|

市场调查报告书

商品编码

1693620

印度电动车:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)India Electric Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

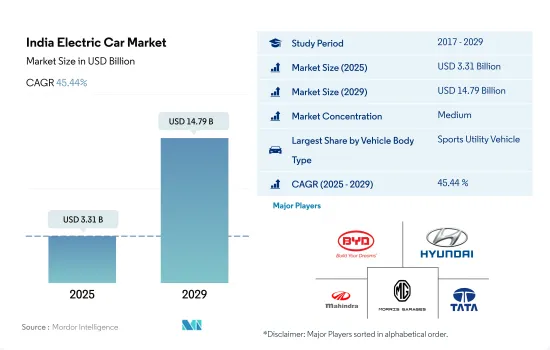

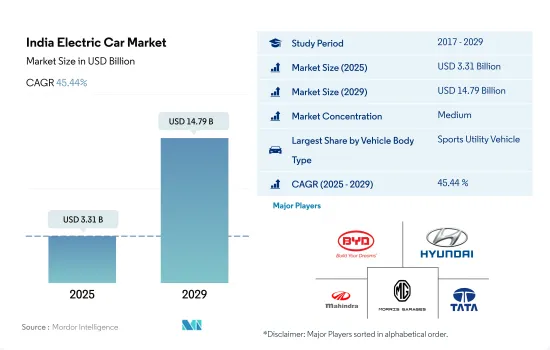

印度电动车市场规模预计在 2025 年为 33.1 亿美元,预计到 2029 年将达到 147.9 亿美元,预测期内(2025-2029 年)的复合年增长率为 45.44%。

印度对电动车的兴趣正在迅速增长,这从汽车结构不断演变以适应消费者需求和驾驶条件可以看出。

- 电动掀背车是进入印度电动车市场的切入点,主要吸引那些寻求紧凑、经济、高效汽车的都市区通勤者。与其他电动车型相比,它的吸引力还在于其价格较低,这对于首次购买电动车的消费者和具有都市区驾驶习惯的消费者来说尤其有吸引力。政府推出的诸如 FAME India 之类的倡议,提供补贴和税收优惠,进一步增加了电动掀背车作为一种经济高效且环保的出行方式的吸引力。

- 兼具豪华、空间和性能的电动轿车和 SUV 在印度电动车市场越来越受欢迎。这些型号迎合了那些注重高级功能、扩展范围和坚固性能的消费者。鑑于 SUV 在印度市场的受欢迎程度,电动 SUV 的推出尤其受到关注。消费者越来越被电动 SUV 所吸引,不仅因为它们的多功能性和空间,还因为它们所代表的地位。降低营运成本和减少环境影响也增加了它的吸引力。

- 儘管 MPV 只占电动车市场的一小部分,但它们具有巨大的成长潜力,尤其是对于大家庭的消费者以及那些寻找团体旅行和商业用途车辆的消费者而言。电动 MPV 具有空间宽敞、效率高的优势,但其广泛普及目前受到高昂的前期成本和缺乏充电基础设施的阻碍。

印度电动车市场趋势

政府措施和严格规范推动印度电动车市场快速成长

- 印度的电动车 (EV) 市场正处于成长阶段,政府正在积极制定应对污染的策略。 2015年启动的Fame India计画在推动汽车电气化方面发挥了关键作用。基于其成功经验,Fame 第二阶段计划将持续到 2022 年 4 月,预计将进一步推动电动车的销量,尤其是在 2021 年,政府将为电池容量高达 15kWh 的电动车提供 10,000 印度卢比(约 1,000 万美元)的补贴。

- 印度各邦政府正大力引进电动公车,以摆脱内燃机(ICE)公车的束缚。此举不仅可以降低营运成本,还可以抑制碳排放并改善空气品质。引人注目的是,德里政府已于 2021 年 3 月批准采购 300 辆新型低地板电动(AC)公车,其中 100 辆将于 2022 年 1 月上路。这些倡议导致印度对电动商用车的需求大幅成长,2022 年与 2021 年相比成长了 62.58%。

- 受政府严格标准的推动,近年来电动车的需求激增。 2021年8月,印度政府宣布了一项车辆报废政策,旨在逐步淘汰污染严重且不合规的车辆,无论其使用年限为何。该政策将于 2024 年实施,旨在推动消费者购买电动车。此外,政府还设定了一个雄心勃勃的目标,即到 2030 年使印度 30% 的汽车实现电动化。这些倡议预计将在 2024 年至 2030 年期间促进印度的电动车销售。

印度电动汽车产业概况

印度电动车市场适度整合,前五大公司占44.21%。该市场的主要企业是:比亚迪印度私人有限公司、现代汽车印度有限公司、马恆达有限公司、MG 汽车印度私人有限公司和塔塔汽车有限公司(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 共乘

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 二手车销售

- 燃油价格

- OEM生产统计

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 车辆配置

- 搭乘用车

- 掀背车

- 多用途车辆

- 轿车

- SUV

- 搭乘用车

- 燃料类别

- BEV

- FCEV

- HEV

- PHEV

第六章竞争格局

- 重大策略倡议

- 市场占有率分析

- 商业状况

- 公司简介

- BMW India Private Limited

- BYD India Private Limited

- Daimler AG(Mercedes-Benz AG)

- Hyundai Motor India Limited

- Kia Corporation

- Mahindra & Mahindra Limited

- Maruti Suzuki India Limited

- MG Motor India Private Limited

- Tata Motors Limited

- Toyota Kirloskar Motor Pvt. Ltd.

- Volvo Auto India Private Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93008

The India Electric Car Market size is estimated at 3.31 billion USD in 2025, and is expected to reach 14.79 billion USD by 2029, growing at a CAGR of 45.44% during the forecast period (2025-2029).

India is witnessing a burgeoning interest in electric mobility, evident from the evolving vehicle configurations that align with consumer demands and driving conditions

- Electric hatchbacks serve as the entry point to India's EV market, primarily attracting urban commuters seeking compact, affordable, and efficient vehicles. Their appeal is bolstered by their lower price tag relative to other electric models, making them especially enticing for first-time EV buyers and those with city-centric driving habits. Government initiatives like FAME India, which offer subsidies and tax benefits, further amplify the attractiveness of electric hatchbacks as cost-effective and eco-friendly mobility options.

- Electric sedans and SUVs are gaining traction in India's EV market, offering a mix of luxury, spaciousness, and performance. These models cater to consumers who prioritize premium features, extended range, and robust performance. The introduction of electric SUVs has garnered particular attention, given the existing popularity of SUVs in the Indian market. Consumers are increasingly drawn to electric SUVs not only for their versatility and space but also for the status they confer. Additionally, the allure of lower operating costs and reduced environmental impact further bolsters their appeal.

- While MPVs constitute a smaller segment of the electric car market, they hold significant growth potential, especially among consumers with larger families or those seeking vehicles for group travel or commercial purposes. Electric MPVs offer the advantages of spaciousness and efficiency, although their adoption is currently hindered by factors such as higher upfront costs and a developing charging infrastructure.

India Electric Car Market Trends

Government initiatives and stringent norms drive rapid growth in the electric vehicle market in India

- India's electric vehicle (EV) market is in a growth phase, with the government actively formulating strategies to combat pollution. The Fame India scheme, launched in 2015, has played a pivotal role in driving vehicle electrification. Building on its success, Fame Phase 2, active till April 2022, further bolstered EV sales, especially in 2021, with the government offering subsidies like INR 10,000 grants for electric cars with battery capacities up to 15 kWh.

- State governments across India are increasingly incorporating electric buses into their fleets, aiming to transition from internal combustion engine (ICE) buses. This move not only cuts operational costs but also curbs carbon emissions and improves air quality. In a notable move, the Delhi government greenlit the procurement of 300 new low-floor electric (AC) buses in March 2021, with 100 of them hitting the roads in January 2022. These initiatives contributed to a significant 62.58% surge in demand for electric commercial vehicles in India in 2022 over 2021.

- The demand for electric cars has surged in recent times, driven by the government's introduction of stringent norms. In August 2021, the Indian government unveiled the Vehicle Scrappage Policy, targeting the phasing out of polluting and unfit vehicles, irrespective of their age. This policy, set to be implemented by 2024, is steering consumers toward electric cars. Additionally, the government has set an ambitious target of having 30% of all cars in India electrified by 2030. These initiatives are poised to propel electric car sales during the 2024-2030 period in India.

India Electric Car Industry Overview

The India Electric Car Market is moderately consolidated, with the top five companies occupying 44.21%. The major players in this market are BYD India Private Limited, Hyundai Motor India Limited, Mahindra & Mahindra Limited, MG Motor India Private Limited and Tata Motors Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Used Car Sales

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Passenger Cars

- 5.1.1.1 Hatchback

- 5.1.1.2 Multi-purpose Vehicle

- 5.1.1.3 Sedan

- 5.1.1.4 Sports Utility Vehicle

- 5.1.1 Passenger Cars

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BMW India Private Limited

- 6.4.2 BYD India Private Limited

- 6.4.3 Daimler AG (Mercedes-Benz AG)

- 6.4.4 Hyundai Motor India Limited

- 6.4.5 Kia Corporation

- 6.4.6 Mahindra & Mahindra Limited

- 6.4.7 Maruti Suzuki India Limited

- 6.4.8 MG Motor India Private Limited

- 6.4.9 Tata Motors Limited

- 6.4.10 Toyota Kirloskar Motor Pvt. Ltd.

- 6.4.11 Volvo Auto India Private Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219