|

市场调查报告书

商品编码

1693603

德国通讯-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Germany Telecom - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

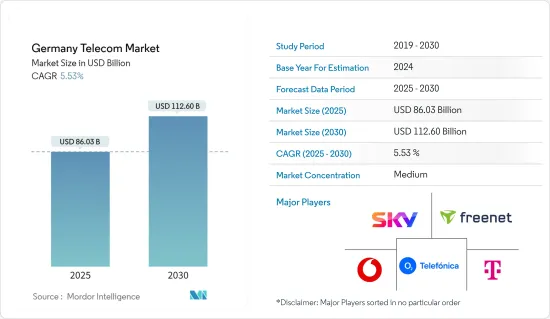

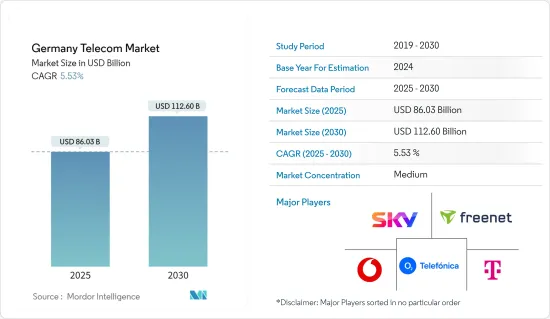

2025年德国通讯市场规模估计为860.3亿美元,预计2030年将达到1126亿美元,市场估计和预测期(2025-2030年)的复合年增长率为5.53%。

过去几年,德国通讯市场发生了重大转变,因为德国政府采取了各种倡议来加强该国的互联网基础设施和宽频连接,增加个人和企业的数据消费,全国范围内 5G 的推广,以及在德国企业发展的主要通讯市场供应商的各种创新。

关键亮点

- 德国通讯市场主要受益于近年来智慧型手机普及率的提高以及个人和企业对通讯服务的高需求。例如,根据GSMA Intelligence的数据,到2025年,德国将成为欧洲连线数最大的智慧型手机市场,市场规模达到1.05亿美元。德国通讯用户普及率预计将从2021年的88%成长至2025年的89%。数据也显示,德国智慧型手机普及率将从2021年的80%成长至2025年的84%。

- 5G 是第五代行动技术,它将定义行动电话网路的运作方式,旨在实现比其前身 4G 快 1,000 倍的数据传输率。 5G的引进将推动AI、AR、VR等技术的全面发展。这是因为这些技术需要更强的处理能力来处理大量资料的连续流。 5G网路将推动物联网(IoT)和云端运算的进步。由于工业 4.0,许多德国产业都在采用该技术,并推动该国通讯市场的发展。

- 德国日益增长的数位化需要快速且稳定的网络,宽频服务可以满足这一需求。这推动了宽频领域通讯供应商的市场发展。此外,宽频连线的可用性是工业 4.0、物联网和电子政府的基本要求——确保和改善社会福利、生活品质以及业务扩展和竞争力——因此,德国宽频的扩展很可能成为未来几年最重要的关注点之一。

- 通讯产业的传统数位化方法正在快速演变。例如,电话不再是最常用的通讯方式。传统的文字电子邮件也好不到哪里去。通讯、视讯和语音通话均透过网路进行。行动电话服务供应商与客户保持联繫的需要减少了。

- 新冠疫情导致德国通讯中断,资料通讯服务需求增加。这主要是由于在家工作、下载量增加、视讯会议通讯、线上游戏等导致数据消费和语音服务的增加,从而对该国行动电话营运商的资料通讯服务需求产生了积极影响。

德国通讯市场的趋势

5G的采用将推动市场成长

- 对更快连结的需求不断增长,推动了对 5G 的需求,各国政府也透过放鬆管制来鼓励 5G 发展。此外,预计预测期内 5G 的采用率提高和协作增多将推动市场成长率。例如,德国通讯于2022年6月宣布将率先使用700MHz频段提供5G服务。欧洲通讯业者表示,700 MHz 频段将改善德国农村地区的通讯覆盖范围。通讯业者指出,分布在约 1,100 个地点的约 3,000 根天线使用 700 MHz 频段的频率来广播 5G。

- 此外,该国的家庭通讯服务也正在透过 5G 推动。例如,德国一家电信业者报告引述德国通讯电信业者( DTV)的话说,目前92%的德国家庭已经可以连接其电信业者网络,到2025年,99%的德国家庭将可以连接其5G网络。

- 德国联邦政府推出了5G倡议,这是一项支援5G网路部署和5G应用程式开发的行动框架。联邦政府的5G策略为2025年前在德国部署5G网路提供了框架和行动领域,其愿景是使德国成为5G应用程式的领导者并支持该国电讯服务的成长。根据爱立信介绍,德国计画在2025年完成3.5GHz频段(5G)的部署。未来两年内,3.5GHz频段的5G网路将覆盖德国43%的人口,高于2023年的42%。然而,2025年,德国仅有7%的地理区域能够被覆盖。

- 例如,2022 年 10 月,沃达丰宣布策略扩张,在德国农村的两个行动站点测试和营运商用 5G 开放无线接取网路(RAN)。这标誌着德国首次部署完全符合欧洲主要行动通讯业者认证的规范和蓝图的 Open RAN 技术。 5G在该国的推出将为供应商创造收益成长机会。

- 此外,政府也计划大幅提高都市区地区的行动通讯容量。这意味着不仅联邦公路和城际公路必须提供足够品质的 5G 连接,而且联邦公路、区域公路、铁路线和重要水道也必须提供足够品质的 5G 连接。未来的覆盖义务将充分实现这些目标。

数据和通讯服务领域占据了很大的市场占有率

- 资料通讯和通讯服务是供应商提供的一种通讯服务,包括固定互联网服务、行动资料通讯和通讯功能。在德国,5G的引进和业务流程的数位化通讯业者提供高速资料通讯服务创造了机会,推动了市场的发展。例如,根据Ookla的报告,2022年德国平均行动网路连线速度增加了17.50Mbps(增幅52.2%),而固定网路连线速度增加了12.07Mbps(增幅21.9%)。

- 该国社群媒体的使用量正在增加,包括 Facebook、Instagram、WhatsApp、YouTube 和 TikTok。为了存取这些平台,电讯服务供应商正在加强其资讯服务。使用者需要网路连线。例如,根据Google的广告工具,截至2022年初,YouTube在德国拥有7,260万用户,占德国总人口的86.5%。

- 随着各行各业转向云端解决方案、消费者转向网路购物,网路的需求日益增长,推动了固定和行动资料服务的发展。例如,据亚马逊称,德国是欧洲最重要的电子商务市场之一,这为通讯服务供应商向该国的电子商务客户提供行动电话资讯服务创造了机会。

- 此外,该国通讯业者德国通讯计划加速其业务数位化服务组合。例如,在日益增长的数位体验服务市场中,德国电信旗下的德国通讯( 通讯 Deutschland)成立了完整的商业数位解决方案和平台的新业务部门,并于2022年11月向Terrizion Technologies投资2500万美元,用于WAN即服务解决方案。德国通讯将把该解决方案用作其企业的互联网主干网,确保可靠、高速的连接。这表明该国互联网和资讯服务的市场潜力,并将推动德国通讯供应商的收益。

- 该国政府优先考虑企业和社区的数位包容,推动资讯服务市场的成长。例如,2022年7月,德国数位部启动了「德国数位觉醒」策略,其中包括到2030年实现所有家庭和企业接入光纤网络,到2025年实现一半家庭和企业接入光纤网路的计画。

- 此外,根据GSMA在2022年4月发布的报告,德国通讯正在建造一个拥有超过5000个天线、兼容3.6GHz频段的5G独立(SA)网络,这将在德国境内创造对该公司提供高速互联网服务的资讯服务的需求。同样,沃达丰德国公司已经在德国市场实现了 5G SA 网路的商业化,约有 4,000 个天线采用了该技术。未来两年,德国的5G连线率预计将达到52%。

德国通讯业概况

德国电讯市场主要由德国电信股份公司、沃达丰(Vodafone GmbH)、西班牙电信德国有限公司、Freenet AG 和天空德国有限公司(Comcast Corporation)等大公司主导。该市场的参与企业正在采取合作、创新和收购等策略来加强其产品供应并获得可持续的竞争优势。市场上还有其他网路服务供应商(ISP)、行动虚拟网路营运商 (MVNO) 和固网服务供应商。一些美国通讯公司面临激烈的国际竞争,并在全球通讯领域确立了强势地位。

2022 年 12 月,O2Telefonica 和诺基亚宣布透过 5G 网路实现更快的檔案和影片上传速度。该电信业者及其技术合作伙伴首次结合了两种 5G 频率,以提高行动网路可传输的最大资料速率。 4G/LTE 网路使用这种所谓的载波聚合技术。此外,两家公司先前已测试过透过 5G 进行资料包下载。 O2Telefonica 和诺基亚目前正在德国首次在 5G 专用网路中演示 6GHz 以下频率的上传载波聚合。

2022年11月,德国沃达丰对新标准Docsis 4.0进行了评估和测试,速度高达10Gbit/s。根据展示的蓝图,沃达丰打算向超过 5% 的家庭提供高达 3 GBit/s 的 Docsis High Split 速度。混合光纤电缆网路计画使用节点分裂、DOCSIS 3.1 高分裂和 DOCSIS 4.0 等技术进行升级,以使光纤更贴近每个连网家庭。混合光纤电缆网路预计最终能够提供 10Gbit/s 的速率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 生态系分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

- 各国监管状况

第五章市场动态

- 市场驱动因素

- 5G的普及将推动市场成长

- 当地对宽频的需求很高

- 市场限制

- 产业数位化颠覆

- 连结市场分析(覆盖详细趋势分析)

- 固定网路

- 宽频(缆线数据机、有线光纤、有线 DSL、固定 Wi-Fi)以及与 ADSL/VDSL、FTTP/B、缆线数据机、FWA 和 5G FWA 相关的趋势

- 窄带

- 行动网路

- 智慧型手机和行动装置的普及

- 行动宽频

- 2G、3G、4G、5G连接

- 智慧家庭物联网和M2M连接

- 固定网路

- 通讯塔走向分析(包括格子形杆塔、导引塔、单桿塔、隐形塔等各类塔型走向分析)

第六章市场区隔

- 按服务

- 语音服务

- 有线

- 无线的

- 数据及通讯服务(含互联网、终端数据包、套餐及折扣)

- OTT/付费电视服务

- 语音服务

第七章竞争格局

- 公司简介

- Deutsche Telekom AG

- Vodafone GmbH

- Telefonica Germany GmbH & Co. OHG

- Freenet AG

- Sky Deutschland Gmbh(comcast Corporation)

- United Internet AG

- M-net Telekommunikations GMBH

- Bt Group PLC

- Tele Columbus AG

- GTT Communications Inc.

- Deutsche Glasfaser

第八章投资分析

第九章 市场机会与未来趋势

The Germany Telecom Market size is estimated at USD 86.03 billion in 2025, and is expected to reach USD 112.60 billion by 2030, at a CAGR of 5.53% during the forecast period (2025-2030).

The German telecom market has undergone significant transformation over the past few years owing to various initiatives taken by the German government to boost the country's internet infrastructure and broadband connection, growth in data consumption from businesses as well as individuals, growth in 5G deployments across the country and various innovations by the major telecom market vendors operating in Germany.

Key Highlights

- The German telecom market is primarily benefitted from the increasing smartphone penetration and high demand for telecom services from individuals and businesses over the past few years. For instance, according to the data from the GSMA Intelligence, by 2025, Germany will be the largest smartphone market in Europe by the number of connections, valued at USD 105 million. Germany's telecom subscriber penetration is expected to increase from 88% in 2021 to 89% in 2025. Also, as per the data, Germany's smartphone adoption will increase from 80% in 2021 to 84% in 2025.

- 5G is a fifth-generation mobile technology that defines the operation of cellular networks and has been designed to enable 1,000 times more data transmission than its predecessor, 4G. By implementing 5G, technologies ranging from AI, AR, and VR can be completely developed because these technologies necessitate substantially higher processing power to handle the continuous streaming of large amounts of data. 5G networks would lead to advancements in the Internet of Things (IoT) and cloud computing, which has been used across many industries in Germany due to its Industry 4.0 and driving the Telecom market in the country.

- The ongoing digitalization trend in the country needs high speed and constant network, which broadband services can fulfill. This is driving the market of telecom vendors in the broadband segment. Additionally, the availability of broadband connections is a fundamental requirement for Industry 4.0, the Internet of Things, and eGovernment, which would make broadband expansion in Germany one of the most important concerns in the following years to ensure and improve social welfare, quality of life, and business's ability to expand and compete.

- The communication industry's traditional digital methods are evolving quickly. For instance, phone calls are no longer the most adopted form of communication. Conventional text texting isn't much better Messaging, video, and voice calls are carried out over the internet. The need for cellphone service providers to keep customers linked has diminished.

- The COVID-19 pandemic led to lockdowns in Germany which increased the demand for data services owing to the increasing growth in data consumption and voice services primarily attributed to the work-from-home conditions, growth in downloading, video conference communication, online gaming, among others, thus positively impacting the demand for data services from the mobile operators in the country.

Germany Telecom Market Trends

5G Deployments Bolster the Market Growth

- With the growing demand for faster connectivity, the demand for 5G has been growing, with the government aiding through easing regulators. In addition, the growing 5G launch alongside the collaborations is analyzed to boost the market growth rate during the forecast period. For instance, Deutsche Telekom declared in June 2022 that it would be the first to offer 5G service using spectrum in the 700 MHz bands. The use of the 700 MHz bands, according to the European operator, enhances mobile communication coverage in rural Germany. The telco noted that 700 MHz frequencies are used by approximately 3,000 antennas spread across roughly 1,100 locations to broadcast 5G.

- Additionally, household telecom services in the country have increased due to 5G. For instance, the German telecom company has published a report stating that Deutsche Telekom has stated that 92% of German households have access to the carrier's 5G network, and 99% of German households would have access to the telco's 5G network by 2025.

- The German Federal Government launched the 5G Initiative, a framework for action to assist the deployment of 5G networks and the development of 5G applications. The Federal Government's 5G Strategy provides the framework and areas of action for deploying 5G networks in Germany until 2025 and having the vision to make Germany a leader in 5G applications, supporting the growth in the Telecom services in the country. According to Ericsson, The 3.5GHz (5G) roll-out is expected to be completed in Germany by 2025. The 3.5GHz 5G network would cover 43 percent of the German population by the next two years, up from 42 percent in 2023. However, only seven percent of the geographical area in Germany will be covered in 2025.

- For instance, in October 2022, Vodafone announced its strategic expansions to undertake a commercial 5G Open Radio Access Network (RAN) pilot at mobile stations in two rural locations in Germany. This would be Germany's first deployment of Open RAN technology that is completely compliant with the specifications and roadmap authorized by Europe's main mobile carriers. This would create an opportunity for the vendor to increase its revenue because of the 5G roll-out in the country.

- Additionally, the country's government intends to significantly enhance mobile communications capacity in urban and rural areas. This means that, in addition to federal highways and intercity roads, 5G connection of the appropriate quality must be made available on federal highways, regional roads, railway lines, and important waterways. Future coverage obligations would ensure that these objectives are met sufficiently.

Data and Messaging Services Segment Holds Significant Market Share

- Data and Messaging services are the type of telecommunication services the market vendors provide, including fixed internet services, Mobile Data, and messaging facilities. The country has been registering an increase in the 5G adoptions and digitalization of business processes, creating an opportunity for telecom companies to offer high-speed Data service and driving the market in Germany. For instance, according to the Ookla report, Germany's median mobile internet connection speed increased by 17.50 Mbps (+52.2%), and fixed internet connection speed in Germany raised by 12.07 Mbps (+21.9%) during the year 2022.

- Social media usage has been increasing in the country, which includes the usage of Facebook, Instagram, WhatsApp, YouTube, TikTok, etc. It is fuelling the Data services of the telecom service providers because of to access these platforms. Users need internet connectivity. For instance, according to Google's advertising tools, YouTube had 72.60 million users in Germany in early 2022, equivalent to 86.5 percent of Germany's total population.

- Internet requirements are rising due to industries moving to cloud solutions, and consumers are moving towards online shopping in the country, fueling both Fixed and mobile data services. For instance, according to Amazon, Germany is one of Europe's most important e-commerce markets, creating an opportunity for telecom service providers to offer handset data services for e-commerce customers in the country.

- Additionally, Deutsche Telekom, a telecom provider in the country, has planned to accelerate its business digitization service portfolio. For instance, in the growing market for digital experience services, Telekom Deutschland, a subsidiary of Deutsche Telekom, has established a new business area for complete business digital solutions and platforms, which has invested USD 25 million in Teridion Technologies in November 2022 for its WAN as-a-Service solution. Telekom Deutschland would use this solution for the company's enterprise internet backbone to ensure reliable and fast connectivity. This shows the market potential of the internet and Data services for businesses in the country, which fuels the telecom vendors' revenue in Germany.

- The country's government has prioritized digital inclusions in businesses and communities, helping the market growth for data services. For instance, in July 2022, the digital ministry of Germany initiated Germany's digital awakening strategy, which includes the plan to connect all households and companies to the fiber optic network by 2030 and a half by 2025.

- Additionally, according to a report published by GSMA published in April 2022, Deutsche Telekom has been making its 5G standalone (SA) network, with over 5,000 antennas compatible with the 3.6 GHz band, which would create a demand for the data service of the company in Germany due to its high-speed internet services. Similarly, Vodafone Germany has already commercially launched a 5G SA network in the German market, with about 4,000 antennae supporting the technology, for handset Data. By the next two years, Germany's 5G connections are expected to reach 52%.

Germany Telecom Industry Overview

The German telecom market is moderately low, with the presence of major players like Deutsche Telekom AG, Vodafone GmbH, Telefonica Germany GmbH & Co. OHG, Freenet AG, and Sky Deutschland Gmbh (Comcast Corporation). Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage. The market also hosts other Internet service providers (ISPs), MVNOs, and fixed-line service providers. Some US telecommunication companies are very competitive internationally and hold strong ground in the global telecom space.

In December 2022, O2 Telefonica and Nokia sped up file and video uploading via the 5G network. The telecoms company and its technology partner have combined two 5G frequencies for the first time to boost the maximum data rate that can be sent across the mobile network. The 4G/LTE network uses this so-called carrier aggregation technology. Moreover, the two businesses have previously tested package downloads via 5G. O2 Telefonica and Nokia are now showcasing carrier aggregation for uploads utilizing the frequencies below 6 GHz used in Germany in the 5G standalone network for the first time.

In November 2022, Vodafone Germany evaluated and tested the new Docsis 4.0 standard at speeds of up to 10 Gbit/s. Vodafone intends to provide up to 3 GBit/s with Docsis High Split in more than 5% of homes, citing the roadmap displayed. The hybrid fiber optic cable network is planned for upgrades to bring fiber closer to every connected household using node splits, DOCSIS 3.1 High Split, and technologies like DOCSIS 4.0. The hybrid fiber optic cable network would eventually be able to deliver rates of 10 Gbit/s.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Market

- 4.5 Regulatory Landscape in the Country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 5G Deployments Bolster the Market Growth

- 5.1.2 High Regional Demand for Broadband

- 5.2 Market Restrain

- 5.2.1 Digital Disruptions In the Industry

- 5.3 Analysis of the Market based on Connectivity (Coverage to include In-depth Trend Analysis)

- 5.3.1 Fixed Network

- 5.3.1.1 Broadband (Cable Modem, Wireline-fiber, Wireline DSL, and Fixed Wi-Fi ) and Trends Regarding ADSL/VDSL, FTTP/B, Cable Modem, FWA, and 5G FWA

- 5.3.1.2 Narrowband

- 5.3.2 Mobile Network

- 5.3.2.1 Smartphone and mobile penetration

- 5.3.2.2 Mobile Broadband

- 5.3.2.3 2G, 3G, 4G, and 5G connections

- 5.3.2.4 Smart Home IoT and M2M connections

- 5.3.1 Fixed Network

- 5.4 Analysis of Telecom Towers (Coverage to Include In-depth Trend Analysis of Various Types of Towers, like, Lattice, Guyed, Monopole, and Stealth Towers)

6 MARKET SEGMENTATION

- 6.1 By Services

- 6.1.1 Voice Services

- 6.1.1.1 Wired

- 6.1.1.2 Wireless

- 6.1.2 Data and Messaging Services (Coverage to include Internet and Handset Data Packages and Package Discounts)

- 6.1.3 OTT/PayTV Services

- 6.1.1 Voice Services

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Deutsche Telekom AG

- 7.1.2 Vodafone GmbH

- 7.1.3 Telefonica Germany GmbH & Co. OHG

- 7.1.4 Freenet AG

- 7.1.5 Sky Deutschland Gmbh (comcast Corporation)

- 7.1.6 United Internet AG

- 7.1.7 M-net Telekommunikations GMBH

- 7.1.8 Bt Group PLC

- 7.1.9 Tele Columbus AG

- 7.1.10 GTT Communications Inc.

- 7.1.11 Deutsche Glasfaser