|

市场调查报告书

商品编码

1692565

印度整车运输(FTL) -市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)India Full-Truck-Load (FTL) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

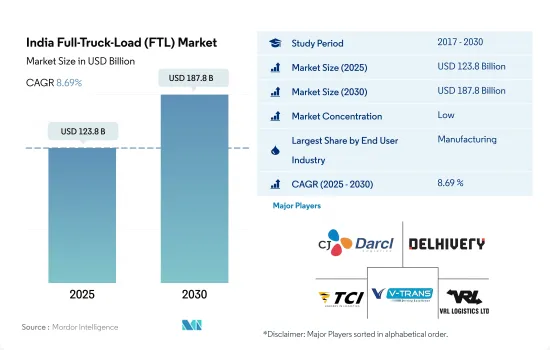

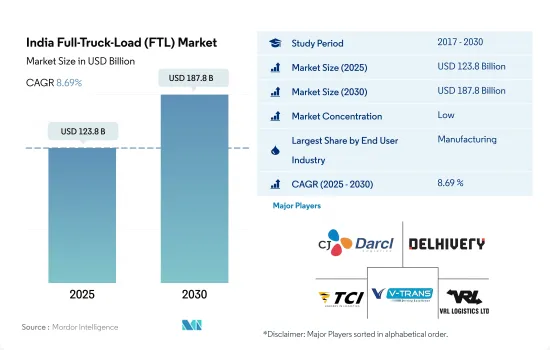

印度 FTL 市场规模预计在 2025 年达到 1,238 亿美元,预计到 2030 年将达到 1,878 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.69%。

在政府不断增加的投资和倡议的推动下,印度製造业正在成为一个快速成长的行业

- 由于印度人口的快速成长,製造业正在成为一个快速成长的行业。该产业的投资正在增加,「印度製造」等倡议旨在将印度打造为全球製造业中心。大多数製造业使用卡车和拖车在国内和跨境运输原料和成品。预计到 2025 年,印度製造业规模将达到 1 兆美元,将增加原材料和成品的运输需求。由于多家汽车製造商已开始大力投资各行业领域以满足日益增长的需求,因此汽车製造业预计将会成长。

- 印度农业也是印度经济的最大贡献者之一,预计由于对农业基础设施的投资增加,未来几年将产生更好的发展势头。未来五年,中央政府计画向渔业投资 90 亿美元,政府的目标是到 2024-2025 年将鱼产量提高到 2,200 万吨。为了维持供应链并帮助农民销售生鲜食品,政府还制定了在主要城市建立水果和蔬菜综合供应链的计画。

印度整车运输(FTL)市场的趋势

政府和私人投资、出口成长以及州际货运量的增加是运输业的主要驱动力。

- 政府已设定目标,2024年将物流成本降低5-6%。印度铁路公司正在努力提高货运能力、加快货运列车速度、降低货运票价、建立专用货运走廊并改善火车站、公路和港口之间最后一英里的连接性。我们正在与首席部长加蒂·沙克蒂合作,赋予物流行业地位,推广数位解决方案并发展物流基础设施。这些努力旨在降低成本并刺激物流领域的GDP成长。

- 预计到 2027 年,这一领域将继续成长,到 2027 年将增加 1,000 万个就业机会。印度渴望成为全球製造和物流中心,最近的倡议吸引了约 100 亿美元的仓储物流领域投资。印度 2024 年的基础设施计划,如孟买跨港口连接线 (MTHL)、新孟买国际机场、诺伊达国际机场和西部专用货运走廊,也有望加速印度成为全球物流领域重要参与企业的进程。

由于多个邦政府削减增值税,柴油价格的涨幅没有汽油价格的涨幅那么大。

- 9 月份,在沙乌地阿拉伯和俄罗斯将自愿减产和出口协议延长至 2023 年后,原油价格触及每桶 90 美元的 10 个月高点。由于印度 85% 的石油依赖进口,燃料价格受到了影响。代表 1,400 万名卡车驾驶人和车辆驾驶人的全印度汽车运输大会表示,不断上涨的燃油价格正在影响印度卡车司机,因为他们转嫁价格上涨的能力有限,而价格上涨占卡车运营成本的 70%。

- 印度政府正考虑在 2024 年将汽油和柴油价格每公升降低 4-6 印度卢比(0.04-0.07 美元),以赶上定于 2024 年上半年举行的人民院选举。目前,政府正在与石油行销公司进行讨论,以平等分担减价负担,这可能会导致每公升汽油和柴油价格大幅下降,最高可达 10 卢比(0.12 美元)。此举旨在减轻人们的经济负担,也可能导致零售通膨率下降,零售通膨率在2023年11月达到5.55%的高峰。

印度整车运输 (FTL) 产业概况

印度整车运输 (FTL) 市场分为五大市场,前五大参与者分别是 CJ Darcl Logistics Limited、Delhivery Ltd.、印度运输公司 (TCI) 和 V-TRA.Ltd。 (TCI)、V-TRANS 和 VRL Logistics Ltd. 是。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 按经济活动分類的GDP分布

- 经济活动GDP成长

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业GDP

- 物流绩效

- 道路长度

- 出口趋势

- 进口趋势

- 燃油价格趋势

- 卡车运输成本

- 卡车持有量(按类型)

- 主要卡车供应商

- 公路货运吨位趋势

- 公路货运价格趋势

- 模态共享

- 通货膨胀率

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 农业、渔业和林业

- 建设业

- 製造业

- 石油和天然气、采矿和采石

- 批发和零售

- 其他的

- 汇出目的地

- 国内的

- 国外

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Allcargo Logistics Ltd.(含Gati Express)

- BLR Logistiks

- CJ Darcl Logistics Limited

- Delhivery Ltd.

- DHL Group

- Relay Express Pvt. Ltd.

- Transport Corporation of India Ltd.(TCI)

- V-TRANS

- VRL Logistics Ltd.

第七章 CEO 的关键策略问题

第 8 章 附录

- 全球物流市场概览

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(市场驱动因素、限制因素、机会)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

- 外汇

简介目录

Product Code: 92382

The India Full-Truck-Load (FTL) Market size is estimated at 123.8 billion USD in 2025, and is expected to reach 187.8 billion USD by 2030, growing at a CAGR of 8.69% during the forecast period (2025-2030).

Manufacturing in India is emerging as a fast-growing sector due to the increasing investments and initiatives taken by the government

- Manufacturing in India has emerged as a fast-growing industry due to the rapidly increasing population in the country. Investments in the industry have increased, and initiatives like 'Make in India' aim to turn the country into a global manufacturing hub. For domestic and cross-border transportation of raw materials or finished goods, the majority of the manufacturing industries use trucks and trailers. The manufacturing industry in India is estimated to reach USD 1 trillion by 2025, and the need for transporting raw materials and finished goods increases. Automobile manufacturing is estimated to grow as several automakers have started investing heavily in various industry segments to keep up with the growing demand.

- The agricultural industry in India is also one of the largest contributors to the Indian economy, and it is expected to generate better momentum in the next few years due to increased investment in agricultural infrastructure. In the next five years, the central government plans to aim for USD 9 billion in investments in the fisheries as the government is targeting raising fish production to 220 lakh tons by 2024-2025. To maintain the supply chain and support the farmers in selling their perishable produce, the government has also rolled out a scheme for the creation of an integrated supply chain for fruits and vegetables in major cities.

India Full-Truck-Load (FTL) Market Trends

Government and private investments, rising exports, and the increasing interstate movement of goods are the major drivers of the transportation industry

- In 2024, the government is dedicated to reducing logistics costs to 5-6%. Indian Railways is taking steps to boost freight capacity, increase the speed of freight trains, lower freight expenses, establish dedicated freight corridors, improve last-mile connectivity between railheads, roads, and ports. They're aligning with PM Gati Shakti, granting industry status to logistics, promoting digital solutions, and developing logistics infrastructure. These efforts aim to cut costs and spur GDP growth in logistics.

- The sector is expected to grow till 2027 and is expected to add 10 million jobs by 2027. India is aiming to become a global hub for manufacturing and logistics, with recent policies attracting around USD 10 billion USD in investments for the warehousing and logistics sector. Also India's infrastructure plans for 2024, such as the Mumbai Trans Harbour Link (MTHL), Navi Mumbai International Airport, Noida International Airport and Western Dedicated Freight Corridor etc, are expected to accelerate India's journey towards becoming a prominent player in the global logistics landscape.

The diesel price increase was less sharp than the increase in petrol prices due to VAT cuts offered by several state governments

- In September 2023, oil prices hit a 10-month high of USD 90 per barrel as Saudi Arabia and Russia extended their voluntary production and export cuts till 2023. As India imports 85% of its oil, the fuel prices were impacted. According to the All-India Motor Transport Congress, which represents 14 million truckers and vehicle operators, the soaring fuel prices are impacting India's truckers as they have limited ability to pass on the rising prices, which account for 70% of the cost of operating a truck.

- The Indian government is contemplating reducing petrol and diesel prices by INR 4 - INR 6 (USD 0.04 - USD 0.07) per litre in 2024, timed with the upcoming Lok Sabha elections in H1 2024. Discussion in ongoing with Oil Marketing Companies to share the burden of this reduction equally, and there's a possibility of a more substantial cut of up to Rs 10 (USD 0.12) per litre. This move aims to alleviate the financial strain on the public and could also help lower retail inflation, which peaked at 5.55% in November 2023.

India Full-Truck-Load (FTL) Industry Overview

The India Full-Truck-Load (FTL) Market is fragmented, with the major five players in this market being CJ Darcl Logistics Limited, Delhivery Ltd., Transport Corporation of India Ltd. (TCI), V-TRANS and VRL Logistics Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Allcargo Logistics Ltd. (including Gati Express)

- 6.4.2 BLR Logistiks

- 6.4.3 CJ Darcl Logistics Limited

- 6.4.4 Delhivery Ltd.

- 6.4.5 DHL Group

- 6.4.6 Relay Express Pvt. Ltd.

- 6.4.7 Transport Corporation of India Ltd. (TCI)

- 6.4.8 V-TRANS

- 6.4.9 VRL Logistics Ltd.

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219