|

市场调查报告书

商品编码

1693414

环氧树脂胶黏剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Epoxy Adhesive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

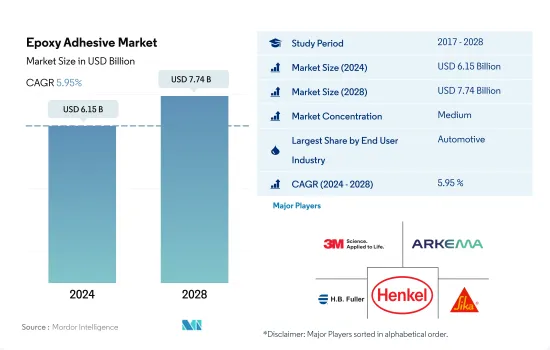

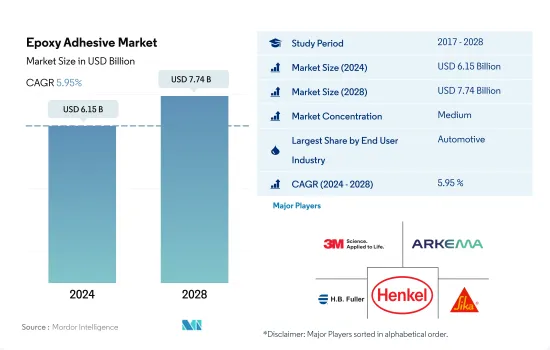

环氧胶黏剂市场规模预计在 2024 年为 61.5 亿美元,预计到 2028 年将达到 77.4 亿美元,预测期内(2024-2028 年)的复合年增长率为 5.95%。

医疗投资增加推动环氧树脂胶合剂需求

- 环氧树脂胶黏剂广泛应用于建筑业,例如地板材料、屋顶和黏合木质零件等。预计到 2030 年,全球建筑业将以每年 3.5% 的速度成长。中国、印度、美国和印尼预计将占全球整体建筑业成长的 58.3%。因此,以金额为准,建筑胶黏剂目前占全球市场占有率的近 18%。

- 环氧树脂胶黏剂广泛应用于汽车工业,因为其可应用于玻璃、金属、塑胶和油漆表面等表面,且其附着力强、耐用、寿命长等特点在汽车工业中很有用。这些产品用于引擎和汽车垫圈。由于发展中国家的需求不断增长,预测期内全球整体汽车产业的电动车领域预计将以 17.75% 的复合年增长率成长。预计这将在预测期内增加对汽车环氧胶黏剂的需求。

- 环氧树脂胶粘剂广泛应用于电子和电气设备製造,因为它们可以用来粘合感测器和电缆。预计全球电子和家用电子电器产业的复合年增长率将分别达到 2.51% 和 5.77%,从而导致 2022-2028 年预测期内对环氧胶合剂的需求增加。

- 环氧树脂基黏合剂用于医疗产业,用于组装和黏合医疗设备组件等应用。全球医疗保健投资的增加将导致预测期内需求的增加。

电动车需求推动环氧胶合剂需求

- 环氧胶黏剂主要由环氧树脂和硬化剂组成。双组分环氧胶黏剂由环氧树脂和硬化剂成分单独包装而成。两种成分混合后,它们会迅速变硬。几乎任何双组分室温固化环氧胶粘剂都可以使用。所有成分,包括环氧树脂和硬化剂,都经过预先混合,以形成单组分环氧黏合剂。环氧树脂黏合剂可与多种基材很好地黏合,可用于黏合金属、玻璃、混凝土、陶瓷、木材和许多聚合物。硬化收缩极小。固化环氧树脂的交联化学结构坚固而刚性,使其适用于结构性黏合应用。透过结合不同的环氧树脂和硬化剂,已经开发出适用于各种应用的各种环氧黏合剂。

- 亚太地区是全球环氧胶黏剂的最大消费地区,约占47%的市场份额,其次是北美(占25%)、欧洲(占23.5%)、中东和非洲(占3.3%)、南美(占3.1%)。预计全部区域建设活动的成长以及由于 COVID-19 疫情后销量增加而导致的汽车产量增加将成为推动环氧胶黏剂成长的关键因素。

- 在所有终端使用领域中,汽车是全球环氧树脂的最大消费者,约占 30.7% 的份额。其次是建筑施工、医疗、航太和木工,分别占约 19.2%、10.2%、7% 和 6.6% 的份额。其他终端用途工业部门约占28%。为了增强永续性,电动车的普及预计将推动全球对环氧胶的需求。

全球环氧胶黏剂市场趋势

政府推行的电动车优惠政策将推动汽车产业

- 预计 2021 年后全球汽车产业将稳定成长,但成长速度将放缓,因为消费者对拥有个人汽车的偏好降低,而对共用出行的偏好。预计预测期内全球汽车产业将以每年 2% 的速度成长,总收益增加价值将达到 1.5 兆美元。

- 2020年,受新冠疫情影响,汽车销量下滑,但2021年却迅速回升。汽车市场通常对GDP贡献巨大,因此世界各国政府纷纷推出措施支持经济。汽车销量从2019年的9000万辆下降到2020年的7800万辆。

- 由于电动车能源成本低廉、环保且移动性能高效,其在全球范围内的普及对全球汽车市场的总收益做出了重大贡献。各种政府政策和标准也在推动电动车产量的成长。例如,欧盟二氧化碳排放标准在2021年增加了对电动车的需求。根据国际能源总署的永续发展情景,到2030年将需要2.3亿辆电动车取代燃油汽车。 2021年,最大的电动车製造商特斯拉的电动车产量增加了157%。预计预测期内(2022-2028 年),消费者对电动车的偏好将进一步成长。

随着住宅基础建设的扩大,建筑业蓬勃发展

- 建筑业呈现稳定成长,2017 年至 2019 年的复合年增长率为 2.6%。这一成长受到全球经济活动好转和独栋住宅需求增加的推动。 2020年,新冠疫情对全球建筑业产生了重大影响。劳动力供应限制、建筑融资和供应链中断以及经济不确定性对全球 AEC 产业产生了负面影响。

- 虽然2021年呈现正成长,但疫情对供应链的衝击导致原物料价格上涨,仍在困扰产业。不过,由于建筑业对一个国家的经济影响重大,北美和亚太国家都透过提供支持计画来重新启动经济週期。支持计划包括澳大利亚的HomeBuilder计划和欧盟国家的经济復苏计划。

- 亚太地区的建设活动,预计到 2028 年仍将是最大的建筑市场,这得益于其庞大的人口、不断加快的都市化以及中国、印度、日本、印尼和韩国等国家对基础设施建设的投资不断增加。

- 预计在预测期内,对绿色建筑的日益重视和减少全球建设活动排放的努力将带来更永续的营运程序。例如,法国对其建筑业实施了75亿欧元的製裁,以努力转型为低碳能源经济。

环氧胶黏剂产业概况

环氧胶黏剂市场适度整合,前五大公司占40.37%的市占率。该市场的主要企业包括 3M、阿科玛集团、HB Fuller 公司、汉高股份公司、西卡股份公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 鞋类皮革

- 包装

- 木製品和配件

- 法律规范

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 中国

- EU

- 印度

- 印尼

- 日本

- 马来西亚

- 墨西哥

- 俄罗斯

- 沙乌地阿拉伯

- 新加坡

- 南非

- 韩国

- 泰国

- 美国

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 医疗保健

- 包装

- 木製品和配件

- 其他的

- 科技

- 反应性

- 溶剂型

- 紫外线固化胶合剂

- 水性

- 地区

- 亚太地区

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 新加坡

- 韩国

- 泰国

- 其他亚太地区

- 欧洲

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地区

- 亚太地区

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Arkema Group

- HB Fuller Company

- Henkel AG & Co. KGaA

- Hubei Huitian New Materials Co. Ltd

- Huntsman International LLC

- Illinois Tool Works Inc.

- Jowat SE

- Kangda New Materials(Group)Co., Ltd.

- KLEBCHEMIE MG Becker GmbH & Co. KG

- MAPEI SpA

- NANPAO RESINS CHEMICAL GROUP

- Pidilite Industries Ltd.

- Sika AG

- Soudal Holding NV

第七章 CEO 的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、限制因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 92473

The Epoxy Adhesive Market size is estimated at 6.15 billion USD in 2024, and is expected to reach 7.74 billion USD by 2028, growing at a CAGR of 5.95% during the forecast period (2024-2028).

Increasing healthcare investments to drive the demand for epoxy resin-based adhesives

- Epoxy resin-based adhesives are widely used in the construction industry because of their applications, such as for flooring, roofing, wooden components joinery, etc. The construction industry globally is expected to grow at 3.5% per annum up to 2030. China, India, the United States, and Indonesia are expected to account for 58.3% of the overall construction growth globally. As a result, construction adhesives account for a nearly 18% share of the global epoxy adhesive market share by value.

- Epoxy resin-based adhesives are widely used in the automotive industry because of their applicability to surfaces such as glass, metal, plastic, painted surfaces, etc., and their features are helpful in the automotive industry, such as for strong bonding, durability, and long-lasting. These products are used in engines and car gaskets. The electric vehicles segment of the automotive industry is expected to record a CAGR of 17.75% globally in the forecast period because of the increased demand for the same in growing economies. This is expected to increase the demand for automotive epoxy adhesives in the forecast period.

- Epoxy adhesives are widely used for electronics and electrical equipment manufacturing as they can be used for sticking sensors and cables. The global electronics and household appliances industries are expected to record CAGRs of 2.51% and 5.77%, respectively, which is expected to lead to an increase in demand for epoxy adhesives in the forecast period 2022-2028.

- Epoxy resin-based adhesives are used in the healthcare industry for applications such as assembling and bonding medical device parts. The increase in healthcare investments worldwide will lead to an increase in their demand in the forecast period.

Electric vehicles demand to drive the demand for epoxy adhesives

- Epoxy adhesives are made up largely of epoxy resin and a curing agent. Two-component epoxy adhesives are made by separately packaging the epoxy and curing agent components. They cure quickly after combining the two components. Almost all two-component room-temperature cure epoxy adhesives are available. All formulated components, including epoxy resin and curing agent, are mixed in advance to make one-component epoxy adhesives. Epoxy adhesives adhere well to various substrates and can be used to attach metals, glass, concrete, ceramics, wood, and many polymers. Curing shrinkage is extremely minimal. The cross-linked chemical structure of cured epoxy resin is strong and rigid, making it appropriate for structural bonding applications. Various epoxy adhesives for diverse uses have been developed by combining various epoxy resins and curing agents.

- Asia-Pacific is the top consumer of epoxy adhesives globally, holding a share of about 47%, followed by North America, Europe, Middle East and Africa, and South America, with shares of 25%, 23.5%, 3.3%, and 3.1%, respectively. Growing construction activities and the rising production of automotive vehicles due to an increase in sales after the COVID-19 pandemic across the region is expected to be the major factor driving the growth of epoxy adhesives.

- Across all the end-use sectors, automotive is the leading consumer of epoxy globally, holding a share of about 30.7%, followed by building and construction, healthcare, aerospace, and woodworking, with shares of about 19.2%, 10.2%, 7%, and 6.6%, respectively. The other end-use industries segment holds about 28%. The rising adoption of EVs to increase sustainability is expected to boost the demand for epoxy adhesives globally.

Global Epoxy Adhesive Market Trends

Favorable government policies to promote electric vehicles will propel automotive industry

- Since 2021, the global automotive industry has been expected to grow steadily but at a slower pace because of the decline in consumers' preferences for individual ownership of passenger vehicles and their increased preference for shared mobility in transportation. The global automotive industry is expected to experience a growth rate of 2% annually, with an expected value addition of USD 1.5 trillion in total revenue during the forecast period.

- In 2020, due to the impact of the COVID-19 pandemic, vehicle sales declined but recovered rapidly in 2021 because the governments of various countries took measures to support their economies, as automotive markets usually contribute majorly to their GDP. Vehicle sales declined from 90 million units of passenger vehicles in 2019 to 78 million units in 2020.

- The introduction of electric vehicles worldwide has contributed significantly to the overall revenue of the global automotive market because of their cheaper energy costs, environmentally benign nature, and efficient mobility features. Various government policies and standards also work as driving factors to increase EV production. For instance, the EU standards for CO2 emissions increased the demand for electric vehicles in 2021. As per the IEA's Sustainable Scenario, 230 million electric vehicles are required to replace combustion fuel-based vehicles by 2030. In 2021, Tesla, the largest EV manufacturer, recorded a rise of 157% in the number of electric vehicles manufactured. This growing trend of consumers preferring electric vehicles is expected to rise further during the forecast period (2022-2028).

Growing residential and infrastructural development to thrive the construction sector

- The building and construction industry witnessed steady growth, with a CAGR of 2.6% from 2017 to 2019. This growth was driven by the upswing in global economic activity and increasing demand for single-family homes. In 2020, the COVID-19 pandemic had a major impact on the global building and construction industry. Constraints in labor supply, disruptions in construction finances and the supply chain, and economic uncertainty negatively impacted the global building and construction industry.

- Though the industry showed positive growth in 2021, the pandemic's effect on supply chains, which resulted in a hike in raw material prices, is still plaguing the industry. However, as the construction industry heavily influences a nation's economy, countries in Europe, North America, and Asia-Pacific have used the construction industry to restart their economic cycles by offering support schemes. Some support schemes include the Homebuilder Programme in Australia and the economic recovery plan of EU countries.

- The Asia-Pacific region experiences the highest volume of construction activities, and it is expected to remain the largest construction market till 2028 due to its huge population, increasing urbanization, and increasing investments in infrastructural development in countries like China, India, Japan, Indonesia, and South Korea.

- Increasing emphasis on green buildings and efforts to reduce emissions from global construction activities are expected to result in more sustainable operational procedures during the forecast period. For example, France has sanctioned EUR 7.5 billion for the construction industry to transform itself into a low-carbon energy economy.

Epoxy Adhesive Industry Overview

The Epoxy Adhesive Market is moderately consolidated, with the top five companies occupying 40.37%. The major players in this market are 3M, Arkema Group, H.B. Fuller Company, Henkel AG & Co. KGaA and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Argentina

- 4.2.2 Australia

- 4.2.3 Brazil

- 4.2.4 Canada

- 4.2.5 China

- 4.2.6 EU

- 4.2.7 India

- 4.2.8 Indonesia

- 4.2.9 Japan

- 4.2.10 Malaysia

- 4.2.11 Mexico

- 4.2.12 Russia

- 4.2.13 Saudi Arabia

- 4.2.14 Singapore

- 4.2.15 South Africa

- 4.2.16 South Korea

- 4.2.17 Thailand

- 4.2.18 United States

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Reactive

- 5.2.2 Solvent-borne

- 5.2.3 UV Cured Adhesives

- 5.2.4 Water-borne

- 5.3 Region

- 5.3.1 Asia-Pacific

- 5.3.1.1 Australia

- 5.3.1.2 China

- 5.3.1.3 India

- 5.3.1.4 Indonesia

- 5.3.1.5 Japan

- 5.3.1.6 Malaysia

- 5.3.1.7 Singapore

- 5.3.1.8 South Korea

- 5.3.1.9 Thailand

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 Europe

- 5.3.2.1 France

- 5.3.2.2 Germany

- 5.3.2.3 Italy

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 United Kingdom

- 5.3.2.7 Rest of Europe

- 5.3.3 Middle East & Africa

- 5.3.3.1 Saudi Arabia

- 5.3.3.2 South Africa

- 5.3.3.3 Rest of Middle East & Africa

- 5.3.4 North America

- 5.3.4.1 Canada

- 5.3.4.2 Mexico

- 5.3.4.3 United States

- 5.3.4.4 Rest of North America

- 5.3.5 South America

- 5.3.5.1 Argentina

- 5.3.5.2 Brazil

- 5.3.5.3 Rest of South America

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 H.B. Fuller Company

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 Hubei Huitian New Materials Co. Ltd

- 6.4.6 Huntsman International LLC

- 6.4.7 Illinois Tool Works Inc.

- 6.4.8 Jowat SE

- 6.4.9 Kangda New Materials (Group) Co., Ltd.

- 6.4.10 KLEBCHEMIE M. G. Becker GmbH & Co. KG

- 6.4.11 MAPEI S.p.A.

- 6.4.12 NANPAO RESINS CHEMICAL GROUP

- 6.4.13 Pidilite Industries Ltd.

- 6.4.14 Sika AG

- 6.4.15 Soudal Holding N.V.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219