|

市场调查报告书

商品编码

1693371

印度黏合剂:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)India Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

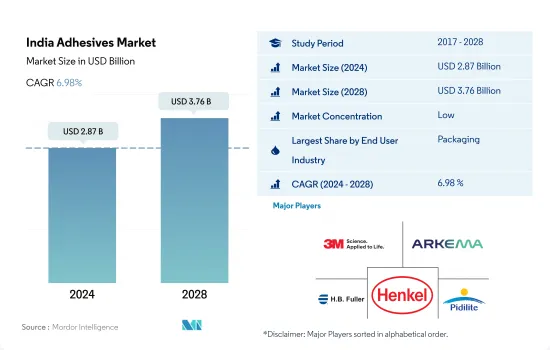

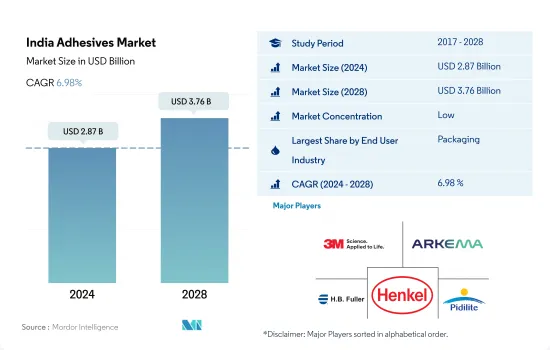

印度黏合剂市场规模预计在 2024 年为 28.7 亿美元,预计到 2028 年将达到 37.6 亿美元,预测期内(2024-2028 年)的复合年增长率为 6.98%。

汽车市场的崛起和不断发展的技术主导包装趋势预计将推动印度黏合剂的消费

- 受新冠疫情影响,2020年印度胶合剂消费量呈下降趋势。与2019年相比,当年的产量以金额为准下降了9.94%。生产设施关闭近三个月以及原材料短缺是印度黏合剂消费量下降的主要因素。

- 包装是印度经济第五大产业,也是该国成长最快的产业之一。根据印度包装产业协会(PIAI)的数据,该产业的复合年增长率为 22% 至 25%。过去几年,包装产业在推动国家技术和创新发展以及为农业和快速消费品等其他製造业增值方面发挥了关键作用。根据印度包装协会(IIP)的数据,印度的包装消费量在过去十年中飙升了200%,从2010年的人均每年4.3公斤增加到2020年的8.6公斤。

- 印度也是一个重要的汽车出口国,预计在不久的将来出口将实现快速成长。此外,随着印度政府和各大汽车公司在印度市场采取各种倡议,预计未来几年印度将成为两轮车和四轮车市场的领导者。 2021 年印度乘用车市场价值为 327 亿美元,预计到 2027 年将达到 548.4 亿美元,2022 年至 2027 年的复合年增长率将超过 9%。预计到 2025 年印度电动车 (EV) 产业价值将达到 70.9 亿美元。这往往会增加对黏合剂的需求。

印度黏合剂市场趋势

更便宜、更轻的包装趋势日益增长,推动了对软质和硬质塑胶包装的需求

- 包装是设计和工程方面成长最快的行业之一,旨在保护和提高产品的安全性和寿命。人们对清洁水、干净的新鲜食品和药品的需求日益增加,先进技术的快速采用也推动了包装产业的发展。包装业已连续多年成为日本经济第五大产业。过去十年,包装产品的使用量增加了200%以上,预计到2020年底,人均年消费量将从4.3公斤增加到8.6公斤。由于农业生产和快速消费品领域的应用不断增加,印度很可能在不久的将来见证显着的成长。

- 新冠疫情导致全国停工和部分製造工厂关闭,扰乱了供应链管道和进出口贸易。因此,该国的包装产量在 2020 年下降了 5%,但由于公共卫生问题导致需求增加,2021 年产量轻鬆回升。该国的包装生产主要由塑胶包装驱动,约占 2021 年包装产量的 82%。由于对廉价、轻质柔性和刚性包装的需求不断增加,塑胶生产部门预计在预测期内将以约 6.88% 的复合年增长率快速增长。

- 印度包装产业的成长主要得益于近年来中阶人口的增加、供应链系统的改善以及电子商务活动的兴起。此外,全国对食品安全和品质的关注度日益提高,推动了食品加工行业的发展并刺激了包装需求。

政府推出的 e-AMRIT 等措施以及汽车贷款利率降低 2-3% 将推动汽车製造业

- 预计到2020年,印度汽车产业将成为亚太地区第四大汽车生产国。政府在2021年拨款4.32兆印度卢比扩建道路等措施也导致道路上车辆数量的增加。预计这一成长趋势将持续到2028年。

- 由于全国范围内的封锁、供应链中断和整体经济放缓,新冠疫情导致乘用车销售量从 2019 年的 338 万辆下降到 2021 年的 239 万辆。然而,由于政府为支持汽车製造业所做的努力,例如将汽车贷款利率降低 2-3%,这一数字在 2022 年 3 月上升至 272 万辆。在乘用车领域,玛鲁蒂铃木是最大的品牌,2021 年的市场占有率为 52%。预计这一成长趋势将在预测期内(2022-2028 年)持续下去。

- 商用车方面,塔塔汽车销售量最大,2022年3月市场占有率接近43%。商用车销量从2021年的568,560辆增加至2022年3月的716,570辆,这得益于2020年新冠疫情引发的亏损经济復苏。商用车销量从2021年的568,560辆增加至2022年3月的716,570辆,这得益于2020年新冠疫情引发的亏损经济復苏。

- 印度政府透过 e-AMRIT 等倡议推动电动车製造业的发展,这将推动 2028 年前电动车产量的增加。与 2020 年相比,2021 年印度的电动车销量将成长 108%。

印度胶黏剂产业概况

印度黏合剂市场较为分散,前五大公司占27.19%的市场。市场的主要企业有:3M、阿科玛集团、HB Fuller Company、汉高股份公司和 Pidilite Industries Ltd.。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 鞋类皮革

- 包装

- 木製品和配件

- 法律规范

- 印度

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 医疗保健

- 包装

- 木製品和配件

- 其他的

- 科技

- 热熔胶

- 反应性

- 溶剂型

- 紫外线固化胶合剂

- 水性

- 树脂

- 丙烯酸纤维

- 氰基丙烯酸酯

- 环氧树脂

- 聚氨酯

- 硅胶

- VAE・EVA

- 其他的

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Arkema Group

- ASTRAL ADHESIVES

- AVERY DENNISON CORPORATION

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Jubilant Industries Ltd.

- Pidilite Industries Ltd.

- Sika AG

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、限制因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 92426

The India Adhesives Market size is estimated at 2.87 billion USD in 2024, and is expected to reach 3.76 billion USD by 2028, growing at a CAGR of 6.98% during the forecast period (2024-2028).

Emerging automotive market and evolving trend of technology driven packaging expected to boost the consumption of adhesives in India

- The consumption of adhesives in India has shown a downward trend in 2020 due to the impact of COVID-19. The production was reduced by 9.94% in terms of value in the same year compared to 2019. The lockdown in the country for nearly three months, due to which production facilities were shut down, and raw material shortages are some of the major reasons for the decline in adhesives consumption in India.

- Packaging is the fifth-largest industry in India's economy and one of the fastest-growing sectors in the country. The sector is developing at a CAGR of 22% to 25%, according to the Packaging Industry Association of India (PIAI). Over the last several years, the packaging industry has played a vital role in driving technology and innovation growth in the country and delivering value to other manufacturing sectors like agriculture and FMCG. According to the Indian Institute of Packaging (IIP), packaging consumption in India has surged 200% over the last decade, reaching 8.6 kg per person per year in 2020 from 4.3 kilograms per person per year in 2010.

- India is also a significant vehicle exporter, with high export growth expected in the near future. Furthermore, various efforts by the Government of India and key automobile firms in the Indian market will likely propel India to the forefront of the two- and four-wheeler markets in the coming periods. The Indian passenger vehicle market was valued at USD 32.70 billion in 2021, and it is predicted to reach USD 54.84 billion by 2027, with a CAGR of more than 9% between 2022 and 2027. The electric vehicle (EV) industry in India is expected to reach USD 7.09 billion by 2025. This tends to increase the demand for adhesives.

India Adhesives Market Trends

Rising trend of cheap and lightweight packaging to drive the demand for flexible and rigid plastic packaging

- Packaging is one of the fast-growing industries in terms of design and technology for protecting and enhancing products' safety and longevity. The rising demand for clean water, clean and fresh food, and pharmaceuticals, along with the rapid adoption of advanced technologies driving the packaging industry. Packaging has registered as the fifth-largest sector in the country's economy over the past few years. The usage of packaging products has increased by over 200% in the past decade, which has registered consumption from 4.3 Kg per person per annum to 8.6 Kg per person per annum by the end of 2020. Owing to rising applications in agriculture production and the FMCG sector, India is likely to gain significant growth in the near future.

- Due to the COVID-19 pandemic, the country-wide lockdowns and partial suspension of manufacturing facilities caused disrupted supply-chain channels and imports and exports trade. As a result, the country's packaging production declined by 5% in 2020 but readily recovered in 2021, owing to rising demand for public health concerns. Packaging production is majorly driven by plastic packaging in the country, which nearly accounts for around 82% of the packaging produced in 2021. With the increasing demand for cheap and lightweight flexible and rigid packaging, the plastic production segment is likely to register the fastest growth of around 6.88% CAGR during the forecast period.

- The growth of the Indian packaging industry is mainly attributed to the rising middle-class population, improvement of the supply-chain system, and emerging e-commerce activities in recent years. Furthermore, the growing attention to food safety and quality across the nation is likely to drive the food processing industry, thus, propelling the packaging demand.

Rising government initiatives such as e-AMRIT and auto loan interest rates decrease by 2-3% to lead the automotive manufacturing

- The Indian automotive industry was the fourth largest in the Asia-Pacific by volume in 2020. With the government initiatives such as the expansion of roads in 2021 by allocation of funds of INR 4.32 trillion, the number of vehicles has also increased on roads. This trend of growth is expected to sustain in the coming years up to 2028.

- Due to the COVID-19 pandemic, there was a dip in sales of passenger vehicles from 3.38 million in 2019 to 2.39 million in 2021 because of nationwide lockdown, supply chain disruptions, and overall economic slowdown. But, with the government initiatives to support the automobile manufacturing sector, such as decreasing interest rates for auto loans by 2-3%, it moved up to 2.72 million vehicles by March 2022. Maruti Suzuki is the largest in the passenger vehicles segment, with a market share of 52% in 2021. This growth trend is expected to sustain in the forecast period, which is 2022-2028.

- In the case of commercial vehicles, Tata Motors is the largest vehicle producer by number, with a market share of nearly 43% in March 2022. The commercial vehicle sales increased from 568,560 in 2021 to 716570 by March 2022 because of recovering loss-ridden economy due to the impact of COVID-19 in 2020. With this growing post-pandemic economy, it is expected to increase in the mentioned period.

- The electric vehicle manufacturing push by the Indian government with initiatives such as e-AMRIT will lead increase in the production of electric vehicles in years up to 2028. The increase in the number of electric vehicles being sold in India increased by 108% in 2021 compared to 2020.

India Adhesives Industry Overview

The India Adhesives Market is fragmented, with the top five companies occupying 27.19%. The major players in this market are 3M, Arkema Group, H.B. Fuller Company, Henkel AG & Co. KGaA and Pidilite Industries Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 India

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured Adhesives

- 5.2.5 Water-borne

- 5.3 Resin

- 5.3.1 Acrylic

- 5.3.2 Cyanoacrylate

- 5.3.3 Epoxy

- 5.3.4 Polyurethane

- 5.3.5 Silicone

- 5.3.6 VAE/EVA

- 5.3.7 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 ASTRAL ADHESIVES

- 6.4.4 AVERY DENNISON CORPORATION

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Huntsman International LLC

- 6.4.8 Jubilant Industries Ltd.

- 6.4.9 Pidilite Industries Ltd.

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219