|

市场调查报告书

商品编码

1693420

欧洲氰基丙烯酸酯黏合剂:市场占有率分析、产业趋势和统计数据、成长预测(2025-2030 年)Europe Cyanoacrylate Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

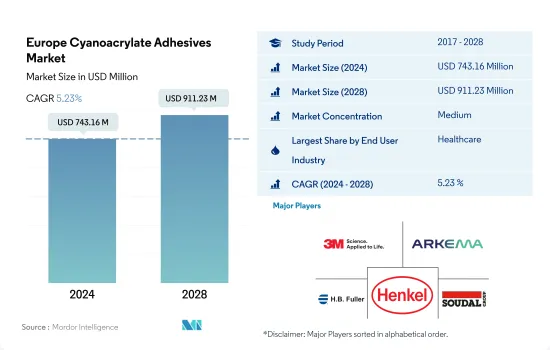

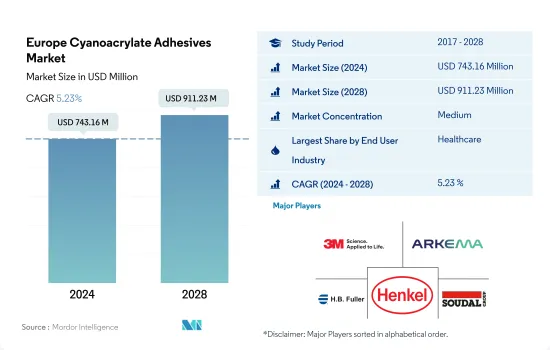

预计 2024 年欧洲氰基丙烯酸酯黏合剂市场规模为 7.4316 亿美元,到 2028 年将达到 9.1123 亿美元,预测期内(2024-2028 年)的复合年增长率为 5.23%。

航太对反应性氰基丙烯酸酯黏合剂的需求推动欧洲市场成长

- 欧洲拥有庞大的製造地和成熟的出口网络。医疗保健、航太、汽车、建筑和船舶是该地区少数几个在 2017 年至 2019 年期间对氰基丙烯酸酯黏合剂产生稳定需求的成熟行业。德国、法国和英国等国家占欧洲地区对氰基丙烯酸酯黏合剂需求的较大份额。

- 2020 年,由于新冠疫情的影响,氰基丙烯酸酯黏合剂的需求量与 2019 年相比下降了 11.24%。营运、贸易和供应链的限制迫使汽车和航太等产业减少产量。这对该地区在此期间对氰基丙烯酸酯黏合剂的需求产生了负面影响。

- 在所有地区中,欧洲的汽车、航太、木工和细木工等产业的研发最为活跃。该地区所有行业都致力于减少碳足迹,并在 2050 年实现净零排放。在预测期内,汽车和航太等行业对氰基丙烯酸酯黏合剂的需求可能会激增,因为燃油效率和轻量化在其中起着关键作用。在所有欧洲国家中,预计法国对氰基丙烯酸酯黏合剂的需求将成长最快,预测期内(2022-2028 年)的复合年增长率为 6.27%。

- 由于用途广泛,医疗保健在氰基丙烯酸酯黏合剂的需求中占据最大份额。然而,航太终端用户产业对采用反应技术的氰基丙烯酸酯黏合剂的需求成长预计在 2022-2028 年期间以 6.95% 的最高复合年增长率成长。

欧洲航太工业的发展将最大程度地推动市场成长

- 氰基丙烯酸酯黏合剂有助于缩短组装时间,主要用于医疗保健产业。欧洲医疗保健产业消耗了约 37,362 吨黏合剂,占 2021 年欧洲氰基丙烯酸酯黏合剂市场的 36.21%。这些黏合剂用于製造一次性医疗设备和其他医疗保健应用。

- 德国是欧洲最大的氰基丙烯酸酯黏合剂消费国。 2021年,约有40%的黏合剂用于德国医疗保健产业,该产业位居世界第三。 2021年,该国医疗保健支出约为7,920亿美元,占全国GDP的近12%。同年,该国医疗设备出口成长11.85%。预计未来几年中国医疗保健产业不断增长的需求将推动氰基丙烯酸酯黏合剂的需求。

- 航太工业是欧洲氰基丙烯酸酯黏合剂消费成长最快的终端用户产业,预计在 2022-2028 年预测期间内复合年增长率为 7.24%。德国航太业以创新为动力,2021年在研发上的投入约25亿欧元。在法国,空中巴士宣布计画将生产力和产能从2021年的每月40架飞机提高到2023年的每月64架飞机,到2024年初提高到每月70架飞机。受这些因素影响,预计未来几年欧洲对氰基丙烯酸酯黏合剂的需求将会增加。

- 反应性氰基丙烯酸酯胶黏剂主要在欧洲消费,占 2021 年氰基丙烯酸酯总需求的 75%。预计在预测期内,需求将进一步成长。

欧洲氰基丙烯酸酯胶黏剂市场趋势

政府大力推广电动车的倡议将推动电动车产业的发展

- 欧洲人均GDP为34,230美元,2022与前一年同期比较成长1.6%。汽车工业部门约占GDP总量的2%。 2021年,欧洲汽车产量将占乘用车81%,商用车17%,其他2%。

- 2020年,欧洲多个国家受到新冠疫情影响,包括德国、义大利、西班牙、俄罗斯、英国等。疫情扰乱了供应链,导致各国工厂关闭,并造成晶片短缺,影响了欧洲的汽车生产。汽车产量与2019年相比大幅下降22%。

- 美国25.3%的汽车进口来自欧洲,其中德国和英国是主要进口国,2021年分别占10.3%和4.7%。 2022年初,俄罗斯入侵乌克兰导致新车销售下降20.5%,也反映在汽车产量上。 2022年第一季欧洲汽车市场与去年同期相比下降了10.6%。

- 由于许多欧洲国家正在对电动车进行新的投资,因此在 2022-2027 年期间,汽车产量的复合年增长率可能达到 2.25%。例如,西班牙计划投资51亿美元用于电动车生产。

对美观和智慧家具的需求不断增长将推动产业成长

- 欧洲是世界主要家俱生产国之一。该地区占全球家具产量的近30%,仅次于亚太地区。德国、义大利、俄罗斯和西班牙是家具及其製品的最大生产国。然而,该地区在 2020 年受到了新冠疫情的影响,迫使多个国家的生产设施暂停营运。结果,家具产量与前一年同期比较下降了7.14%。

- 德国是欧洲最大的家俱生产国。 2021年,其家具产量将接近3.236亿件,占欧洲家具产量的23%。德国零售商已经开始提供 3D 产品视觉化和扩增实境应用程序,这透过该国的电子商务入口网站推动了对家具产品的需求。

- 义大利也是欧洲家具和家具产品的主要生产国,因此义大利家具成为热门的选择。该国占欧洲家具产量的15%。该国有出口维持稳定成长率,2018年约2.7%,2019年约3%。义大利木工和细木工行业的技术进步在全球范围内采用。

- 欧洲引领家具市场的高端领域。据称,全球销售的每三件豪华家具产品中,近两件都是在欧盟生产的。欧洲家具製造商在生产中使用松木、橡木和山毛榉等环保材料,这增加了该地区的需求。这些因素可能会导致未来几年欧洲家具产量增加。

欧洲氰基丙烯酸酯胶黏剂产业概况

欧洲氰基丙烯酸酯胶黏剂市场适度整合,前五大公司占63.01%的市占率。该市场的主要企业有:3M、阿科玛集团、HB Fuller Company、汉高股份公司和Soudal Holding NV(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 木製品和配件

- 法律规范

- EU

- 俄罗斯

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 卫生保健

- 木製品和配件

- 其他最终用户产业

- 科技

- 反应性

- 紫外线固化胶合剂

- 国家

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲国家

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Arkema Group

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- HB Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- Jowat SE

- Permabond LLC.

- Soudal Holding NV

- ThreeBond Holdings Co., Ltd.

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、限制因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 92479

The Europe Cyanoacrylate Adhesives Market size is estimated at 743.16 million USD in 2024, and is expected to reach 911.23 million USD by 2028, growing at a CAGR of 5.23% during the forecast period (2024-2028).

Demand for cyanoacrylate adhesives based on reactive technology in aerospace to lead in growth rate in Europe

- Europe has a large manufacturing base and well-established export networks. Healthcare, aerospace, automotive, building and construction, and marine are among the few well-established industries in the region which have collectively generated steady demand for cyanoacrylate adhesives from 2017 to 2019. Countries like Germany, France, and The United Kingdom have occupied a larger share of the demand generated for cyanoacrylate adhesives from the Europe region.

- In 2020, the demand for cyanoacrylate adhesives declined by 11.24% compared to the 2019 levels because of the covid-19 pandemic. Operational, trade and supply chain restrictions have forced industries like automotive, aerospace, and others to have production cuts. This has negatively affected the demand for cyanoacrylate adhesives from the region during this period.

- Among all regions, European automotive, aerospace and woodworking and joinery, and other industries are heavily engaged in R&D activities. All Industries in the region are focusing on reducing their carbon footprint to achieve a net zero emissions goal by 2050. Industries like automotive and aerospace, where fuel efficiency and weight reduction play an important role, might witness a surge in demand for cyanoacrylate adhesives during the forecast period. Among all countries in Europe, France is expected to witness the highest growth in the demand for cyanoacrylate adhesives, with a CAGR of 6.27% during the forecast period (2022-2028).

- Healthcare occupies the largest share of the demand for cyanoacrylate adhesives because of the large number of applications. However, the growth in demand for cyanoacrylate adhesives with reactive technology from the aerospace end-user industry is expected to be with the highest CAGR of 6.95% in 2022-2028.

Developments in the aerospace industry across the European countries to have boost the market's growth the most

- Cyanoacrylate adhesives help in the reduction of assembly times and are consumed mainly in the healthcare industry. The healthcare industry consumes around 37,362 tons of adhesives in Europe, which accounted for 36.21% of the European cyanoacrylate adhesives market in 2021. These adhesives are used to manufacture disposable medical devices and other healthcare applications.

- Germany is the largest consumer of cyanoacrylate adhesives in Europe. In 2021, around 40% of these adhesives were used in the healthcare industry of Germany, which is the third largest healthcare industry globally. In 2021, the healthcare expenditure in the country was around USD 792 billion and contributed nearly 12% of the country's GDP. In the same year, the exports of medical devices by the country increased by 11.85%. Such rising demand from the healthcare industry in the country is expected to drive the demand for cyanoacrylate adhesives over the coming years.

- Aerospace is the fastest-growing end-user industry in the consumption of cyanoacrylate adhesives in Europe and is expected to record a CAGR of 7.24% during the forecast period 2022-2028. Germany's aerospace industry is driven by technological innovation, and around EUR 2.5 billion was spent on research and development in 2021. In France, Airbus announced plans to increase production speeds and capacity from 40 aircraft per month in 2021 to 64 per month in 2023 and as many as 70 per month by early 2024. These abovementioned factors are expected to boost the demand for cyanoacrylate adhesives over the coming years in Europe.

- Reactive cyanoacrylate adhesives are primarily consumed in Europe and accounted for 75% of the total cyanoacrylate demand in 2021. Their demand is expected to grow further over the forecast period.

Europe Cyanoacrylate Adhesives Market Trends

Supportive government initiatives to promote electric vehicles will raise the industry size

- Europe has a GDP of 34,230 USD per capita with a growth rate of 1.6% y-o-y in 2022. The automotive industry sector contributes a percentage of around 2% of the total GDP. The European vehicle production comprises 81% passenger vehicles, 17% commercial vehicles, and 2% other vehicles in 2021.

- In 2020, many European countries were affected by the COVID-19 pandemic, including Germany, Italy, Spain, Russia, and the United Kingdom. The pandemic resulted in supply chain disruptions, lockdowns in the countries, and chip shortages which affected automotive production in Europe. The production of vehicles sharply declined by 22% compared to 2019.

- The United States imports 25.3% worth of cars from Europe and became one of the leading importers of the United States, where Germany accounted for 10.3% and the United Kingdom for 4.7% of total imports of vehicles in the country in 2021. At the beginning of 2022, the sale of the new vehicle dropped by 20.5% due to the invasion of Ukraine by Russia, which reflected in vehicle production as well. In the first quarter of 2022, the European automotive market was down by 10.6% compared to the same period last year.

- Vehicle production is likely to grow with a CAGR of 2.25% during the period (2022 to 2027) due to the new investments being made in electric vehicles by many European countries. For instance, Spain is going to invest USD 5.1 billion in electric vehicle production.

Rising demand for aesthetic and smart furniture to aid the industry growth

- Europe is one of the largest producers of furniture in the world. The region contributes nearly 30% of global furniture production after the Asia-Pacific region. Germany, Italy, Russia, and Spain are the top producers of furniture and its products. However, the region was impacted by the COVID-19 outbreak in 2020, which resulted in the shutdown of production facilities in several countries. This has reduced their furniture production by 7.14% compared to the previous year.

- Germany is the largest producer of Furniture units in Europe. The country produced nearly 323.6 million units in 2021, which is 23% of Europe's furniture production. German retailers have started offering 3D product visualizations or augmented reality apps which are boosting the demand for furniture products through e-commerce portals in the country.

- Italy is another major producer of furniture and its products in Europe, and the country is popular for Italian Furniture. The country holds 15% of Europe's furniture production. The country's furniture exports recorded a constant growth rate, which was about 2.7% in 2018 and 3% in 2019. The technological advancement in the woodworking and joinery industry of Italy is adopted worldwide.

- Europe is a leader in the high-end segment of the furniture market. It is said that nearly two out of every three high-end furniture products sold in the world are produced in the European Union. The furniture manufacturers in Europe are using eco-friendly materials such as pine wood, oak wood, beech wood, and a few others for production, which is gaining demand in the region. These factors will raise furniture production in the coming years in Europe.

Europe Cyanoacrylate Adhesives Industry Overview

The Europe Cyanoacrylate Adhesives Market is moderately consolidated, with the top five companies occupying 63.01%. The major players in this market are 3M, Arkema Group, H.B. Fuller Company, Henkel AG & Co. KGaA and Soudal Holding N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 EU

- 4.2.2 Russia

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Woodworking and Joinery

- 5.1.7 Other End-user Industries

- 5.2 Technology

- 5.2.1 Reactive

- 5.2.2 UV Cured Adhesives

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Russia

- 5.3.5 Spain

- 5.3.6 United Kingdom

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 DELO Industrie Klebstoffe GmbH & Co. KGaA

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Illinois Tool Works Inc.

- 6.4.7 Jowat SE

- 6.4.8 Permabond LLC.

- 6.4.9 Soudal Holding N.V.

- 6.4.10 ThreeBond Holdings Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219