|

市场调查报告书

商品编码

1693386

新加坡黏合剂:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Singapore Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

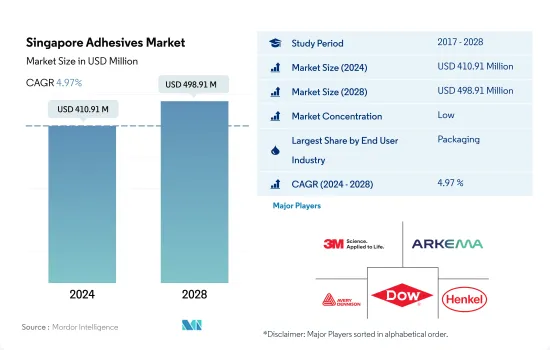

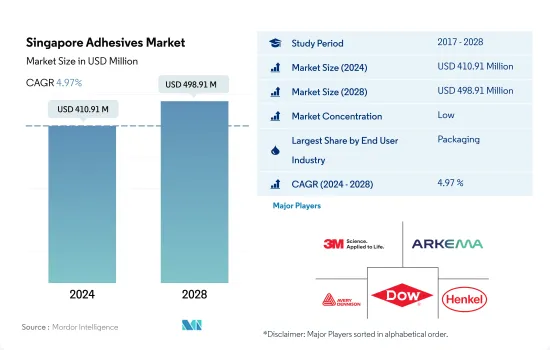

新加坡黏合剂市场规模预计在 2024 年达到 4.1091 亿美元,预计到 2028 年将达到 4.9891 亿美元,预测期内(2024-2028 年)的复合年增长率为 4.97%。

新加坡医疗保健产业的关键成长率将对整体黏合剂市场的成长产生重大影响

- 新加坡在医疗保健、包装和电子行业拥有强大的製造能力和黏合剂,这为其在黏合和组装应用领域带来了成长机会。 2020年,由于新冠疫情造成的贸易和供应链限制,黏合剂需求下降,与2019年相比下降了7.5%以上。

- 黏合剂主要用于国内包装产业,因为它们在黏合塑胶、金属、纸张和纸板包装应用中具有重要意义。由于成本低且这些应用所需的黏合强度高,水基黏合剂在工业中的消耗量很高。据估计,2021年国内包装产业消耗了约3.2万吨水性黏合剂。热熔胶是包装产业成长最快的技术,2022年至2028年的复合年增长率为5.58%。永续食品包装有助于确保食品安全,同时减少食品废弃物,从而增加产业对胶合剂的需求。这些因素极大地刺激了食品业对包装的需求。

- 新加坡的黏合剂也主要用于医疗保健产业。新加坡的医疗保健系统提供先进的治疗,被认为是世界上最优秀的医疗保健系统之一。这是由于强有力的法律规范、包括商业和公共部门的成本分摊结构以及健康储蓄帐户的支付。

新加坡黏合剂市场趋势

包装塑胶中使用可回收塑胶为产业成长带来新机会

- 包装主要用于保护、容纳、资讯、实用和促销。预计不断增长的新加坡包装市场在预测期内的复合年增长率将达到 3.77%。 2017年,包括纸、纸板和塑胶包装在内的包装用量为3,340万吨。 2020年,受新冠疫情影响,供应链中断、包装材料短缺、货物进出口受限、工厂产能低等因素影响,市场出现-5.54%的负成长。

- 2021年市场将达到4.40%的正成长,各类包装材料的使用量将达到3,560万吨。随着电子商务行业的兴起以及货物运输需要专门的包装,包装行业预计未来将继续增长,这将极大地促进包装行业的发展。 2021年,新加坡的电子商务市场价值为59亿美元,预计2026年将成长到100亿美元。在当今竞争激烈的快速消费品市场中,企业必须使用有吸引力的包装并在包装上进行创新,才能在竞争中脱颖而出并在市场上保持品牌地位。

- 新加坡政府正在实施法规,将可回收塑胶纳入产品中。在该国,包装生产主要由塑胶驱动,约占 2021 年包装产量的 64%。由于塑胶的可回收性不断提高,预计塑胶产业将保持成长,预测期内的复合年增长率约为 4.75%。

公共建筑建设的持续和未来投资将支持终端用户产业

- 预计 2022 年至 2028 年预测期内新加坡建设产业的复合年增长率约为 2.6%。 2019 年建筑需求达到五年来的最高水平,订单的计划价值估计为 334 亿新元,超过了上半年预测的 320 亿新元。与 2018 年相比,建筑需求增加了 9.5%。然而,2020 年,新冠疫情的影响扰乱了计划交付计划,导致快报估计建筑需求下降 36.5% 至 213 亿美元。预计在预测期内(2022-2028 年),新加坡建筑胶合剂和密封剂市场销量的复合年增长率约为 2.86%,价值的复合年增长率约为 5.31%。

- 由于政府需要时间考虑疫情对资源管理和计划进度的影响,某些大型基础设施计划被推迟,公共部门建设投资从 2019 年的 190 亿新加坡元下降到 2020 年的 132 亿新加坡元。此外,预计2022年新加坡的建筑需求将在270亿美元至320亿美元之间,其中公共部门约占总需求的60%。公共部门建设需求预计为160亿美元至190亿美元。

- 同时,由于未售出建筑库存不断增加,新加坡的住宅依然低迷,而新冠疫情引发的景气衰退进一步加剧了这一情况。但为了在疫情期间降低宿舍密度,政府计划在 2020 年底前为约 6 万名农民工建造更多住宅。预计这些因素将在预测期内抑制对黏合剂和密封剂的需求。

新加坡黏合剂产业概况。

新加坡黏合剂市场较为分散,前五大公司占19.36%的市占率。该市场的主要企业有:3M、阿科玛集团、艾利丹尼森公司、陶氏化学和汉高股份公司(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 包装

- 木製品和配件

- 法律规范

- 新加坡

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 卫生保健

- 包装

- 木製品和配件

- 其他最终用户产业

- 科技

- 热熔胶

- 反应性

- 溶剂型

- 紫外线固化胶合剂

- 水

- 树脂

- 丙烯酸纤维

- 氰基丙烯酸酯

- 环氧树脂

- 聚氨酯

- 硅胶

- VAE・EVA

- 其他树脂

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- ALTECO co., ltd.

- Arkema Group

- AVERY DENNISON CORPORATION

- Dow

- Dymax

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Sika AG

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、限制因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 92441

The Singapore Adhesives Market size is estimated at 410.91 million USD in 2024, and is expected to reach 498.91 million USD by 2028, growing at a CAGR of 4.97% during the forecast period (2024-2028).

The major growth rates poised for the Healthcare industry of Singapore to have a considerable influence on the overall growth of adhesives market

- Singapore's strong manufacturing capacities across healthcare, packaging, and electronic industries and adhesives have found a growth opportunity in terms of bonding and assembling applications. The demand for adhesives declined in 2020 due to trade and supply chain restrictions because of the COVID-19 pandemic, which resulted in a decline of above 7.5% in comparison to that of 2019.

- Adhesives are majorly consumed in the packaging industry in the country owing to their importance in bonding plastics, metals, and paper and cardboard packaging applications. Waterborne adhesives are highly consumed in the industry because of their cheaper cost and high bonding strength, which is required in these applications. It is seen that nearly 32 thousand tons of water-borne adhesives were consumed in the packaging industry of the country in 2021. Hot-melt adhesives are the fastest-growing technology in the packaging industry, with a CAGR of 5.58% during the period 2022-2028. Sustainable food packaging may assist ensure the safety of the food consumed while also reducing food waste and thus helping the adhesives demand to increase in the industry. These factors have highly motivated the demand for packaging in the food sector.

- Singapore's adhesives are also largely being consumed across the healthcare industry. Singapore's healthcare system is regarded as one of the greatest in the world, offering some of the most cutting-edge medical treatments. This is due to robust regulatory oversight, a cost-sharing structure that includes both the commercial and public sectors and payments from medical savings accounts.

Singapore Adhesives Market Trends

Usage of recyclable plastics for packaging production will open new opportunities to the industry growth

- Packaging is mainly used for protection, containment, information, utility, and promotion. The growing Singaporean packaging market segment is expected to register a CAGR of 3.77% during the forecast period. In 2017, packaging usage accounted for 33.4 million ton of packaging, including paper, paperboard, and plastic packaging. Due to the COVID-19 outbreak in 2020, the market registered a negative growth of -5.54% due to disruptions in the supply chain, shortage of packaging material, restrictions on the import and export of goods, and factories operating at low capacity.

- In 2021, the market registered a positive growth of 4.40%, with 35.6 million ton of packaging material used for various purposes. The packaging industry is expected to keep growing as there has been a rise in the e-commerce sector, which has significantly boosted the packaging industry as special packaging is required for shipping goods. In 2021, the Singaporean e-commerce market was valued at USD 5.9 billion, and it is expected to rise to USD 10 billion by 2026. In today's competitive FMCG market, it has become inevitable for companies to use attractive packaging and bring innovation to their packaging to stand out from their competitors and maintain their brand in the market.

- The Singaporean government has implemented regulations to include recyclable plastics in products. Packaging production is majorly driven by plastic in the country, which nearly accounts for around 64% of the packaging produced in 2021. With the advancement of plastic recyclability, the plastic segment is likely to maintain its growth and record a CAGR of around 4.75% during the forecast period.

Ongoing and upcoming investments in the construction of public buildings will support the end-user industry

- The Singaporean construction industry is projected to record a CAGR of about 2.6% during the forecast period from 2022 to 2028. The construction demand hit a five-year high in 2019, with an estimated SGD 33.4 billion worth of projects awarded, higher than its top-end projection of SGD 32 billion. This represented a 9.5% increase in construction demand compared to 2018. However, in 2020, due to the impact of the COVID-19 pandemic, which disrupted project implementation schedules, the preliminary figure for construction demand witnessed a decline of 36.5% to SGD 21.3 billion. The Singaporean construction adhesives and sealants market is projected to record a CAGR of about 2.86% in volume and 5.31% in value during the forecast period 2022-2028.

- Public sector construction declined from SGD 19 billion in 2019 to SGD 13.2 billion in 2020, as certain large infrastructure projects were postponed due to the need for more time to examine the pandemic's impact on resource management and project scheduling. Moreover, construction demand in Singapore is estimated to be between USD 27 billion and USD 32 billion in 2022, and the public sector is likely to provide roughly 60% of the overall demand. The public sector's construction demand is expected to range between USD 16 billion and USD 19 billion.

- On the other hand, residential construction in Singapore remains weak due to the growing stock of unsold buildings, further aggravated by the economic downturn due to the COVID-19 pandemic. However, to reduce the population density in dormitories amid the pandemic, the government had planned to construct additional housing for around 60,000 migrant workers by the end of 2020. These factors are expected to restrain the demand for adhesives and sealants over the forecast period.

Singapore Adhesives Industry Overview

The Singapore Adhesives Market is fragmented, with the top five companies occupying 19.36%. The major players in this market are 3M, Arkema Group, AVERY DENNISON CORPORATION, Dow and Henkel AG & Co. KGaA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Singapore

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured Adhesives

- 5.2.5 Water-borne

- 5.3 Resin

- 5.3.1 Acrylic

- 5.3.2 Cyanoacrylate

- 5.3.3 Epoxy

- 5.3.4 Polyurethane

- 5.3.5 Silicone

- 5.3.6 VAE/EVA

- 5.3.7 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 ALTECO co., ltd.

- 6.4.3 Arkema Group

- 6.4.4 AVERY DENNISON CORPORATION

- 6.4.5 Dow

- 6.4.6 Dymax

- 6.4.7 H.B. Fuller Company

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Huntsman International LLC

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219