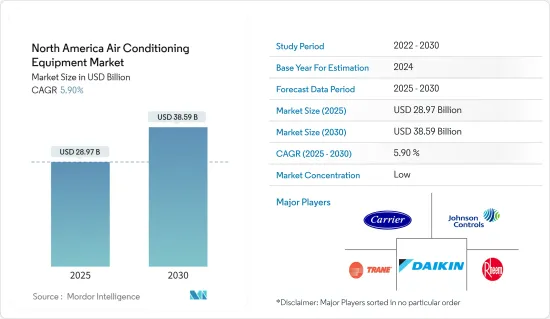

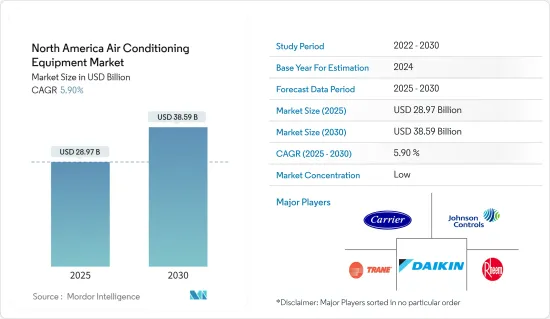

北美空调设备市场规模预计在 2025 年为 289.7 亿美元,预计到 2030 年将达到 385.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.9%。

空调是一种透过提取热量并将其转移到室外来冷却空间的系统。然后,冷却的空气透过通风分布到整栋建筑物。作为暖通空调系统的重要组成部分,空调可以调节家中的温度,使家中更加舒适宜居住。

主要亮点

- 由于住宅、商业和工业领域的建筑支出增加以及建筑许可激增,美国房地产市场正在强劲增长。值得注意的是,在联邦政府大量基础设施投资的推动下,美国建筑业预计将进一步扩张。这种势头不仅限于公共倡议,私人商业建设项目也正在获得关注。

- 这些互联的智慧空调设备提供了许多好处。智慧空调系统透过了解您的偏好并相应地调整冷冻时间表来帮助优化能源使用。这不仅提供了舒适感,而且还降低了能源消耗和成本。透过智慧型手机应用程式或语音命令远端控制空调系统的能力正迅速成为消费者的标准期望。先进的智慧空调系统可以监控自身的性能,并在问题变得更严重之前提醒用户潜在问题。这将有助于延长设备的使用寿命并使其保持高效运作。

- 自 1970 年代石油危机以来,家庭能源效率努力经历了显着上升,减少能源消耗的经济奖励不断增加。能源效率目前是住宅维修的主要驱动力,并受到北美各种政策的支持。这些政策包括能源审核、能源性能证书以及财政奖励,如补助金、津贴、税额扣抵、低利率贷款和第三方融资。

- 北美暖通空调产业必须遵守严格的安全法规和标准。使用气体检测和监测系统证明符合并遵守安全准则。透过采用这些系统,HVAC 公司可以满足监管标准,创造更安全的职场,并减少面临处罚或法律后果的机会。

- 支援物联网的智慧空调设备已经受到消费者的欢迎,因为它们允许消费者透过智慧型手机或桌上型电脑控制和管理空调。 2024年4月,全球知名物联网连接供应商Soracom Inc.宣布与三菱电机欧洲有限公司合作。此次合作旨在将 Soracom 的蜂窝连接整合到三菱电机云端基础的远端系统管理系统 MELCloud 中。 MELCloud 专门支援三菱电机的空调、暖气和热回收/通风产品,开创了远端控制和管理功能的新时代。

北美空调设备市场趋势

住宅领域占据市场主导地位

- 该地区对住宅空调设备的需求正在增加,因为它对于在夏季减少炎热并提供舒适感至关重要。住宅环境中常用的空调系统类型取决于气候、建筑设计、能源可用性和文化偏好等因素。

- 根据美国能源资讯署 (EIA) 的数据,中央空调被北美人广泛采用作为家庭降温的主要方式。 EIA 报告称,该地区越来越多的家庭选择中央空调系统。另一个流行的选择是无管道迷你分离式系统。无管道迷你分离系统可实现区域冷却,使住宅可以分别控制房屋不同区域的温度。

- 由于气候变迁导致当地气温上升,许多州对空调系统的需求已从奢侈品变为必需品。因此,该地区越来越多的人选择在家中安装空调。随着全球气温持续上升,这种采用趋势可能会升级。考虑到气候动态,住宅空调市场预计在预测期内将大幅增长。

- 此外,根据美国人口普查局的数据,2024 年 4 月住宅建筑和住宅建设与 2023 年 4 月相比增加了 8%。 2024 年 4 月,住宅建筑支出预计达到年度 9,022.9 亿美元。预计这些因素将推动市场成长。此外,预计未来几年全部区域住宅的增加将创造新的市场机会。

加拿大正在经历快速成长

- 由于豪华住宅基础设施计划的增加,该国对空调的需求激增。市场相关人员预计,都市化加快和人均收入上升等因素将在预测期内提供大量商机。中央空调系统在加拿大很受欢迎,是中型到大型家庭住宅和多层住宅的理想选择。

- 根据加拿大房地产协会 (CREA) 预测,2023 年住宅销售量将达到 443,511 套,2025 年将达到近 525,500 套。多变的天气和严酷的冬季使得空调成为大多数加拿大家庭的必需品。加拿大许多地区正经历极端高温和热浪,其特征是气温升高、湿度升高。根据不列颠哥伦比亚省验尸官服务处发布的初步数据,今年夏天,不列颠哥伦比亚省持续遭受热浪侵袭,总合619 人因热浪丧生。

- 为了避免这种情况,政府正在努力免费提供空调。例如,2024年5月,不列颠哥伦比亚省政府宣布额外拨款2,000万加元(1,453万美元),为需要经济援助或怕热的人们免费提供数千台空调。

- 该计划由 BC Hydro 管理,迄今已免费分发了 6,000 台空调,加上额外资金,预计总合将分发约 28,000空调。

北美空调设备产业概况

北美空调设备市场比较分散,阀门市场公司较多。由于空调行业是最大的市场之一,如此多的领先供应商的存在是永续的,而不会侵蚀市场占有率。公司包括大金工业有限公司、开利公司、Rheem製造公司、Tran公司(特灵科技公司)、江森自控国际公司等。

- 2024 年 3 月,开利公司推出适用于资料中心的先进、创新的高效能冷却器系列。这些冷却器旨在减少能源消耗和碳排放,并降低资料中心营运商的营运成本。这些装置的功率范围从 486.4 kW 到 1,464 kW,采用可靠的 Carrier 螺桿压缩机,确保效率和长寿命。

- 2024 年 2 月:DAIKIN INDUSTRIES透过专注于关键要素来增强空调。我们使用具有较低全球暖化潜势的 R32 冷媒 HFC-32,并专注于环保和节能。此外,空调的基本性能也得到了提升。作为一项重要倡议,大金将于 2024 年 11 月推出大楼用多功能空调。该系列拥有业界领先的能源效率,这对于减少您的环境足迹和营运负担至关重要。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 新冠疫情和其他宏观经济因素的后续影响将影响市场

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 提高现有设备性能,恢復空调设备减税

- 家庭和大楼自动化系统的采用日益增多

- 市场限制

- 严格的法规遵循和安全标准

第六章市场区隔

- 按类型

- 单元空调

- 管道式分体

- 无管迷你分离式

- 室内包装和屋顶

- 室内空调

- 包终端机空调

- 冷却器

- 可变冷媒流量 (VRF)

- 单元空调

- 按最终用户

- 住宅

- 商业和工业

- 按国家

- 美国

- 加拿大

- 按效率

- 效率低(13 SEER)

- 高效率(>13 SEER)

第七章竞争格局

- 公司简介

- Daikin Industries Ltd

- Carrier Corporation

- Rheem Manufacturing Company

- Trane Inc.(Trane Technologies PLC)

- Johnson Controls International PLC

- Mitsubishi Electric Corporation

- Lennox International Inc.

- Systemair AB

- Robert Bosch GmbH

- Electrolux AB

- LG Electronics Inc.

- Midea Group

- Schneider Electric SE

- GE Appliances

- Whirlpool Corporation

第八章冷冻设备分销管道分析:中央空调、房间空调

- 直销

- 零售商

- 批发商/经销商/承包商

第九章投资分析

第十章:市场的未来

The North America Air Conditioning Equipment Market size is estimated at USD 28.97 billion in 2025, and is expected to reach USD 38.59 billion by 2030, at a CAGR of 5.9% during the forecast period (2025-2030).

An air conditioner is a system that cools a space by extracting heat and transferring it outside. This cooled air is then distributed throughout a building via ventilation. As an essential part of the HVAC system, air conditioners regulate home temperatures to enhance comfort and livability.

Key Highlights

- The US real estate market is witnessing a robust upswing, buoyed by escalating construction outlays and a surge in building permits across residential, commercial, and industrial segments. Notably, the US construction sector is poised for further expansion, fueled by substantial federal investments in infrastructure. This momentum extends beyond public initiatives, with private commercial construction endeavors also gaining traction.

- These interconnected and smart AC equipment offer numerous benefits. Smart AC systems help optimize energy usage by learning user preferences and adjusting cooling schedules accordingly. This not only provides comfort but also reduces energy consumption and costs. The ability to control AC systems remotely via smartphone apps or voice commands is becoming a standard consumer expectation. Advanced smart AC systems can monitor their own performance and alert users to potential issues before they become major problems. This can extend the life of the unit and ensure it operates efficiently.

- Efforts to promote energy efficiency in homes have experienced significant fluctuations since the oil shocks of the 1970s, which increased the financial incentives for reducing energy consumption. Currently, energy efficiency is a primary driver for home renovations, supported by various policies across North America. These policies include energy audits, energy performance certificates, and financial incentives like grants, subsidies, tax credits, low-interest loans, and third-party financing.

- The North American HVAC industry is required to follow strict safety regulations and standards. Utilizing gas detection and monitoring systems shows dedication to compliance and following safety guidelines. By incorporating these systems, HVAC companies can meet regulatory standards, create a safe workplace, and reduce the likelihood of facing penalties or legal consequences.

- IoT-enabled smart air conditioning equipment gained traction among consumers as these systems enable users to operate and manage ACs using smartphones and desktops. In April 2024, Soracom Inc., a prominent global IoT connectivity provider, announced its collaboration with Mitsubishi Electric Europe BV. The partnership aims to integrate Soracom's cellular connectivity into MELCloud, Mitsubishi Electric's cloud-based remote management system. MELCloud specifically caters to Mitsubishi Electric's air conditioning, heating, and heat recovery/ventilation products, ushering in a new era of remote control and management capabilities.

North America Air Conditioning Equipment Market Trends

Residential Sector to Dominate the Market

- The demand for residential air conditioning units in the region is increasing as they are crucial for providing comfort and relief from hot temperatures during the summer months. The types of air conditioning systems commonly used in residential settings vary depending on factors such as climate, building design, energy availability, and cultural preferences.

- According to the Energy Information Administration (EIA), central air conditioning is widely adopted by North Americans as the primary method of cooling their homes. The EIA reports a growing trend of households in the region opting for central air conditioning systems, which are significantly more favored than window or wall units. Another popular option is ductless mini-split systems. They provide zoned cooling, allowing homeowners to control the temperatures of different areas of the house independently.

- The rising temperatures in the region, attributed to climate change, have elevated the need for air conditioning systems from a luxury to a necessity in many states. Consequently, a growing number of individuals in the region are choosing to equip their homes with air conditioning. This adoption trend is poised to escalate further as the planet's temperature continues its upward trajectory. Given the shifting climate dynamics, the residential air conditioning market is set for significant growth over the forecast period.

- In addition, according to the US Census Bureau, construction of residential buildings and homes increased by 8% in April 2024 compared to April 2023. In April 2024, construction spending in residential reached an estimated annual rate of USD 902.29 billion. Such factors are anticipated to drive the market's growth. Furthermore, the growing residential construction across the region is expected to create new market opportunities in the coming years.

Canada to Witness Significant Growth

- The country is experiencing a surge in air conditioning demand due to the rise in luxury residential infrastructure projects. Market players can expect numerous opportunities over the forecast period, thanks to factors such as increased urbanization and higher per capita income. Central air conditioning systems are highly favored in Canada and are ideal for mid-to-large family homes, as well as for homes with multiple stories.

- According to CREA, the number of home sales in 2023 was recorded at 443,511, and it is expected to reach almost 525,500 by 2025. Due to the variable climate and severe winters, air conditioner equipment has become essential in the majority of Canadian households. Numerous regions in Canada experience extreme heat events or heat waves characterized by soaring temperatures and high levels of humidity. According to the initial data disclosed by the BC Coroners Service, a total of 619 individuals lost their lives due to the intense heat during the prolonged summer heat wave in British Columbia.

- To avoid such circumstances, the government is focusing on providing free air conditioning equipment. For instance, in May 2024, the BC government announced an additional CAD 20 million (USD 14.53 million) to provide thousands of free air conditioning units to those who need financial assistance and people vulnerable to heat.

- The program managed by BC Hydro has distributed 6,000 complimentary AC units up to this point, with additional funding anticipated to result in a total of approximately 28,000 AC units being distributed.

North America Air Conditioning Equipment Industry Overview

The North American air conditioning equipment market is fragmented due to many valve market players. Since the AC equipment industry is one of the largest markets, the existence of such a sheer number of major vendors without compromising their market shares is sustainable, and some of the players include Daikin Industries Ltd, Carrier Corporation, Rheem Manufacturing Company, Trane Inc. (Trane Technologies PLC), and Johnson Controls International PLC.

- March 2024: Carrier Corporation introduced an advanced, innovative line of high-performance chillers for data centers. These chillers are engineered to slash energy consumption and carbon footprints and lower operational expenses for data center operators. Ranging from 486.4 kW to 1,464 kW, these units leverage Carrier's trusted screw compressors, guaranteeing efficiency and longevity in operation.

- February 2024: Daikin Industries Ltd enhanced its air conditioners by focusing on critical elements. This includes shifting to HFC-32, an R32 refrigerant with low global warming potential, emphasizing its eco-friendliness and energy efficiency. Additionally, Daikin has bolstered the fundamental performance of its air conditioning units. In a significant move, Daikin is set to launch the VRV 7 multi-air conditioner series for buildings in November 2024. This series boasts the industry's top energy efficiency and is pivotal in lessening environmental footprints and operational burdens.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Replace Existing Equipment With Better Performance Equipment and Reinstate Tax Credits for Air Conditioning Equipment

- 5.1.2 Growing Adoption of Home and Building Automation Systems

- 5.2 Market Restraint

- 5.2.1 Stringent Regulatory Compliance and Safety Standards

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Unitary Air Conditioners

- 6.1.1.1 Ducted Splits

- 6.1.1.2 Ductless Mini-splits

- 6.1.1.3 Indoor Packaged and Roof Tops

- 6.1.2 Room Air Conditioners

- 6.1.3 Packaged Terminal Air Conditioners

- 6.1.4 Chillers

- 6.1.5 Variable Refrigerant Flow (VRF)

- 6.1.1 Unitary Air Conditioners

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Commercial and Industrial

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

- 6.4 By Efficiency

- 6.4.1 Low Efficiency (13 SEER)

- 6.4.2 High Efficiency (>13 SEER)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries Ltd

- 7.1.2 Carrier Corporation

- 7.1.3 Rheem Manufacturing Company

- 7.1.4 Trane Inc. (Trane Technologies PLC)

- 7.1.5 Johnson Controls International PLC

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Lennox International Inc.

- 7.1.8 Systemair AB

- 7.1.9 Robert Bosch GmbH

- 7.1.10 Electrolux AB

- 7.1.11 LG Electronics Inc.

- 7.1.12 Midea Group

- 7.1.13 Schneider Electric SE

- 7.1.14 GE Appliances

- 7.1.15 Whirlpool Corporation

8 ANALYSIS OF COOLING EQUIPMENT DISTRIBUTION CHANNEL CENTRAL AIR CONDITIONING, ROOM AIR CONDITIONING

- 8.1 Direct

- 8.2 Retailers

- 8.3 Wholesalers/Dealers/Contractors