|

市场调查报告书

商品编码

1693415

亚太地区环氧胶黏剂:市场占有率分析、产业趋势和成长预测(2025-2030)Asia-Pacific Epoxy Adhesive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

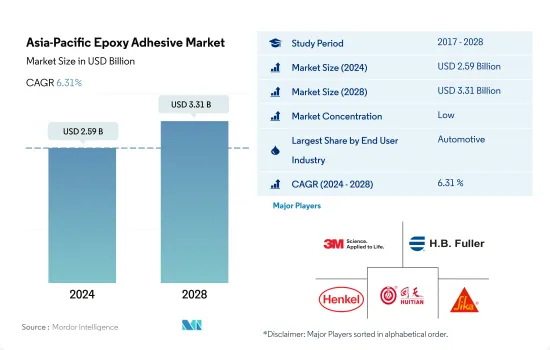

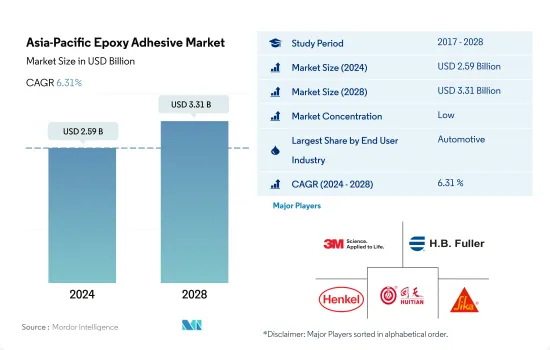

亚太地区环氧胶黏剂市场规模预计在 2024 年为 25.9 亿美元,预计到 2028 年将达到 33.1 亿美元,预测期内(2024-2028 年)的复合年增长率为 6.31%。

该地区汽车产量不断增长,预计到 2028 年将达到 6,600 万辆,这将推动对环氧胶黏剂的需求。

- 环氧树脂胶黏剂是热固性树脂,固化后具有高强度和低收缩性。这些黏合剂坚韧且耐化学性和环境损害。环氧树脂胶黏剂具有对多种基材优异的黏合性、优异的耐溶剂性和良好的电绝缘性能。此外,环氧胶黏剂的黏合硬度高达 80 肖氏硬度以上。

- 2020年环氧胶黏剂的消费量与2019年相比下降了9.66%,这主要是由于包括中国、印度、日本和韩国在内的许多国家受到新冠疫情的影响。全国范围的封锁、供应链中断和经济放缓导致大多数国家的生产陷入停滞,导致环氧胶的消费下降。 2021年受各国经济復苏影响,环氧胶合剂产量增加,新增3,680万单位。

- 中国是该地区环氧胶黏剂的主要市场,其次是日本和印度。 2021年中国对环氧胶黏剂的需求约为12亿美元。汽车和建筑是使用环氧胶黏剂进行各种应用的主要终端使用产业。

- 由于该国生产的汽车数量不断增加,汽车产业已成为该地区最大的环氧胶黏剂消费产业。环氧树脂胶黏剂主要用于结构应用,是用于黏合金属、玻璃和塑胶的所有树脂基胶黏剂中抗拉强度最高的,约为 35-41N/mm2。该地区的汽车产量预计将从 2021 年的 4,790 万辆增至 2028 年的 6,600 万辆。预计汽车产量的成长将在未来几年推动对环氧胶黏剂的需求。

汽车电子元件需求的不断增长可能会增加对环氧胶黏剂的需求

- 在评估环氧胶黏剂的效率时,查看其组成化学物质的整体成分很有用。两种初始成分(树脂和硬化剂)的混合物聚合产生环氧树脂。当树脂与特定催化剂结合时,固化就开始了。环氧树脂胶黏剂可黏合多种材料,其品质取决于系统的化学性质和可用的交联类型。出色的耐化学性和耐热性、良好的附着力和耐水性、令人满意的机械和电气绝缘性能是最重要的性能参数。

- 环氧树脂胶黏剂是最常用的结构型胶合剂,通常为单组分或双组分体系。单组分环氧胶黏剂通常在 250-300°F 的温度范围内固化,从而产生强度高、对金属黏合力强、耐环境和耐化学性优异的产品。

- 在所有终端使用领域中,汽车是全球环氧树脂的最大消费者,约占 35.7% 的份额,其次是建筑、医疗、木工和航太,分别约占 19.4%、6.3%、4.7% 和 2.1% 的份额。其他终端用途产业的份额约为31.1%。在整个汽车产业,人们越来越重视永续性,预计亚太地区的电动车产量将会增加。为此,新兴国家纷纷采取措施抑制汽车产业对传统能源的消耗。这项因素将会增加对汽车电子元件的需求,从而促进全部区域对环氧胶黏剂的消费。

亚太环氧胶黏剂市场趋势

电动车的普及正在推动该产业

- 由于汽车销售强劲成长,亚太汽车产业成为领先的市场领域之一。在所有国家中,中国是最大的汽车生产国,占该地区汽车产量的57%左右,其次是日本(17%)、印度(10%)和韩国(8%)。

- 该地区的汽车销售和产量均大幅下降,影响了黏合剂的使用。 2017- 与前一年同期比较变动为-1.8%,而2018-19年度则进一步下降-6.4%。 2019-20年度,受新冠疫情影响,该地区产量再次受到负面影响,较去年同期与前一年同期比较10.2%。由于製造工厂停工和供应链中断,汽车零件短缺,生产水准受到限制。然而,预计汽车需求将在 2021 年再次增加并持续增长,从而导致预测期内全部区域的黏合剂使用量增加。

- 亚太电动车市场为黏合剂市场带来了另一个成长机会。电动和混合动力汽车的产量和采用率的不断提高,推动了汽车电子组装中黏合剂的使用量。中国是世界上最大的电动车生产国,也是全部区域最大的电动车生产国。 2016年至2021年间,商用电动车数量从562,603辆增加到1,116,382辆,成长率约98%。预计这些因素将增加对黏合剂的需求,有助于预测期内的市场成长。

加大基础建设投资将扩大产业规模

- 亚太地区受中国、日本和印度等世界主要经济体推动。中国正处于持续都市化进程中,2030年都市化率目标达到70%。都市化加快将增加都市区生活空间需求,鼓励都市区中等收入者追求更好的居住条件,这将对住宅市场产生影响,从而增加全国的住宅建设。

- 非住宅基础设施可能会大幅扩张。 2019年,中国政府核准了26个基础建设计划,总价值约1420亿美元,预计2023年完工。中国拥有全球最大的建筑市场,占全球建筑投资的20%。到2030年,政府计划在建设方面投资超过13兆美元。因此,预计预测期内(2022-2028 年)建筑市场的复合年增长率为 4.48%。

- 建筑业是亚太地区最大的产业之一,2019 年取得了可喜的成长。由于该地区包括越南、马来西亚、印尼、泰国和其他南亚国家等许多新兴国家,该产业持续成长。然而,受新冠疫情影响,全部区域政府实施封锁,建筑业大幅下滑,严重影响了包括印度、中国、日本和东南亚国协在内的开发中国家。

- 亚太地区建筑领域也越来越受到国际投资者的兴趣。随着发展中国家为投资者提供更好的利益和机会,建筑开发领域的外国直接投资(FDI)正在增加。

亚太环氧胶黏剂产业概况

亚太地区环氧胶黏剂市场细分化,前五大公司占22.42%。该市场的主要企业包括 3M、HB Fuller Company、汉高股份公司、湖北迴天新材料、西卡股份公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 鞋类皮革

- 包装

- 木製品和配件

- 法律规范

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 新加坡

- 韩国

- 泰国

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 医疗保健

- 包装

- 木製品和配件

- 其他的

- 科技

- 反应性

- 溶剂型

- 紫外线固化胶合剂

- 水性

- 国家

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 新加坡

- 韩国

- 泰国

- 其他亚太地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Arkema Group

- HB Fuller Company

- Henkel AG & Co. KGaA

- Hubei Huitian New Materials Co. Ltd

- Huntsman International LLC

- Kangda New Materials(Group)Co., Ltd.

- NANPAO RESINS CHEMICAL GROUP

- Pidilite Industries Ltd.

- Sika AG

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、限制因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 92474

The Asia-Pacific Epoxy Adhesive Market size is estimated at 2.59 billion USD in 2024, and is expected to reach 3.31 billion USD by 2028, growing at a CAGR of 6.31% during the forecast period (2024-2028).

Increasing vehicle production which is expected to reach 66 million units by 2028 in the region is likely to drive the demand for epoxy adhesives

- Epoxy adhesives are thermosetting resins that demonstrate high strength and low shrinkage during curing. These adhesives are tough and resistant to chemicals and environmental damage. Epoxy adhesives offer excellent adhesion to various substrates, superior resistance solvents, and good electrical insulation. In addition, epoxy adhesives offer high hardness to the bond, which is more than 80 shore.

- The consumption of epoxy adhesives shrunk by 9.66% in 2020 compared to 2019, mainly due to the impact of the COVID-19 pandemic in many countries, including China, India, Japan, and South Korea. Production stopped in most countries due to nationwide lockdowns, supply chain disruptions, and economic slowdowns, which resulted in a decline in the consumption of epoxy adhesives. In 2021, the economic recovery in the countries caused a rise in the production of epoxy adhesives, which registered a growth of 36.8 million in volume.

- China is the major market for epoxy adhesives in the region, followed by Japan and India. China's demand for epoxy adhesives was nearly USD 1.2 billion in 2021. Automotive and construction are the major end-user industries that use epoxy adhesives for different applications.

- Automotive is the region's largest consumer industry for epoxy adhesives, owing to the rising vehicle production in the country. Epoxy adhesive is mainly used in structural applications and offers the highest tensile strength, around 35-41 N/mm2, among all other resin-based adhesives to bond metal, glass, and plastic. It is expected that vehicle production will reach 66 million units in the region in 2028 from 47.9 million units in 2021. Rising vehicle production is expected to drive the demand for epoxy adhesives over the coming years.

Increasing demand for electronic components for vehicles is likely to boost the demand for epoxy adhesives

- When evaluating the efficiency of an epoxy adhesive, it is beneficial to examine the general composition of the chemicals that comprise it. Polymerization of a mixture of two initial components, the resin and the hardener, produces epoxy. Curing begins when the resin is combined with a specific catalyst. Epoxy adhesives stick to a wide range of materials, and their qualities are determined by the system's chemistry and the type of cross-linking available. Exceptional chemical and heat resistance, great adhesion and water resistance, and satisfactory mechanical and electrical insulating qualities are among the most significant performance parameters.

- Epoxy adhesives, the most generally used structural type adhesive, are commonly available as one-component or two-component systems. One-component epoxy adhesives are typically cured at temperatures ranging from 250 to 300°F, resulting in a product with great strength, strong adherence to metals, and exceptional environmental and harsh chemical resistance.

- Across all the end-use sectors, automotive is the leading consumer of epoxy globally, holding a share of about 35.7%, followed by building and construction, healthcare, woodworking, and aerospace, with shares of approximately 19.4%, 6.3%, 4.7%, and 2.1%, respectively. The other end-use industries hold about 31.1%%. Across the automotive industry, the rising adoption of sustainability is expected to increase EV production across the Asia-Pacific region. Owing to this reason, emerging nations are moving toward limiting the consumption of conventional energy in the automotive industry. The factor tends to increase the demand for electronic components for vehicles and, thus, boost the consumption of epoxy adhesives across the region.

Asia-Pacific Epoxy Adhesive Market Trends

Increasing adoption of electric vehicles to drive the industry

- The Asia-Pacific automotive industry is one of the leading industries in the market, as the sales of automotive vehicles are largely increasing. Among all the countries, China is the largest automotive producer, accounting for about 57% of the regional production, followed by Japan with 17%, India with 10%, and South Korea with 8%.

- Vehicle sales in the region have majorly declined along with production, owing to which the utilization of adhesives has been impacted. While the Y-o-Y variation in 2017-18 was -1.8%, it fell further by -6.4% in 2018-19. In 2019-20, regional production was again impacted negatively and recorded a -10.2% decline from the previous year due to the COVID-19 pandemic. The shutdown of manufacturing facilities and the shortage of vehicle components due to disruptions in the supply chain constrained the production level. However, in 2021, the demand for automobiles rose again and is expected to continue, thereby increasing the utilization of adhesives across the region over the forecast period.

- The EV market in Asia-Pacific offers another opportunity for the adhesives market to grow. The rising production and adoption of EVs and hybrid vehicles are boosting the usage of adhesives for electronic component assembly in vehicles. China is the largest producer of EVs globally as well as across the region. From 2016 to 2021, the volume of commercial electric vehicles increased from 562,603 to 1,116,382 units, recording a growth rate of about 98%. These factors are expected to increase the demand for adhesives and result in the higher market growth over the forecast period.

Raising investment to expand infrastructural activities will augment the industry size

- Asia-Pacific is driven by the world's major economies, such as China, Japan, and India. China is promoting and undergoing a process of continuous urbanization, with a target rate of 70% for 2030. The increased living spaces required in the urban areas resulting from increasing urbanization and the desire of middle-income urban residents to improve their living conditions may impact the housing market and, thereby, increase the residential constructions in the country.

- Non-residential infrastructure is likely to expand significantly. The Chinese government approved 26 infrastructure projects worth approximately USD 142 billion in 2019, with completion due in 2023. The country has the largest construction market globally, accounting for 20% of all worldwide construction investments. By 2030, the government plans to spend over USD 13 trillion on construction. Thus, the construction market is expected to register a 4.48% CAGR during the forecast period (2022-2028).

- The construction industry is one of the largest industries in Asia-Pacific and recorded promising growth in 2019. The industry continues to grow as the region constitutes many developing countries such as Vietnam, Malaysia, Indonesia, Thailand, and other South Asian countries. However, due to the COVID-19 pandemic, the construction sector witnessed a significant decline owing to lockdowns by governments across the region, which severely affected developing countries, including India, China, Japan, and ASEAN countries.

- The Asia-Pacific region is also witnessing significant interest from international investors in the construction space. Foreign Direct Investment (FDI) in the construction development sector is increasing as developing countries provide better returns and opportunities for investors.

Asia-Pacific Epoxy Adhesive Industry Overview

The Asia-Pacific Epoxy Adhesive Market is fragmented, with the top five companies occupying 22.42%. The major players in this market are 3M, H.B. Fuller Company, Henkel AG & Co. KGaA, Hubei Huitian New Materials Co. Ltd and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Australia

- 4.2.2 China

- 4.2.3 India

- 4.2.4 Indonesia

- 4.2.5 Japan

- 4.2.6 Malaysia

- 4.2.7 Singapore

- 4.2.8 South Korea

- 4.2.9 Thailand

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Reactive

- 5.2.2 Solvent-borne

- 5.2.3 UV Cured Adhesives

- 5.2.4 Water-borne

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 Singapore

- 5.3.8 South Korea

- 5.3.9 Thailand

- 5.3.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 H.B. Fuller Company

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 Hubei Huitian New Materials Co. Ltd

- 6.4.6 Huntsman International LLC

- 6.4.7 Kangda New Materials (Group) Co., Ltd.

- 6.4.8 NANPAO RESINS CHEMICAL GROUP

- 6.4.9 Pidilite Industries Ltd.

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219